- United States

- /

- Banks

- /

- NYSE:UCB

3 Dividend Stocks To Consider With Up To 3.3% Yield

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 1.7% in the last week and up 12% over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this environment, dividend stocks can be an attractive option for investors seeking steady income and potential growth, particularly those offering yields up to 3.3%.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.61% | ★★★★★★ |

| Southside Bancshares (SBSI) | 4.98% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.50% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.68% | ★★★★★★ |

| Ennis (EBF) | 5.41% | ★★★★★★ |

| Dillard's (DDS) | 6.34% | ★★★★★★ |

| CompX International (CIX) | 4.79% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.28% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.99% | ★★★★★☆ |

| Chevron (CVX) | 4.78% | ★★★★★★ |

Click here to see the full list of 150 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

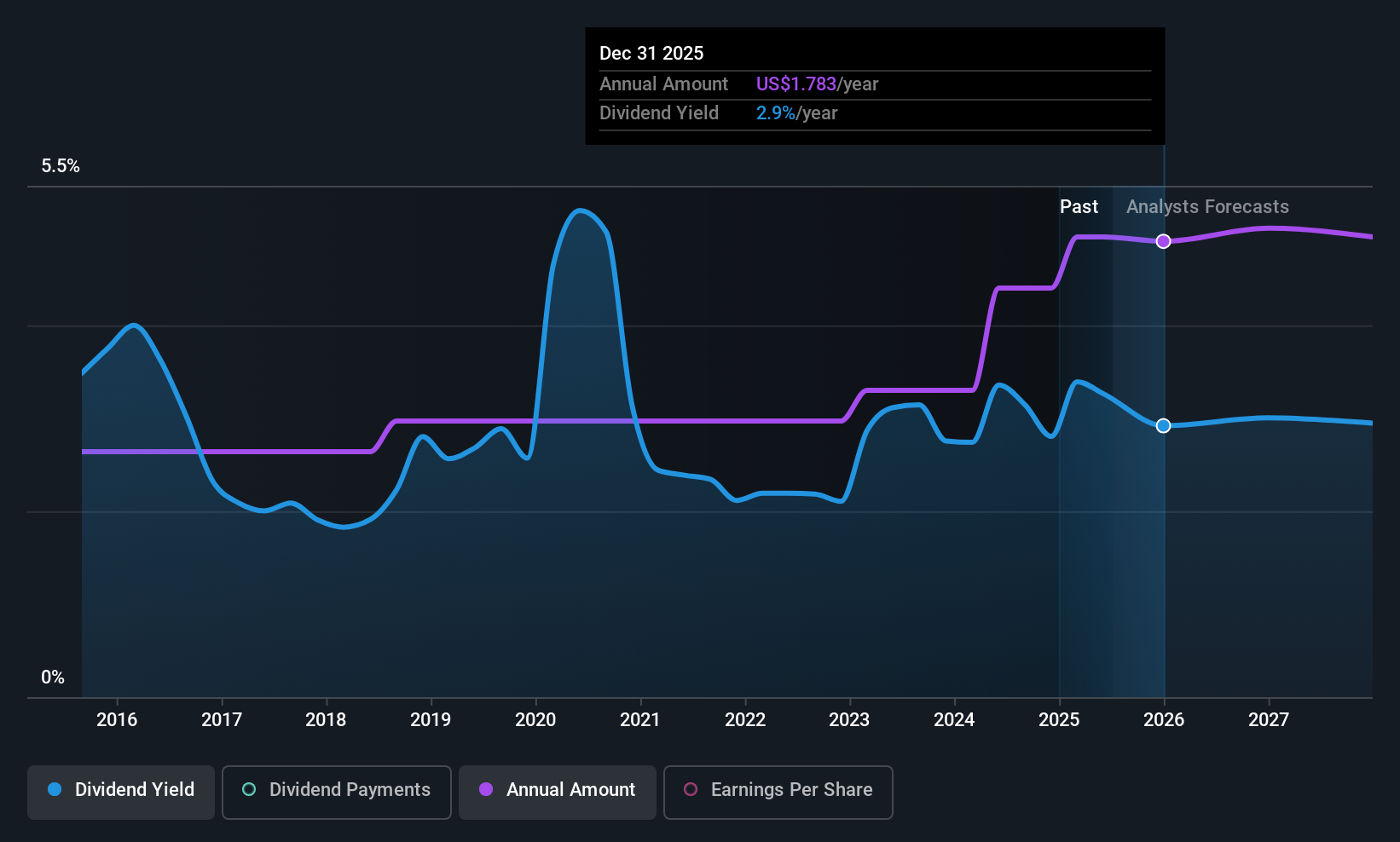

Hancock Whitney (HWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hancock Whitney Corporation, with a market cap of $4.81 billion, operates as the financial holding company for Hancock Whitney Bank, offering traditional and online banking services to commercial, small business, and retail customers in the United States.

Operations: Hancock Whitney Corporation generates revenue of $1.40 billion from its banking operations, catering to commercial, small business, and retail clients in the U.S.

Dividend Yield: 3.2%

Hancock Whitney's dividend payments have been both stable and reliable over the past decade, with a current yield of 3.22%, which is lower than the top quartile of US dividend payers. The dividends are well-covered by earnings, maintaining a low payout ratio of 30.3%. Recent earnings growth supports this coverage, with net income rising to US$119.5 million in Q1 2025 from US$108.61 million a year prior. Additionally, the company affirmed its quarterly dividend at $0.45 per share for June 2025 payment.

- Get an in-depth perspective on Hancock Whitney's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Hancock Whitney's share price might be too pessimistic.

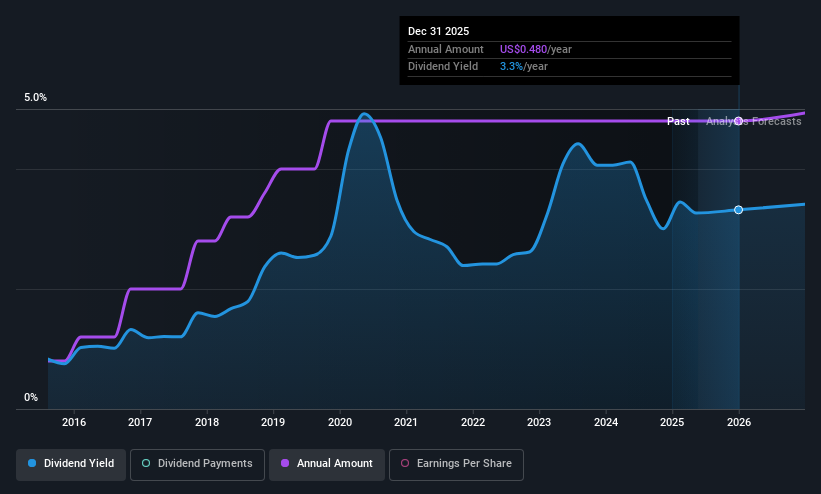

Shore Bancshares (SHBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shore Bancshares, Inc. is a bank holding company for Shore United Bank, N.A., with a market cap of $508.62 million.

Operations: Shore Bancshares, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $201.67 million.

Dividend Yield: 3.2%

Shore Bancshares has consistently delivered reliable dividends over the past decade, with a current yield of 3.16%, below the top US dividend payers. The payout ratio is low at 32.3%, indicating strong earnings coverage. Recent Q1 2025 earnings showed net income growth to US$13.76 million from US$8.18 million, supporting dividend sustainability. The company declared a $0.12 per share quarterly dividend for May 2025 and filed a shelf registration for $19.22 million in common stock offerings related to ESOPs.

- Click to explore a detailed breakdown of our findings in Shore Bancshares' dividend report.

- Our valuation report here indicates Shore Bancshares may be overvalued.

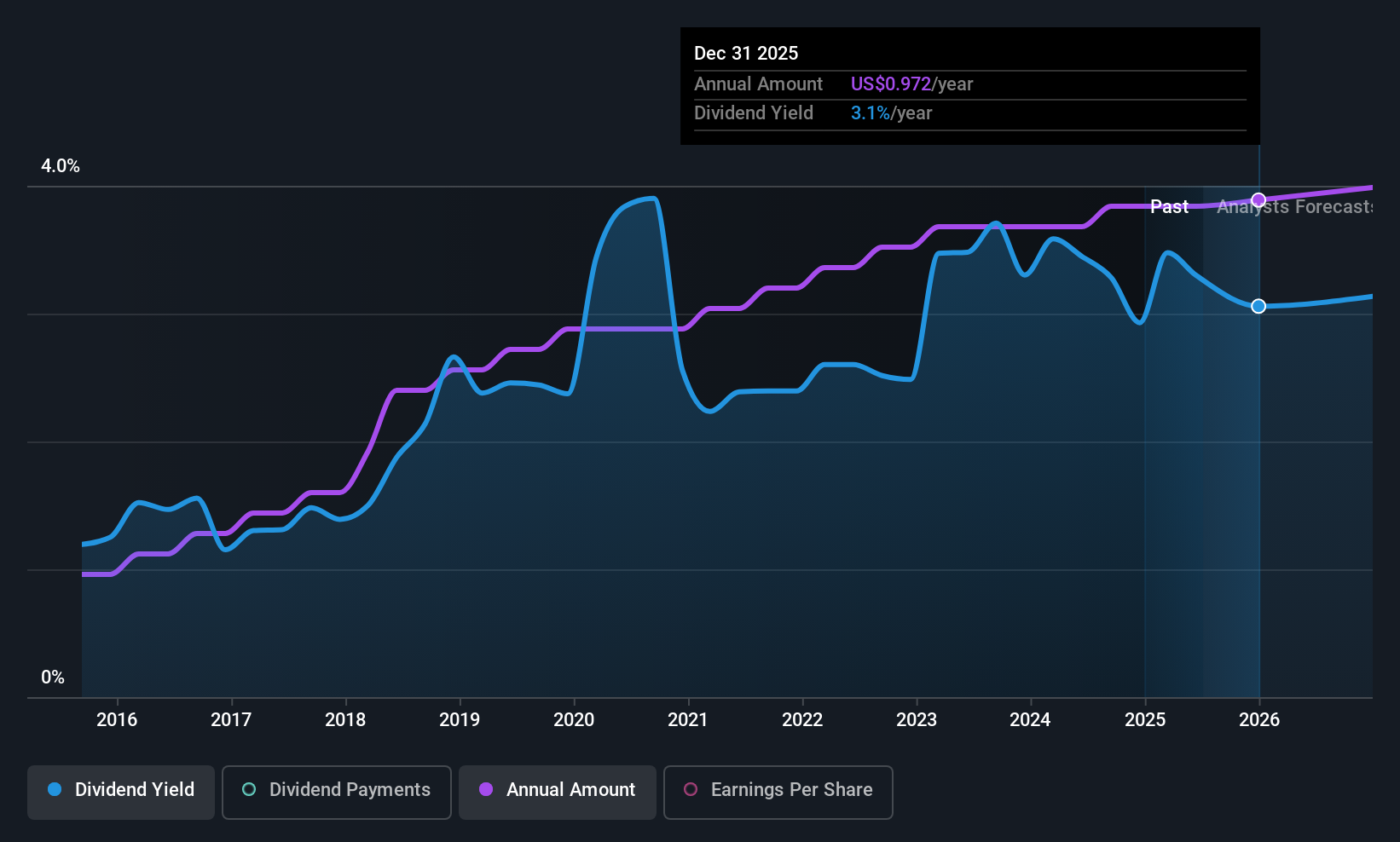

United Community Banks (UCB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Community Banks, Inc. is a bank holding company for United Community Bank, offering financial products and services across various sectors in the United States, with a market cap of $3.53 billion.

Operations: United Community Banks, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $907.59 million.

Dividend Yield: 3.3%

United Community Banks has maintained stable and growing dividends over the past decade, currently yielding 3.31%, which is below the top US dividend payers. Its payout ratio of 45% suggests dividends are well covered by earnings. Recent Q1 2025 results showed net income increased to US$71.41 million from US$62.63 million a year ago, supporting dividend reliability. The company announced a quarterly cash dividend of $0.24 per share, payable in July 2025, and completed a share buyback worth $13.9 million.

- Take a closer look at United Community Banks' potential here in our dividend report.

- Our valuation report unveils the possibility United Community Banks' shares may be trading at a discount.

Taking Advantage

- Delve into our full catalog of 150 Top US Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UCB

United Community Banks

Operates as the bank holding company for United Community Bank that provides financial products and services to commercial, retail, government, education, energy, health care, and real estate sectors in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives