- United States

- /

- Banks

- /

- NasdaqGS:UVSP

Top Undervalued Small Caps With Insider Action In March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced an 8.1% increase over the past year with earnings forecasted to grow by 14% annually. In this environment, identifying small-cap stocks that are perceived as undervalued and show insider activity can be a strategic approach for investors seeking opportunities in a dynamic market landscape.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 10.4x | 2.3x | 7.93% | ★★★★★☆ |

| First United | 9.7x | 2.6x | 47.24% | ★★★★★☆ |

| MVB Financial | 11.1x | 1.5x | 29.29% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 14.46% | ★★★★★☆ |

| S&T Bancorp | 11.0x | 3.8x | 41.35% | ★★★★☆☆ |

| Citizens & Northern | 12.3x | 3.0x | 43.81% | ★★★☆☆☆ |

| West Bancorporation | 14.2x | 4.3x | 42.88% | ★★★☆☆☆ |

| Franklin Financial Services | 14.3x | 2.3x | 32.72% | ★★★☆☆☆ |

| PDF Solutions | 207.3x | 4.7x | 13.10% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -203.00% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

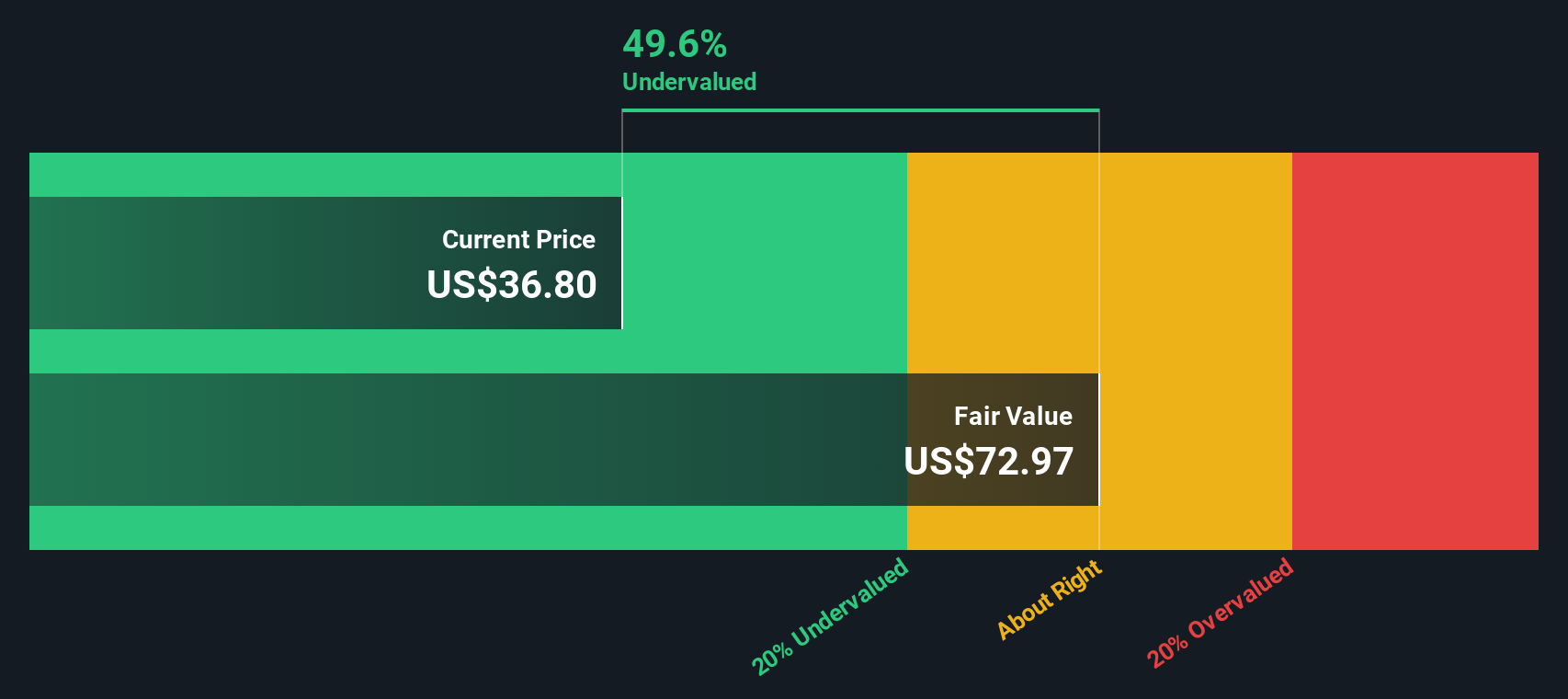

German American Bancorp (NasdaqGS:GABC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: German American Bancorp operates as a financial services holding company providing core banking, insurance, and wealth management services, with a market capitalization of approximately $1.15 billion.

Operations: German American Bancorp's revenue is primarily driven by its Core Banking segment, contributing $196.36 million, with additional income from Wealth Management Services and Insurance at $14.57 million and $4.38 million respectively. The company's operating expenses are significant, with General & Administrative Expenses consistently above $100 million in recent periods. The net income margin has shown variability, reaching as high as 37.62% during the period analyzed but standing at 33.46% in the most recent quarter ending December 2024.

PE: 17.3x

German American Bancorp, a small company in the financial sector, shows potential for growth with earnings forecasted to increase by 23.54% annually. Insider confidence is evident through share purchases in 2024 and early 2025. The recent merger added experienced leaders like G. Scott McComb to its board, potentially enhancing strategic direction. Despite a slight dip in annual net income from US$85.89 million to US$83.81 million, quarterly performance improved with net income rising from US$21.51 million to US$23.21 million year-over-year by Q4 2024, reflecting operational resilience and strategic positioning for future opportunities.

- Unlock comprehensive insights into our analysis of German American Bancorp stock in this valuation report.

Gain insights into German American Bancorp's past trends and performance with our Past report.

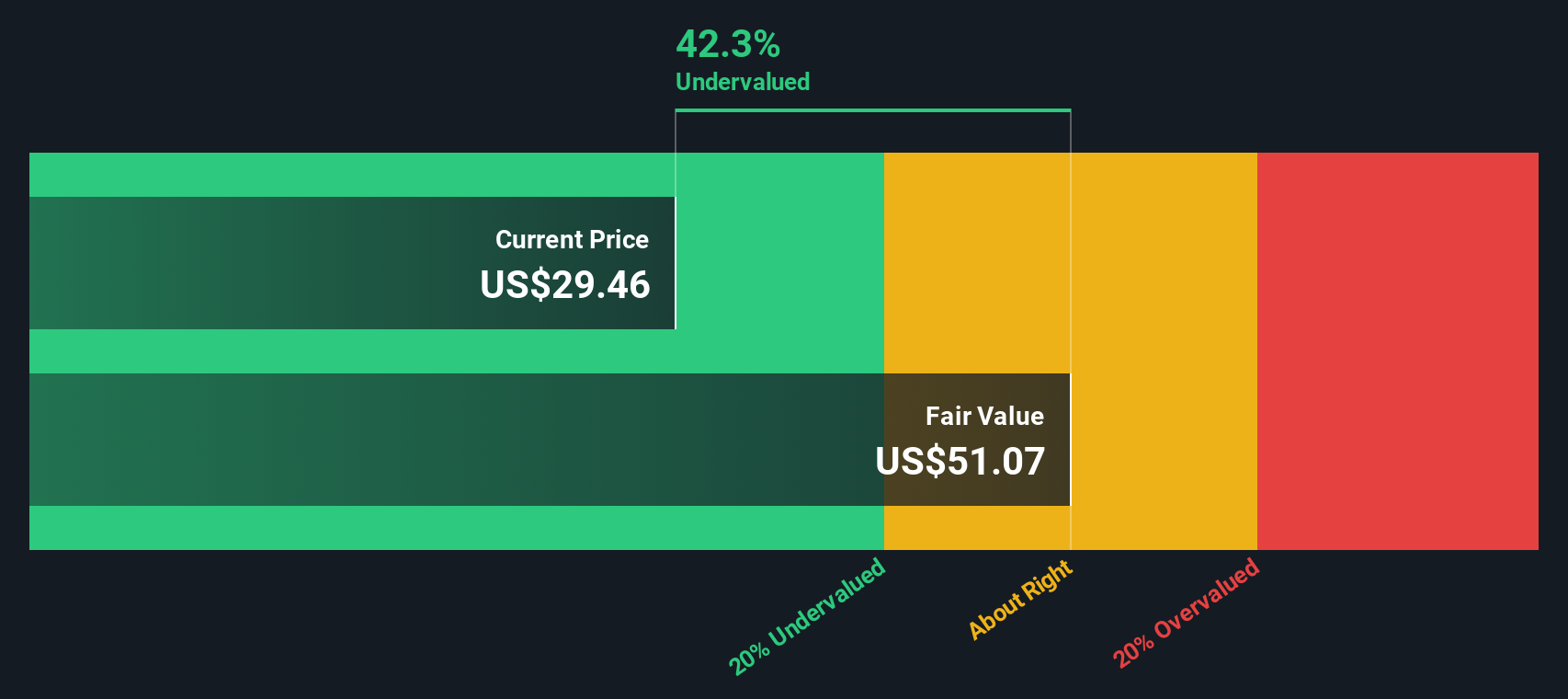

Univest Financial (NasdaqGS:UVSP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Univest Financial is a financial services company offering banking, insurance, and wealth management services with a market cap of approximately $0.76 billion.

Operations: Banking is the primary revenue stream, contributing significantly to the overall income. The company has consistently achieved a gross profit margin of 100%, reflecting no cost of goods sold across all periods. Operating expenses are largely driven by general and administrative costs, which reached $162.58 million in recent periods. Net income margins have shown variability, with a recent figure of 25.91%.

PE: 10.9x

Univest Financial, a smaller player in the financial sector, has shown promising signs despite some recent hurdles. Their net income rose to US$75.93 million for 2024 from US$71.1 million the previous year, indicating resilience amid challenges like net loan charge-offs decreasing to US$767,000 for Q4 2024. Insider confidence is evident with recent share repurchases totaling 139,492 shares at a cost of US$4.13 million in late 2024. Earnings are expected to grow annually by 3.23%, suggesting potential steady growth ahead.

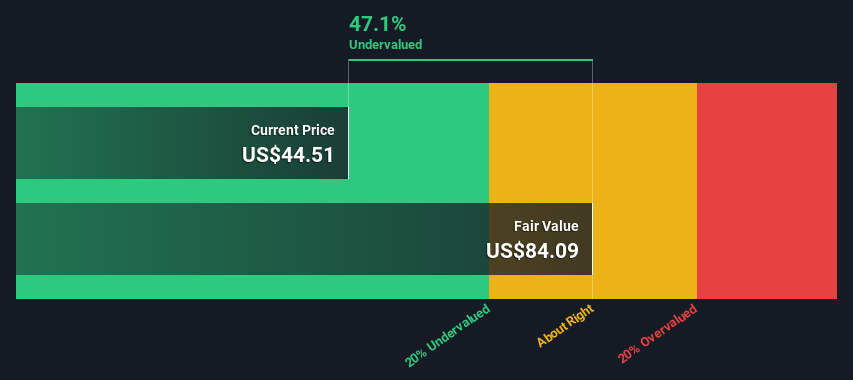

PHINIA (NYSE:PHIN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PHINIA operates in the automotive industry, focusing on aftermarket products and fuel systems with a market cap of $1.67 billion.

Operations: PHINIA generates revenue primarily from its Fuel Systems segment, contributing $2.26 billion, and the Aftermarket segment, adding $1.39 billion. The company's gross profit margin has shown variability over recent periods, reaching 22.22% as of March 18, 2025. Operating expenses have been a significant cost factor with general and administrative expenses consistently above $400 million in recent quarters.

PE: 22.3x

PHINIA, a smaller U.S. company, has been catching attention due to its strategic moves and financial activities. Recently, insider confidence was evident as they increased their stake in the firm over the past months. The company reported annual sales of US$3.4 billion for 2024 but faced a drop in net income to US$79 million from US$102 million previously. Despite this, PHINIA is expanding its buyback plan by US$200 million and boosting dividends by 8% to $0.27 per share, signaling potential resilience amidst challenges. Their innovative partnerships with Alpine on hydrogen-powered technology highlight a forward-thinking approach towards sustainability and growth prospects in motorsport design.

- Delve into the full analysis valuation report here for a deeper understanding of PHINIA.

Assess PHINIA's past performance with our detailed historical performance reports.

Key Takeaways

- Navigate through the entire inventory of 73 Undervalued US Small Caps With Insider Buying here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UVSP

Univest Financial

Operates as the bank holding company for Univest Bank and Trust Co.

Flawless balance sheet, undervalued and pays a dividend.