- United States

- /

- Banks

- /

- NasdaqGS:CATY

3 Dividend Stocks Offering Yields Up To 3.6%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 1.7% decline, although it remains up by 3.6% over the past year with earnings projected to grow by 13% annually in the coming years. In this context, dividend stocks offering yields up to 3.6% can be appealing as they potentially provide both income and growth opportunities amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.32% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.52% | ★★★★★★ |

| Douglas Dynamics (NYSE:PLOW) | 5.00% | ★★★★★★ |

| Brookline Bancorp (NasdaqGS:BRKL) | 5.36% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.01% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 8.09% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.75% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 5.10% | ★★★★★★ |

| Chevron (NYSE:CVX) | 4.98% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.48% | ★★★★★★ |

Click here to see the full list of 163 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

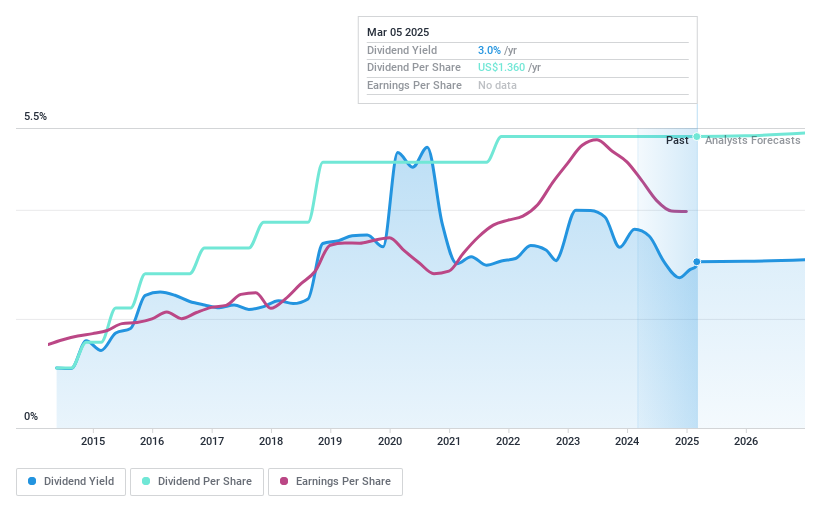

First National (NasdaqCM:FXNC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First National Corporation, with a market cap of $166.25 million, operates as the bank holding company for First Bank, offering a range of commercial banking services to small and medium-sized businesses, individuals, estates, local governmental entities, and non-profit organizations in Virginia.

Operations: First National Corporation generates revenue primarily through its banking segment, which accounts for $58.01 million in commercial banking services.

Dividend Yield: 3.1%

First National Corporation offers a stable dividend, with payments consistently reliable over the past decade and currently yielding 3.15%. Despite recent shareholder dilution, dividends remain covered by earnings with a payout ratio of 60.4%, forecasted to improve to 26.4% in three years. Recent executive changes, including the appointment of Brad E. Schwartz as CFO, aim to strengthen financial strategy amid challenges such as declining profit margins and net income from previous years.

- Delve into the full analysis dividend report here for a deeper understanding of First National.

- The valuation report we've compiled suggests that First National's current price could be inflated.

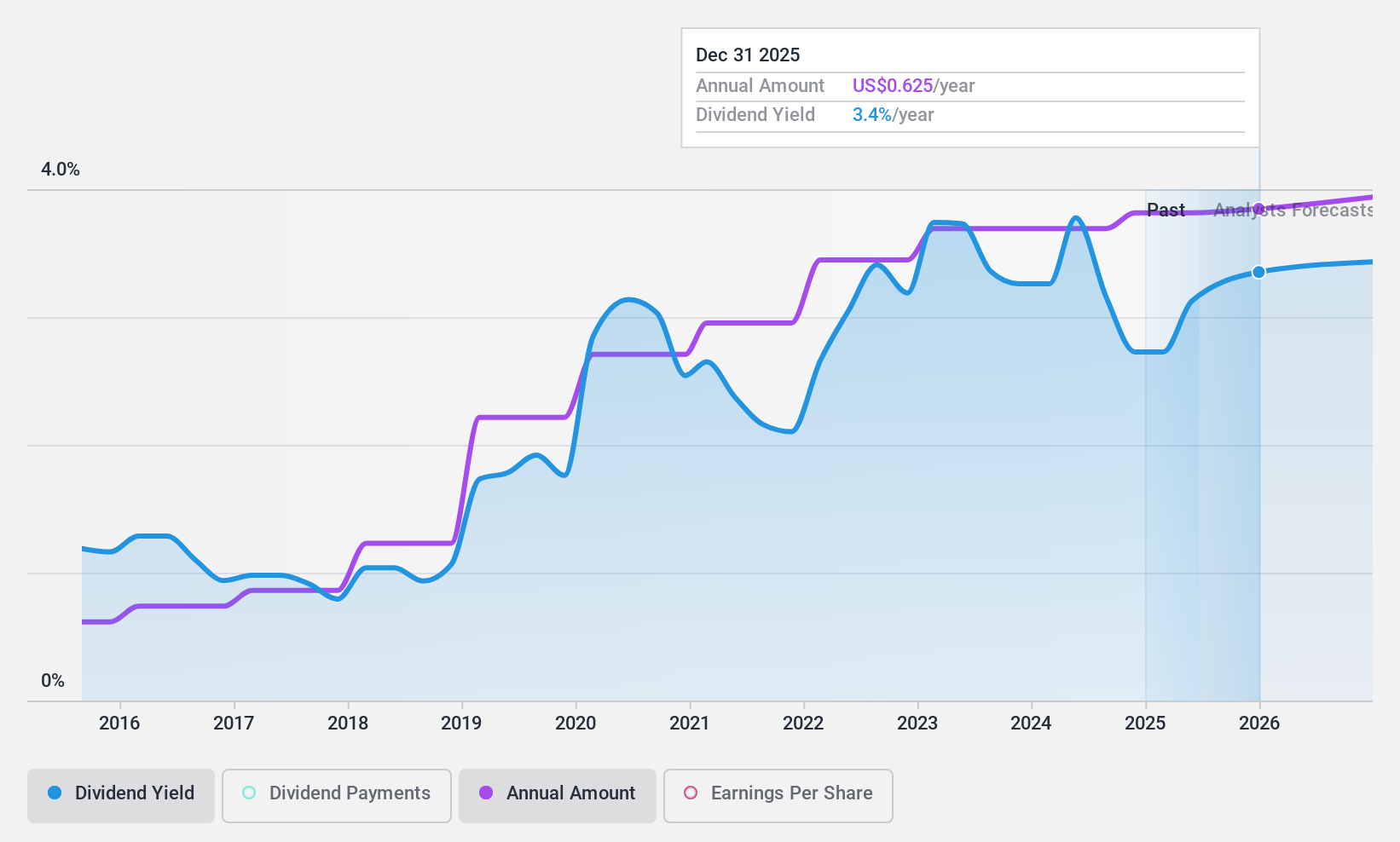

Cathay General Bancorp (NasdaqGS:CATY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cathay General Bancorp is the holding company for Cathay Bank, providing a range of commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States, with a market cap of approximately $2.90 billion.

Operations: Cathay General Bancorp generates its revenue primarily from its banking segment, amounting to $691.28 million.

Dividend Yield: 3.3%

Cathay General Bancorp maintains a stable dividend history with consistent growth over the past decade, currently yielding 3.29%. The payout ratio of 34.2% suggests dividends are well covered by earnings. Despite recent net charge-offs increasing to US$1.98 million, the company completed a significant share buyback worth US$125.07 million, enhancing shareholder value. However, its yield is lower than top-tier U.S. dividend payers and lacks sufficient data for long-term sustainability predictions beyond three years.

- Navigate through the intricacies of Cathay General Bancorp with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Cathay General Bancorp is trading behind its estimated value.

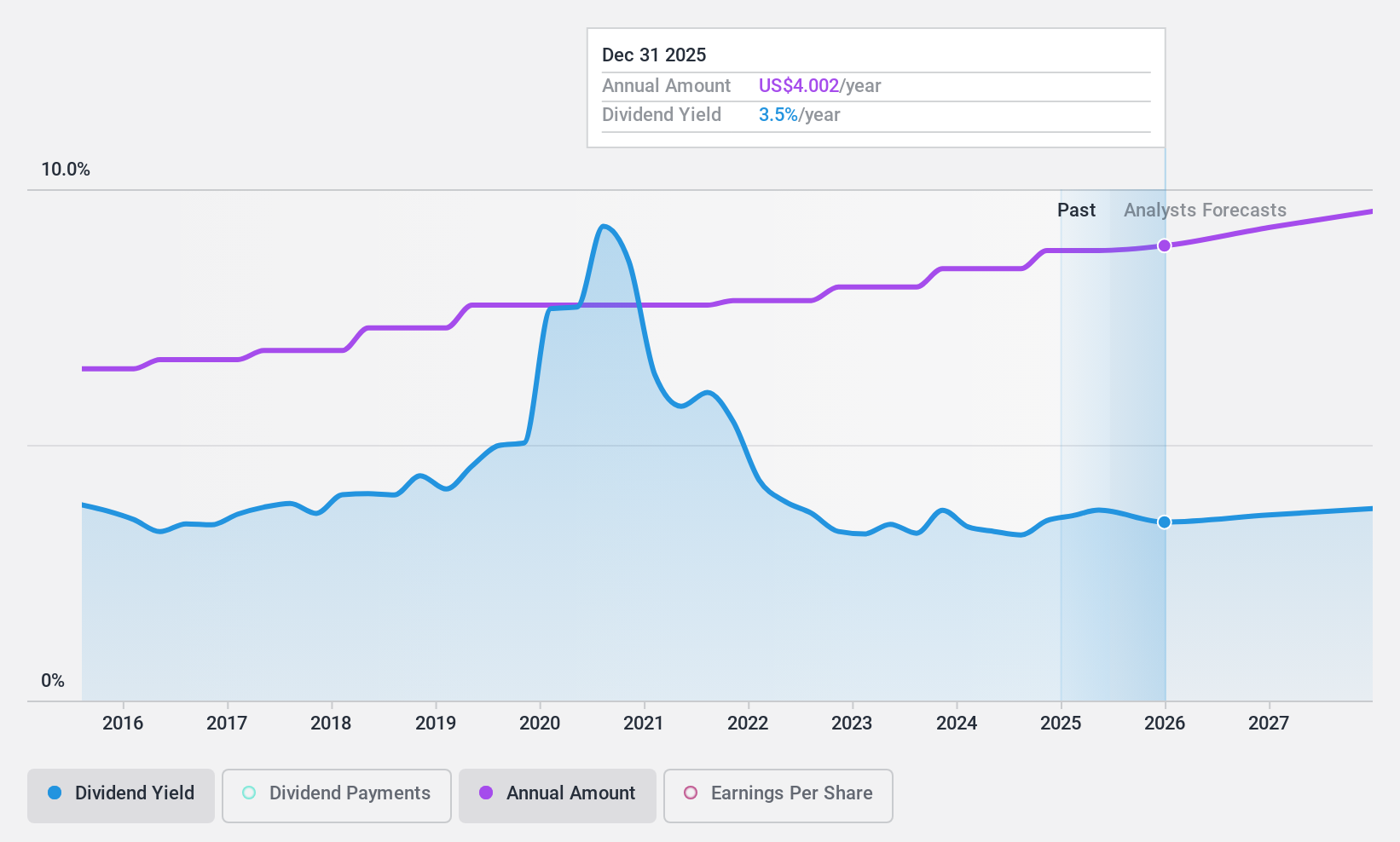

Exxon Mobil (NYSE:XOM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exxon Mobil Corporation is involved in the exploration and production of crude oil and natural gas across various countries including the United States, Canada, and the United Kingdom, with a market cap of approximately $455.67 billion.

Operations: Exxon Mobil's revenue segments include Upstream operations in the United States ($47.56 billion) and internationally ($56.01 billion), Chemical operations in the United States ($15.89 billion) and internationally ($18.23 billion), Energy Products in the United States ($124.95 billion) and internationally ($185.57 billion), as well as Specialty Products in the United States ($8.25 billion) and internationally ($13.04 billion).

Dividend Yield: 3.7%

Exxon Mobil offers a stable dividend history with consistent growth over the past decade, currently yielding 3.66%. The dividends are well covered by earnings and cash flows, with payout ratios of 49% and 55.8%, respectively. Despite being lower than top-tier U.S. dividend payers, Exxon Mobil's recent $192.80 million fixed-income offering indicates strong financial management to support future payouts and shareholder value through strategic initiatives like share buybacks totaling $51.67 billion since December 2021.

- Get an in-depth perspective on Exxon Mobil's performance by reading our dividend report here.

- Our valuation report unveils the possibility Exxon Mobil's shares may be trading at a discount.

Turning Ideas Into Actions

- Delve into our full catalog of 163 Top US Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CATY

Cathay General Bancorp

Operates as the holding company for Cathay Bank that offers various commercial banking products and services to individuals, professionals, and small to medium-sized businesses in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives