- United States

- /

- Banks

- /

- NasdaqGM:FDBC

US Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As U.S. stock indexes experience mixed trading following a series of declines, investors are keeping a close eye on the economic outlook and policy impacts from the White House. In this environment, dividend stocks can offer stability and income potential, making them an appealing consideration for those looking to navigate market volatility.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.47% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.79% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.11% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.42% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.08% | ★★★★★★ |

| Virtus Investment Partners (NYSE:VRTS) | 4.98% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.11% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Fidelity D & D Bancorp (NasdaqGM:FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering banking, trust, and financial services to individuals, small businesses, and corporate clients with a market cap of $249.23 million.

Operations: Fidelity D & D Bancorp, Inc. generates revenue of $79.41 million from its banking, trust, and financial services provided to a diverse clientele including individuals, small businesses, and corporate customers.

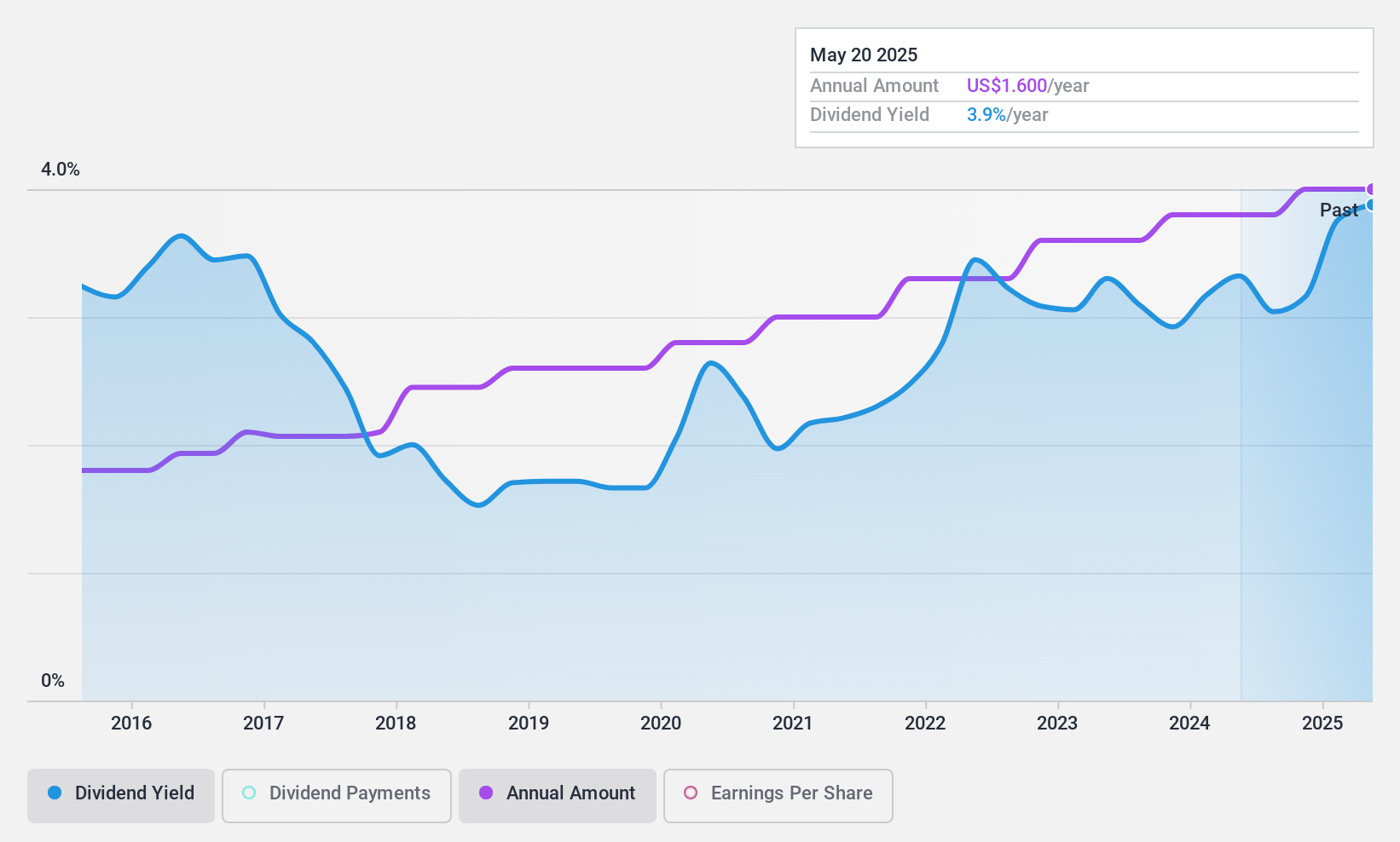

Dividend Yield: 3.7%

Fidelity D & D Bancorp offers a stable and growing dividend, recently increasing its quarterly payout to US$0.40 per share. The company's dividends have been reliable over the past decade, supported by a low payout ratio of 42.4%, indicating strong earnings coverage. While its dividend yield of 3.69% is lower than the top quartile in the US market, recent earnings growth and trading at a discount to estimated fair value may appeal to some investors seeking stability and potential value.

- Click here to discover the nuances of Fidelity D & D Bancorp with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Fidelity D & D Bancorp is trading behind its estimated value.

Lakeland Financial (NasdaqGS:LKFN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lakeland Financial Corporation, with a market cap of $1.68 billion, operates as the bank holding company for Lake City Bank, offering a range of banking products and services in the United States.

Operations: Lakeland Financial Corporation generates its revenue primarily from its Financial Services segment, which accounted for $236.77 million.

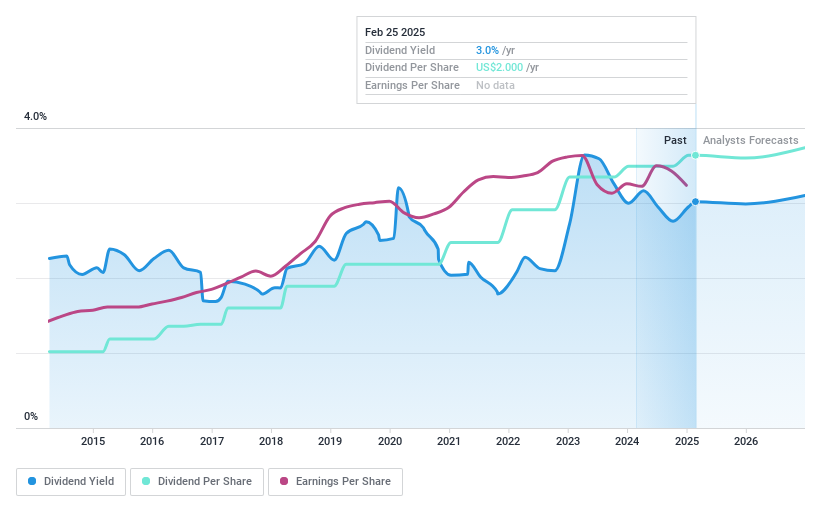

Dividend Yield: 3%

Lakeland Financial offers a stable dividend, recently increased to US$0.50 per share for Q1 2025, marking a 4% rise from 2024. The payout ratio of 53.3% indicates dividends are well-covered by earnings, though the yield of 3.05% is below the top quartile in the US market. Despite this, dividends have grown consistently over the past decade with minimal volatility, providing reliability for investors seeking steady income streams amidst modest earnings growth forecasts.

- Navigate through the intricacies of Lakeland Financial with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Lakeland Financial's current price could be inflated.

Eastman Chemical (NYSE:EMN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eastman Chemical Company operates as a specialty materials company in the United States, China, and internationally, with a market cap of approximately $11.36 billion.

Operations: Eastman Chemical Company's revenue is primarily derived from its Advanced Materials segment at $3.05 billion, followed by Additives & Functional Products at $2.86 billion, Chemical Intermediates at $2.13 billion, and Fibers at $1.32 billion.

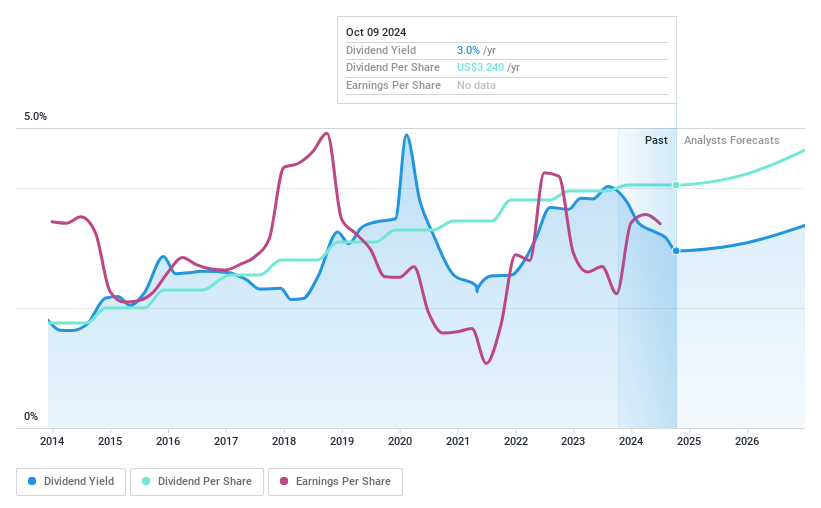

Dividend Yield: 3.4%

Eastman Chemical's dividend reliability is underscored by a stable 10-year growth history and a recent increase to US$0.83 per share. With a payout ratio of 42%, dividends are well-covered by earnings, though the yield of 3.38% lags behind top-tier US payers. The company’s financial position is bolstered by strong earnings growth, yet it carries high debt levels. Recent strategic moves include completing a $248.62 million fixed-income offering and share buybacks totaling $3.06 billion since 2018.

- Unlock comprehensive insights into our analysis of Eastman Chemical stock in this dividend report.

- Our valuation report unveils the possibility Eastman Chemical's shares may be trading at a discount.

Taking Advantage

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 140 more companies for you to explore.Click here to unveil our expertly curated list of 143 Top US Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FDBC

Fidelity D & D Bancorp

Operates as the bank holding company for The Fidelity Deposit and Discount Bank that provides a range of banking, trust, and financial services to individuals, small businesses, and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives