- United States

- /

- Banks

- /

- NasdaqGM:FDBC

Fidelity D & D Bancorp And 2 More Dividend Stocks To Consider

Reviewed by Simply Wall St

The market has climbed by 2.2% over the past week and is up 13% over the past 12 months, with earnings forecasted to grow by 15% annually. In this context of steady growth, identifying dividend stocks like Fidelity D & D Bancorp can be a strategic way to potentially benefit from both income and capital appreciation.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 5.63% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.56% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.15% | ★★★★★★ |

| Ennis (EBF) | 5.38% | ★★★★★★ |

| Dillard's (DDS) | 5.77% | ★★★★★★ |

| Credicorp (BAP) | 4.86% | ★★★★★☆ |

| CompX International (CIX) | 4.69% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.74% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.67% | ★★★★★☆ |

| Chevron (CVX) | 4.62% | ★★★★★★ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Fidelity D & D Bancorp (FDBC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering a variety of banking, trust, and financial services to individuals, small businesses, and corporate customers with a market cap of $274.88 million.

Operations: Fidelity D & D Bancorp, Inc. generates revenue of $81.32 million from its banking, trust, and financial services provided to a diverse clientele including individuals, small businesses, and corporate customers.

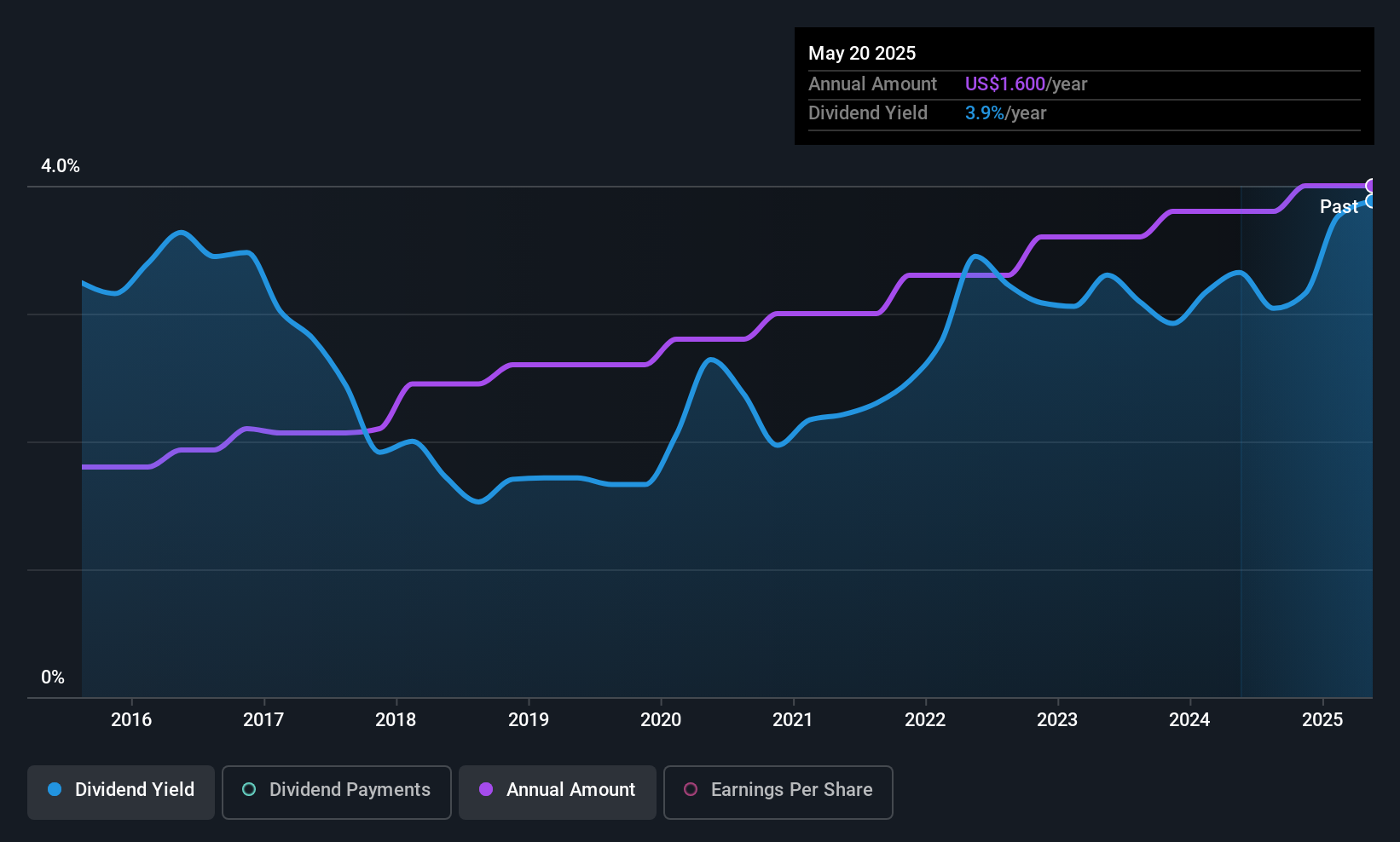

Dividend Yield: 3.4%

Fidelity D & D Bancorp offers a stable dividend profile with a reliable 3.38% yield, supported by a low payout ratio of 41.2%, indicating sustainability from earnings. Despite trading at 52.6% below its estimated fair value, the stock's dividend yield is lower than the top quartile in the US market. Recent affirmations of its quarterly $0.40 per share dividend underscore its commitment to consistent payouts, although future coverage remains uncertain due to insufficient data.

- Click here to discover the nuances of Fidelity D & D Bancorp with our detailed analytical dividend report.

- Our expertly prepared valuation report Fidelity D & D Bancorp implies its share price may be lower than expected.

Zions Bancorporation National Association (ZION)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zions Bancorporation, National Association offers a range of banking products and services across several Western U.S. states, with a market cap of approximately $7.93 billion.

Operations: Zions Bancorporation, National Association generates revenue through several segments, including Zions First National Bank ($882 million), California Bank & Trust ($685 million), Amegy Corporation ($677 million), National Bank of Arizona ($287 million), Nevada State Bank ($259 million), Vectra Bank Colorado ($161 million), and The Commerce Bank of Washington ($72 million).

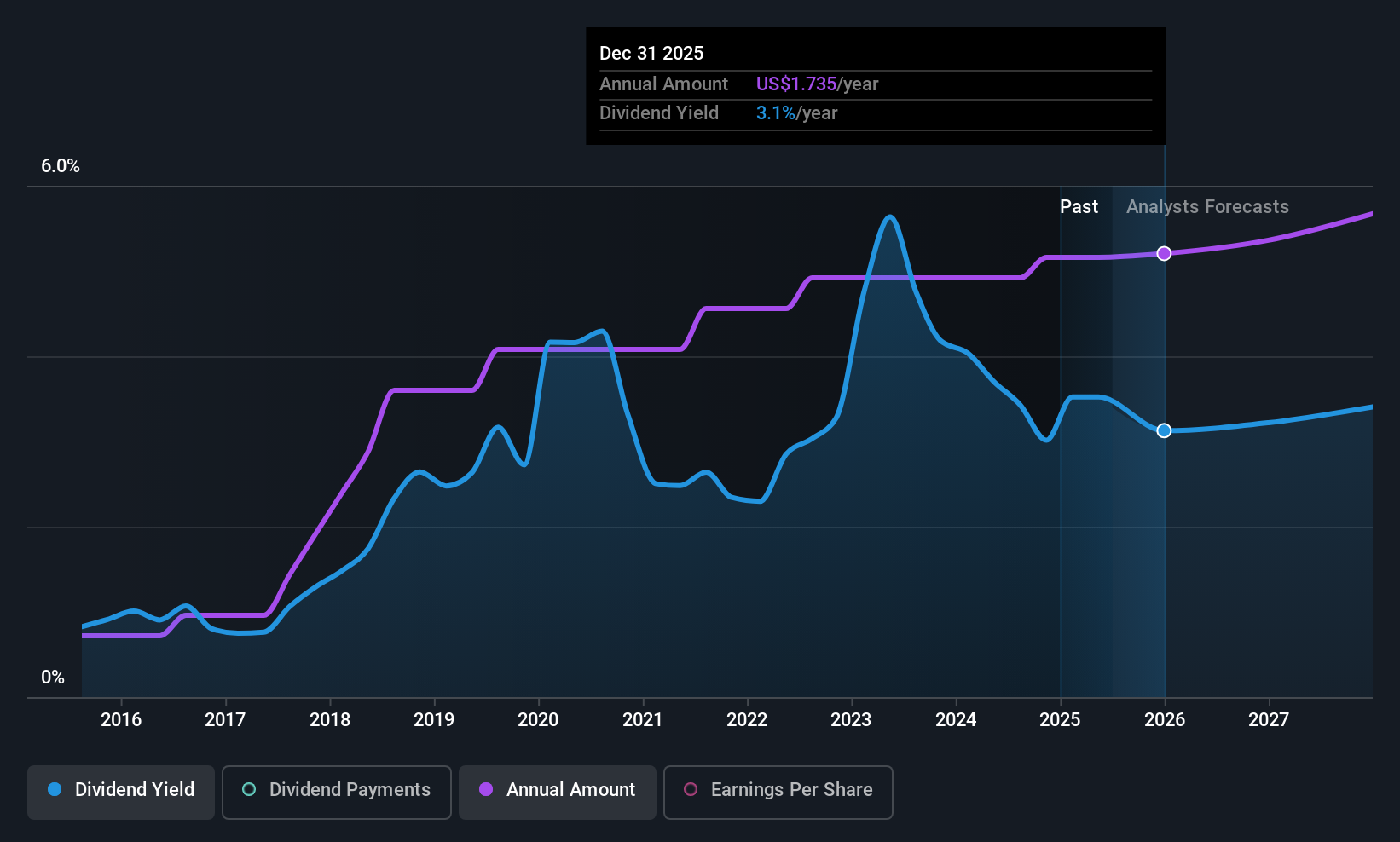

Dividend Yield: 3.1%

Zions Bancorporation offers a stable dividend profile with a 3.14% yield, supported by a low payout ratio of 32.8%, ensuring sustainability from earnings. The stock trades at 52.1% below its estimated fair value, presenting potential value for investors seeking dividends. Recent affirmations of its $0.43 per share dividend highlight ongoing commitment to payouts, while earnings growth and reliable dividends over the past decade enhance its appeal despite being lower than top-tier yields in the US market.

- Unlock comprehensive insights into our analysis of Zions Bancorporation National Association stock in this dividend report.

- The analysis detailed in our Zions Bancorporation National Association valuation report hints at an deflated share price compared to its estimated value.

Citizens Financial Group (CFG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Citizens Financial Group, Inc. is a bank holding company offering retail and commercial banking services to a wide range of clients in the United States, with a market cap of approximately $19.99 billion.

Operations: Citizens Financial Group generates revenue through its Consumer Banking segment, which accounts for $5.50 billion, and its Commercial Banking segment, contributing $2.42 billion.

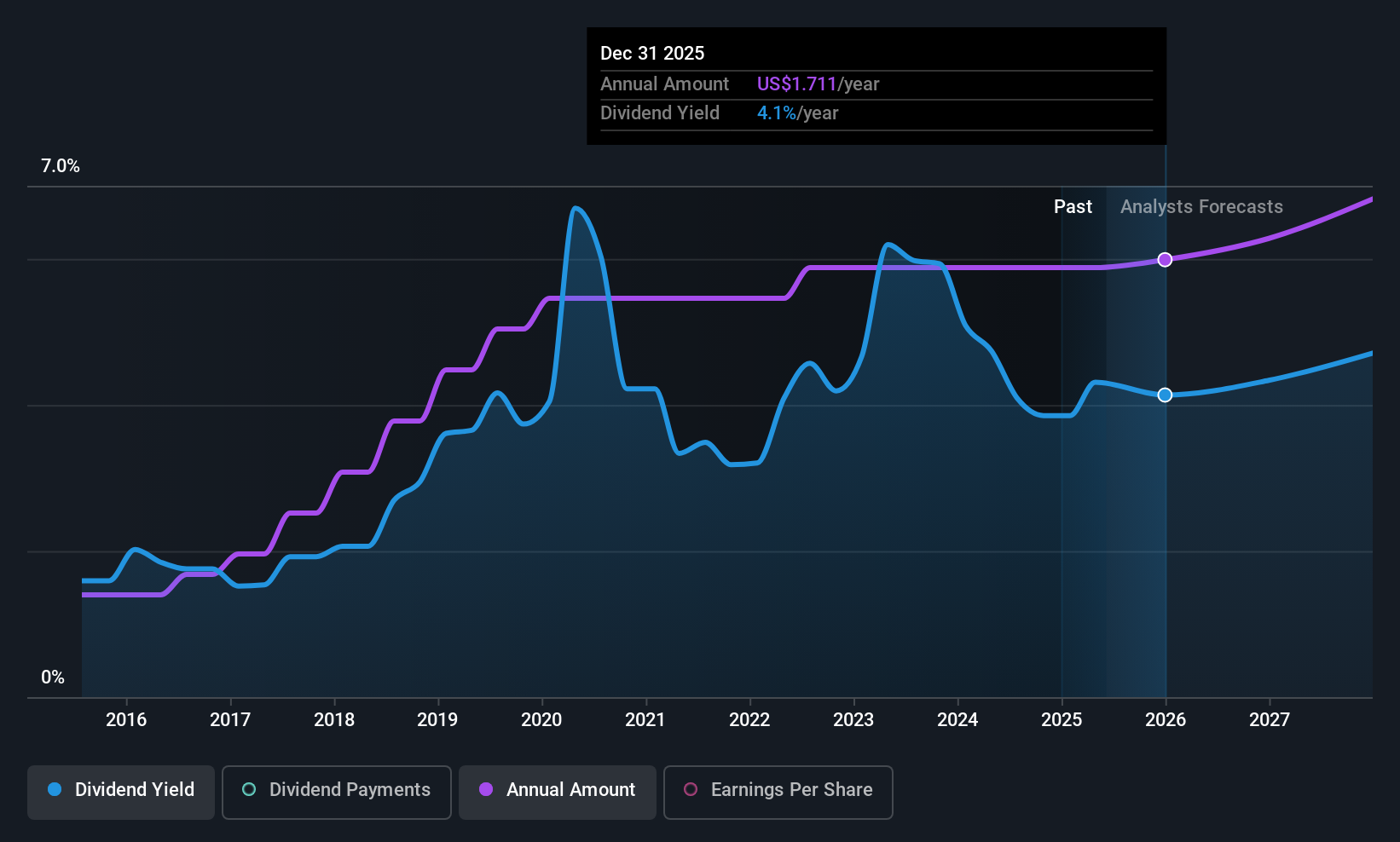

Dividend Yield: 3.6%

Citizens Financial Group maintains a reliable dividend profile with a 3.57% yield, supported by a moderate payout ratio of 53.1%, ensuring coverage from earnings. The company has consistently increased dividends over the past decade, despite being below top-tier yields in the US market. Recent developments include an expanded $4.30 billion buyback plan and strategic initiatives like new credit card offerings, underscoring its commitment to shareholder returns and growth through innovation and customer engagement.

- Click to explore a detailed breakdown of our findings in Citizens Financial Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Citizens Financial Group shares in the market.

Taking Advantage

- Investigate our full lineup of 135 Top US Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FDBC

Fidelity D & D Bancorp

Operates as the bank holding company for The Fidelity Deposit and Discount Bank that provides a range of banking, trust, and financial services to individuals, small businesses, and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)