- United States

- /

- Banks

- /

- NasdaqGS:CTBI

Exploring 3 Undervalued Small Caps With Insider Action Across Regions

Reviewed by Simply Wall St

As the U.S. stock market hovers near record highs, investors are closely watching economic indicators and upcoming earnings reports to gauge the potential direction of interest rates and consumer spending. In this environment, small-cap stocks can offer unique opportunities for those looking to diversify their portfolios, especially when insider activity suggests confidence in a company's future prospects. Identifying such stocks requires careful consideration of market conditions and company fundamentals.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.2x | 4.0x | 38.71% | ★★★★★★ |

| First United | 9.4x | 2.7x | 47.23% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 22.33% | ★★★★★☆ |

| Citizens & Northern | 11.2x | 2.8x | 43.30% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.6x | 37.38% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 25.63% | ★★★★☆☆ |

| GEN Restaurant Group | NA | 0.1x | -626.65% | ★★★★☆☆ |

| Tilray Brands | NA | 1.5x | 4.97% | ★★★★☆☆ |

| Auburn National Bancorporation | 13.3x | 2.8x | 24.82% | ★★★☆☆☆ |

| Citizens Community Bancorp | 12.5x | 2.7x | 20.72% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

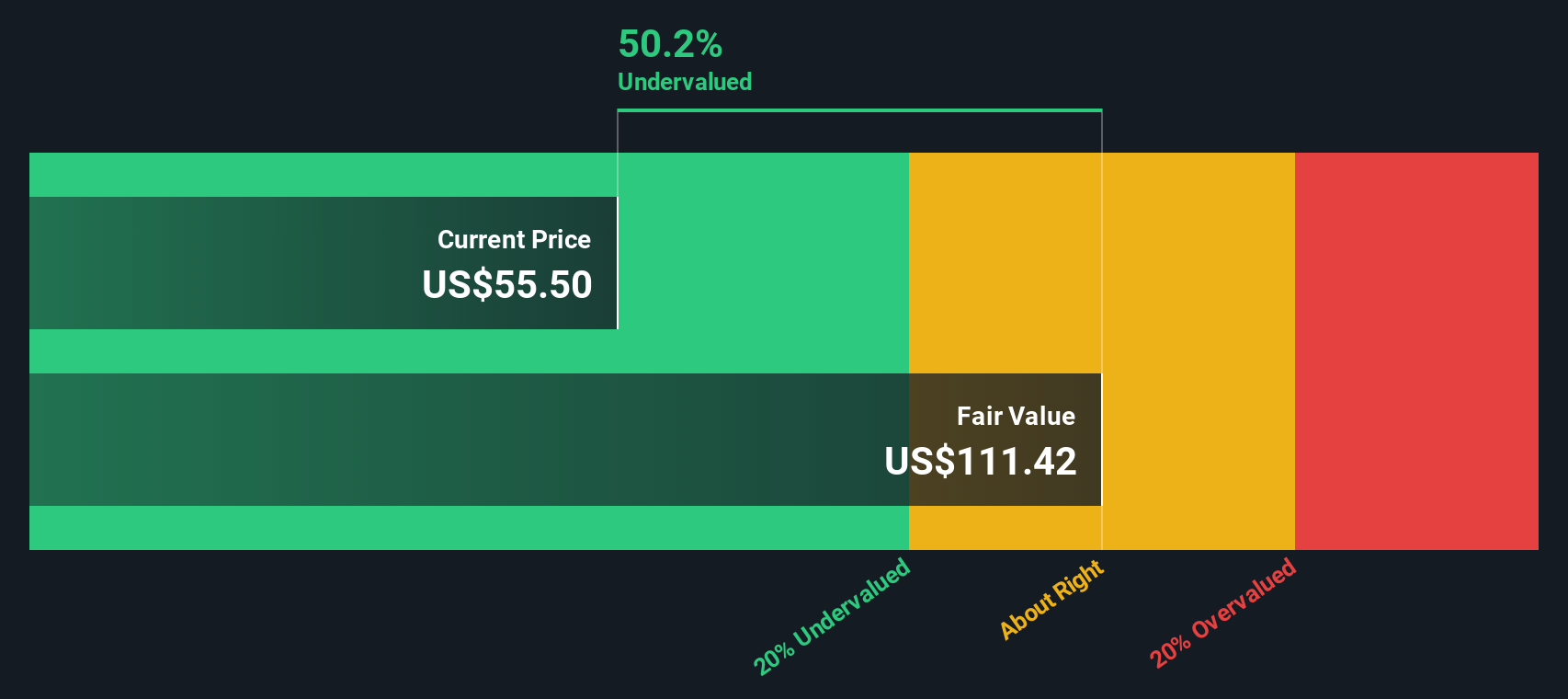

Community Trust Bancorp (CTBI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Community Trust Bancorp operates primarily in community banking services and holding company activities, with a focus on providing financial products and services, and has a market cap of approximately $0.72 billion.

Operations: Community Trust Bancorp generates revenue primarily from its Community Banking Services and Holding Company segments, with the former contributing significantly more. The company's net income margin has shown an upward trend over several periods, reaching 36.05% in mid-2025. Operating expenses are a substantial part of the cost structure, with General & Administrative Expenses consistently forming a significant portion.

PE: 11.2x

Community Trust Bancorp, a smaller U.S. financial institution, shows potential for growth with earnings projected to rise by 5.55% annually. Recent financials reveal net interest income increased to US$54 million in Q2 2025 from US$46 million the previous year, while net income rose to US$24.9 million from US$19.5 million. The company boosted its quarterly dividend to $0.53 per share starting October 2025, signaling confidence in future cash flows despite recent charge-offs totaling $1.4 million across various loan categories.

- Take a closer look at Community Trust Bancorp's potential here in our valuation report.

Learn about Community Trust Bancorp's historical performance.

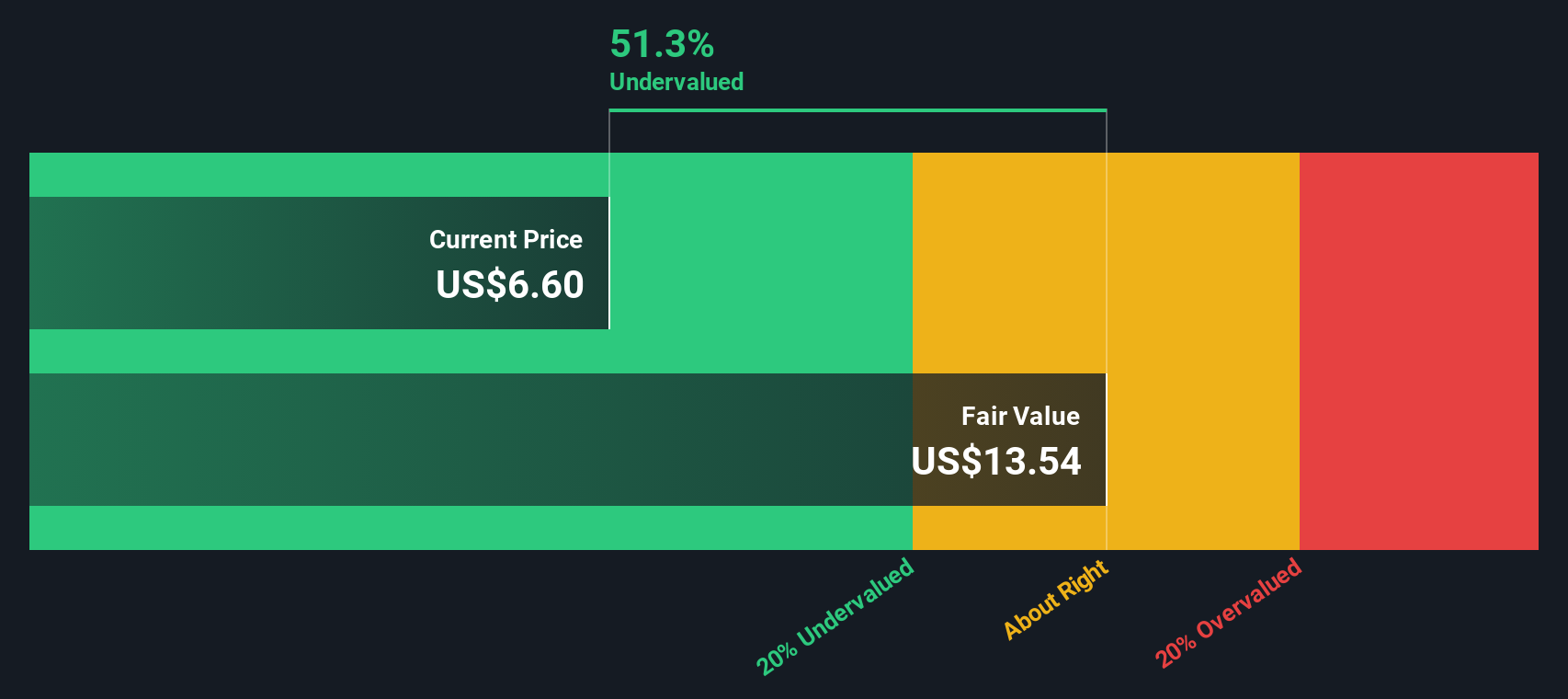

Udemy (UDMY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Udemy is an online learning platform that offers a wide range of courses to individual consumers and enterprises, with a market cap of approximately $1.57 billion.

Operations: Udemy generates revenue primarily from its Consumer and Enterprise segments, with recent financial data revealing a gross profit margin of 64.33%. The company's cost structure includes significant expenditures on sales and marketing, research and development, and general administrative expenses. Despite increasing revenues over the periods observed, Udemy has consistently reported net losses.

PE: -34.2x

Udemy, a growing player in the education technology sector, has shown promising financial performance with Q2 2025 sales reaching US$199.88 million and net income of US$6.27 million, reversing last year's losses. The company's strategic expansion into the Middle East with an Arabic platform launch highlights its global reach and adaptability to diverse markets. Insider confidence is evident as executives have increased their stakes over recent months, reflecting belief in Udemy's growth trajectory amid its AI-driven initiatives and consumer-focused strategies.

- Click here and access our complete valuation analysis report to understand the dynamics of Udemy.

Understand Udemy's track record by examining our Past report.

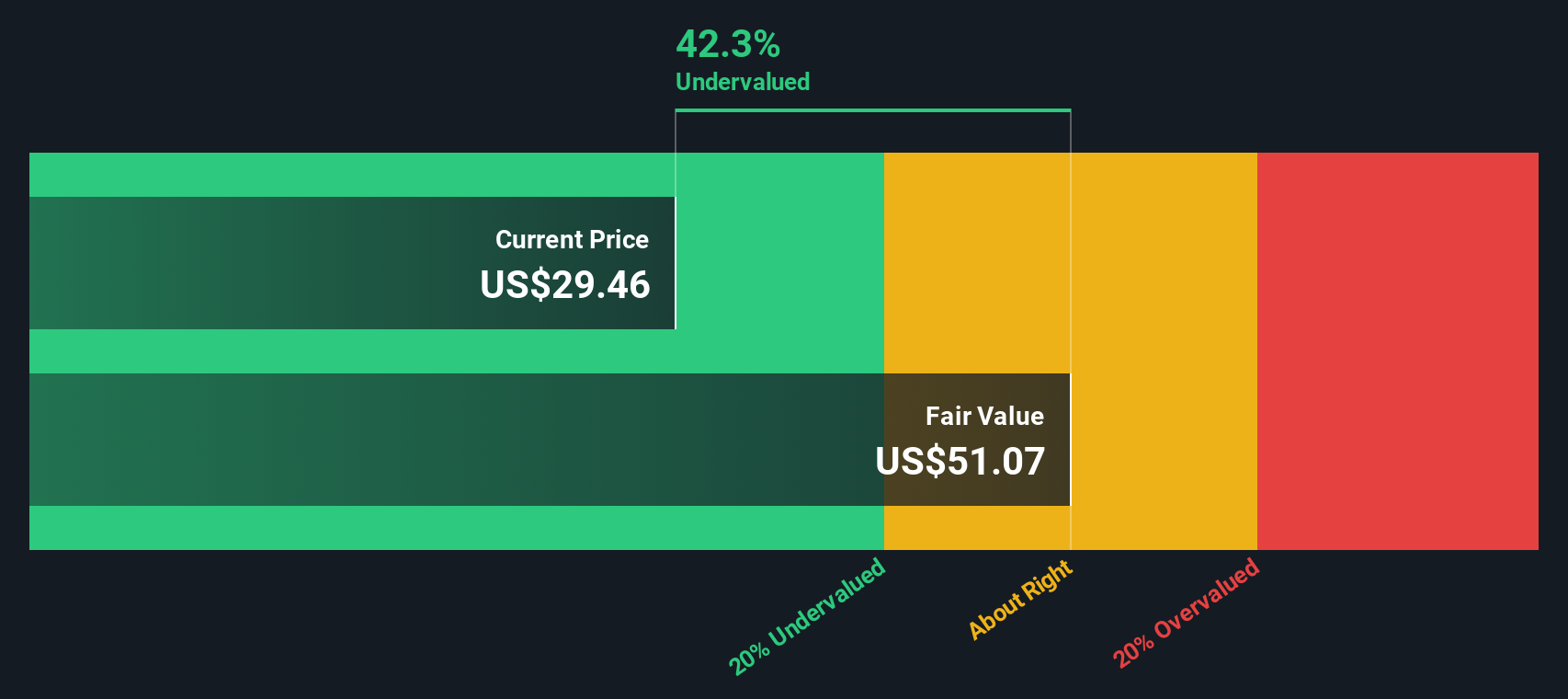

Univest Financial (UVSP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Univest Financial operates in banking, insurance, and wealth management sectors with a market cap of $0.78 billion.

Operations: Univest Financial generates revenue primarily from its Banking segment, which contributes $253.93 million, followed by Wealth Management and Insurance segments with $31.37 million and $22.17 million respectively. The company consistently achieves a gross profit margin of 100%, reflecting its ability to generate revenue without direct costs of goods sold being reported in the data provided. Operating expenses are a significant component, with General & Administrative Expenses accounting for a substantial portion, reaching up to $163.78 million in recent periods.

PE: 10.9x

Univest Financial, a smaller company in the financial sector, recently reported net interest income of US$59.54 million for Q2 2025, up from US$51.03 million the previous year. Despite facing a significant $7.8 million charge-off related to one credit issue, they maintained profitability with net income rising to US$19.98 million from US$18.11 million year-on-year. Insider confidence is evident with share repurchases totaling 172,757 shares in Q2 2025 for $4.97 million, suggesting management's belief in potential growth despite challenges ahead.

- Unlock comprehensive insights into our analysis of Univest Financial stock in this valuation report.

Next Steps

- Gain an insight into the universe of 91 Undervalued US Small Caps With Insider Buying by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTBI

Community Trust Bancorp

Operates as the bank holding company for Community Trust Bank, Inc.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)