- United States

- /

- Specialty Stores

- /

- NasdaqGS:SCVL

3 Undiscovered Gems In The US Market To Watch

Reviewed by Simply Wall St

As the U.S. market navigates a landscape marked by cautious optimism over trade talks and fluctuating indices, investors are keenly observing small-cap stocks for potential opportunities. In this environment, identifying promising stocks often involves looking beyond the headlines to discover companies with solid fundamentals and growth potential that may not yet be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Central Bancompany | 32.38% | 5.41% | 6.60% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Innovex International | 2.58% | 42.69% | 44.34% | ★★★★★☆ |

| Greenfire Resources | 39.33% | 22.94% | -38.12% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Community Trust Bancorp (NasdaqGS:CTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Community Trust Bancorp, Inc. operates as the bank holding company for Community Trust Bank, Inc., with a market cap of $907.26 million.

Operations: Community Trust Bancorp generates revenue primarily from its Community Banking Services, which amounted to $249.27 million. The segment adjustment is noted at -$5.14 million.

Community Trust Bancorp, with total assets of US$6.3 billion and equity of US$784.2 million, stands out for its robust financial health. Total deposits reach US$5.1 billion against loans of US$4.6 billion, indicating a solid funding base primarily from customer deposits, which are less risky than external borrowing. The company shows a strong allowance for bad loans at 215%, well above the necessary threshold, while non-performing loans are kept low at 0.6%. Earnings growth hit 11% last year, surpassing industry averages and reflecting high-quality earnings performance amidst trading at an attractive value point below estimated fair value by over half (60%).

Shoe Carnival (NasdaqGS:SCVL)

Simply Wall St Value Rating: ★★★★★★

Overview: Shoe Carnival, Inc., along with its subsidiaries, operates as a family footwear retailer in the United States with a market cap of $484.52 million.

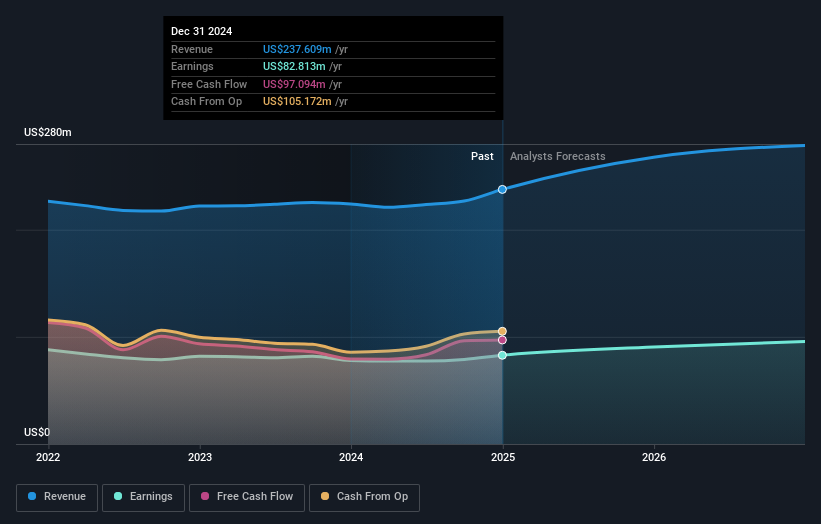

Operations: Shoe Carnival generates revenue primarily from its retail footwear segment, which reported $1.20 billion in sales. The company's net profit margin is a key financial metric to consider when evaluating its profitability and operational efficiency.

Shoe Carnival, a nimble player in the retail space, is making strategic moves with its rebanner expansion to attract premium shoppers. This initiative aims to revamp 51% of its store fleet within two years, potentially boosting sales by over 10% and net margins by more than 20% by 2027. Despite facing challenges like fluctuating consumer spending and supply chain risks, the company remains debt-free and boasts high-quality earnings. Its recent full-year sales reached US$1.2 billion, while net income slightly increased to US$73.77 million compared to last year. Analysts maintain a price target of US$21.5 per share, suggesting potential undervaluation in current market conditions.

Tompkins Financial (NYSEAM:TMP)

Simply Wall St Value Rating: ★★★★★★

Overview: Tompkins Financial Corporation is a financial holding company that offers a range of services including commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, as well as insurance services, with a market cap of $886.42 million.

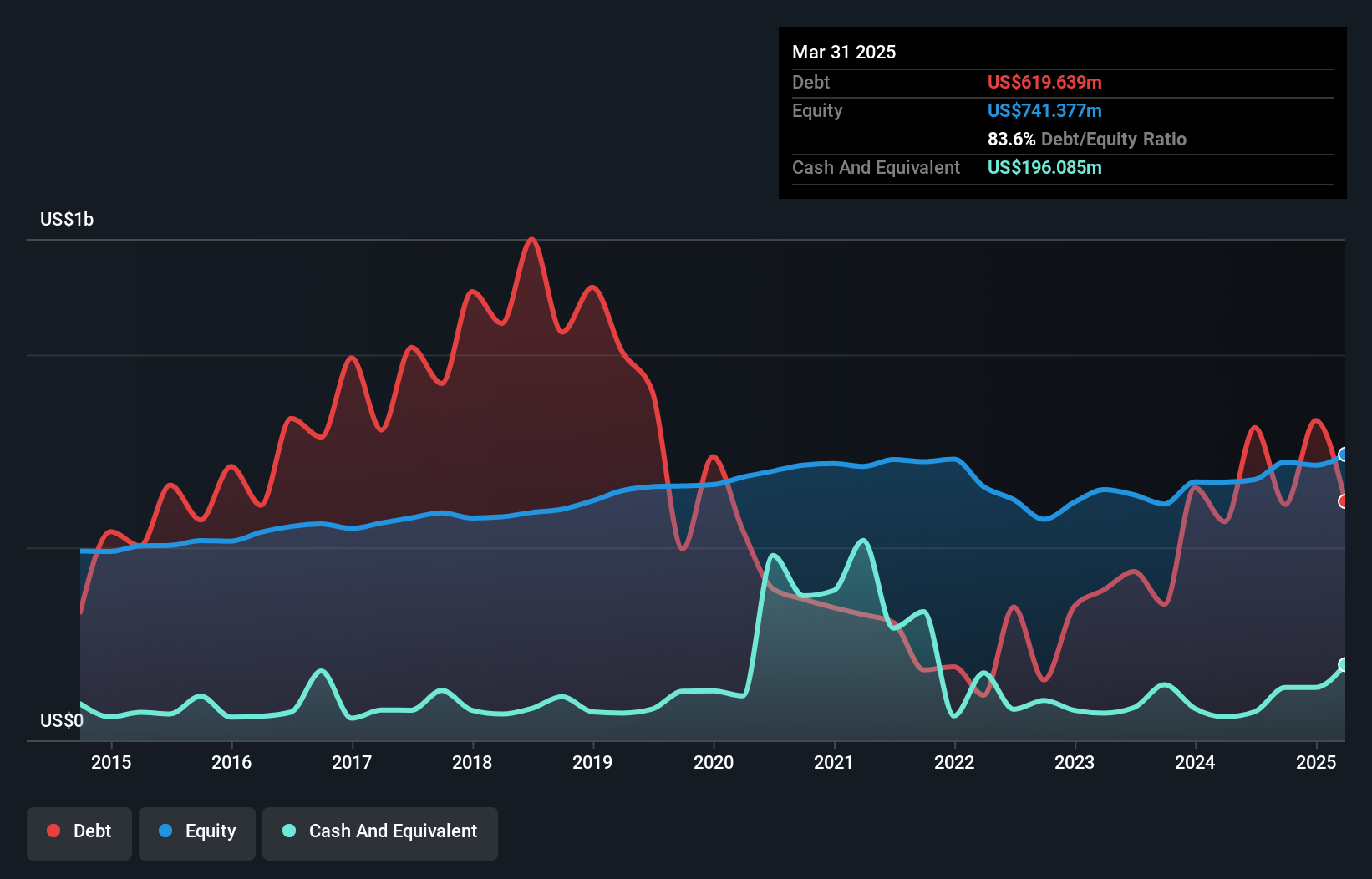

Operations: Tompkins generates revenue primarily through its diverse financial services, including banking and investment management. The company's net profit margin stands at 25%, reflecting its efficiency in converting revenue into profit.

Tompkins Financial, with assets totaling US$8.2 billion and equity of US$741.4 million, is a financial entity that thrives on stability with 91% of its liabilities funded by low-risk customer deposits. The bank's total deposits stand at US$6.8 billion while loans amount to US$6 billion, complemented by an appropriate bad loan allowance at 0.8% of total loans. Its net interest margin is 2.8%. Recent earnings showed impressive growth, surging by 956%, far outpacing the industry average of 4.6%. Despite not engaging in share repurchases recently, it remains a solid player with high-quality earnings and sound fundamentals.

- Get an in-depth perspective on Tompkins Financial's performance by reading our health report here.

Gain insights into Tompkins Financial's past trends and performance with our Past report.

Summing It All Up

- Reveal the 284 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SCVL

Shoe Carnival

Operates as a family footwear retailer in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion