- United States

- /

- Auto

- /

- NYSE:NIO

Acelyrin Leads The Charge With 2 Other US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a five-session losing streak, led by a rally in major technology companies, investors are keenly observing opportunities across various sectors. Penny stocks, while often seen as relics of past trading eras, continue to offer intriguing prospects for growth and value discovery. These stocks typically represent smaller or newer companies that can deliver significant returns when supported by strong financials and sound fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8224 | $5.97M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.00 | $1.76B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $102.23M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.63 | $10.89M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.3264 | $12.01M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.26 | $98.88M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.74 | $47.54M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.40 | $24.83M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9846 | $88.55M | ★★★★★☆ |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Acelyrin (NasdaqGS:SLRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acelyrin, Inc. is a clinical biopharma company dedicated to identifying, acquiring, and accelerating the development and commercialization of transformative medicines, with a market cap of $383.24 million.

Operations: Acelyrin, Inc. has not reported any revenue segments.

Market Cap: $383.24M

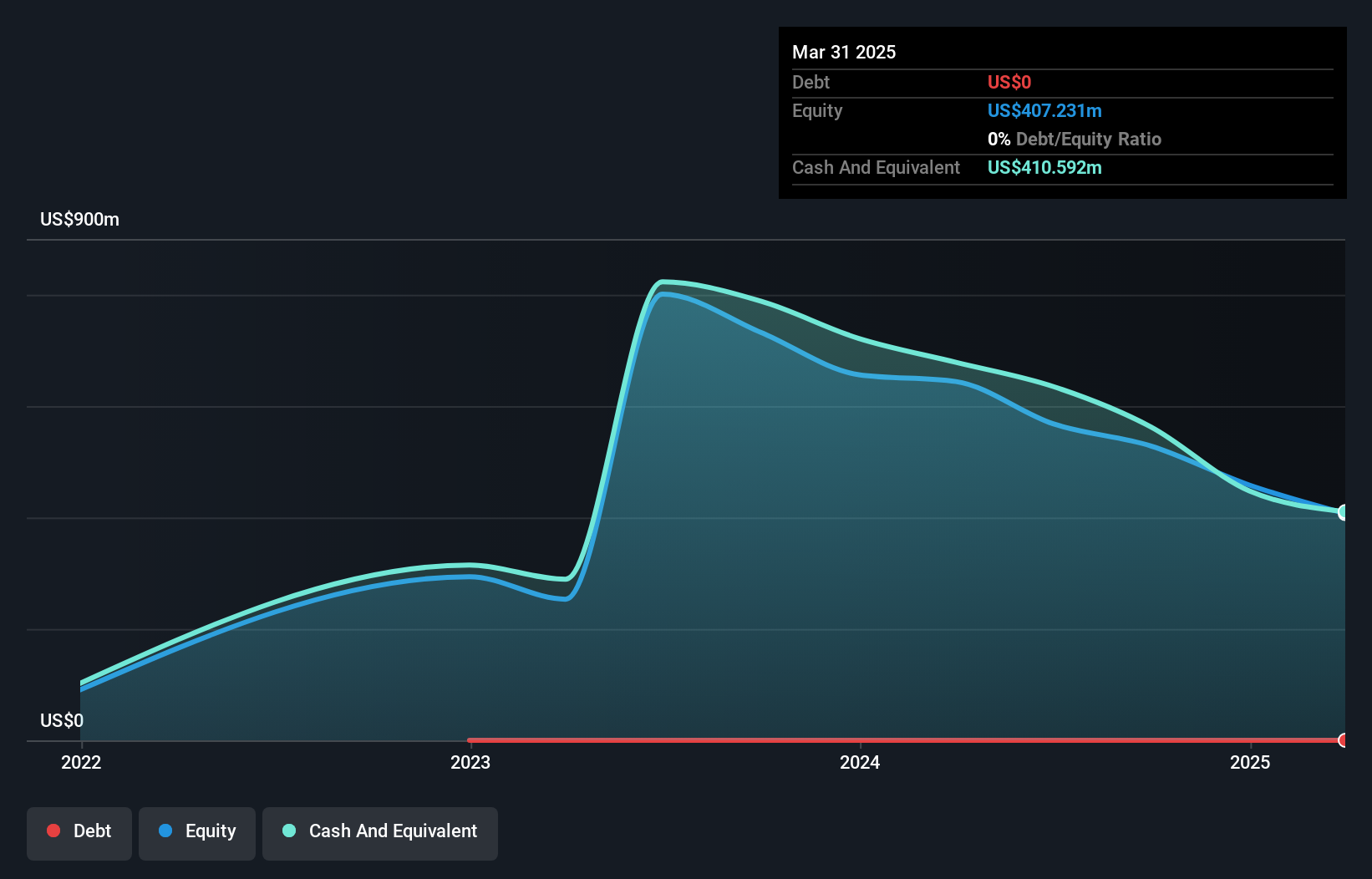

Acelyrin, Inc., a clinical biopharma company with a market cap of US$383.24 million, remains pre-revenue and unprofitable. Despite its debt-free status and sufficient cash runway projected to mid-2027, the company's recent Phase 2b/3 trial for izokibep in uveitis did not meet primary endpoints, leading to halted internal investment in this area. The focus has shifted to lonigutamab for thyroid eye disease. Recent executive resignations may impact operations as the company navigates these strategic adjustments amid high share volatility and past shareholder dilution through equity offerings totaling US$150 million.

- Click here to discover the nuances of Acelyrin with our detailed analytical financial health report.

- Learn about Acelyrin's future growth trajectory here.

Taysha Gene Therapies (NasdaqGS:TSHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taysha Gene Therapies, Inc. is a gene therapy company that develops and commercializes adeno-associated virus-based treatments for monogenic diseases of the central nervous system, with a market cap of approximately $393.49 million.

Operations: The company's revenue segment is focused on developing AAV-based gene therapies for the treatment of rare monogenic diseases, generating $9.92 million.

Market Cap: $393.49M

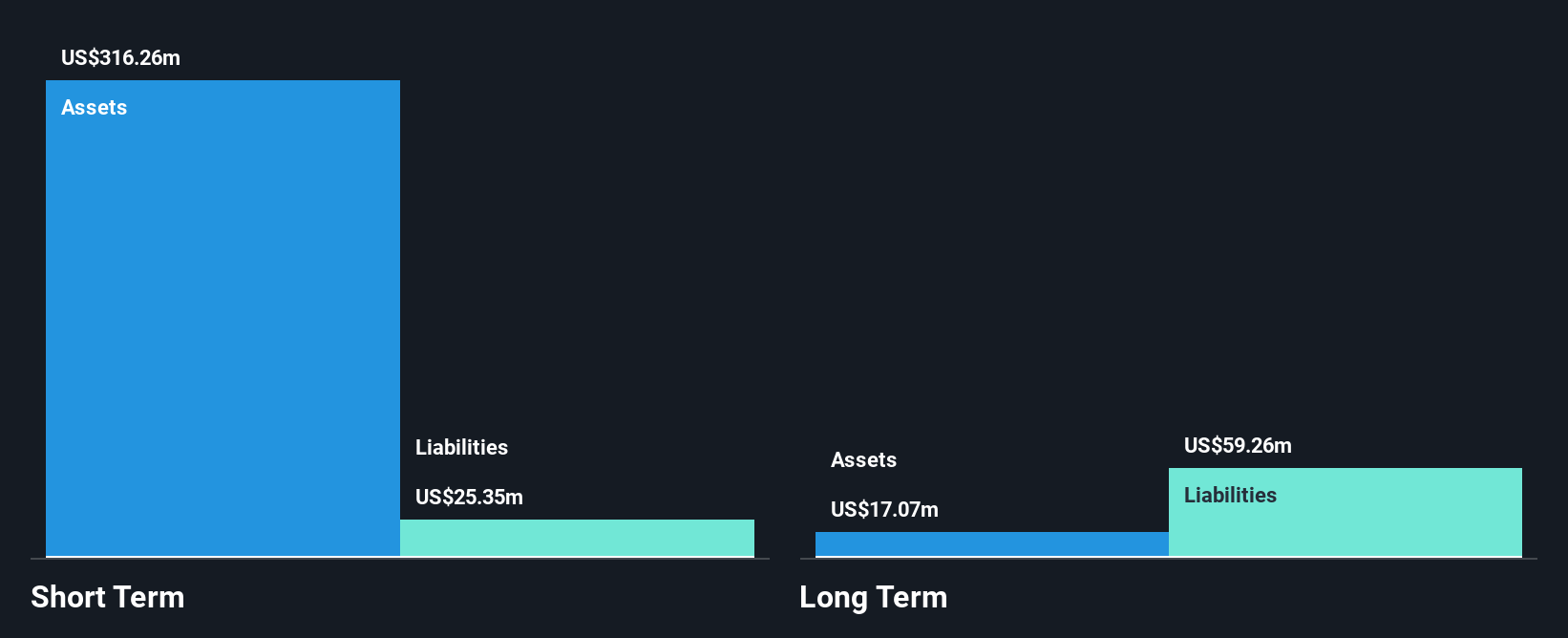

Taysha Gene Therapies, Inc., with a market cap of US$393.49 million, has faced challenges typical for penny stocks in the biotech sector. The company remains unprofitable with increasing losses over five years and recent impairments of long-lived assets totaling US$4.84 million. Despite this, it maintains a strong cash position, with short-term assets exceeding both short- and long-term liabilities significantly. Recent inclusion in the S&P Biotechnology Select Industry Index could enhance visibility among investors. However, shareholders have experienced dilution as shares outstanding increased by 9.6%. Revenue is forecast to grow substantially at 57.43% annually despite current volatility and financial hurdles.

- Get an in-depth perspective on Taysha Gene Therapies' performance by reading our balance sheet health report here.

- Assess Taysha Gene Therapies' future earnings estimates with our detailed growth reports.

NIO (NYSE:NIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NIO Inc. is a company that designs, develops, manufactures, and sells smart electric vehicles in China with a market capitalization of approximately $9.73 billion.

Operations: The company generates revenue from its Auto Manufacturers segment, which amounted to CN¥63.13 billion.

Market Cap: $9.73B

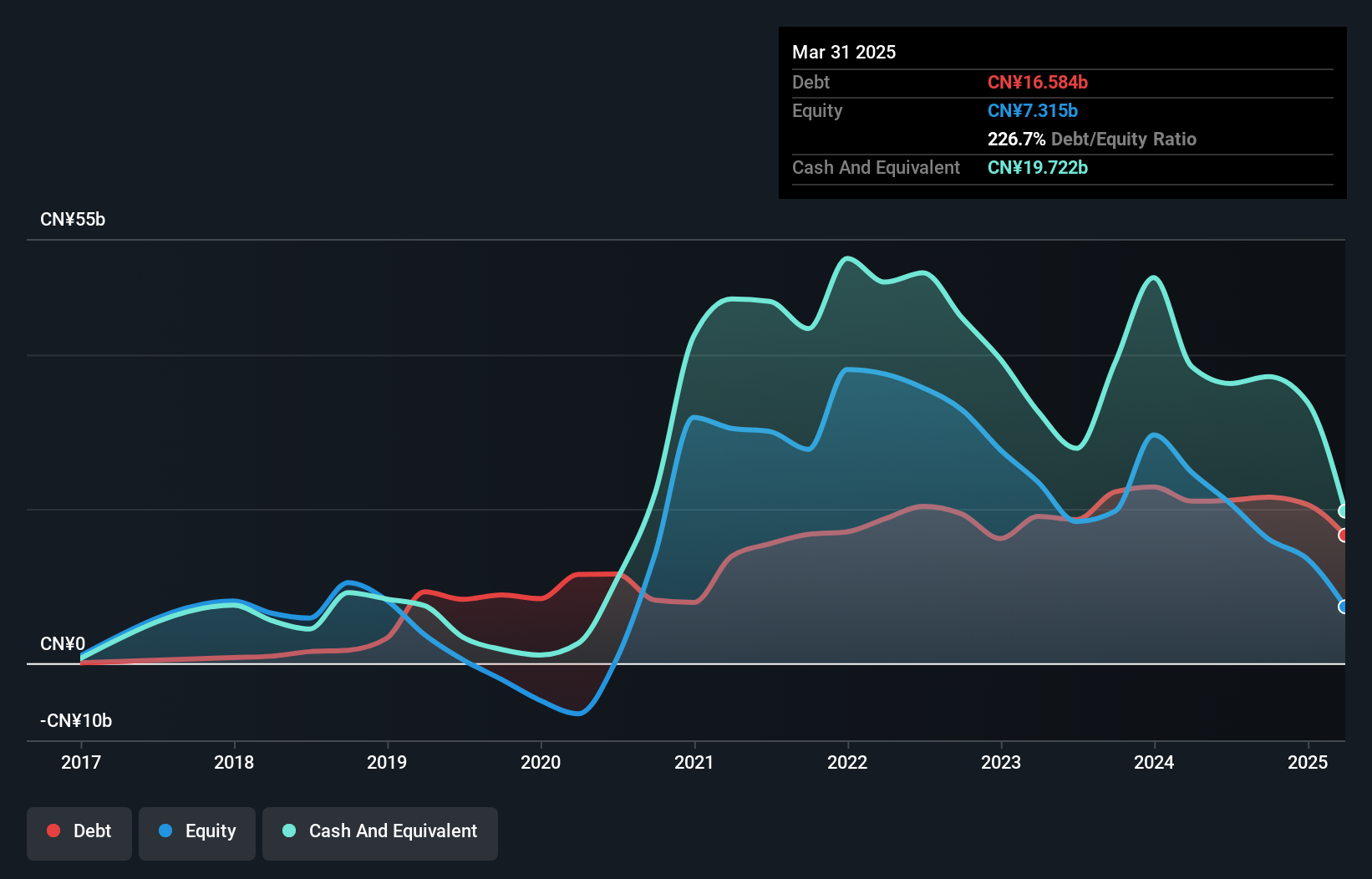

NIO Inc., with a market cap of approximately $9.73 billion, continues to face profitability challenges, reflected in its negative return on equity and increasing losses over five years. However, the company has demonstrated robust revenue growth potential, with forecasts suggesting a 23.59% annual increase. Despite being unprofitable, NIO's short-term assets exceed both short- and long-term liabilities, indicating financial stability in covering obligations. Recent vehicle delivery records highlight strong demand for its electric vehicles, while new product launches like the ET9 and Firefly model could further enhance market presence and drive future growth opportunities in the smart EV sector.

- Dive into the specifics of NIO here with our thorough balance sheet health report.

- Explore NIO's analyst forecasts in our growth report.

Seize The Opportunity

- Explore the 717 names from our US Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives