- United States

- /

- Software

- /

- NYSE:KVYO

3 Stocks That May Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

In recent days, U.S. stock indexes have shown little movement as investors digest revised jobs data indicating a weaker labor market than previously thought. Amid these conditions, identifying stocks that may be trading below their fair value can present opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Phibro Animal Health (PAHC) | $39.43 | $77.67 | 49.2% |

| Peapack-Gladstone Financial (PGC) | $29.05 | $56.54 | 48.6% |

| Northwest Bancshares (NWBI) | $12.74 | $24.41 | 47.8% |

| Niagen Bioscience (NAGE) | $9.45 | $18.63 | 49.3% |

| McGraw Hill (MH) | $15.04 | $28.87 | 47.9% |

| Investar Holding (ISTR) | $22.98 | $45.29 | 49.3% |

| Horizon Bancorp (HBNC) | $16.63 | $31.86 | 47.8% |

| Exact Sciences (EXAS) | $53.89 | $103.12 | 47.7% |

| AGNC Investment (AGNC) | $10.34 | $20.38 | 49.3% |

| Advanced Flower Capital (AFCG) | $4.55 | $8.76 | 48.1% |

Let's review some notable picks from our screened stocks.

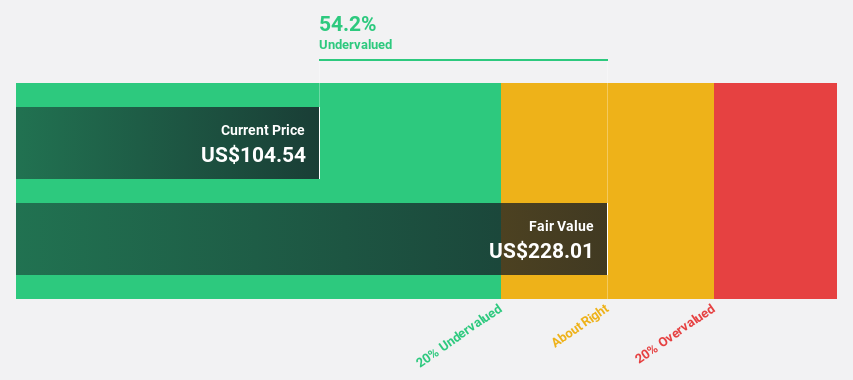

Ligand Pharmaceuticals (LGND)

Overview: Ligand Pharmaceuticals Incorporated is a biopharmaceutical company that develops and licenses biopharmaceutical assets globally, with a market cap of approximately $3.27 billion.

Operations: The company generates revenue of $187.58 million from the development and licensing of biopharmaceutical assets globally.

Estimated Discount To Fair Value: 42%

Ligand Pharmaceuticals is trading at US$165.86, significantly below its estimated fair value of US$285.86, indicating potential undervaluation based on cash flows. The company is projected to become profitable within three years, with earnings expected to grow by 56.66% annually, outpacing the market's average growth rate. Recent developments include raising revenue guidance for 2025 and completing a US$400 million fixed-income offering, which could bolster financial flexibility and support future growth initiatives.

- Our growth report here indicates Ligand Pharmaceuticals may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Ligand Pharmaceuticals.

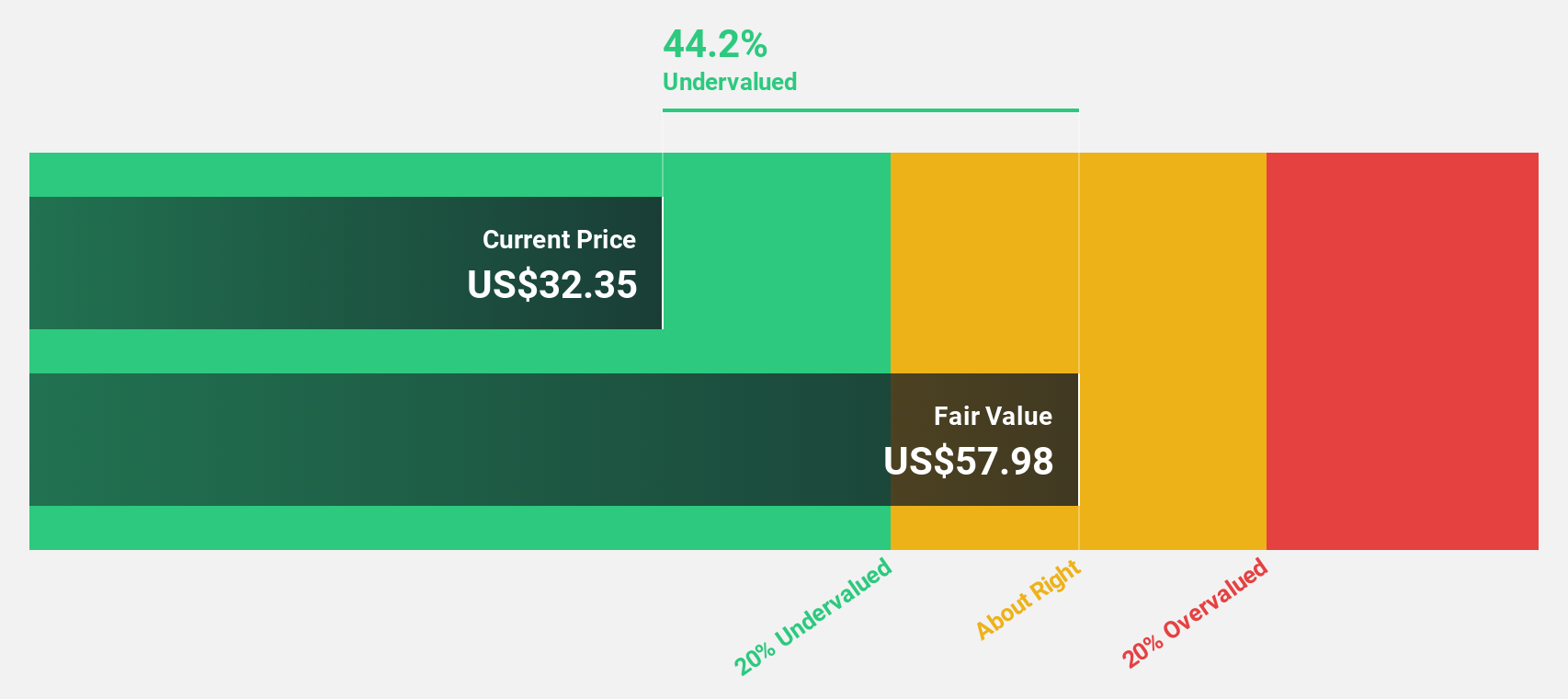

Klaviyo (KVYO)

Overview: Klaviyo, Inc. is a technology company that offers a software-as-a-service platform globally, with a market cap of approximately $9.66 billion.

Operations: Klaviyo generates revenue primarily from its Internet Software segment, which amounts to $1.08 billion.

Estimated Discount To Fair Value: 38.9%

Klaviyo is trading at US$33.2, significantly below its estimated fair value of US$54.34, highlighting potential undervaluation based on cash flows. The company anticipates becoming profitable within three years, with revenue growth projected to exceed the broader market rate. Recent strategic moves include a $195 million follow-on equity offering and leadership changes with Chano Fernández as Interim Executive Officer, potentially enhancing operational focus and financial stability amidst ongoing product innovations in AI-driven customer experiences.

- Upon reviewing our latest growth report, Klaviyo's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Klaviyo's balance sheet health report.

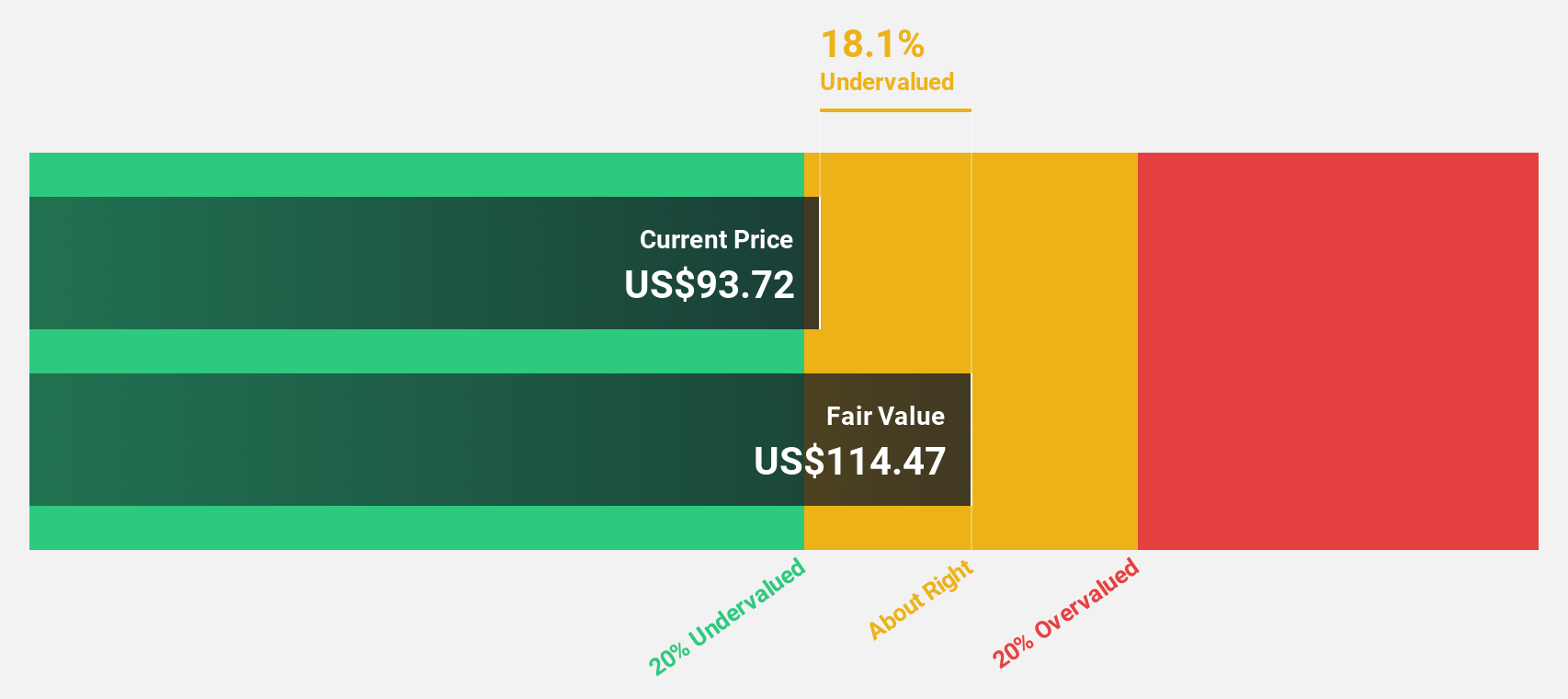

Modine Manufacturing (MOD)

Overview: Modine Manufacturing Company specializes in designing, engineering, testing, manufacturing, and selling mission-critical thermal solutions globally, with a market cap of $7.10 billion.

Operations: The company's revenue is primarily derived from its Climate Solutions segment, which generated $1.48 billion, and its Performance Technologies segment, which contributed $1.14 billion.

Estimated Discount To Fair Value: 18.1%

Modine Manufacturing trades at US$138.65, below its estimated fair value of US$169.38, suggesting undervaluation based on cash flows. With projected earnings growth of 31.6% annually, surpassing the broader market's rate, Modine is positioned for robust expansion. Recent initiatives include launching advanced cooling products and expanding manufacturing capacity in the U.S., reinforcing its strategic focus on high-growth data center markets while addressing increasing demand driven by AI applications.

- Our earnings growth report unveils the potential for significant increases in Modine Manufacturing's future results.

- Dive into the specifics of Modine Manufacturing here with our thorough financial health report.

Taking Advantage

- Click this link to deep-dive into the 189 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)