- United States

- /

- Auto

- /

- NYSE:F

Ford (NYSE:F) is Bidding to Become a Primary EV Competitor with more than 30 billion in Capital Investments

Today we're going to analyze the Ford Motor Company ( NYSE:F ). The company's stock saw a significant share price rise of over 20% in the past couple months. With many analysts covering the large-cap stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price, but an overview of the fundamentals will give investors a better grounding into the future potential of the stock.

Ford operates in three main segments, automotive - their traditional revenue stream, mobility - the new, EV focused segment and arguably the one for which investors are most excited about, and their Credit service - which primarily deals with financing and leasing activities.

View our latest analysis for Ford Motor

In the last earnings report, Ford posted some mixed results:

In North America, third quarter 2021 wholesales decreased 16% from a year ago, primarily reflecting the impact of semiconductor-related production constraints. The company lost 2.4% market share for the year to date, from 13.7% to 11.3% market share.

In South America, Ford lost 3.5% market share, but kept year to date revenues at roughly the same level of US$1.6b, which implies that competitors are posting stronger growth.

In Europe, the company remained relatively stable, losing only 0.8% market share YTD, however it managed to increase revenues from US$15.5b to US$18.7b.

Finally, in China - the company retained its market share, but revenues declined from US$2.4b to US$1.96b, implying that the last quarter auto sales were generally down, but the company managed to retain its relative position.

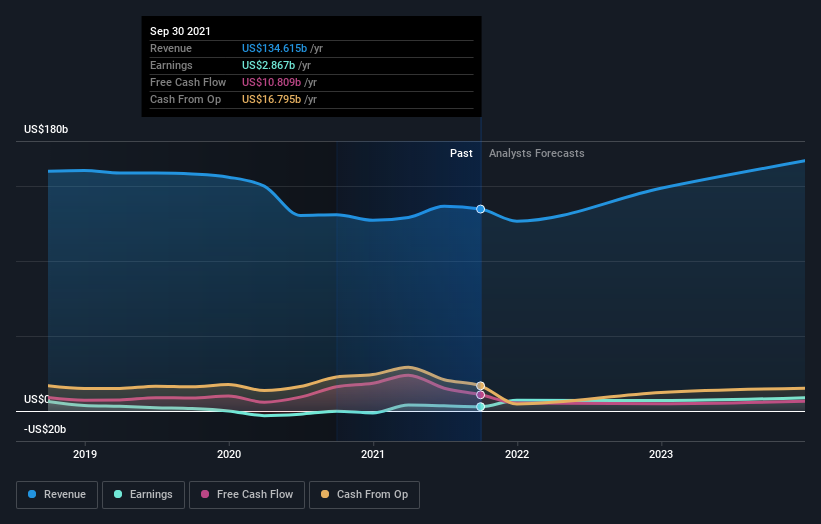

The consolidated income on a trailing twelve-month basis, along with analyst estimates, shows a fuller picture for the company:

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio.

It seems that 2020 and 2021 have been bad for Ford, and the company will struggle to get back to pre-2020 revenue levels in the future.

Looking, at profitability, we see a different picture. Even though statutory profits are low, free cash flows are higher, and that is arguably a better measure. We can expect these two differences to converge in the future, and they tend to do so on the free cash flows, which would show that Ford is actually more profitable than it currently seems.

The most exciting segment of Ford is the Mobility segment, where the company is still posting a loss, primarily because it is currently in the investment and development phase of the EV and Autonomous Intelligent Driving from Argo AI.

Ford is spending more than US$30b in cumulative investments by 2025, which is intended to place Ford as a primary competitor in the EV market. Investors may need to wait some time, before the investments result in higher cash flows, but on the other hand investing before the growth is priced-in may be a viable strategy.

Key Takeaways

Ford is undergoing the EV transformation, and is committing to substantial investment in operations in order to become a primary competitor in the EV and mobility market.

The value of Ford comes from the future growth prospects and the success of delivering on their EV project.

The company fundamentals are stable, but significant growth is not expected in the next few years, and investors will have to keep watch of how the EV race is unfolding among big and small competitors in the future.

Ford, has the brand, production capacity and financial leverage to engage in large, capital intense projects, and therefore might be a viable investment for the EV and automotive industry.

In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Our analysis shows 3 warning signs for Ford Motor (1 can't be ignored!) and we strongly recommend you look at these before investing.

If you are no longer interested in Ford Motor, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)