- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Three Growth Companies Insiders Are Heavily Invested In

Reviewed by Simply Wall St

As the U.S. stock markets rebound sharply following a softened stance on China trade tensions, investors are keenly observing sectors that might benefit from renewed optimism and stability. In this environment, companies with strong growth potential and significant insider ownership often attract attention, as insider investment can be seen as a vote of confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 86.6% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We're going to check out a few of the best picks from our screener tool.

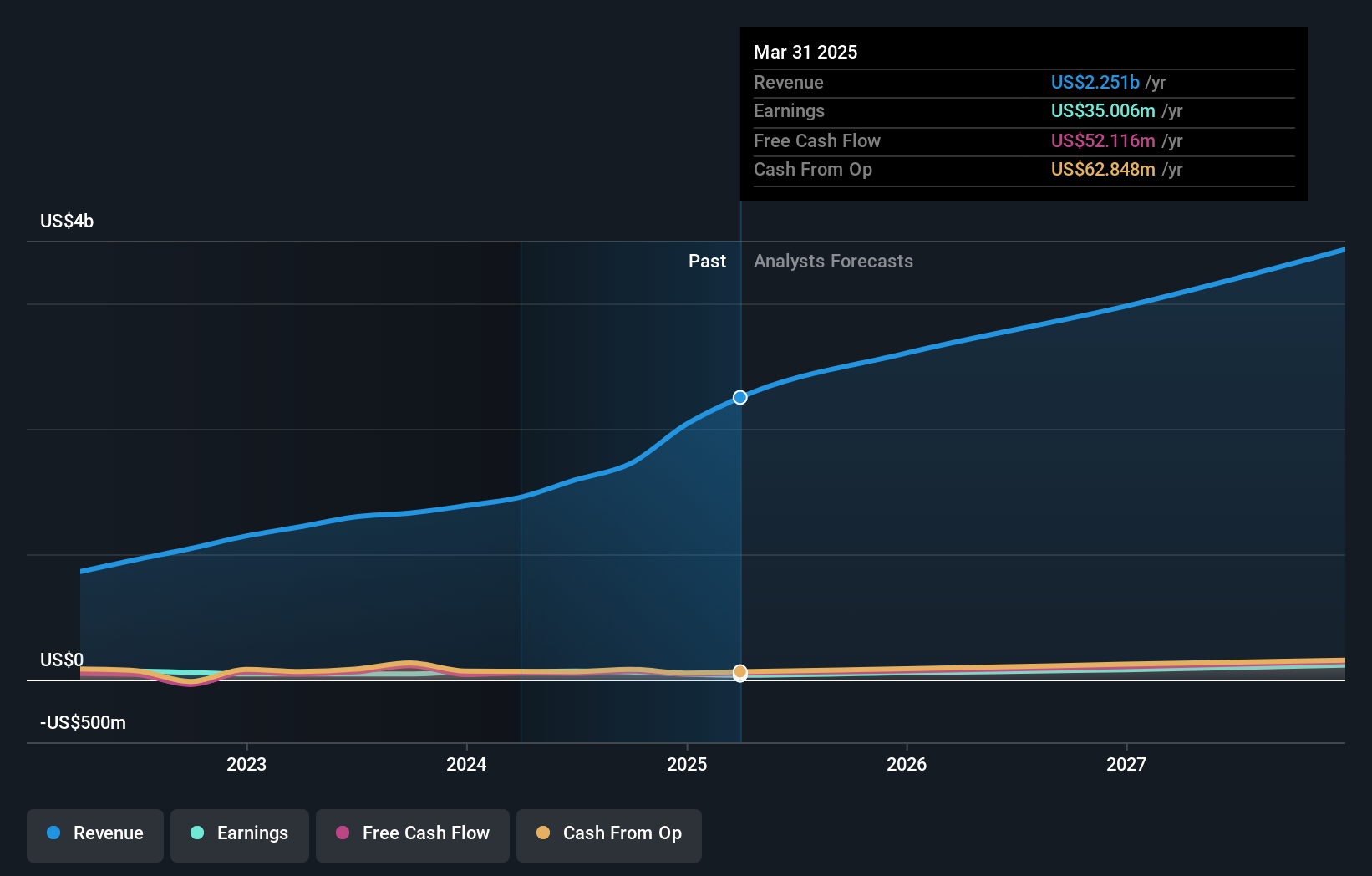

Astrana Health (ASTH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Astrana Health, Inc. is a healthcare management company that offers medical care services in the United States with a market cap of $1.45 billion.

Operations: The company's revenue is primarily derived from its Care Partners segment at $2.34 billion, followed by Care Delivery at $142.87 million and Care Enablement at $166.46 million.

Insider Ownership: 12.5%

Revenue Growth Forecast: 17.2% p.a.

Astrana Health demonstrates strong growth potential with earnings projected to rise significantly at 34.2% annually, outpacing the US market. Revenue is also set to grow faster than the market at 17.2%. Despite a recent decline in profit margins from 4.3% to 1%, insider ownership remains high, aligning management interests with shareholders'. The stock trades well below its estimated fair value and analysts anticipate a price increase of over 50%.

- Click to explore a detailed breakdown of our findings in Astrana Health's earnings growth report.

- Our comprehensive valuation report raises the possibility that Astrana Health is priced lower than what may be justified by its financials.

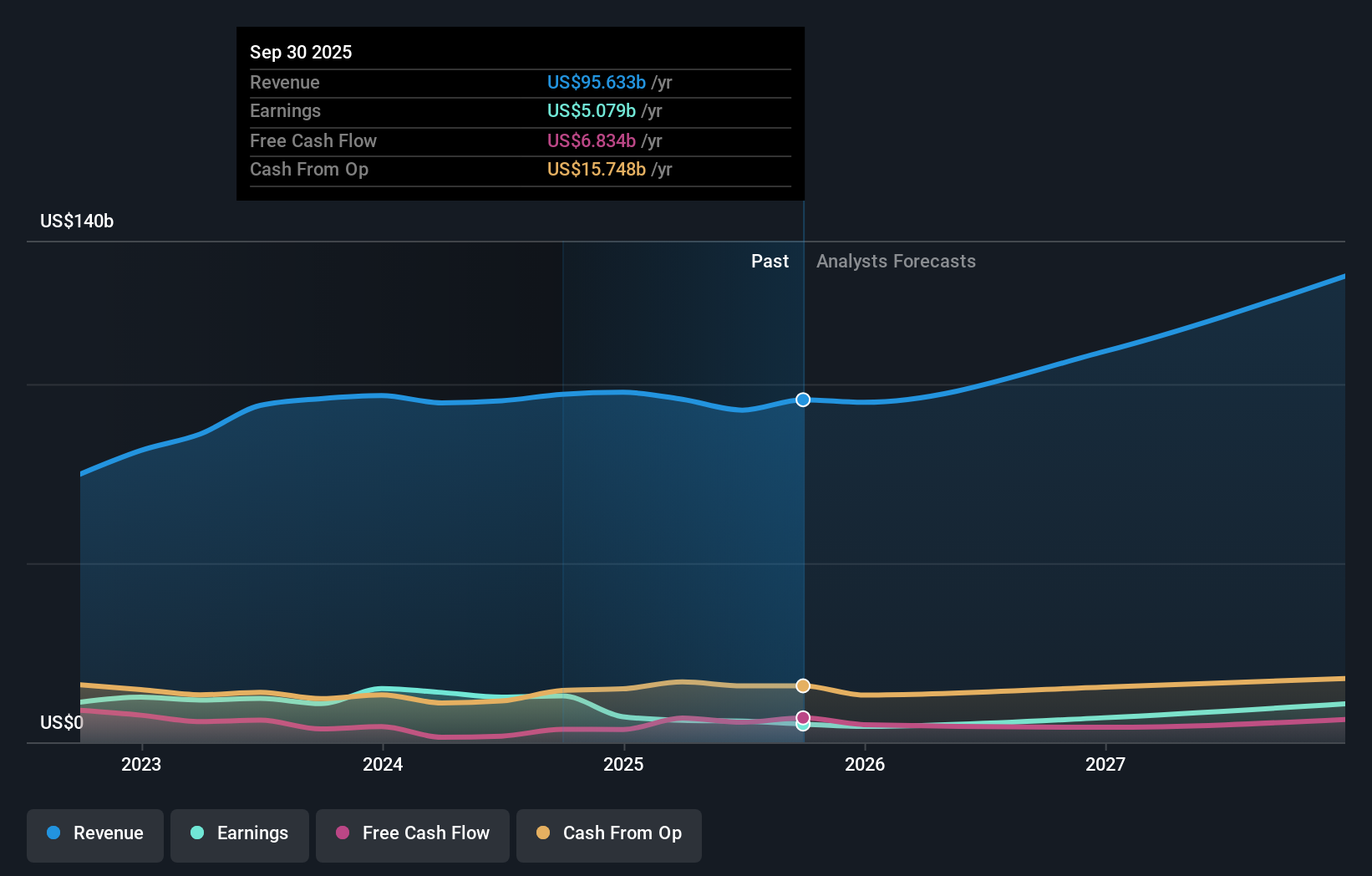

Tesla (TSLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tesla, Inc. is involved in the design, development, manufacturing, leasing, and sale of electric vehicles and energy generation and storage systems globally, with a market capitalization of approximately $1.45 trillion.

Operations: Tesla's revenue is primarily derived from its automotive segment, which generated $81.76 billion, and its energy generation and storage segment, which contributed $10.96 billion.

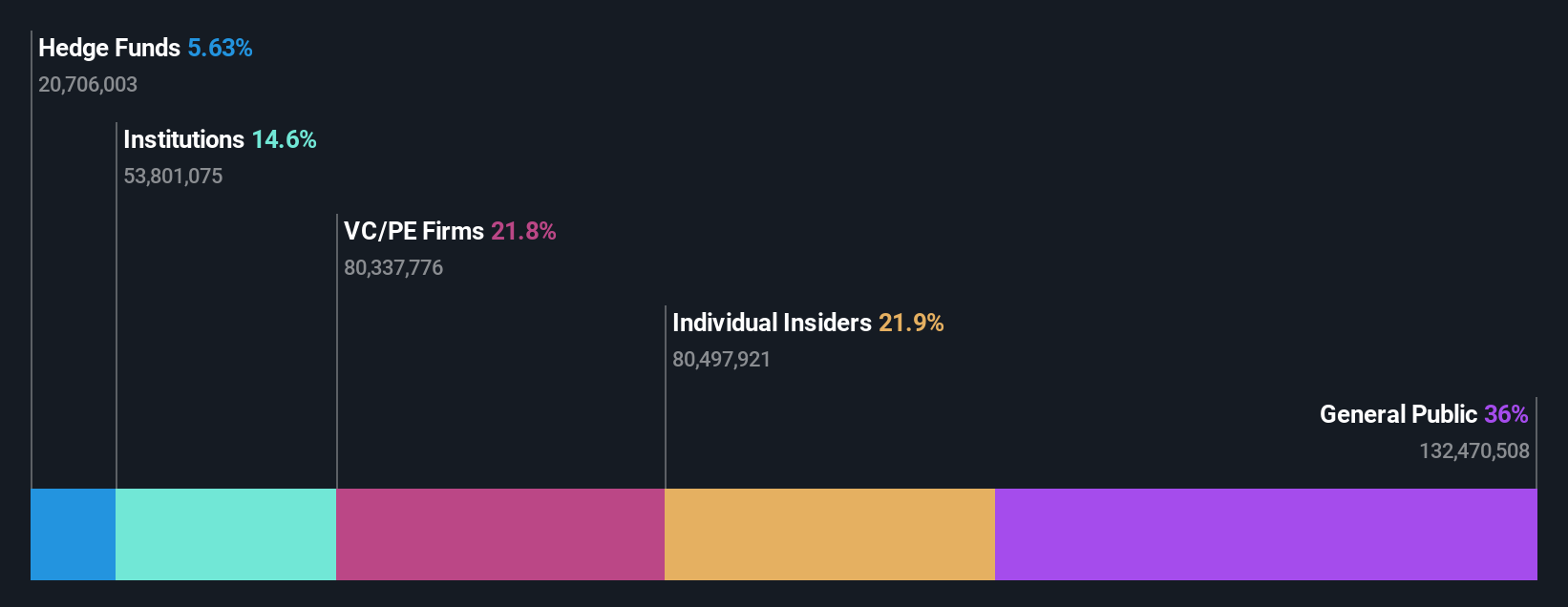

Insider Ownership: 15.4%

Revenue Growth Forecast: 16.5% p.a.

Tesla's projected earnings growth of 29.1% annually surpasses the US market average, despite its declining profit margins from 13.2% to 6.3%. Insider activity shows more shares bought than sold recently, suggesting confidence in future prospects. However, legal challenges and investor activism highlight governance concerns, with proposals for democratic governance and accountability gaining traction among shareholders ahead of a critical vote requiring a supermajority approval amidst Elon Musk's increasing control efforts.

- Delve into the full analysis future growth report here for a deeper understanding of Tesla.

- Our valuation report unveils the possibility Tesla's shares may be trading at a premium.

StubHub Holdings (STUB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: StubHub Holdings, Inc. operates a global ticketing marketplace for live event tickets and has a market cap of approximately $6.95 billion.

Operations: The company generates revenue from its ticketing marketplace for live events, with the Recreational Activities segment contributing $1.80 billion.

Insider Ownership: 19.3%

Revenue Growth Forecast: 32.5% p.a.

StubHub Holdings recently completed a US$800 million IPO and filed substantial shelf registrations, indicating significant capital raising activities. The company's revenue is forecast to grow at 32.5% annually, outpacing the broader US market. Despite trading well below its estimated fair value, shares remain highly illiquid with no recent insider trading activity reported. StubHub is expected to achieve profitability within three years, reflecting above-average market growth potential amidst ongoing structural changes post-IPO.

- Take a closer look at StubHub Holdings' potential here in our earnings growth report.

- Our expertly prepared valuation report StubHub Holdings implies its share price may be too high.

Summing It All Up

- Delve into our full catalog of 200 Fast Growing US Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)