- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Reports First Quarter 2025 Vehicle Production & Delivery

Reviewed by Simply Wall St

Tesla (NasdaqGS:TSLA) reported its first quarter 2025 results on April 2, revealing the production of 362,615 vehicles and delivery of 336,681 vehicles, which aligns with its long-term operational goals. These robust figures may have bolstered investor confidence, contributing to a 15% gain in the company's share price over the past week. Despite the broader market downturn prompted by U.S. restrictions on chip exports to China affecting major tech stocks, Tesla managed to outperform the trend. This suggests the company's strong operational results provided a counterweight to the negative market environment experienced by other tech firms.

We've identified 3 possible red flags for Tesla that you should be aware of.

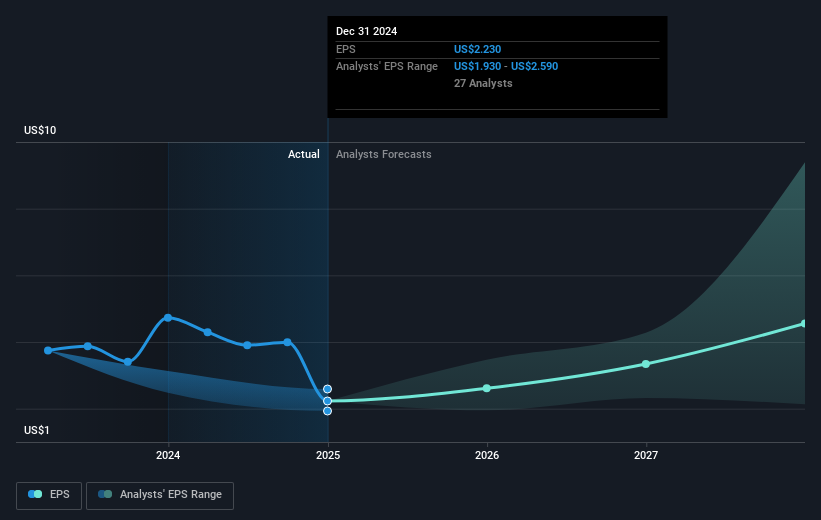

The recent production and delivery figures reported by Tesla, alongside its significant share price gain, suggest that the company's operational success is resonating with investors and could potentially influence its revenue and earnings forecasts. With a solid foundation in Full Self-Driving (FSD) capabilities, AI, and other technological advancements, Tesla's strategic initiatives may further enhance its growth potential, driving increased revenue and improved margins. These developments could also affect the consensus price target of US$313.96, potentially altering market expectations.

Over the past five years, Tesla's total shareholder return was very large, which highlights its long-term appeal. Comparatively, Tesla also achieved remarkable performance over the past year, significantly exceeding the US Auto industry's return of 44.9%. This performance, in connection with its current initiatives, continues to distinguish Tesla as a key player in the electric vehicle and technology sectors.

While the price target suggests a potential upside from the current share price of US$221.86 to US$318.27, the impact of Tesla's recent performance could influence future valuation assessments. Investors should consider how the company's expansion in AI, FSD, and robotics may further shape revenue growth, while the aggressive manufacturing changes present risks to both margins and earnings forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives