- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Robotaxies and Robots - What was Remarked on Tesla's (NASDAQ:TSLA) Q1 Earnings Call

Tesla, Inc. (NASDAQ:TSLA), issued the latest Q1 earnings call yesterday. Trading picked up, and the stock is trending 7% up pre-hours. We will examine the latest Q1 results along with the remarks from management.

Notably, the popular fund AARK sold 67.884k shares of Tesla stock, yesterday.

Analysts also update their future estimates shortly after earnings, so in is worth putting the company into your watchlist to get notified when that happens.

The highlights from the Q1 earnings call are:

- Delivered 310k vehicles in Q1 2022

- Lost about a month of build volume during the Shanghai factory shutdown

- Automotive gross margin reached 32.9%, operating margin of 19%+

- Total Q1 revenues of US$18.8b, an increase of 81% YoY, US$50.2b in the last 12 months

- Quarterly net income US$3.318b, US$8.4b in the last 12 months

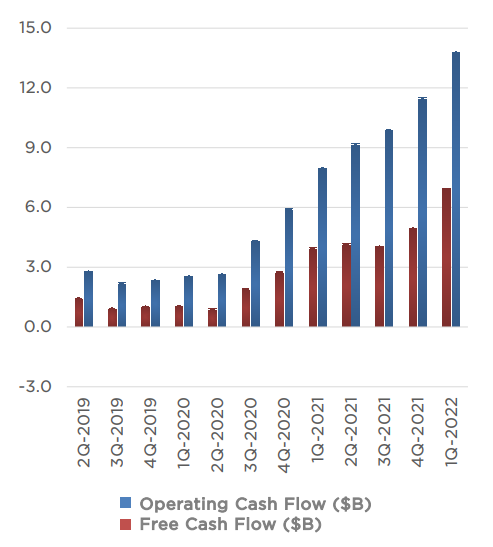

- Cash flow from operations at US$13.85b in the last 12 months

- Free cash flow at US$6,950b in the last 12 months

Outlook and Management remarks:

- Pushing for the autonomous robotaxi production to reach volume production by 2024

- Estimated production of 1.5 million vehicles by the end of 2022 - 60% growth

- Musk expressed confidence that the company will grow at a 50% CAGR for the next 5+ years

- In Q2 vehicle production to stagnate to Q1 levels, but Q3 and Q4 to make up for the loss

- At maturity, Musk expects Tesla to produce around 20 million cars annually

- Musk notes that investors are underestimating the value of the Optimus robot program, which he thinks will be more than the whole car business.

Outlook Review

In general, it seems that Tesla is striving to maintain high revenue growth over the next decade, when the company should produce around 20 million vehicles when it matures - after it builds up full capacity. Q2 is expected to be about as successful as Q1, while the second half of 2022 is expected to make up and ultimately finish the year with a 50%+ revenue growth.

Musk also commented on the value of Optimus as having more potential than the car business. While it is certainly possible to go beyond the imaginable with innovation, this remark lacks a basis and is highly speculative. When thinking about future projects, investors need to be provided with a path to growth, capital expenditures for the project and profitability. Considering where Optimus is in its development, this sounds like a promise being made "based on a theory before a phase-I clinical trial". Seasoned investors may take caution, and management can always fall back on the disclaimer made before making these forward-looking statements.

Be up-to-date with the fundamentals and check out our latest analysis for Tesla!

There are many ways of discovering value, one is to look at a list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives