- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (NasdaqGS:RIVN) Sees 7% Dip Despite Q4 Revenue Jump To US$1,734 Million

Reviewed by Simply Wall St

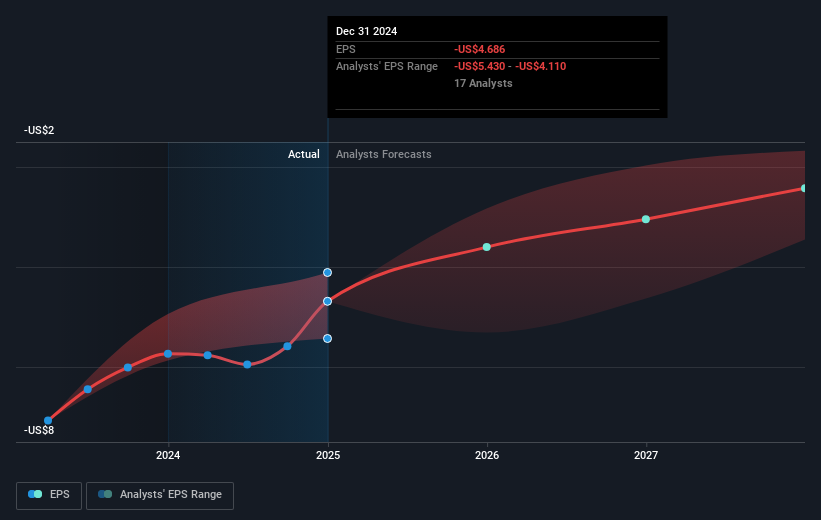

Rivian Automotive (NasdaqGS:RIVN) recently announced earnings for the fourth quarter of 2024, reporting a revenue increase to $1,734 million while reducing its net loss to $744 million. Despite the improved financials and positive corporate guidance for 2025, the company's stock saw a 6.71% decline over the last quarter. Noteworthy developments include the opening of sales for the Rivian Commercial Van in the U.S. and a sizable Shelf Registration filing for $880 million related to employee stock ownership. These moves occurred amid broader market uncertainty, with major U.S. indexes presenting mixed performances as investors reacted to economic concerns and policy developments from the White House. Given that the Nasdaq slid 0.6% and the overall market dropped 3.6% within the period, Rivian's price movement reflects sector trends alongside company-specific factors, such as the anticipated impact of new tariffs and production projections.

Click to explore a detailed breakdown of our findings on Rivian Automotive.

Over the past year, Rivian Automotive's total shareholder return was 0.89%, underperforming both the US market, which returned 16.9%, and the US Auto industry, which gained 30.7%. This modest return can be partially attributed to several key developments. Notably, Rivian's joint venture with Volkswagen Group established in November 2024 focused on next-generation electrical architecture, promising future innovation but possibly weighing on immediate investor sentiment due to associated costs and long-term timelines. Additionally, the class action lawsuit filed in June 2024, alleging misleading statements regarding production and financial projections, may have heightened investor uncertainty.

Rivian's financial maneuvers included a substantial debt financing initiative in January 2025, securing up to US$6.6 billion from the U.S. Department of Energy to fund a new manufacturing facility in Georgia. Such investments suggest future capacity expansion, although short-term financial impacts could have been perceived negatively. Lastly, operationally, Rivian's collaboration with Patagonia and Sol Systems for renewable energy projects, announced in October 2024, highlights their commitment to sustainability, potentially appealing to socially responsible investors but without immediate financial returns.

- Analyze Rivian Automotive's fair value against its market price in our detailed valuation report—access it here.

- Assess the downside scenarios for Rivian Automotive with our risk evaluation.

- Is Rivian Automotive part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives