3 European Dividend Stocks To Consider With Up To 5.3% Yield

Reviewed by Simply Wall St

As European markets experience a wave of cautious optimism due to potential EU-U.S. trade agreements and steady interest rates from the European Central Bank, investors are closely monitoring opportunities for stable returns amidst economic uncertainties. In this context, dividend stocks can offer a compelling option for income-focused investors seeking resilience and potential growth in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.51% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.85% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.24% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.63% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.81% | ★★★★★★ |

| ERG (BIT:ERG) | 5.21% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.03% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★★ |

Click here to see the full list of 227 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

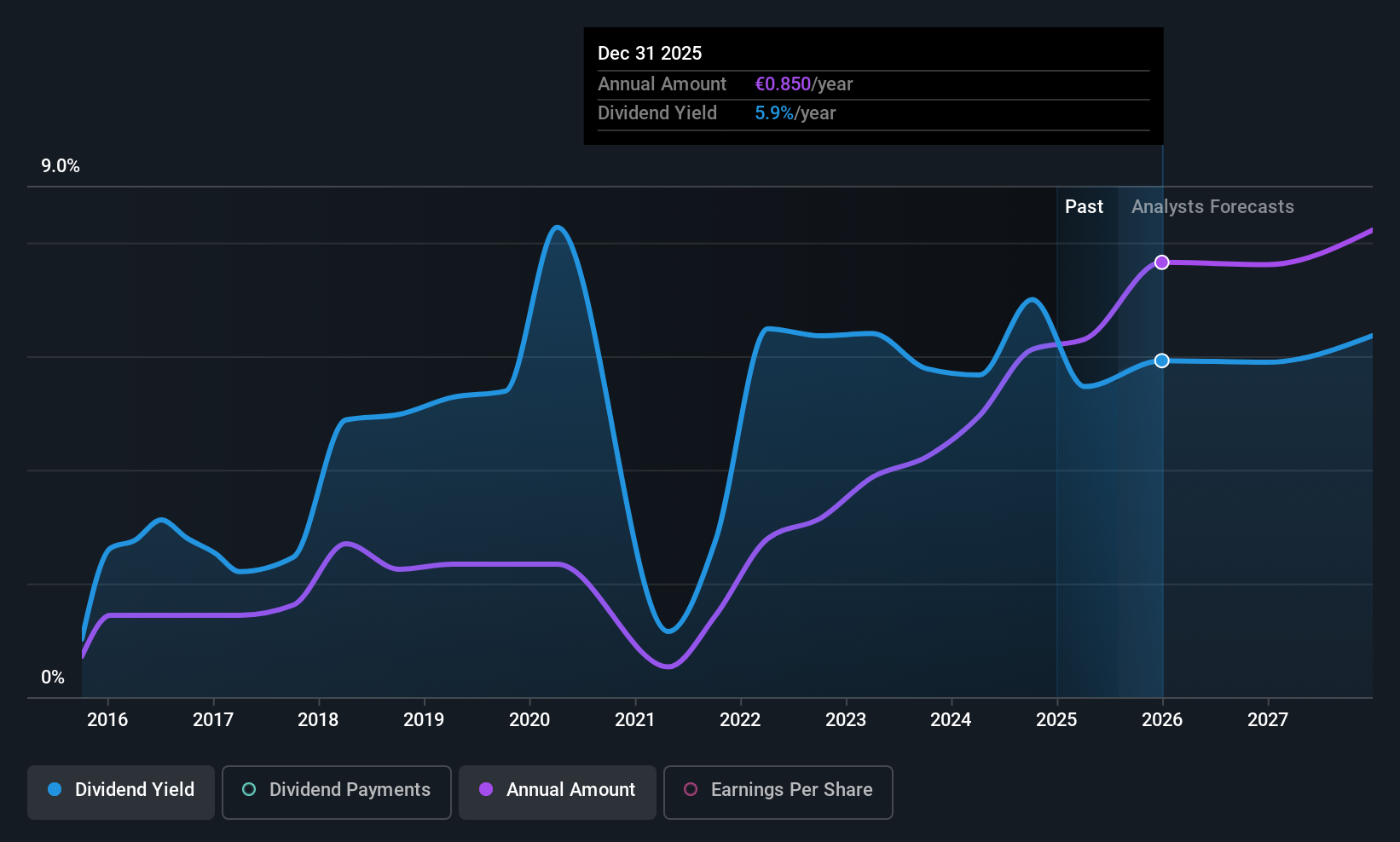

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. is a financial institution offering retail and wholesale banking as well as asset management services across Spain, Mexico, Turkey, South America, Europe, the United States, and Asia with a market cap of €75.96 billion.

Operations: Banco Bilbao Vizcaya Argentaria, S.A.'s revenue segments include €12.03 billion from Mexico, €3.90 billion from Turkey, €4.33 billion from South America, and €9.22 billion from Spain (including Non Core Real Estate).

Dividend Yield: 5.3%

BBVA's dividend profile presents mixed elements for investors. While the bank's current dividend yield is in the top 25% of Spanish market payers, its historical payments have been unreliable and volatile over the past decade. Despite this, dividends are well-covered by earnings with a low payout ratio of 39.7%, indicating sustainability. Recent earnings growth and strategic moves like the tender offer for Banco de Sabadell suggest potential for future stability, but high bad loan levels remain a concern.

- Take a closer look at Banco Bilbao Vizcaya Argentaria's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Banco Bilbao Vizcaya Argentaria is trading behind its estimated value.

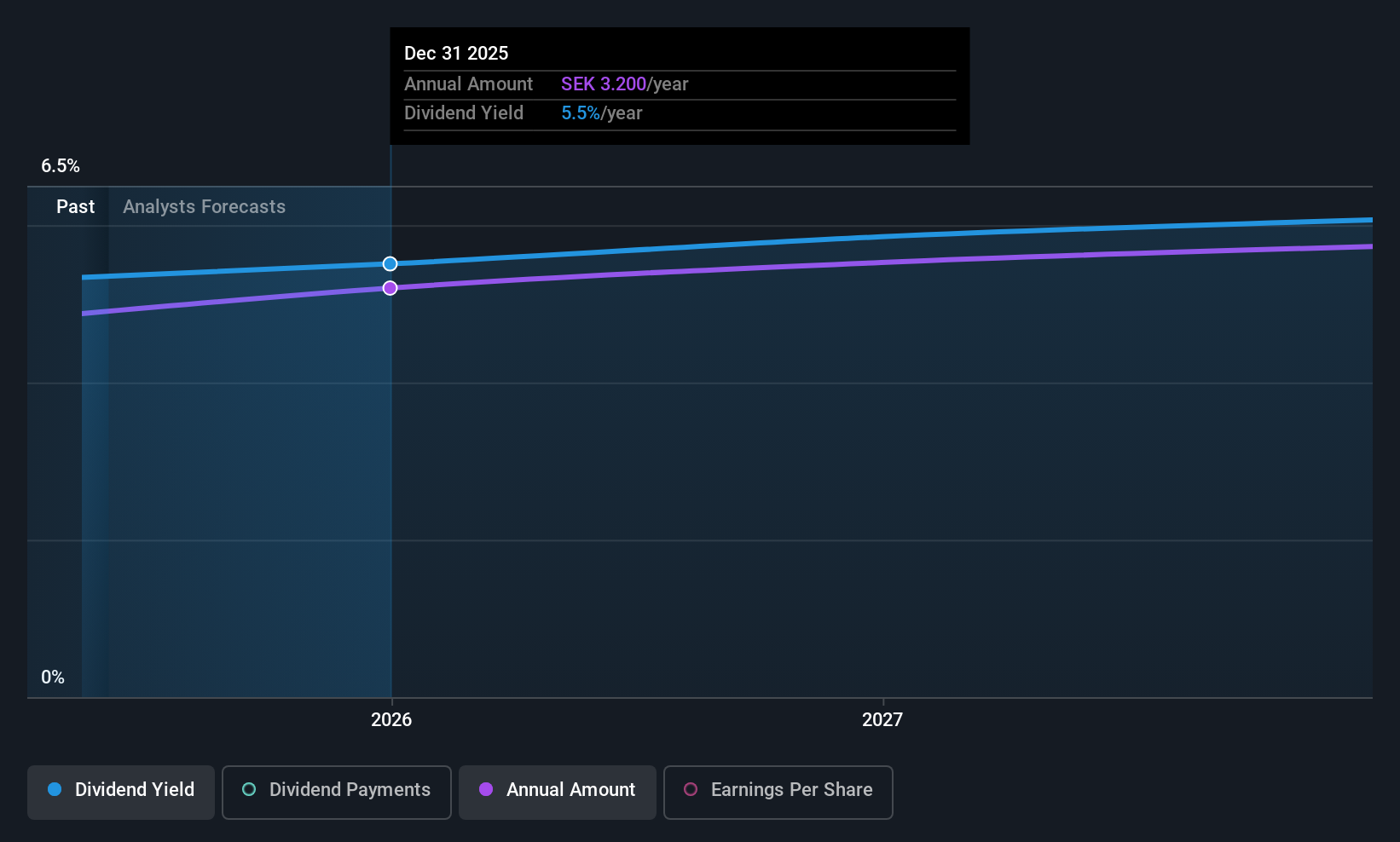

Björn Borg (OM:BORG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Björn Borg AB (publ) and its subsidiaries manufacture, distribute, and sell underwear, sportswear, footwear, bags, and eyewear under the Björn Borg brand with a market cap of SEK1.50 billion.

Operations: Björn Borg AB generates revenue through various segments including License (SEK39.38 million), Wholesale (SEK697.69 million), Own Stores (SEK104.69 million), Distributors (SEK700.41 million), and Own E-Commerce (SEK192.63 million).

Dividend Yield: 5%

Björn Borg's dividend yield is among the top 25% in Sweden, but its sustainability is questionable due to a high cash payout ratio of 143.6%, indicating dividends are not well-covered by free cash flow. Although earnings cover the current payout ratio of 86.3%, past payments have been volatile and unreliable, with significant drops over the last decade. Recent board changes and a SEK 3 per share dividend for 2025 highlight ongoing strategic adjustments amid improving earnings performance.

- Navigate through the intricacies of Björn Borg with our comprehensive dividend report here.

- Our valuation report here indicates Björn Borg may be overvalued.

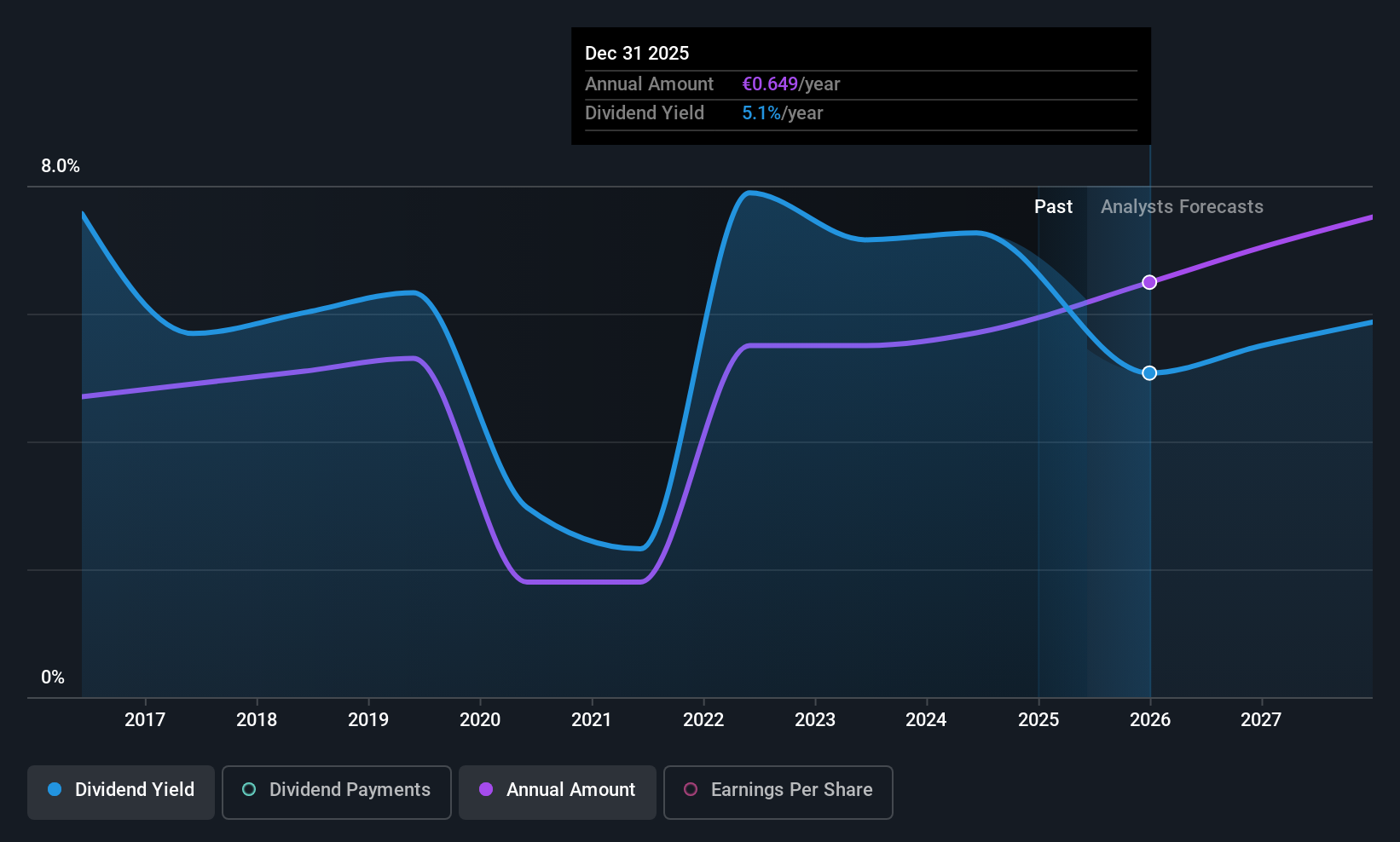

UNIQA Insurance Group (WBAG:UQA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UNIQA Insurance Group AG is an insurance company operating in Austria and Central and Eastern Europe, with a market cap of €3.77 billion.

Operations: UNIQA Insurance Group AG generates revenue primarily through its insurance operations in Austria and Central and Eastern Europe.

Dividend Yield: 4.9%

UNIQA Insurance Group's dividend payments, while covered by earnings and cash flows with payout ratios of 53.3% and 43.8%, respectively, have been volatile over the past decade. Despite a recent increase in dividends to €0.60 per share for 2024, their yield remains below Austria's top quartile at 4.89%. The company's decision to redeem €200 million in subordinated notes may impact future financial flexibility but reflects prudent debt management ahead of the July redemption date.

- Click here and access our complete dividend analysis report to understand the dynamics of UNIQA Insurance Group.

- Insights from our recent valuation report point to the potential undervaluation of UNIQA Insurance Group shares in the market.

Key Takeaways

- Explore the 227 names from our Top European Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives