3 Stocks Estimated To Be Undervalued By At Least 31.1% Offering Potential Opportunities

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty marked by inflation concerns and fluctuating interest rates, investors are keenly observing how these factors impact stock valuations. In this environment, identifying stocks that are perceived to be undervalued can present intriguing opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.11 | CN¥34.17 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.32 | TRY78.59 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.89 | 49.9% |

| Helens International Holdings (SEHK:9869) | HK$1.93 | HK$3.85 | 49.9% |

| Elekta (OM:EKTA B) | SEK61.10 | SEK122.02 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.93 | CN¥43.78 | 49.9% |

| Meriaura Group Oyj (OM:MERIS) | SEK0.49 | SEK0.98 | 50% |

| Constellium (NYSE:CSTM) | US$10.32 | US$20.58 | 49.9% |

| W5 Solutions (OM:W5) | SEK47.20 | SEK93.96 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.8% |

Here's a peek at a few of the choices from the screener.

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation operates in the global manufacture, marketing, and distribution of chemicals, polymers, plastics, agri-nutrients, and metal products with a market cap of SAR201 billion.

Operations: The company's revenue segments include Agri-Nutrients generating SAR10.34 billion and Petrochemicals & Specialties contributing SAR129.98 billion.

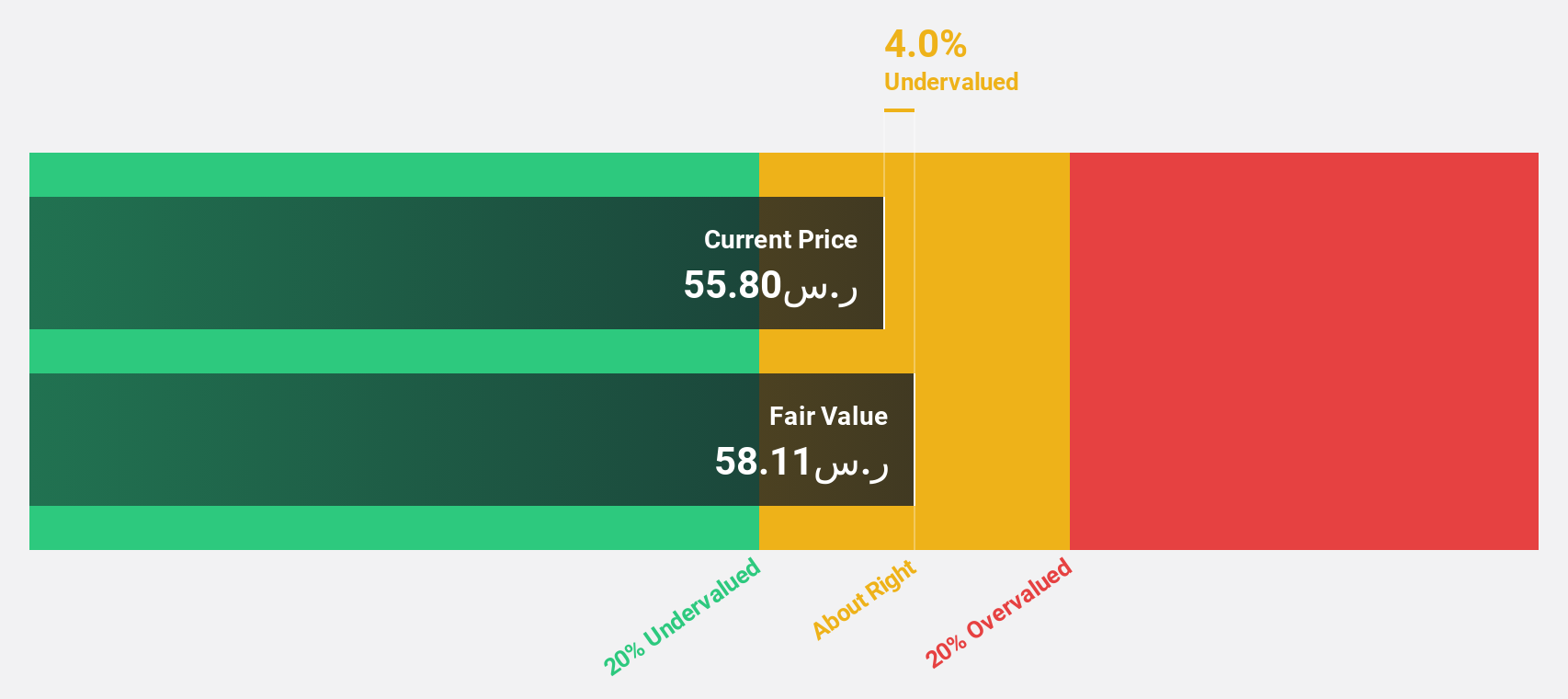

Estimated Discount To Fair Value: 31.1%

Saudi Basic Industries is trading at 31.1% below its estimated fair value of SAR97.27, suggesting potential undervaluation based on discounted cash flows. Despite a low forecasted return on equity and a dividend not well covered by earnings, the company shows significant projected earnings growth of 51.84% annually, outpacing the Saudi Arabian market average. Recent financial improvements include a net income turnaround to SAR1 billion in Q3 2024 from a loss last year, highlighting operational recovery.

- Our expertly prepared growth report on Saudi Basic Industries implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Saudi Basic Industries' balance sheet health report.

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide, with a market cap of CHF4.92 billion.

Operations: Revenue segments for Temenos include software licensing at $368 million, maintenance at $516 million, and services at $259 million.

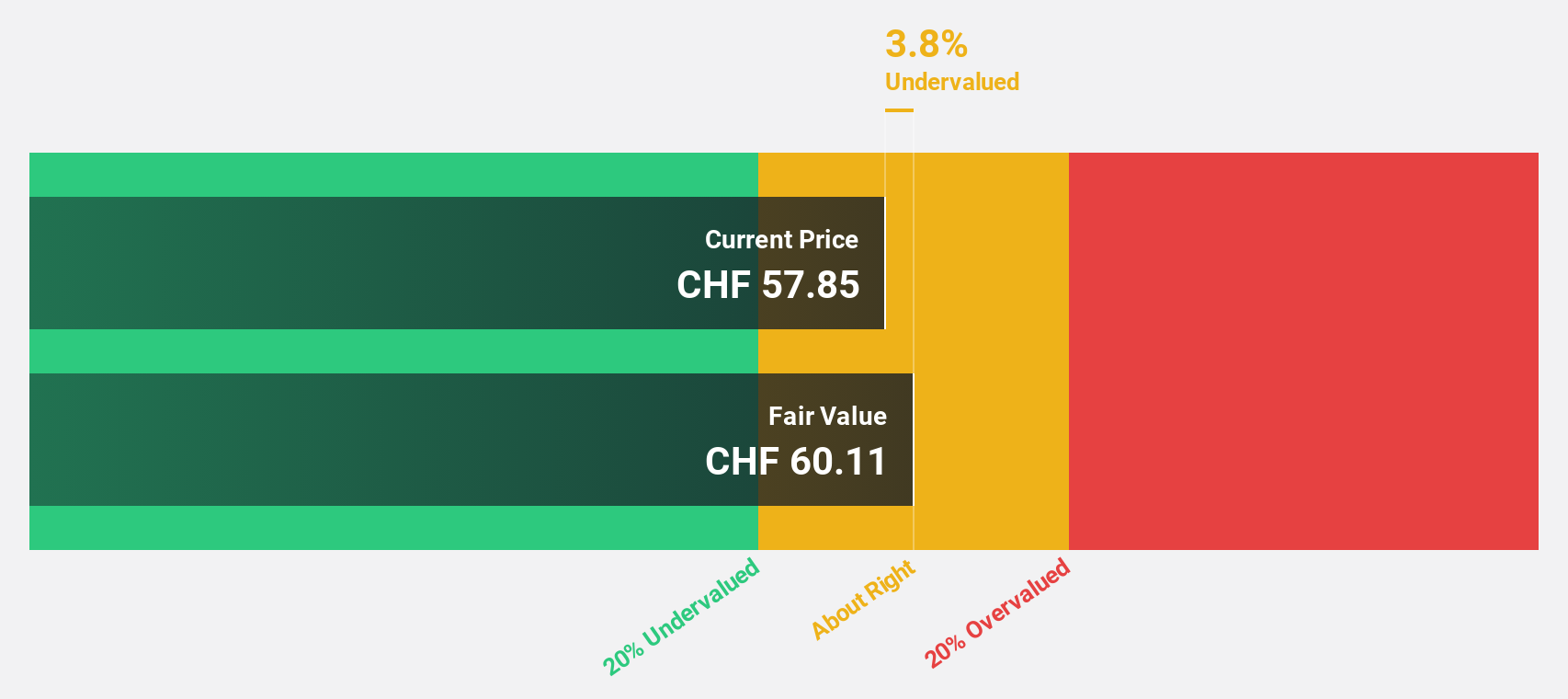

Estimated Discount To Fair Value: 39.5%

Temenos is trading at 39.5% below its estimated fair value of CHF111.46, highlighting potential undervaluation based on discounted cash flows. Despite high debt levels, Temenos shows promising financial prospects with forecasted earnings growth of 11.8% annually and revenue growth surpassing the Swiss market average at 7.2% per year. Recent client acquisitions and technological advancements, such as partnerships with AHAM Capital and NVIDIA, underscore its strategic focus on innovation and operational efficiency improvements in banking solutions.

- According our earnings growth report, there's an indication that Temenos might be ready to expand.

- Navigate through the intricacies of Temenos with our comprehensive financial health report here.

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that produces and sells sweets, with a market cap of ¥329.11 billion.

Operations: The company's revenue segments consist of Shukrei at ¥27.89 billion, Kujukushima at ¥6.75 billion, KCC Co., Ltd. at ¥19.67 billion, Sales Subsidiaries at ¥7.15 billion, and Kotobuki Confectionery/Tajima Kotobuki at ¥13.87 billion.

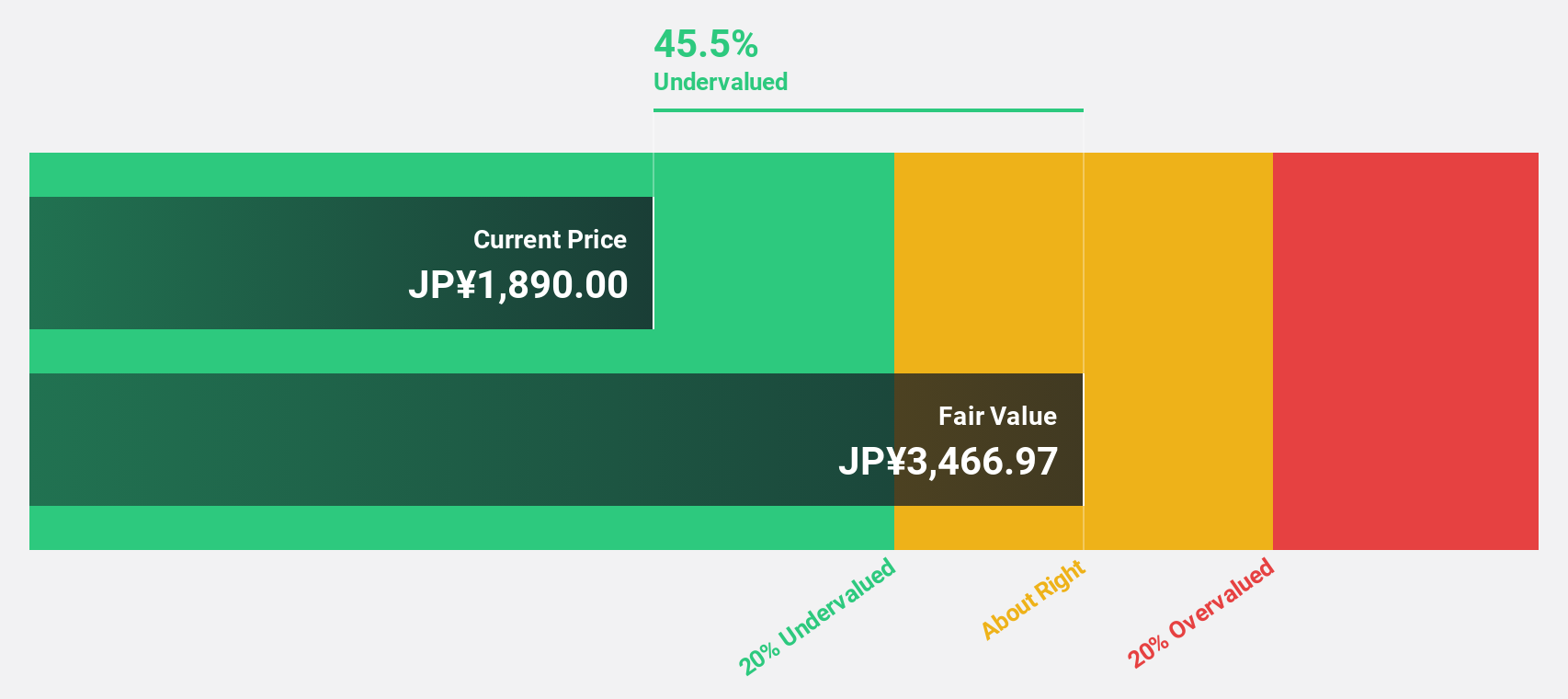

Estimated Discount To Fair Value: 46.8%

Kotobuki Spirits is trading at ¥2,114.5, significantly below its estimated fair value of ¥3,973.5, suggesting undervaluation based on discounted cash flows. The company forecasts a revenue growth of 12.5% annually, outpacing the Japanese market average and projecting earnings growth of 15.34% per year. Recent strategic moves include a share buyback program worth ¥3 billion to enhance shareholder returns and improve capital efficiency amidst ongoing equity offerings and robust financial guidance for FY2025.

- Our earnings growth report unveils the potential for significant increases in Kotobuki Spirits' future results.

- Click here to discover the nuances of Kotobuki Spirits with our detailed financial health report.

Taking Advantage

- Click this link to deep-dive into the 870 companies within our Undervalued Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kotobuki Spirits might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2222

Flawless balance sheet with solid track record.