- Japan

- /

- Auto Components

- /

- TSE:5991

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and political uncertainties, investors are navigating a choppy start to the year. With U.S. equities experiencing declines and interest rates remaining a focal point, dividend stocks can offer a reliable source of income amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

Click here to see the full list of 2017 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

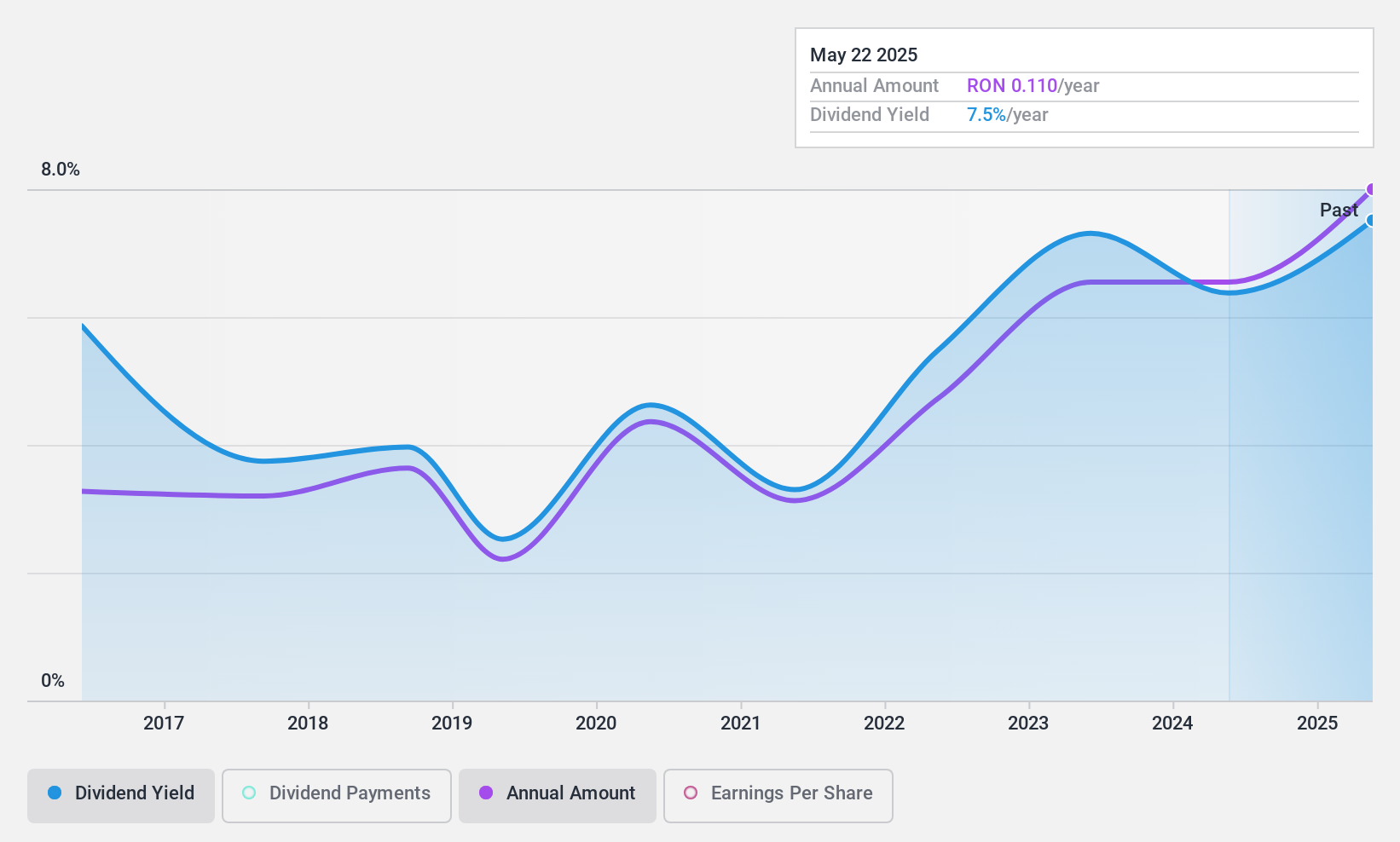

Evergent Investments (BVB:EVER)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evergent Investments SA is a publicly owned investment manager with a market capitalization of RON1.35 billion.

Operations: Evergent Investments generates revenue primarily from Financial Investment Services (RON304.43 million), with additional contributions from the Manufacture of Agricultural Machinery and Equipment (RON25.18 million), Cultivation of Fruit-Bearing Trees (Blueberries) (RON7.63 million), and Real Estate Development (Apartments) (RON0.31 million).

Dividend Yield: 6.1%

Evergent Investments offers a dividend yield of 6.06%, which is lower than the top 25% in its market. However, its dividends are well covered by earnings and cash flows, with payout ratios of 28.6% and 34.7%, respectively, indicating sustainability. Despite this coverage, Evergent has an unstable dividend track record with volatility over the past decade. Its price-to-earnings ratio of 4.7x suggests good value compared to the market average of 13x.

- Get an in-depth perspective on Evergent Investments' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Evergent Investments is priced higher than what may be justified by its financials.

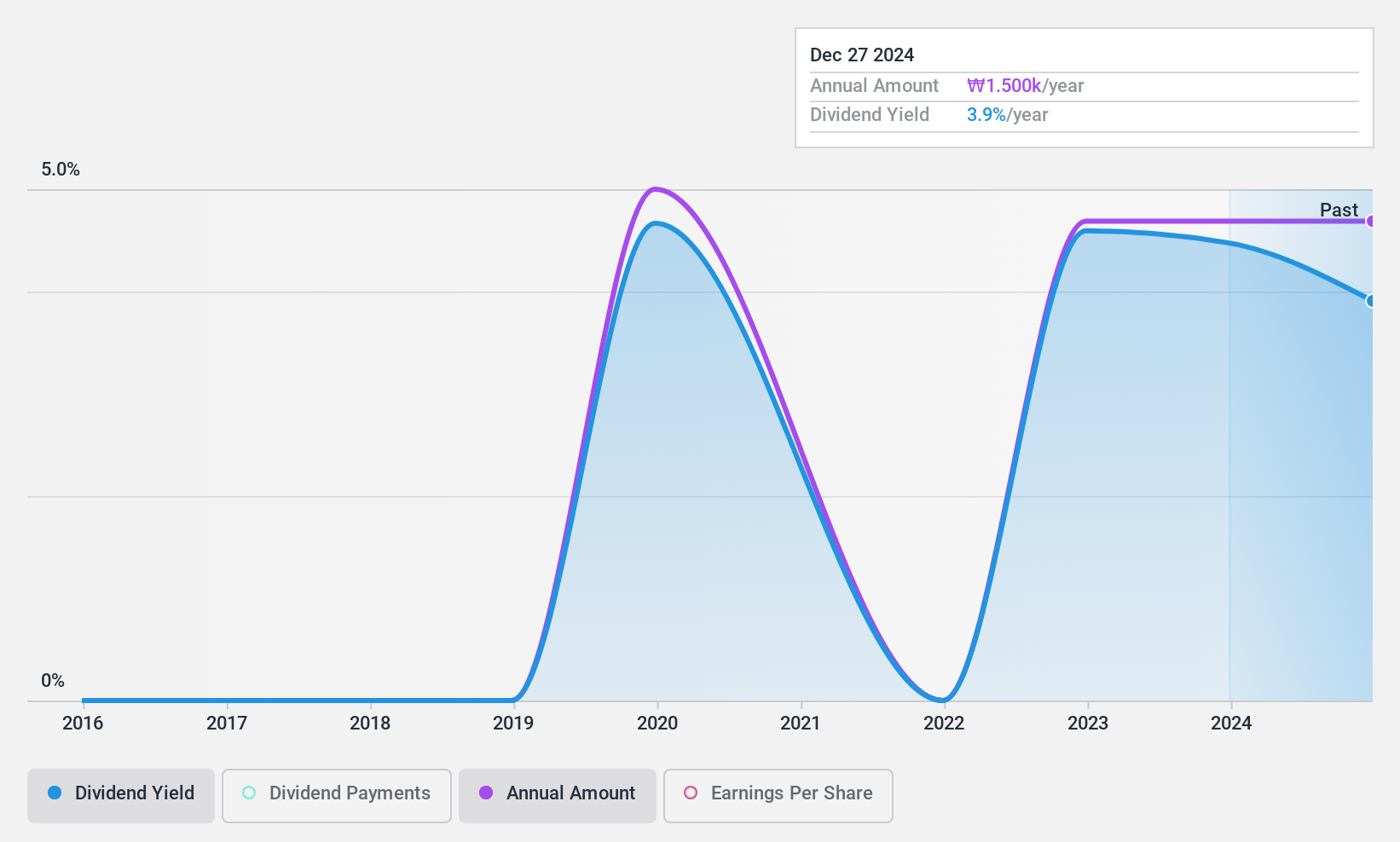

sindohLtd (KOSE:A029530)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sindoh Co., Ltd. is a company that manufactures and sells printers, multi-functional machines, and office solutions both in Korea and internationally, with a market cap of ₩326.80 billion.

Operations: Sindoh Co., Ltd. generates its revenue from the manufacturing segment, which amounts to ₩352.10 billion.

Dividend Yield: 4%

Sindoh Ltd.'s dividend yield of 3.96% ranks in the top 25% of the KR market, supported by a low payout ratio of 26.9%, indicating strong coverage by earnings and cash flows. However, its five-year dividend history shows volatility and declining payments, raising concerns about sustainability despite recent earnings growth. The company's dividends are well-covered but have been unreliable, reflecting an unstable track record that may deter some investors seeking consistent returns.

- Dive into the specifics of sindohLtd here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of sindohLtd shares in the market.

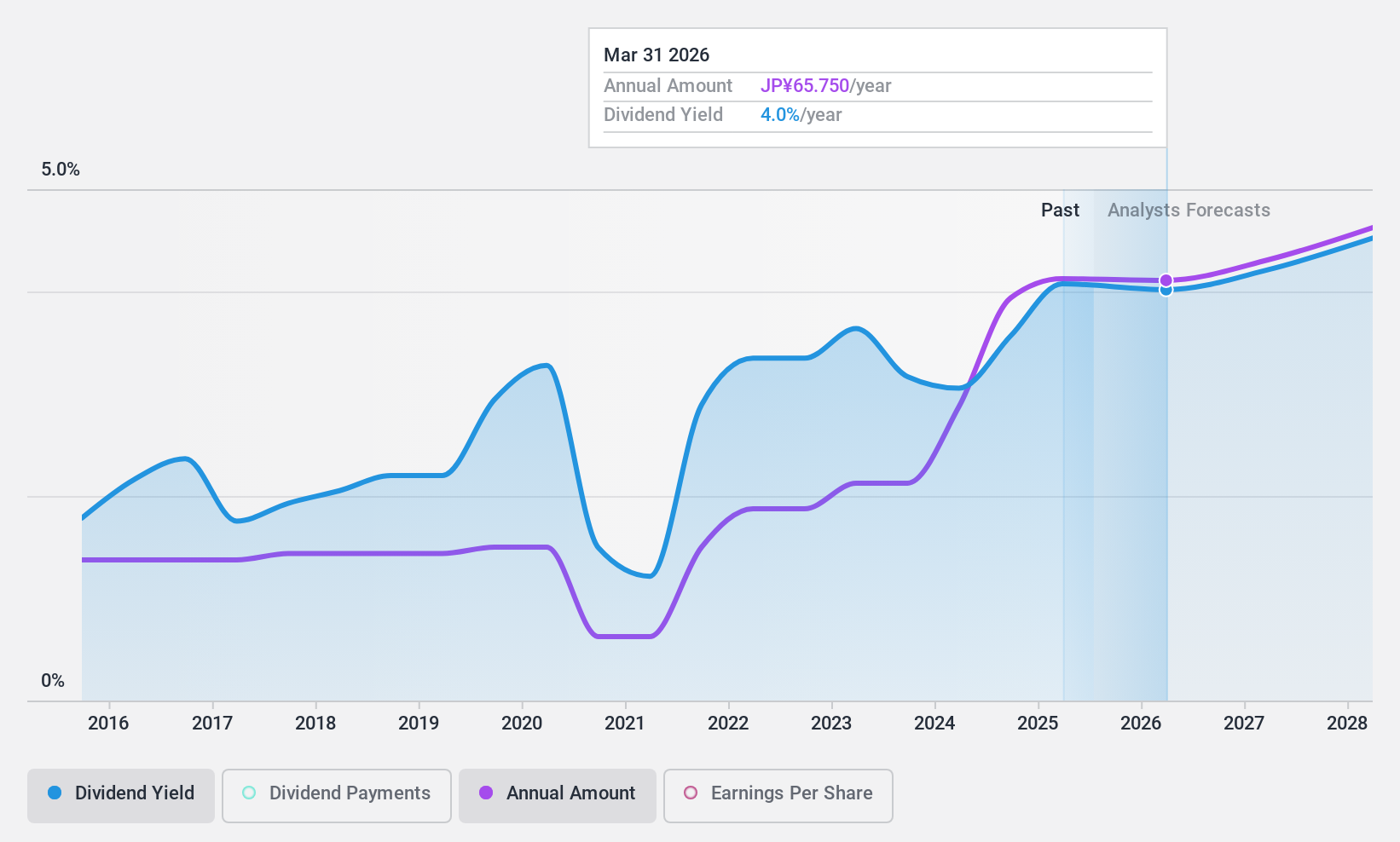

NHK Spring (TSE:5991)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NHK Spring Co., Ltd. operates in the automobile, data communications, and industry and lifestyle products sectors in Japan with a market cap of ¥417.83 billion.

Operations: NHK Spring Co., Ltd.'s revenue segments include Sheet at ¥319.58 billion, Precision Parts at ¥72.23 billion, Suspension Spring at ¥177.95 billion, and Industrial Equipment & Other at ¥124.53 billion.

Dividend Yield: 3.4%

NHK Spring's dividend payments have been volatile and unreliable over the past decade, despite recent growth. The company's dividends are well-covered by earnings with a low payout ratio of 26.2% and are supported by cash flows at an 85% cash payout ratio. Trading below its estimated fair value, NHK Spring offers some potential for capital appreciation. Recent share buybacks totaling ¥8.85 billion may enhance shareholder returns but do not address the inconsistent dividend history directly.

- Unlock comprehensive insights into our analysis of NHK Spring stock in this dividend report.

- Our valuation report here indicates NHK Spring may be undervalued.

Seize The Opportunity

- Click this link to deep-dive into the 2017 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NHK Spring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5991

NHK Spring

Provides automobile, data communications, and industry and lifestyle products in Japan.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives