- South Korea

- /

- Auto

- /

- KOSE:A005380

These 4 Measures Indicate That Hyundai Motor (KRX:005380) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Hyundai Motor Company (KRX:005380) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Hyundai Motor

What Is Hyundai Motor's Net Debt?

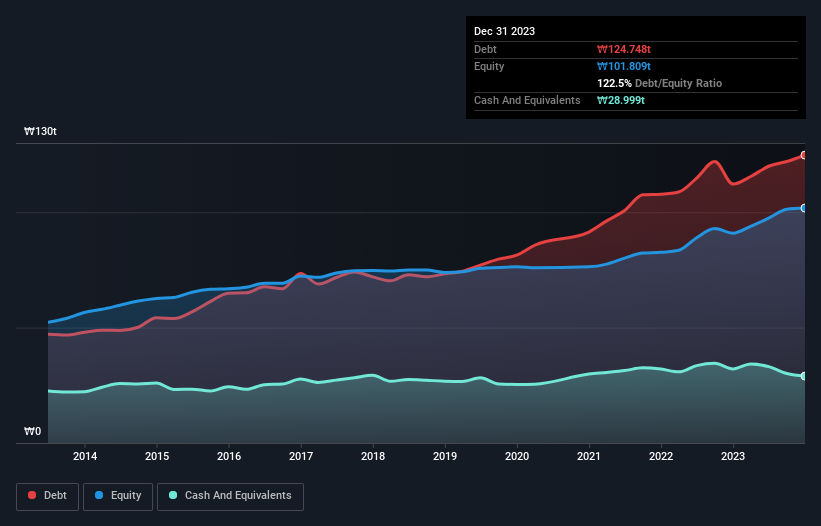

The image below, which you can click on for greater detail, shows that at December 2023 Hyundai Motor had debt of ₩125t, up from ₩112t in one year. However, it also had ₩29t in cash, and so its net debt is ₩96t.

How Healthy Is Hyundai Motor's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hyundai Motor had liabilities of ₩73t due within 12 months and liabilities of ₩107t due beyond that. On the other hand, it had cash of ₩29t and ₩8.95t worth of receivables due within a year. So it has liabilities totalling ₩143t more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₩53t company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Hyundai Motor would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

As it happens Hyundai Motor has a fairly concerning net debt to EBITDA ratio of 5.2 but very strong interest coverage of 1k. So either it has access to very cheap long term debt or that interest expense is going to grow! Importantly, Hyundai Motor grew its EBIT by 54% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hyundai Motor can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Hyundai Motor burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Hyundai Motor's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. Looking at the bigger picture, it seems clear to us that Hyundai Motor's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Hyundai Motor (1 can't be ignored) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A005380

Hyundai Motor

Manufactures and distributes motor vehicles and parts worldwide.

Very undervalued with proven track record and pays a dividend.