- South Korea

- /

- Entertainment

- /

- KOSDAQ:A122870

High Growth Tech And 2 Other Innovative Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, major indices like the S&P 500 and Nasdaq Composite have recorded significant gains. In this context of optimism and potential rate cuts, identifying high-growth tech stocks alongside other innovative companies can be crucial for investors seeking to capitalize on market momentum and technological advancements.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

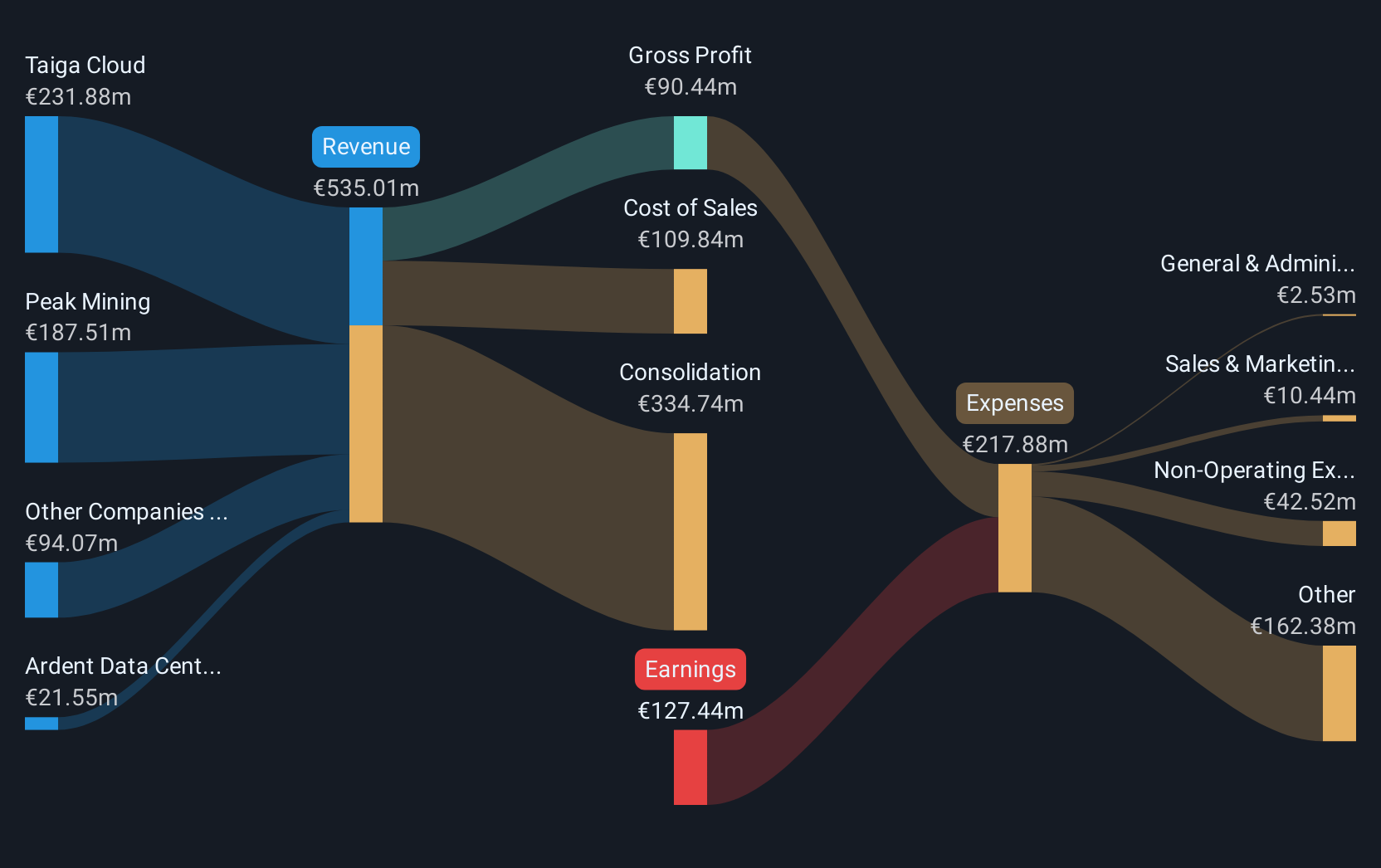

Overview: Northern Data AG develops and operates high-performance computing infrastructure solutions for businesses and research institutions globally, with a market capitalization of €3.07 billion.

Operations: Northern Data AG generates revenue primarily from Peak Mining (€156.13 million) and Ardent Data Centers (€31.46 million), with additional contributions from Taiga Cloud (€22.13 million). The company experienced a negative impact on its consolidation segment (-€178.50 million).

Northern Data's recent initiatives, particularly its AI Accelerator program, underscore its strategic focus on fostering innovation in the AI sector. The company has selected five startups from a global pool, providing them with crucial resources like NVIDIA's advanced computing platforms and expert mentorship to enhance their AI-driven products. This move not only diversifies Northern Data’s engagement within the tech ecosystem but also enhances its reputation as a leader in sustainable AI solutions, operating Europe's largest carbon-free GenAI cloud service provider. Financially, the firm is navigating through unprofitability with an expected revenue growth of 26.3% per year, outpacing the German market average significantly. While facing challenges such as substantial shareholder dilution over the past year and a highly volatile share price, Northern Data is poised for future profitability with earnings forecasted to surge by 86.4% annually.

- Click here and access our complete health analysis report to understand the dynamics of Northern Data.

Explore historical data to track Northern Data's performance over time in our Past section.

YG Entertainment (KOSDAQ:A122870)

Simply Wall St Growth Rating: ★★★★★☆

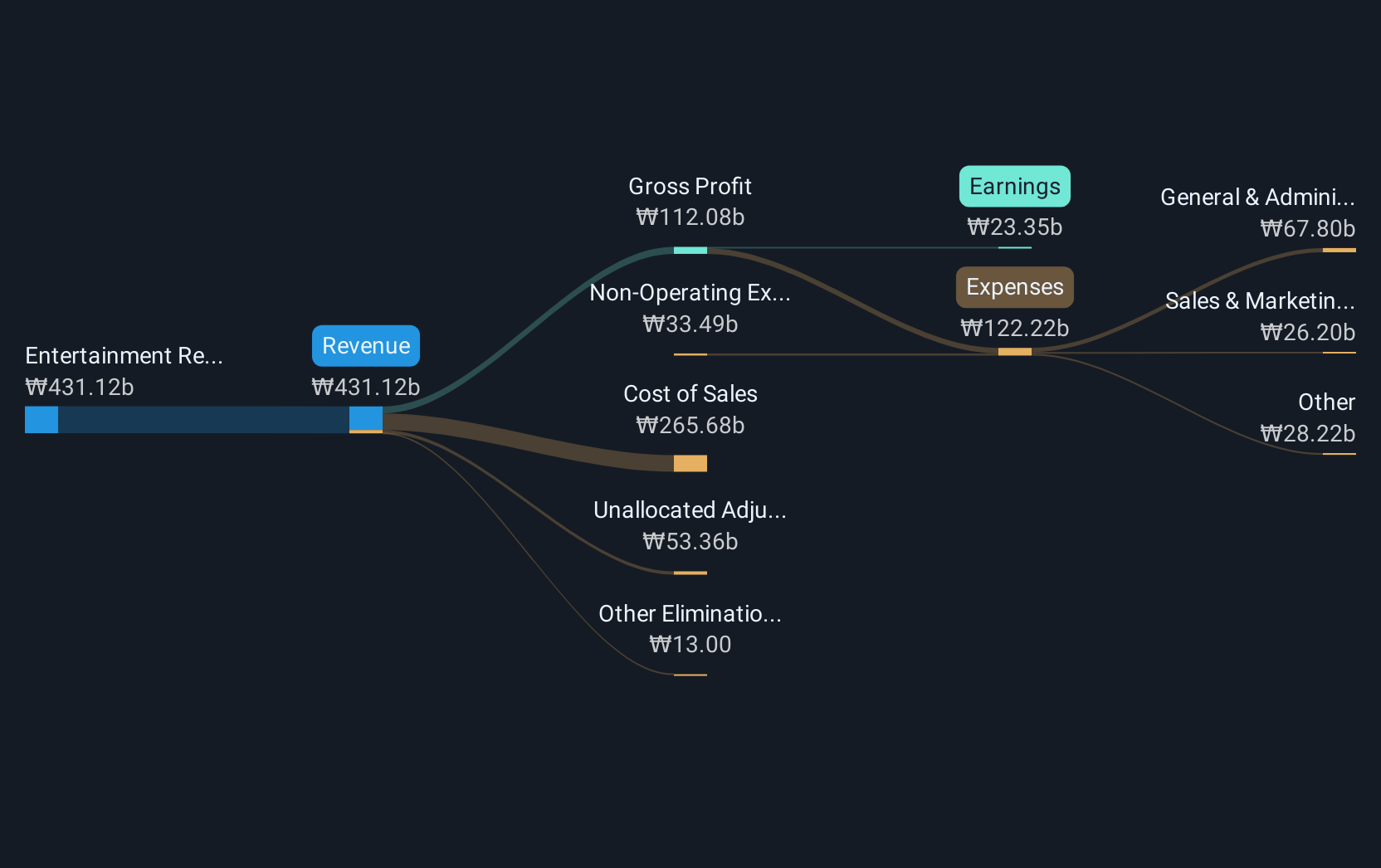

Overview: YG Entertainment Inc. is an entertainment company that operates in South Korea, Japan, and internationally with a market capitalization of ₩895.81 billion.

Operations: The company generates revenue primarily from entertainment-related activities, amounting to ₩415.71 billion.

YG Entertainment, amidst a challenging phase, reported a stark contrast in its recent financial performance with a net loss of KRW 157.99 million this quarter compared to a net income of KRW 10.607 billion the previous year. Despite these hurdles, the company's revenue growth forecast stands at an impressive 25.1% annually, outpacing South Korea's market average of 9.3%. This suggests resilience and potential for recovery fueled by strategic initiatives in entertainment and media sectors which remain crucial in driving future growth. Additionally, with earnings expected to surge by 98.3% per year, YG Entertainment is positioning itself to leverage its creative assets effectively against market volatilities while navigating through temporary setbacks marked by significant one-off losses totaling KRW 9.3 billion last year.

- Dive into the specifics of YG Entertainment here with our thorough health report.

Examine YG Entertainment's past performance report to understand how it has performed in the past.

baudroieinc (TSE:4413)

Simply Wall St Growth Rating: ★★★★★☆

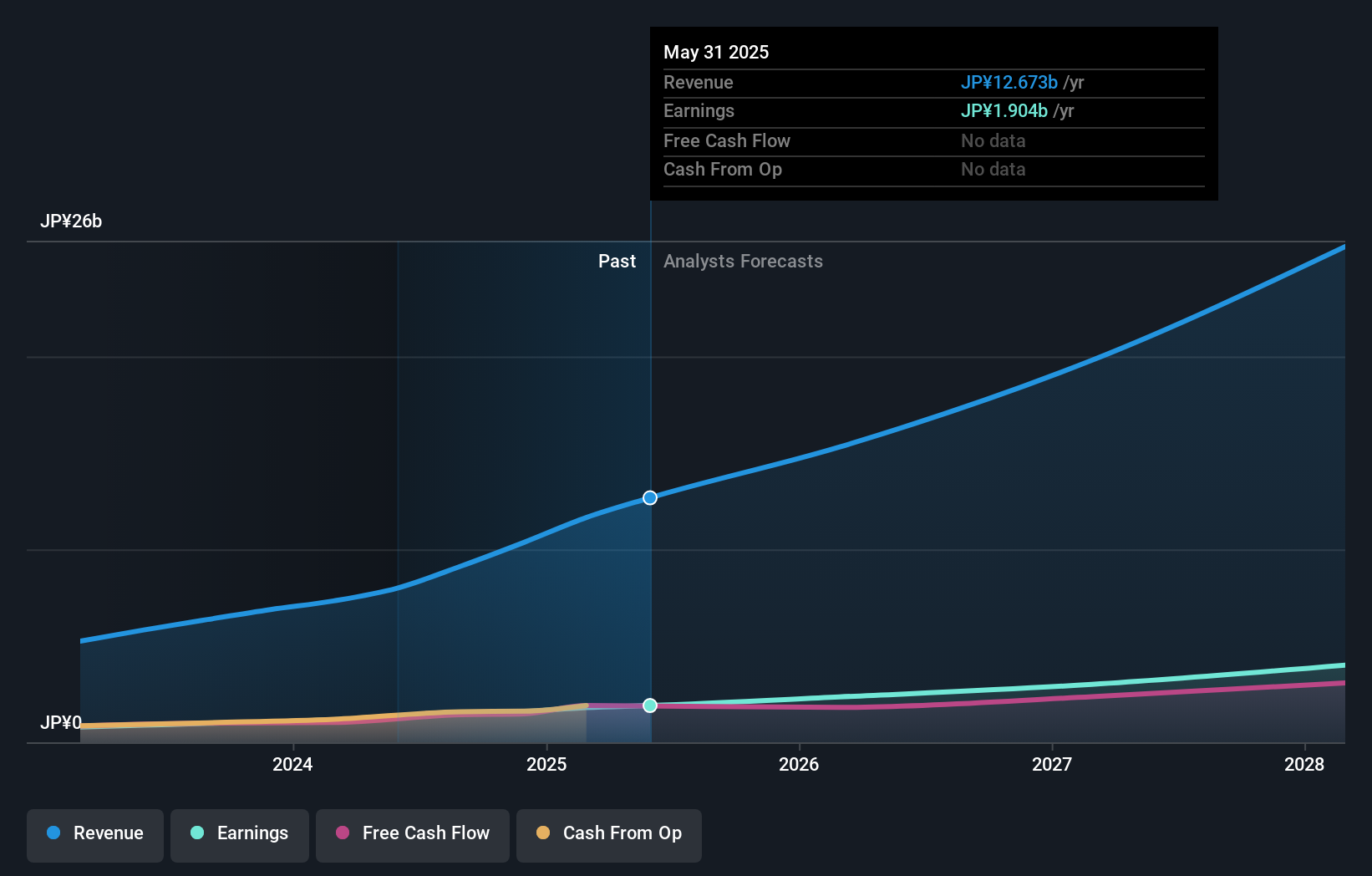

Overview: Baudroie Inc. specializes in delivering optimal IT solutions within Japan and has a market capitalization of ¥72.57 billion.

Operations: Baudroie focuses on the IT infrastructure sector in Japan, generating revenue of ¥10.36 billion from this segment.

Baudroie, Inc. is demonstrating robust growth dynamics, with a forecasted annual revenue increase of 29% and earnings expected to surge by 28.6%. The company's recent corporate guidance anticipates net sales reaching JPY 11.4 billion and an operating profit of JPY 2.3 billion for the fiscal year ending February 2025, indicating a strong upward trajectory in financial performance. Additionally, Baudroie has actively engaged in capital management strategies, including a share repurchase program announced on November 25, which aims to buy back up to 640,600 shares for JPY 3.5 billion by April 2025. This reflects not only a commitment to shareholder value but also flexibility in its capital allocation amid evolving market conditions.

- Delve into the full analysis health report here for a deeper understanding of baudroieinc.

Understand baudroieinc's track record by examining our Past report.

Next Steps

- Delve into our full catalog of 1225 High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A122870

YG Entertainment

Operates as an entertainment company in South Korea, Japan, and internationally.

High growth potential with excellent balance sheet.