- South Korea

- /

- Machinery

- /

- KOSDAQ:A013030

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher due to easing inflation and robust bank earnings, investors are increasingly looking towards small-cap stocks for untapped opportunities. In this dynamic environment, identifying promising stocks involves evaluating their potential for growth and resilience amidst shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Hy-Lok (KOSDAQ:A013030)

Simply Wall St Value Rating: ★★★★★★

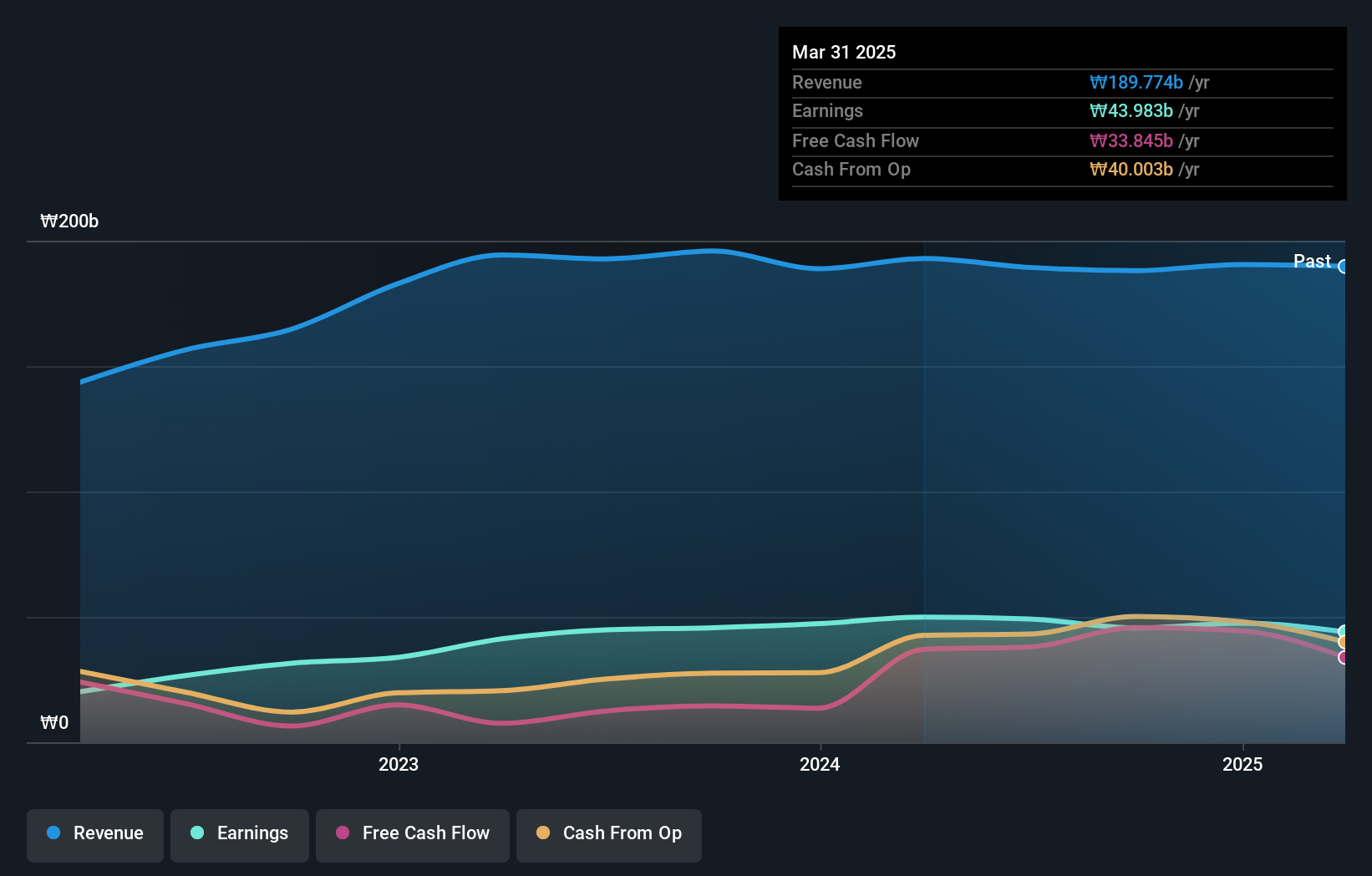

Overview: Hy-Lok Corporation operates in the fluid and control system industry worldwide with a market cap of ₩361.27 billion.

Operations: Hy-Lok Corporation generates revenue primarily from manufacturing and selling fittings for mechanical equipment, flange valves, unions, and nipples, amounting to ₩188.07 billion.

Hy-Lok, a promising player in the machinery sector, offers an intriguing investment opportunity with its current trading position at 60.8% below estimated fair value. With no debt on its books now compared to a debt-to-equity ratio of 0.6% five years ago, the company has significantly strengthened its balance sheet. Despite experiencing negative earnings growth of -0.3% over the past year, which aligns with industry trends, Hy-Lok remains profitable and boasts high-quality past earnings. The forecasted annual earnings growth of 5.92% suggests potential for future expansion within this niche market space.

- Click here to discover the nuances of Hy-Lok with our detailed analytical health report.

Gain insights into Hy-Lok's historical performance by reviewing our past performance report.

Wuhan East Lake High Technology Group (SHSE:600133)

Simply Wall St Value Rating: ★★★★☆☆

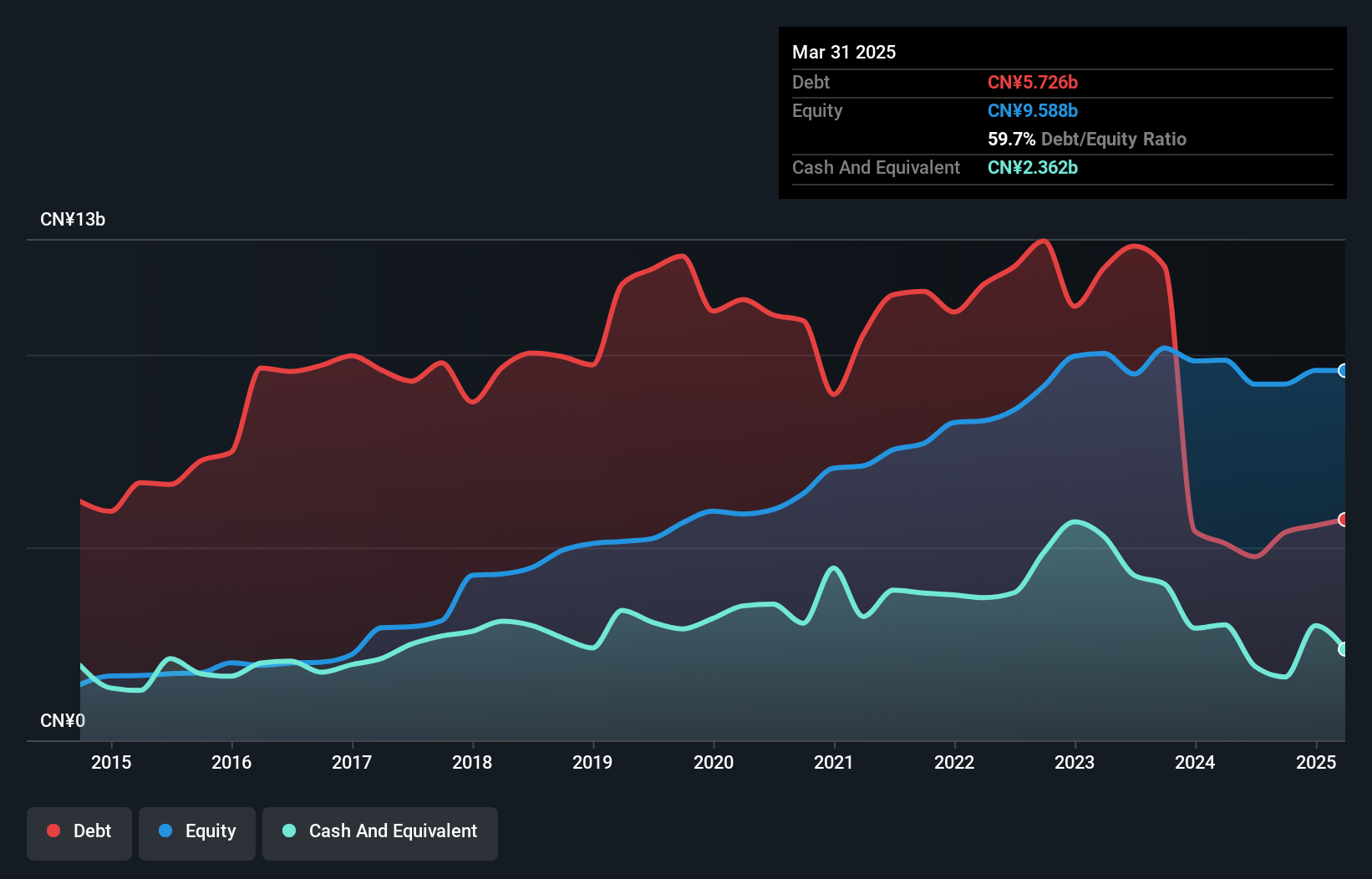

Overview: Wuhan East Lake High Technology Group Co., Ltd. operates as a diversified company engaged in high-tech industries and services, with a market cap of CN¥9.68 billion.

Operations: Wuhan East Lake High Technology Group generates revenue from its diversified high-tech industries and services. The company's financial performance is influenced by its net profit margin, which reflects the efficiency of converting revenue into actual profit.

Wuhan East Lake High Technology Group, a smaller player in its field, showcases robust financial health with high-quality earnings and a notable 107.1% growth in the past year, outpacing the construction industry's -3.9%. Their price-to-earnings ratio stands at 9.1x, significantly lower than the CN market's 34.8x, indicating potential value for investors. Over five years, they have impressively reduced their debt to equity ratio from 222.7% to 58.4%, although their net debt to equity remains high at 40.6%. A special shareholders meeting scheduled for November highlights active engagement with stakeholders amidst these promising metrics.

Leopalace21 (TSE:8848)

Simply Wall St Value Rating: ★★★★★★

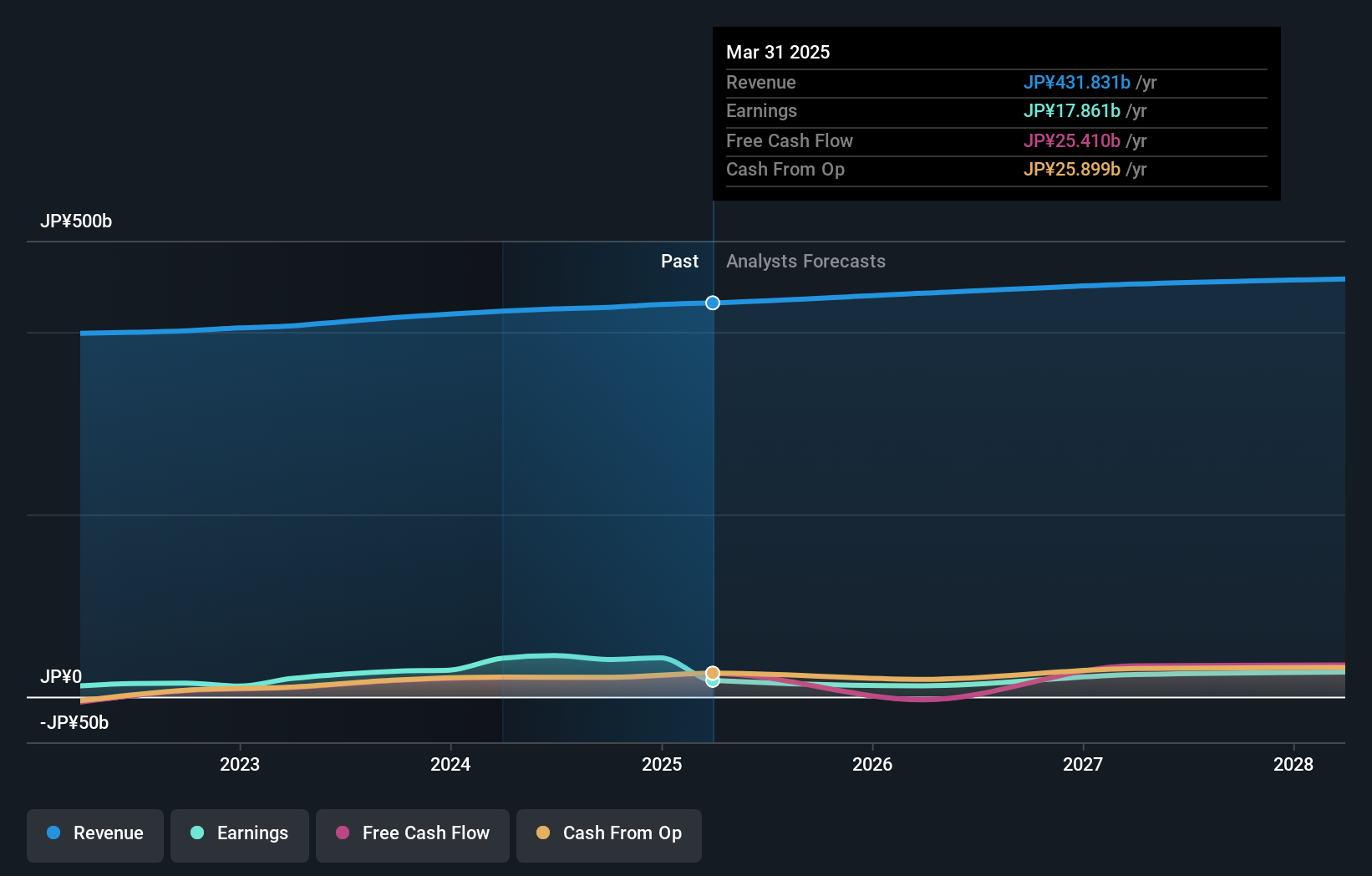

Overview: Leopalace21 Corporation, with a market cap of ¥176.32 billion, operates in Japan through its construction, leasing, and sale of apartments, condominiums, and residential housing.

Operations: Leopalace21 generates revenue primarily from its Leasing Business, which includes development activities, contributing ¥411.98 billion. The Elderly Care Business adds ¥13.79 billion to the revenue stream.

Leopalace21, a notable player in the real estate sector, has demonstrated impressive earnings growth of 45.9% over the past year, outpacing its industry peers' 25.8%. This growth is supported by a robust financial position with cash exceeding total debt and a debt-to-equity ratio reduction from 54.6% to 35.2% over five years. The company's interest payments are well covered by EBIT at 12.9 times, indicating strong operational efficiency. Despite this solid performance, future earnings are projected to decline by an average of 8.6% annually for the next three years, posing potential challenges ahead for investors seeking long-term value.

- Dive into the specifics of Leopalace21 here with our thorough health report.

Examine Leopalace21's past performance report to understand how it has performed in the past.

Summing It All Up

- Navigate through the entire inventory of 4657 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hy-Lok might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A013030

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives