- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A336370

High Growth Tech Stocks Including Solus Advanced Materials And Two Others

Reviewed by Simply Wall St

The global markets have recently experienced a boost, with major U.S. stock indexes climbing higher due to cooling inflation and robust bank earnings, while European stocks also saw gains amid hopes for continued interest rate cuts. In this context of shifting economic indicators and market sentiment, identifying high growth tech stocks such as Solus Advanced Materials can be appealing for investors looking to capitalize on technological advancements and innovation within the sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Solus Advanced Materials (KOSE:A336370)

Simply Wall St Growth Rating: ★★★★★☆

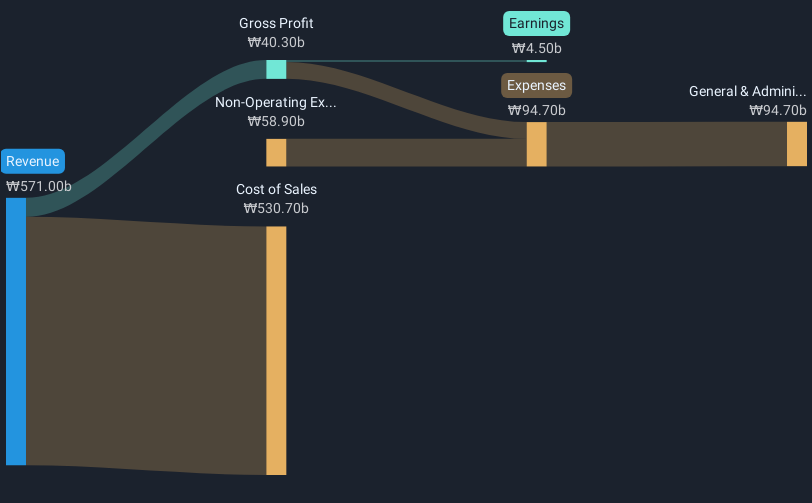

Overview: Solus Advanced Materials Co., Ltd. offers materials and solutions across South Korea, Europe, and globally with a market cap of approximately ₩786.79 billion.

Operations: Solus Advanced Materials Co., Ltd. generates revenue primarily through its Copper Foil/Battery Foil Sector, contributing ₩386.59 billion, and the Advanced Materials Division, adding ₩128.35 billion. The company operates in various international markets including South Korea and Europe.

Solus Advanced Materials, navigating a challenging landscape, reported a significant shift from a net income of KRW 227.3 billion last year to a net loss of KRW 21.7 billion in Q3 2024, despite an increase in sales to KRW 134.7 billion from KRW 111.2 billion. This volatility underscores the company's aggressive pursuit of growth, with revenues expected to climb by an annual rate of 26.9%. Looking ahead, Solus is poised for profitability within three years, forecasting earnings growth at an impressive rate of approximately 120.6% annually—a stark contrast to the broader Electronic industry's contraction by about -1%. As it strides towards financial stability and market competitiveness, strategic R&D investment remains crucial for Solus to differentiate itself and capitalize on emerging tech trends.

- Delve into the full analysis health report here for a deeper understanding of Solus Advanced Materials.

Assess Solus Advanced Materials' past performance with our detailed historical performance reports.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

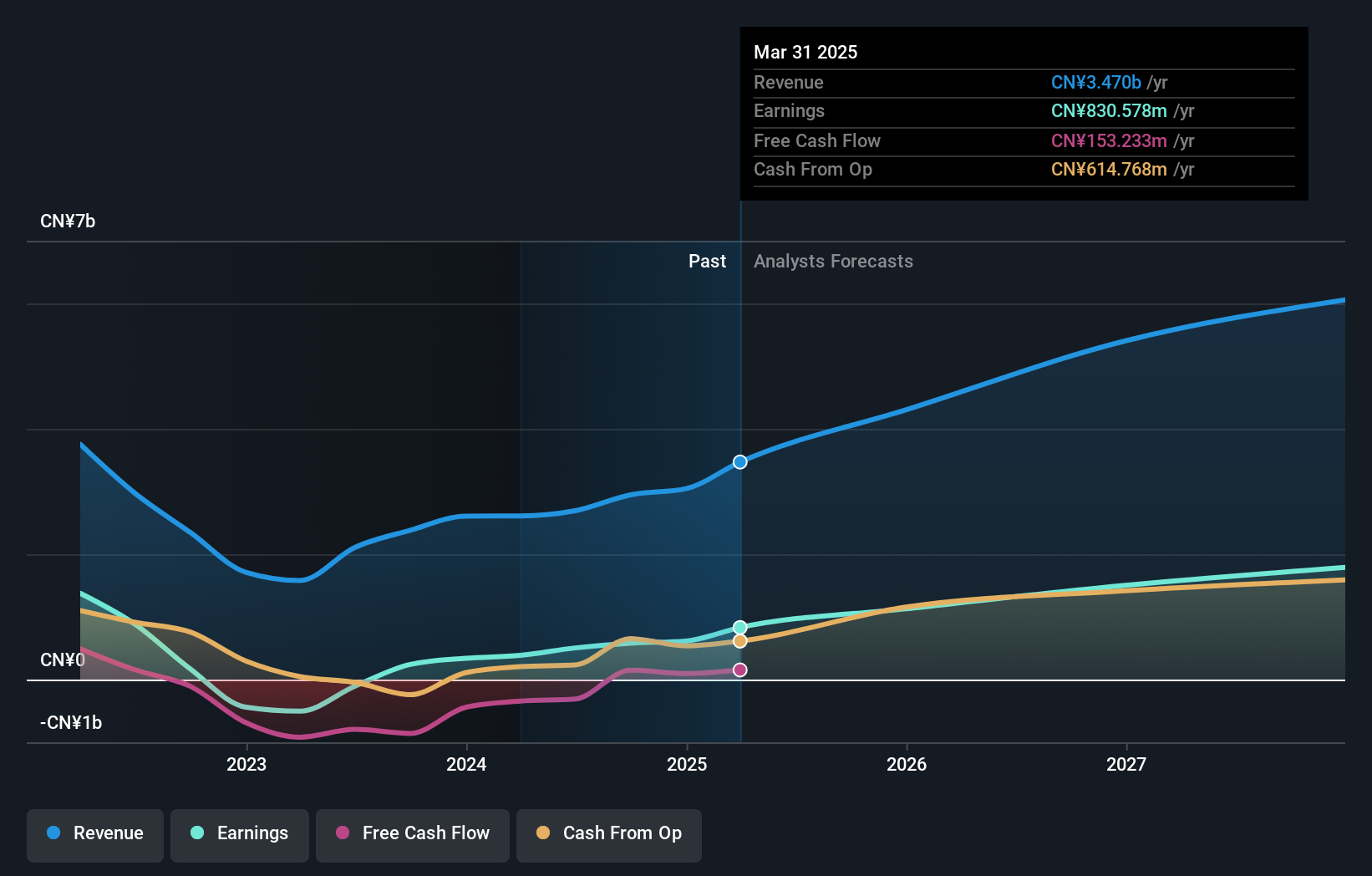

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company that focuses on the research, development, production, and sale of insulin analog APIs and injections in China, with a market cap of CN¥26.08 billion.

Operations: The company generates revenue primarily from the development, production, and sale of insulin and related products, amounting to CN¥2.95 billion. Its operations are centered in China, focusing on insulin analog APIs and injections.

Gan & Lee Pharmaceuticals, amidst a dynamic biotech landscape, has demonstrated robust financial performance with a notable increase in revenue to CNY 2.25 billion, up from CNY 1.91 billion year-over-year, and a surge in net income to CNY 507.27 million from CNY 266.48 million. This growth trajectory is underpinned by promising clinical advancements, such as the recent positive results from the Phase 1 trial of GZR18 tablets, highlighting their potential in GLP-1 receptor agonist therapy for weight management. Despite being removed from an index recently, Gan & Lee's aggressive R&D strategy—evident from its significant investment in developing novel bi-weekly and once-weekly dosing regimens for GZR18 injections—positions it well within the high-growth tech sphere of biotechnology by potentially setting new benchmarks for treatment efficacy and patient convenience.

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★☆☆

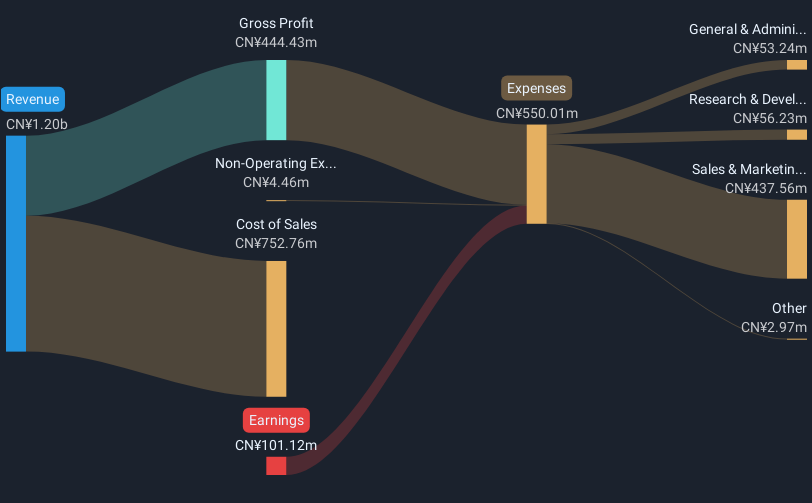

Overview: COL Group Co., Ltd. operates in the digital publishing industry in China and has a market capitalization of CN¥17.76 billion.

Operations: The company is involved in digital publishing within China. It focuses on generating revenue through its digital content offerings, which form the core of its business model.

COL GroupLtd, amidst a challenging market, has shown resilience with expected annual revenue growth at 19.9%, outpacing the CN market's 13.4%. Despite recent earnings turbulence—reporting a net loss of CNY 188.12 million compared to last year's modest profit—the firm is optimistic about reversing this trend with anticipated earnings growth of 113.6% annually. The company also actively manages its capital through share repurchases, having bought back shares worth CNY 27 million recently, signaling confidence in its future prospects and financial health.

- Navigate through the intricacies of COL GroupLtd with our comprehensive health report here.

Gain insights into COL GroupLtd's past trends and performance with our Past report.

Seize The Opportunity

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1222 more companies for you to explore.Click here to unveil our expertly curated list of 1225 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A336370

Solus Advanced Materials

Provides materials and solutions in South Korea, Europe, and internationally.

High growth potential and overvalued.