- Hong Kong

- /

- Real Estate

- /

- SEHK:1821

3 Noteworthy Stocks Estimated To Be Trading Below Intrinsic Value By Up To 47.8%

Reviewed by Simply Wall St

In a week marked by significant economic reports and fluctuating market indices, global markets have shown mixed performance, with major U.S. indexes mostly lower amid busy earnings announcements and cautious investor sentiment. As growth stocks lagged behind value shares and manufacturing activity continued to decline, investors are increasingly focused on identifying opportunities in undervalued stocks that may offer potential upside when trading below their intrinsic value. In such an environment, a good stock is often characterized by strong fundamentals and the potential for growth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.85 | US$37.48 | 49.7% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.47 | 50% |

| Arteche Lantegi Elkartea (BME:ART) | €6.10 | €12.20 | 50% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 50% |

| Bangkok Genomics Innovation (SET:BKGI) | THB2.68 | THB5.35 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.72 | CN¥9.39 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.91 | US$546.14 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

ESR Group (SEHK:1821)

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and internationally with a market cap of HK$45.60 billion.

Operations: The company's revenue segments include Fund Management at $627.98 million and New Economy Development at $113.33 million, while Investment reported a negative revenue of -$106.44 million.

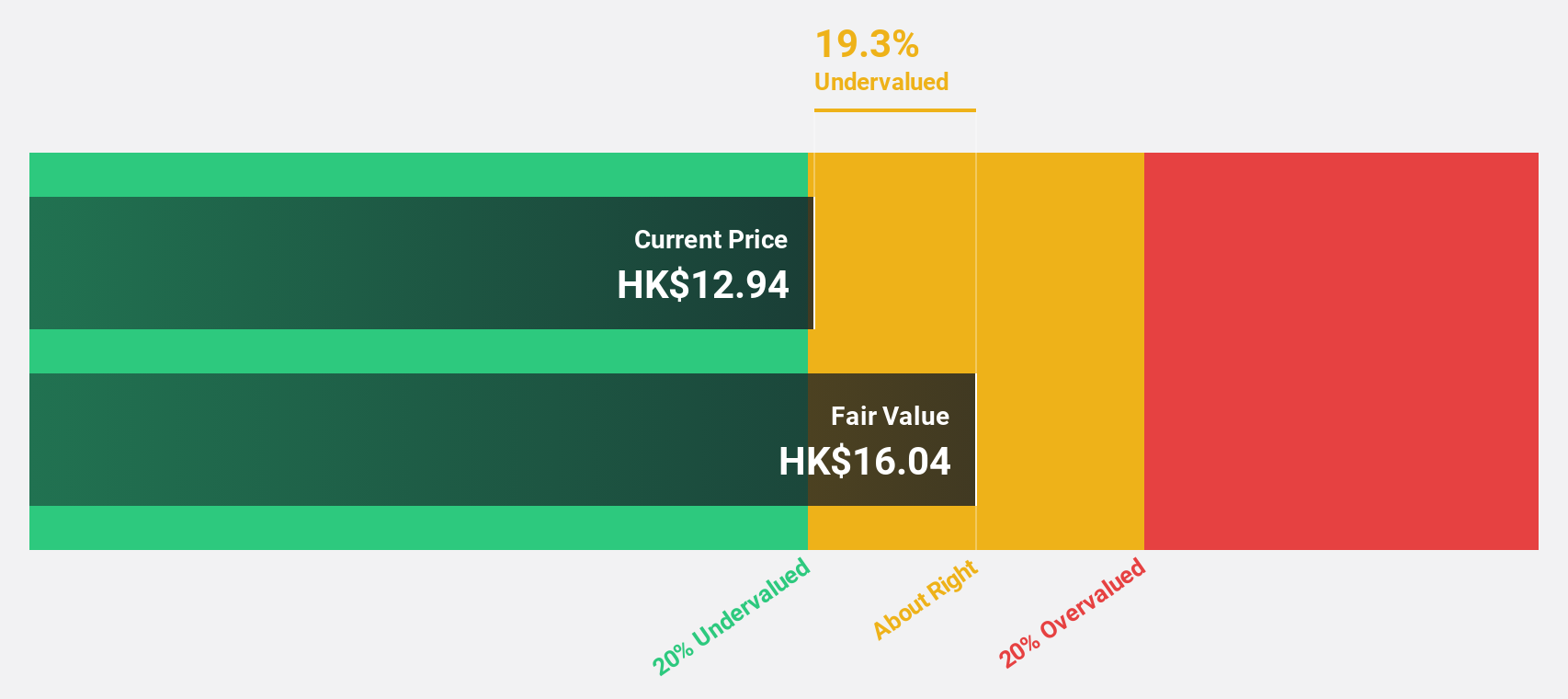

Estimated Discount To Fair Value: 32.9%

ESR Group is trading at HK$10.96, significantly below its estimated fair value of HK$16.33, suggesting potential undervaluation based on cash flows. Despite recent financial challenges, including a net loss of US$218.72 million for H1 2024 due to non-cash asset revaluations and market conditions, the company's revenue is projected to grow faster than the Hong Kong market at 15.9% annually. However, interest payments are not well covered by earnings currently.

- Our comprehensive growth report raises the possibility that ESR Group is poised for substantial financial growth.

- Click here to discover the nuances of ESR Group with our detailed financial health report.

China Tobacco International (HK) (SEHK:6055)

Overview: China Tobacco International (HK) Company Limited operates in the tobacco industry and has a market capitalization of approximately HK$17.15 billion.

Operations: The company's revenue is derived from several segments, including the Tobacco Leaf Products Import Business at HK$8.43 billion, the Tobacco Leaf Products Export Business at HK$1.82 billion, the Cigarettes Export Business at HK$1.52 billion, the Brazil Operation Business at HK$884.06 million, and the New Tobacco Products Export Business at HK$139.60 million.

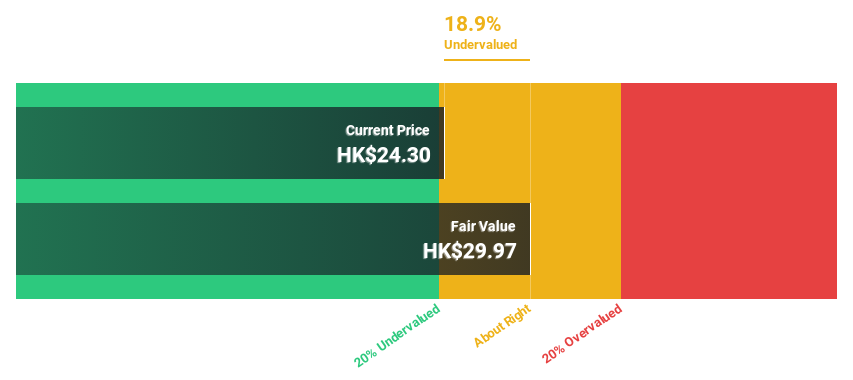

Estimated Discount To Fair Value: 18.4%

China Tobacco International (HK) is trading at HK$24.9, below its estimated fair value of HK$30.5, indicating potential undervaluation based on cash flows. Recent earnings for H1 2024 showed a net income increase to HKD 643.34 million from the previous year's HKD 456.95 million, reflecting solid growth prospects with forecasted annual earnings growth of 12.3%. However, debt coverage by operating cash flow remains a concern despite robust revenue projections exceeding market averages at 11.4% annually.

- Upon reviewing our latest growth report, China Tobacco International (HK)'s projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of China Tobacco International (HK) stock in this financial health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company engaged in the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$61.21 billion.

Operations: The company generates revenue of CN¥1.87 billion from its activities in researching, developing, producing, and selling biopharmaceutical products.

Estimated Discount To Fair Value: 47.8%

Akeso is currently trading at HK$69.65, significantly below its estimated fair value of HK$133.51, highlighting potential undervaluation based on cash flows. The company's revenue is expected to grow at 33.4% annually, outpacing the Hong Kong market's growth rate of 7.7%. Although Akeso has diluted shareholders recently and reported a net loss for H1 2024, its forecasted earnings growth of 53.31% per year suggests improving profitability prospects in the coming years.

- Our growth report here indicates Akeso may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Akeso.

Make It Happen

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 955 more companies for you to explore.Click here to unveil our expertly curated list of 958 Undervalued Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESR Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1821

ESR Group

Engages in the logistics real estate development, leasing, and management activities in Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe, and internationally.

Reasonable growth potential and slightly overvalued.