- Hong Kong

- /

- Retail Distributors

- /

- SEHK:6055

3 Stocks Estimated To Be Trading Below Intrinsic Value In January 2025

Reviewed by Simply Wall St

As global markets navigate a mix of moderate gains and economic uncertainties, highlighted by fluctuating consumer confidence and manufacturing data in the U.S., investors are increasingly attentive to stocks that may be trading below their intrinsic value. In this environment, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on market inefficiencies and secure assets at a price lower than their estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| Wasion Holdings (SEHK:3393) | HK$7.13 | HK$14.19 | 49.7% |

| First Solar (NasdaqGS:FSLR) | US$176.24 | US$350.71 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7309.53 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.70 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7652.96 | 49.9% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.71 | 49.8% |

| ASMPT (SEHK:522) | HK$74.90 | HK$149.66 | 50% |

Let's dive into some prime choices out of the screener.

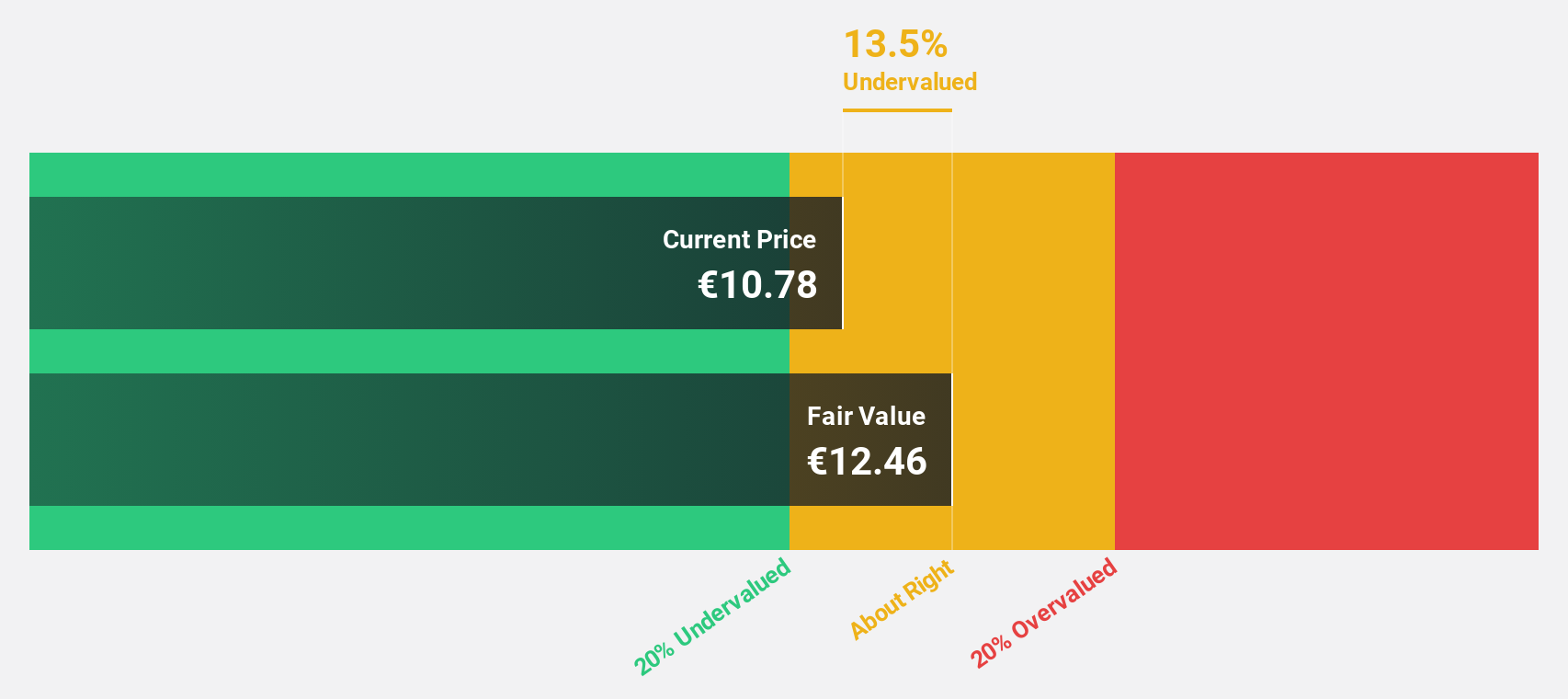

Alfen (ENXTAM:ALFEN)

Overview: Alfen N.V. operates through its subsidiaries to design, engineer, develop, produce, and service smart grids, energy storage systems, and electric vehicle charging equipment with a market cap of €261.52 million.

Operations: The company's revenue segments consist of Smart Grid Solutions (€196.32 million), EV Charging Equipment (€153.59 million), and Energy Storage Systems (€176.37 million).

Estimated Discount To Fair Value: 49.2%

Alfen is trading at €12.03, significantly below its estimated fair value of €23.69, suggesting it may be undervalued based on cash flows. Despite a volatile share price recently, Alfen's earnings are forecast to grow significantly at 42.6% annually over the next three years, outpacing the Dutch market's growth rate of 15.7%. However, recent profit margins have decreased to 1.8% from last year's 8.3%, indicating potential profitability challenges ahead.

- Our expertly prepared growth report on Alfen implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Alfen.

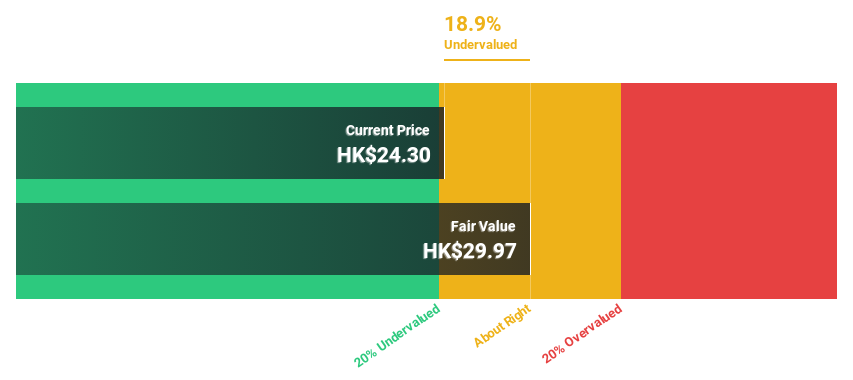

China Tobacco International (HK) (SEHK:6055)

Overview: China Tobacco International (HK) Company Limited operates in the tobacco industry and has a market capitalization of HK$16.32 billion.

Operations: The company's revenue is derived from several segments: Brazil Operation Business (HK$884.06 million), Cigarettes Export Business (HK$1.52 billion), New Tobacco Products Export Business (HK$139.60 million), Tobacco Leaf Products Export Business (HK$1.82 billion), and Tobacco Leaf Products Import Business (HK$8.43 billion).

Estimated Discount To Fair Value: 21.8%

China Tobacco International (HK) is trading at HK$23.75, over 20% below its estimated fair value of HK$30.37, highlighting potential undervaluation based on cash flows. The company forecasts a profit increase of at least 30% for 2024 due to optimized business structures and enhanced profitability across various segments. Despite slower revenue growth projections compared to significant benchmarks, its earnings are expected to grow faster than the Hong Kong market average, supported by strategic improvements in gross profit margins.

- In light of our recent growth report, it seems possible that China Tobacco International (HK)'s financial performance will exceed current levels.

- Click here to discover the nuances of China Tobacco International (HK) with our detailed financial health report.

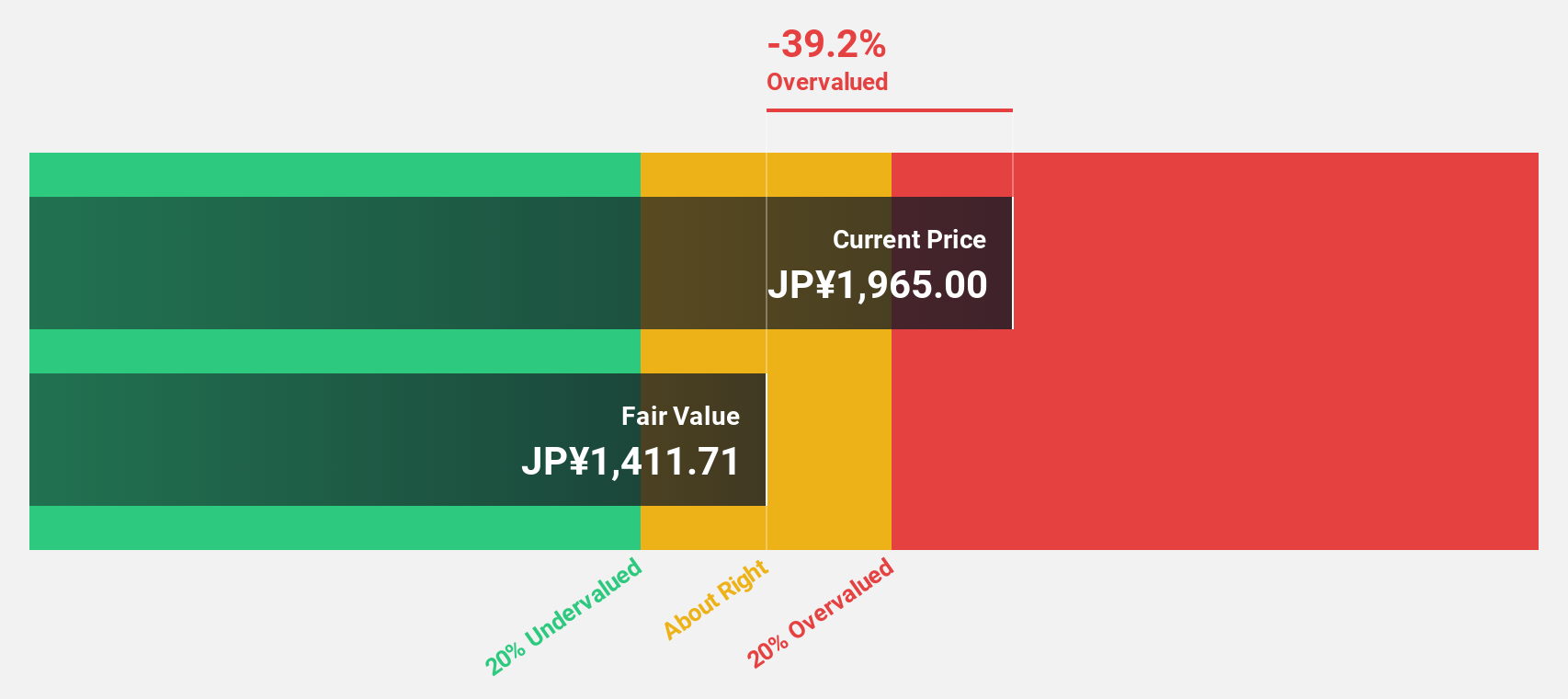

Lifedrink Company (TSE:2585)

Overview: Lifedrink Company, Inc. manufactures and sells beverages in Japan with a market cap of ¥118.84 billion.

Operations: The company's revenue is primarily derived from its Beverage and Leaf Business, which generated ¥41.86 billion.

Estimated Discount To Fair Value: 14.1%

Lifedrink Company is trading at ¥2274, slightly below its estimated fair value of ¥2647.58, suggesting potential undervaluation in terms of cash flows. Earnings are projected to grow 15.9% annually, outpacing the JP market's average growth rate. However, the company faces high debt levels and a volatile share price history. Revenue growth is expected at 9% per year, exceeding the market average but remaining moderate overall.

- Our earnings growth report unveils the potential for significant increases in Lifedrink Company's future results.

- Dive into the specifics of Lifedrink Company here with our thorough financial health report.

Where To Now?

- Click here to access our complete index of 872 Undervalued Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6055

Outstanding track record with reasonable growth potential.