- Hong Kong

- /

- Electrical

- /

- SEHK:580

3 Penny Stocks With Market Caps Under US$1B To Consider

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of economic indicators, with U.S. consumer confidence dipping and European stocks edging higher, investors are keeping a close eye on opportunities across various sectors. Penny stocks, often seen as relics of past market eras, remain relevant due to their potential for growth at accessible price points. By focusing on companies with strong financials and solid fundamentals, investors can uncover promising prospects among these smaller or newer firms that might otherwise fly under the radar.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.05 | £772.37M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.948 | £149.54M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.62 | £69.04M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Sun.King Technology Group (SEHK:580)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sun.King Technology Group Limited is an investment holding company that manufactures and trades power electronic components for sectors such as power transmission, distribution, and electrified transportation in China, with a market cap of approximately HK$2.20 billion.

Operations: The company generates revenue of CN¥1.25 billion from its manufacturing and trading segment focused on power electronic components.

Market Cap: HK$2.2B

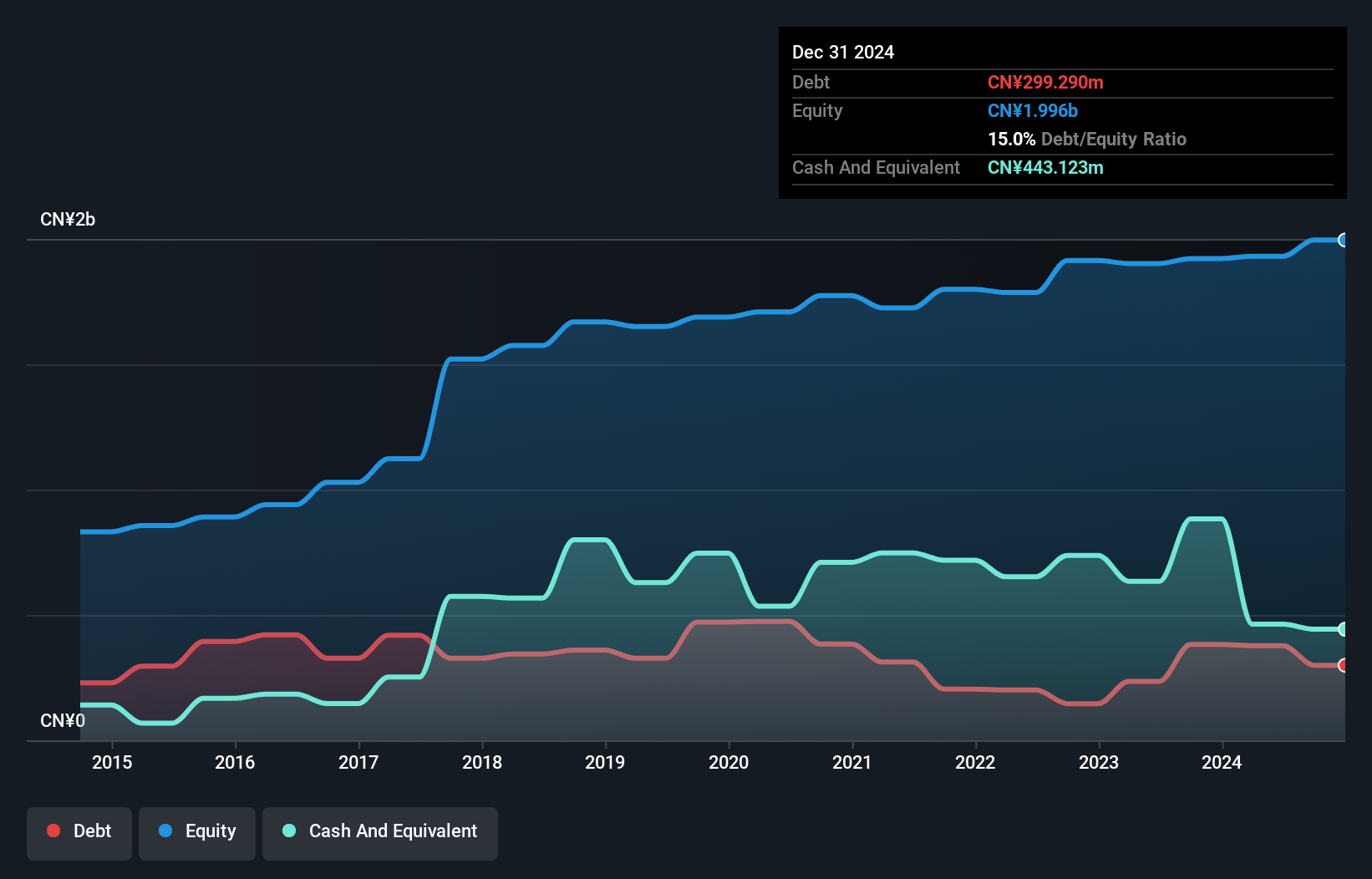

Sun.King Technology Group, with a market cap of approximately HK$2.20 billion, has shown significant earnings growth over the past year at 184.9%, surpassing its five-year average decline of 45.5% annually. The company's short-term assets (CN¥1.9 billion) comfortably cover both its short-term and long-term liabilities, indicating solid financial health despite negative operating cash flow that affects debt coverage. While the return on equity remains low at 3.1%, profit margins have improved to 5.7%. Recent board changes include Ms. Zhang Ling's resignation as a non-executive director in October 2024, reflecting ongoing governance adjustments.

- Take a closer look at Sun.King Technology Group's potential here in our financial health report.

- Evaluate Sun.King Technology Group's historical performance by accessing our past performance report.

Sansiri (SET:SIRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, with a market cap of THB31.12 billion, operates in Thailand's property development sector through its subsidiaries.

Operations: The company generates revenue primarily from Real Estate at THB35.79 billion, supplemented by Building Management, Project Management and Real Estate Brokerage at THB2.13 billion, and the Hotel Business contributing THB553 million.

Market Cap: THB31.12B

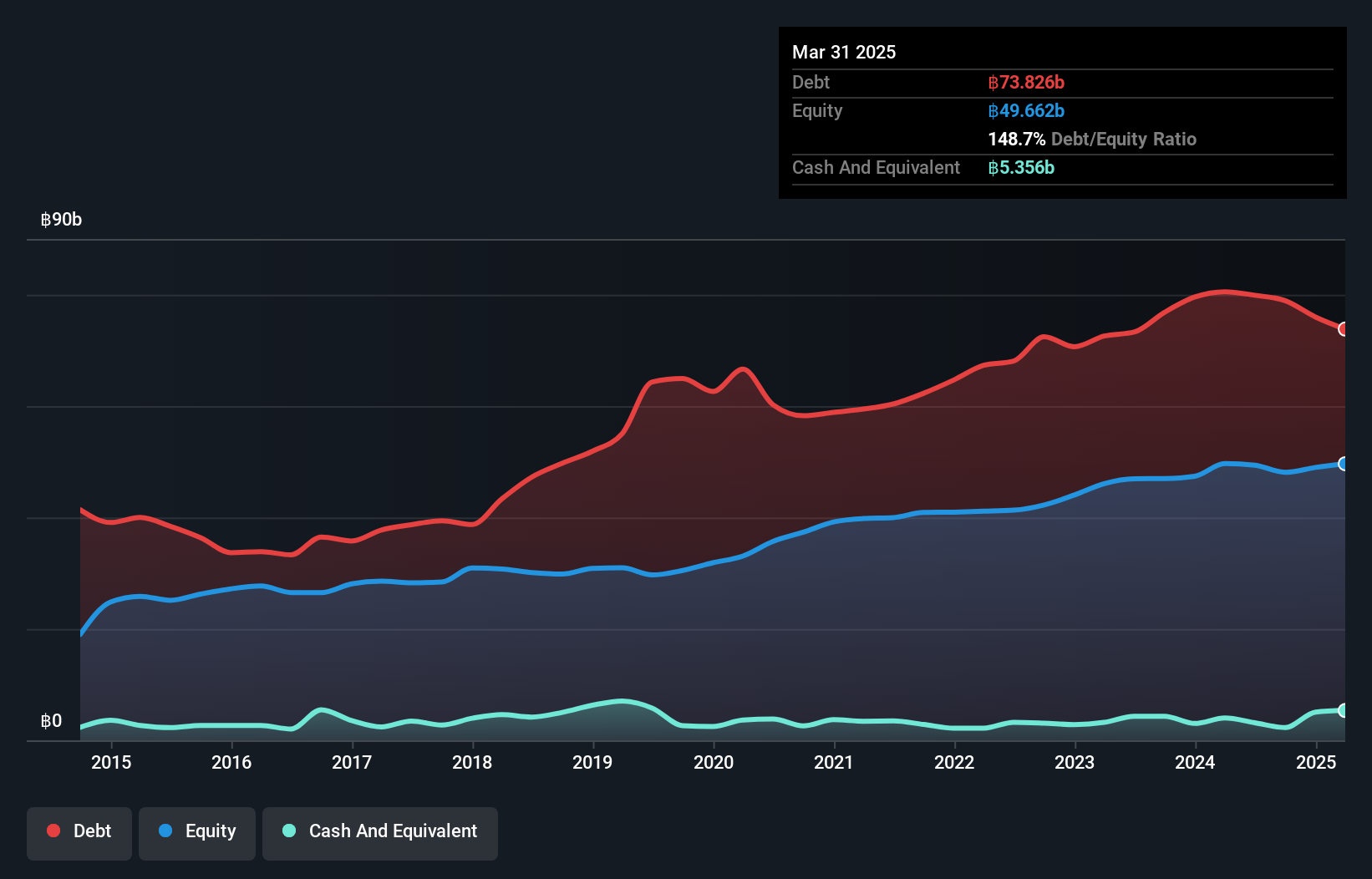

Sansiri Public Company Limited, with a market cap of THB31.12 billion, operates in Thailand's property development sector and has recently announced a fixed-income offering. The company reported third-quarter revenue of THB9.42 billion, showing stability compared to the previous year, although net income decreased to THB1.31 billion from THB1.56 billion. Despite a high net debt-to-equity ratio of 159.3%, Sansiri's interest payments are well covered by EBIT at 88 times coverage, indicating strong debt management capabilities. However, shareholder dilution occurred over the past year and profit margins have declined from 16.7% to 12.6%.

- Navigate through the intricacies of Sansiri with our comprehensive balance sheet health report here.

- Gain insights into Sansiri's outlook and expected performance with our report on the company's earnings estimates.

Sheng Siong Group (SGX:OV8)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheng Siong Group Ltd is an investment holding company that operates a chain of supermarket retail stores in Singapore, with a market cap of SGD2.47 billion.

Operations: The company's revenue is primarily generated from its supermarket operations, selling consumer goods, which amounted to SGD1.41 billion.

Market Cap: SGD2.47B

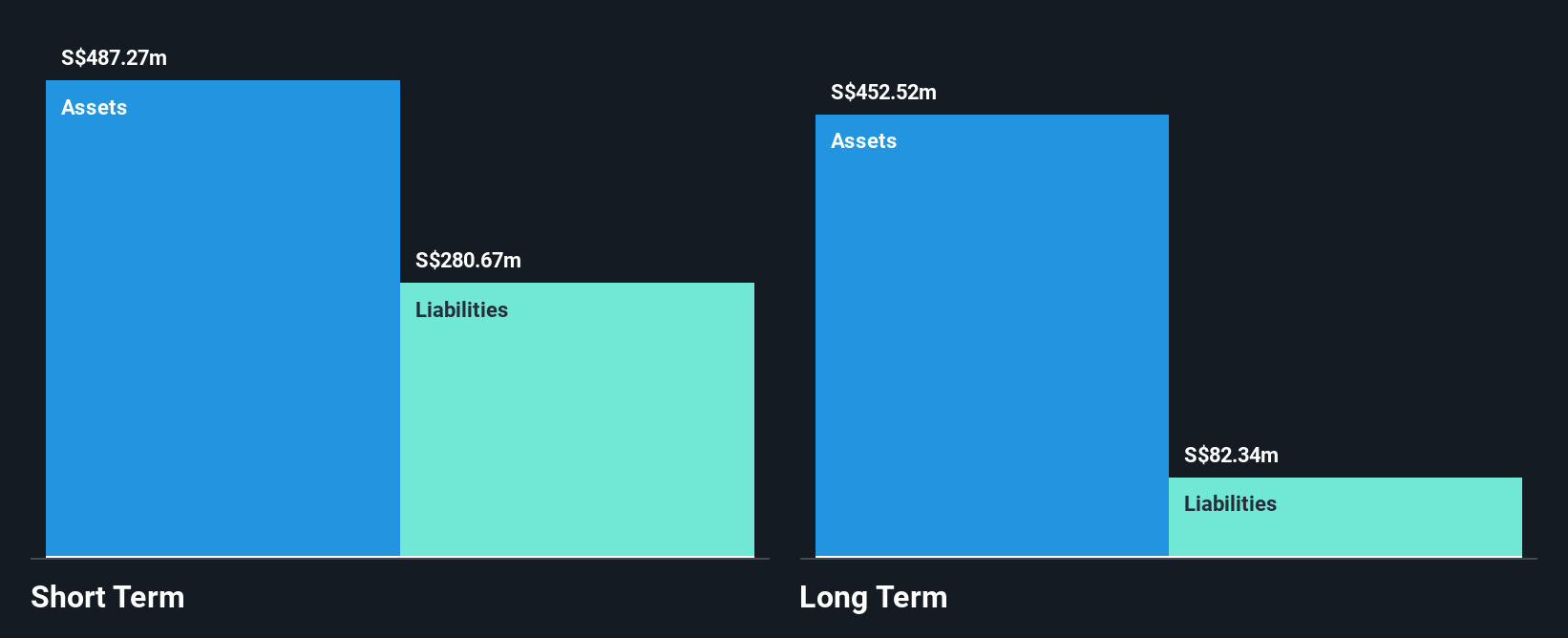

Sheng Siong Group Ltd, with a market cap of SGD2.47 billion, has demonstrated stable financial performance in the retail sector. Recent earnings for the third quarter showed sales growth to SGD363.25 million and net income increased to SGD39.1 million, reflecting solid operational efficiency with high-quality earnings and improved profit margins from 9.8% to 10.1%. The company remains debt-free, enhancing its financial stability, while short-term assets significantly cover both short- and long-term liabilities. Despite not outperforming industry growth rates recently, Sheng Siong's experienced management team continues to guide its strategic expansions such as forming MDL Property Pte. Ltd., focusing on property rental and warehouse management.

- Click here to discover the nuances of Sheng Siong Group with our detailed analytical financial health report.

- Examine Sheng Siong Group's earnings growth report to understand how analysts expect it to perform.

Turning Ideas Into Actions

- Dive into all 5,815 of the Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:580

Sun.King Technology Group

An investment holding company, manufactures and trades in power electronic components for use in power transmission and distribution, electrified transportation, industrial, and other sectors in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)