- Hong Kong

- /

- Paper and Forestry Products

- /

- SEHK:2689

A Piece Of The Puzzle Missing From Nine Dragons Paper (Holdings) Limited's (HKG:2689) Share Price

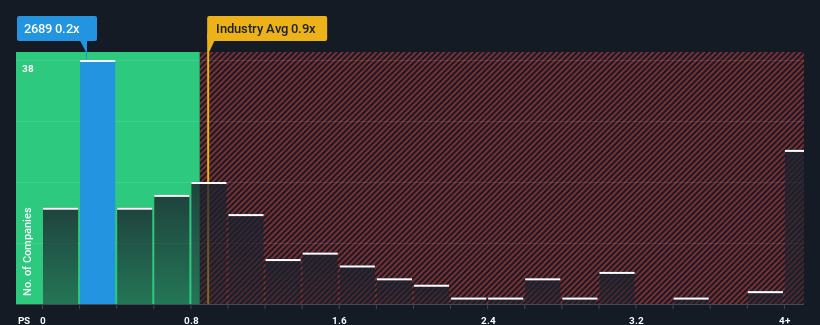

There wouldn't be many who think Nine Dragons Paper (Holdings) Limited's (HKG:2689) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Forestry industry in Hong Kong is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Nine Dragons Paper (Holdings)

How Has Nine Dragons Paper (Holdings) Performed Recently?

With revenue that's retreating more than the industry's average of late, Nine Dragons Paper (Holdings) has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nine Dragons Paper (Holdings).Do Revenue Forecasts Match The P/S Ratio?

Nine Dragons Paper (Holdings)'s P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 8.3% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.2% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 19% as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

With this information, we find it interesting that Nine Dragons Paper (Holdings) is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Nine Dragons Paper (Holdings) currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It is also worth noting that we have found 1 warning sign for Nine Dragons Paper (Holdings) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nine Dragons Paper (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2689

Nine Dragons Paper (Holdings)

Manufactures and sells packaging paper, printing and writing paper, and specialty paper products and pulp in the People’s Republic of China.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives