- United Kingdom

- /

- Hospitality

- /

- LSE:ROO

UK Penny Stocks To Watch In March 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, impacting companies tied to global economic fortunes. Despite these broader market pressures, investors often look for opportunities in less conventional areas such as penny stocks. Although the term might seem outdated, penny stocks—typically smaller or newer companies—can offer growth potential at lower price points when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.76 | £64.43M | ✅ 4 ⚠️ 3 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.10 | £308.31M | ✅ 4 ⚠️ 5 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.13 | £333.65M | ✅ 4 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.68 | £418.58M | ✅ 4 ⚠️ 1 View Analysis > |

| City of London Investment Group (LSE:CLIG) | £3.40 | £167.56M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.375 | £421.74M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.005 | £160.17M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.746 | £2.08B | ✅ 6 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.335 | £36.25M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

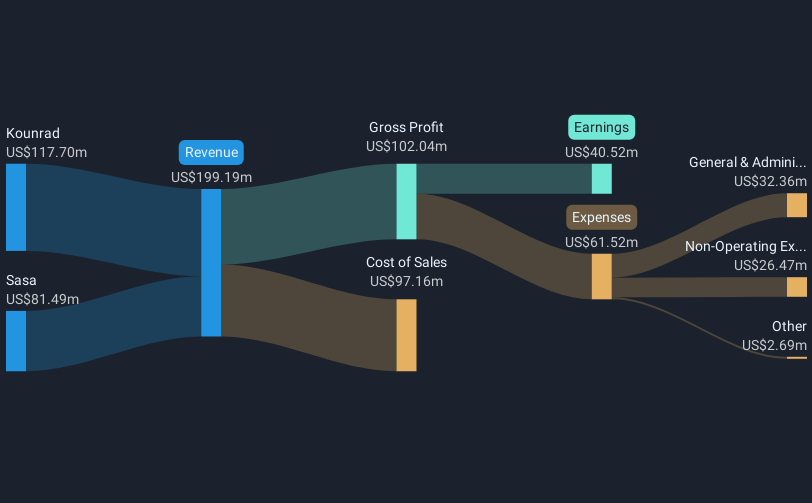

Central Asia Metals (AIM:CAML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Central Asia Metals plc, with a market cap of £292.62 million, operates as a base metals producer through its subsidiaries.

Operations: No specific revenue segments are reported for Central Asia Metals plc.

Market Cap: £292.62M

Central Asia Metals plc, with a market cap of £292.62 million, demonstrates strong financial health despite challenges in production volumes. Recent earnings growth of 36.6% surpasses its five-year average decline and the industry rate, highlighting improvement in profitability. The company trades at a significant discount to estimated fair value and maintains robust cash flow coverage for debt obligations, which have decreased markedly over five years. While dividends remain unstable and management is relatively new, the experienced board provides stability. Short-term assets comfortably cover liabilities, supporting financial resilience amid fluctuating base metal outputs.

- Jump into the full analysis health report here for a deeper understanding of Central Asia Metals.

- Learn about Central Asia Metals' future growth trajectory here.

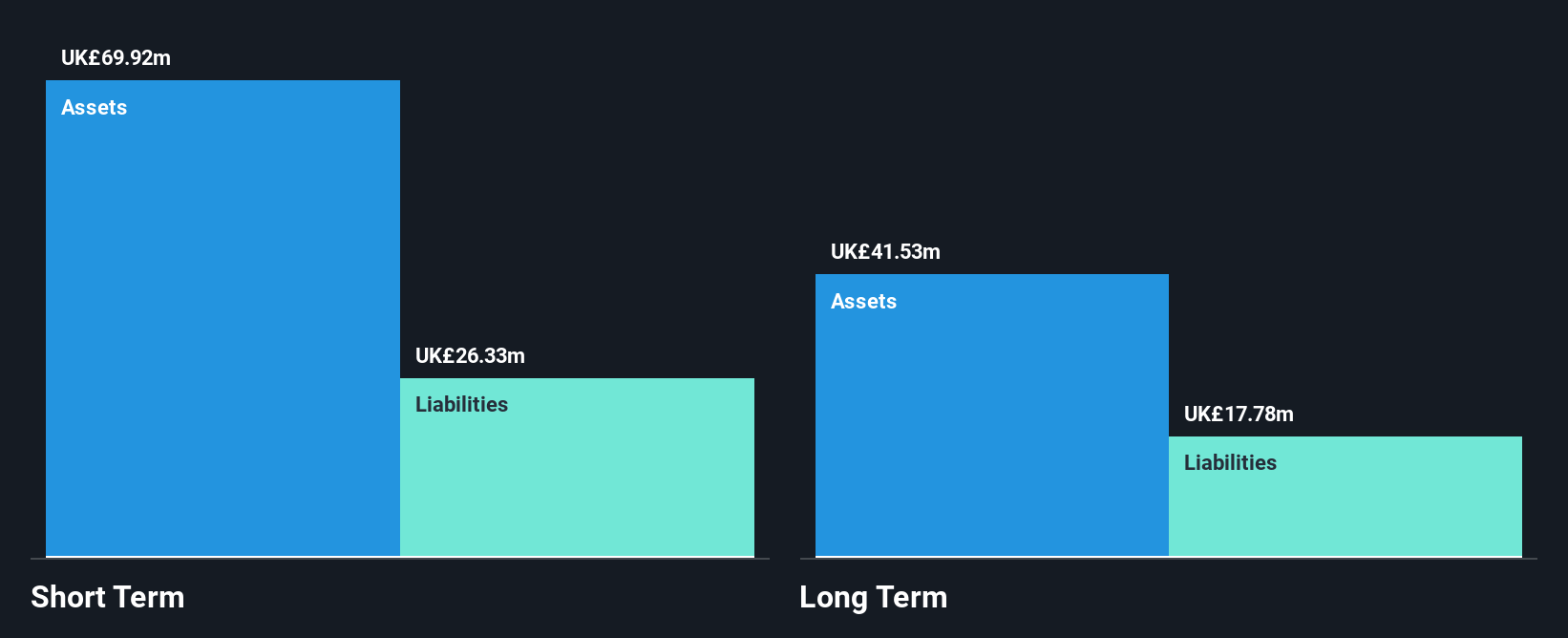

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FDM Group (Holdings) plc is an IT services provider operating across the UK, North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £272.76 million.

Operations: Revenue Segments: No specific revenue segments have been reported.

Market Cap: £272.76M

FDM Group (Holdings) plc, with a market cap of £272.76 million, faces challenges as its revenue for 2024 is expected to decrease by 23% to £258 million. Despite this, the company benefits from being debt-free and having strong short-term assets (£69.9M) that cover both long-term (£17.8M) and short-term liabilities (£26.3M). However, profit margins have declined from 12.2% to 8%, and earnings growth has been negative over the past year (-49.7%). The proposed dividend reduction reflects these pressures, yet FDM trades at a good value compared to peers and industry estimates of fair value.

- Dive into the specifics of FDM Group (Holdings) here with our thorough balance sheet health report.

- Explore FDM Group (Holdings)'s analyst forecasts in our growth report.

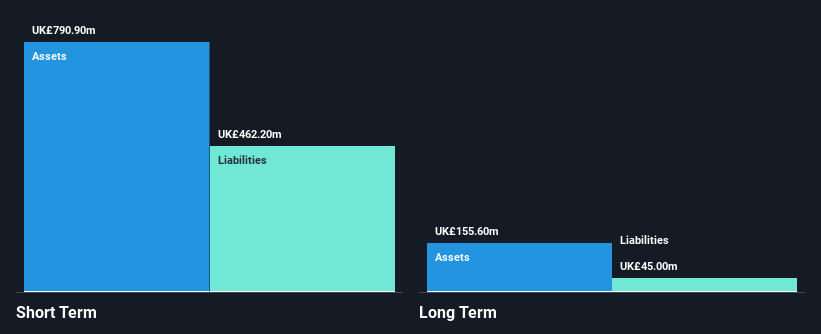

Deliveroo (LSE:ROO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deliveroo plc operates an online food delivery platform across several countries including the UK, Ireland, and France, with a market cap of £1.82 billion.

Operations: The company generates revenue of £2.07 billion from its on-demand food delivery platform operations.

Market Cap: £1.82B

Deliveroo, with a market cap of £1.82 billion, has shown resilience despite being unprofitable by significantly reducing losses at 41.5% annually over five years and maintaining a positive free cash flow that supports a cash runway exceeding three years. The company reported net income of £2.9 million for 2024, marking an improvement from the previous year's loss. Deliveroo remains debt-free and has increased its equity buyback plan to £250 million, suggesting confidence in its financial position. Despite trading below estimated fair value, challenges persist with negative return on equity and volatility concerns in the competitive food delivery sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Deliveroo.

- Gain insights into Deliveroo's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Navigate through the entire inventory of 443 UK Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ROO

Deliveroo

A holding company, operates an online food delivery platform in the United Kingdom, Ireland, France, Italy, Belgium, Hong Kong, Singapore, the United Arab Emirates, Kuwait, and Qatar.

Flawless balance sheet with high growth potential.