- United Kingdom

- /

- Software

- /

- AIM:CRTA

3 UK Penny Stocks With Market Caps Under £70M

Reviewed by Simply Wall St

The UK stock market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns over weak trade data from China, which is impacting global economic sentiment. Despite these broader market challenges, penny stocks remain an intriguing area for investors seeking growth opportunities in smaller or newer companies. While the term "penny stock" might seem outdated, these stocks can still present valuable prospects when backed by strong financials, combining potential value and growth that larger firms may overlook.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £511.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.85 | £230.24M | ✅ 5 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.405 | £43.82M | ✅ 4 ⚠️ 3 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.44 | £428.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Vertu Motors (AIM:VTU) | £0.60 | £187.62M | ✅ 3 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.94 | £347.59M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.085 | £110.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.165 | £185.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.695 | £271.99M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.35 | £71.6M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Arecor Therapeutics (AIM:AREC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arecor Therapeutics plc is a clinical-stage biotechnology company in the United Kingdom focused on developing innovative medicines to address significant unmet patient needs, with a market cap of £26.62 million.

Operations: The company generates its revenue from the biotechnology segment, totaling £5.05 million.

Market Cap: £26.62M

Arecor Therapeutics, with a market cap of £26.62 million and revenue of £5.05 million, is navigating the challenges typical for clinical-stage biotech firms. Despite being unprofitable and having a cash runway of less than a year, its debt-free status and strong asset position provide some financial stability. The company recently formed a Scientific Advisory Board with renowned experts to bolster its innovative drug delivery efforts, potentially enhancing its research capabilities. While earnings have declined significantly over five years, the experienced management team offers strategic leadership during this critical growth phase in the volatile biotech sector.

- Unlock comprehensive insights into our analysis of Arecor Therapeutics stock in this financial health report.

- Evaluate Arecor Therapeutics' prospects by accessing our earnings growth report.

Cirata (AIM:CRTA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cirata plc, along with its subsidiaries, develops and provides collaboration software across North America, Germany, the rest of Europe, China, and other international markets with a market cap of £26.53 million.

Operations: The company generates $9.52 million from developing and selling software licenses, along with related maintenance and support services.

Market Cap: £26.53M

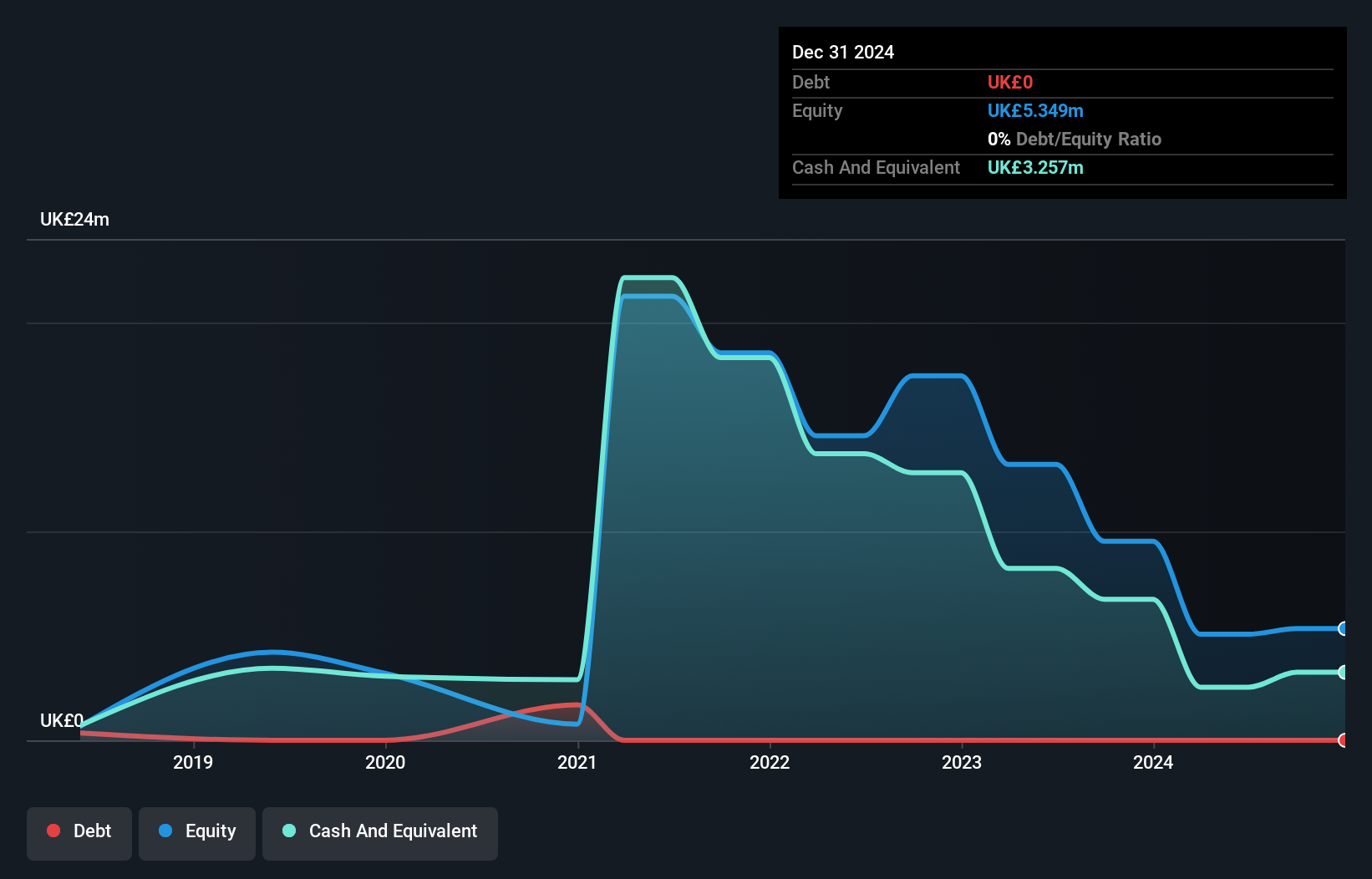

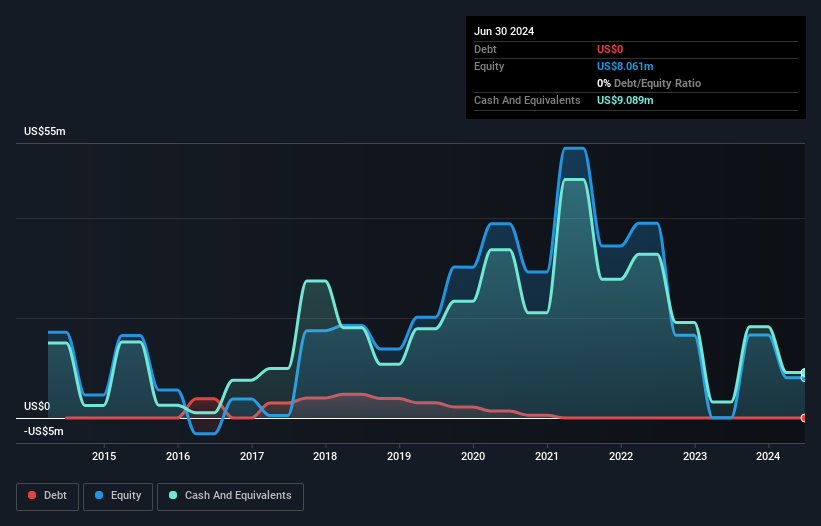

Cirata plc, with a market cap of £26.53 million, is navigating the volatile penny stock landscape by focusing on software development and sales, generating US$9.52 million in revenue. Despite its unprofitable status and high share price volatility over recent months, Cirata's financial position is bolstered by being debt-free and having short-term assets exceeding liabilities. Recent developments include a significant contract renewal with a Canadian bank for its Data Integration software and strategic leadership changes aimed at enhancing revenue growth. The company's cash runway remains limited to under one year, highlighting the need for careful financial management amidst ongoing expansion efforts.

- Dive into the specifics of Cirata here with our thorough balance sheet health report.

- Gain insights into Cirata's future direction by reviewing our growth report.

Logistics Development Group (AIM:LDG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Logistics Development Group plc operates as an investment company with a market cap of £61.25 million.

Operations: Logistics Development Group plc has not reported any specific revenue segments.

Market Cap: £61.25M

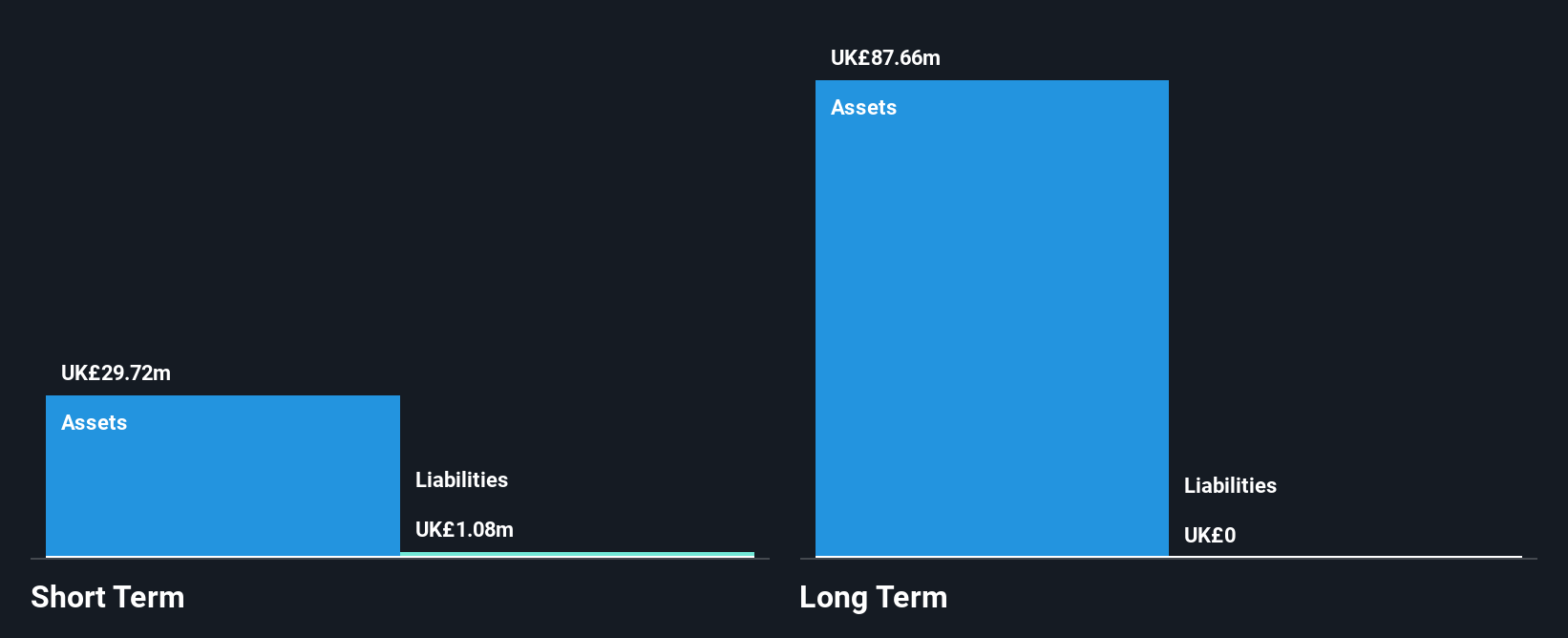

Logistics Development Group plc, with a market cap of £61.25 million, operates as an investment company without significant revenue streams, indicating it is pre-revenue. Its financial health is strong due to a debt-free status and short-term assets of £29.7 million surpassing liabilities by a considerable margin. The company's price-to-earnings ratio of 3.5x suggests potential undervaluation compared to the UK market average of 16.4x, though its return on equity at 14.9% remains low. Despite recent profitability and stable weekly volatility, the board's inexperience could pose challenges in strategic decision-making moving forward.

- Navigate through the intricacies of Logistics Development Group with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Logistics Development Group's track record.

Taking Advantage

- Explore the 297 names from our UK Penny Stocks screener here.

- Ready For A Different Approach? Uncover 10 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CRTA

Cirata

Engages in the development and provision of collaboration software in North America, Germany, rest of Europe, China, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives