- United Kingdom

- /

- Specialty Stores

- /

- LSE:SMWH

Discover On The Beach Group And Two Other UK Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China and its impact on global demand. In such volatile conditions, identifying stocks that are potentially undervalued can offer investors opportunities to find companies trading below their intrinsic value, as is the case with On The Beach Group and two other UK stocks highlighted in this article.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £1.71 | 45.9% |

| Hercules Site Services (AIM:HERC) | £0.475 | £0.91 | 47.6% |

| Fevertree Drinks (AIM:FEVR) | £6.715 | £13.12 | 48.8% |

| Gaming Realms (AIM:GMR) | £0.372 | £0.72 | 48.1% |

| On the Beach Group (LSE:OTB) | £2.54 | £5.02 | 49.4% |

| GlobalData (AIM:DATA) | £1.815 | £3.58 | 49.2% |

| Informa (LSE:INF) | £8.268 | £16.33 | 49.4% |

| Duke Capital (AIM:DUKE) | £0.303 | £0.58 | 47.7% |

| Victrex (LSE:VCT) | £9.99 | £19.53 | 48.8% |

| BATM Advanced Communications (LSE:BVC) | £0.19 | £0.38 | 49.8% |

Let's uncover some gems from our specialized screener.

On the Beach Group (LSE:OTB)

Overview: On the Beach Group plc is an online retailer specializing in short-haul beach holidays in the United Kingdom, with a market cap of £410.04 million.

Operations: The company generates revenue through its Classic Collection segment, contributing £9 million, and the OTB segment, comprising Onthebeach.Co.Uk and Sunshine.Co.Uk, which accounts for £119.20 million.

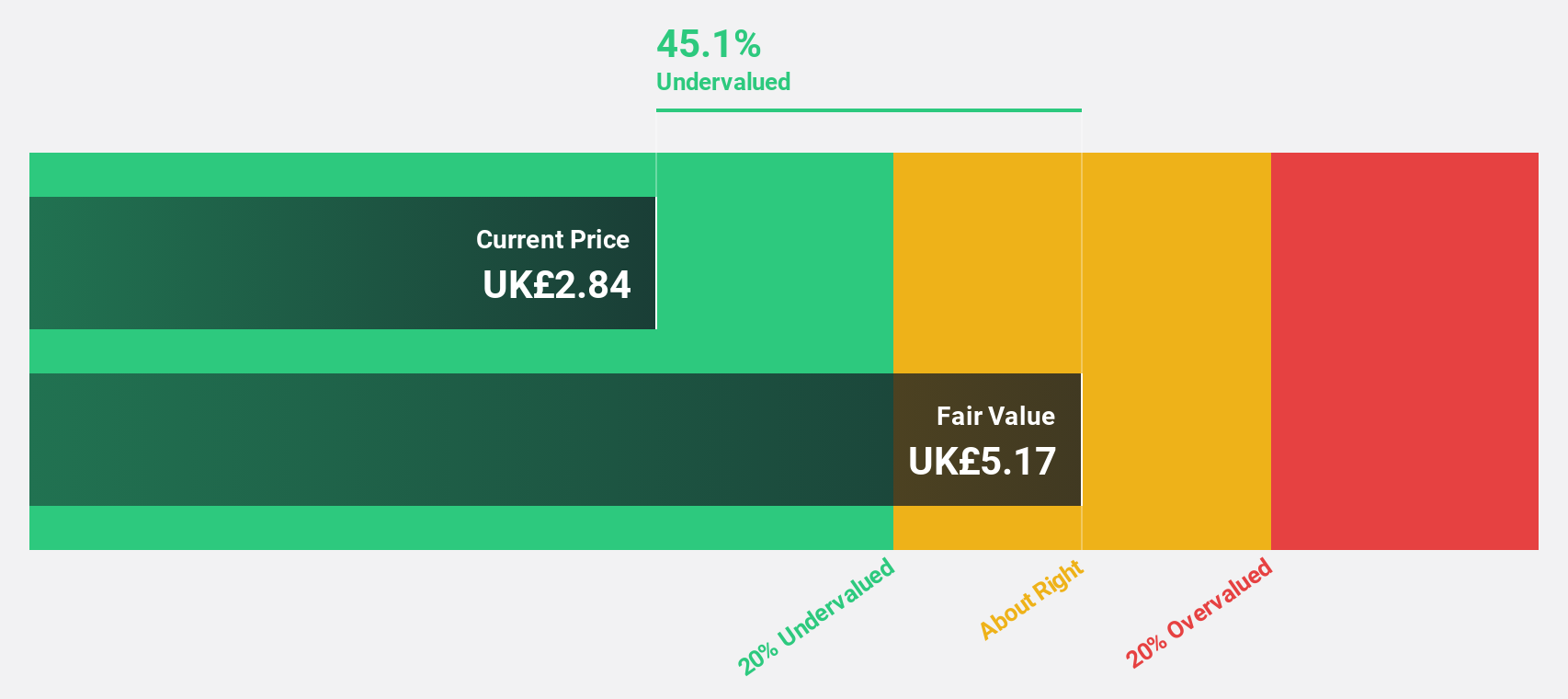

Estimated Discount To Fair Value: 49.4%

On the Beach Group is trading at a substantial discount, about 49.4% below its estimated fair value, with shares priced at £2.54 against a fair value of £5.02. Despite volatile share prices recently, earnings are projected to grow significantly by 20.7% annually, outpacing the UK market's growth rate of 14.6%. The company has initiated a share buyback program and reported improved earnings for fiscal year 2024, indicating strong cash flow potential amidst strategic board changes.

- The growth report we've compiled suggests that On the Beach Group's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in On the Beach Group's balance sheet health report.

WH Smith (LSE:SMWH)

Overview: WH Smith PLC is a travel retailer with operations in the United Kingdom, North America, Australia, Ireland, Spain, and internationally, and has a market cap of £1.47 billion.

Operations: The company's revenue segments include £452 million from High Street operations and £1.47 billion from Travel, comprising £795 million in the UK, £401 million in North America, and £270 million from the Rest of The World.

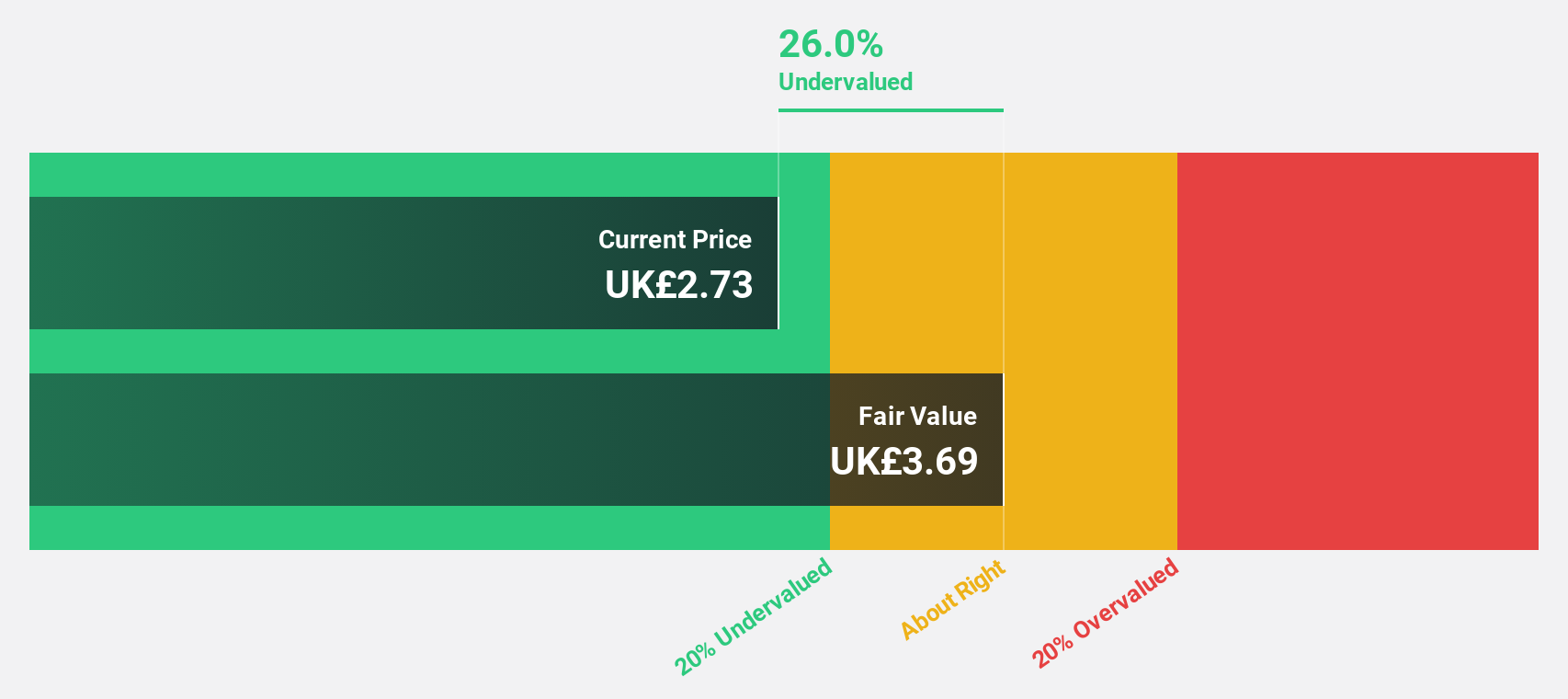

Estimated Discount To Fair Value: 27%

WH Smith is trading at a 27% discount to its estimated fair value of £15.79, with shares priced at £11.52. Despite high debt levels and one-off items affecting results, the company demonstrates strong cash flow generation, as seen in its proposed dividend increase to 33.6 pence per share for 2024. Analysts anticipate a 33.1% stock price rise, supported by forecasted earnings growth of 17.8% annually—outpacing UK market expectations—and ongoing share buybacks valued at £6 million.

- The analysis detailed in our WH Smith growth report hints at robust future financial performance.

- Get an in-depth perspective on WH Smith's balance sheet by reading our health report here.

Trainline (LSE:TRN)

Overview: Trainline Plc operates an independent rail and coach travel platform that sells tickets in the United Kingdom and internationally, with a market cap of £1.57 billion.

Operations: The company's revenue segments comprise £146.08 million from Trainline Solutions, £58.28 million from International Consumer, and £224.53 million from United Kingdom Consumer.

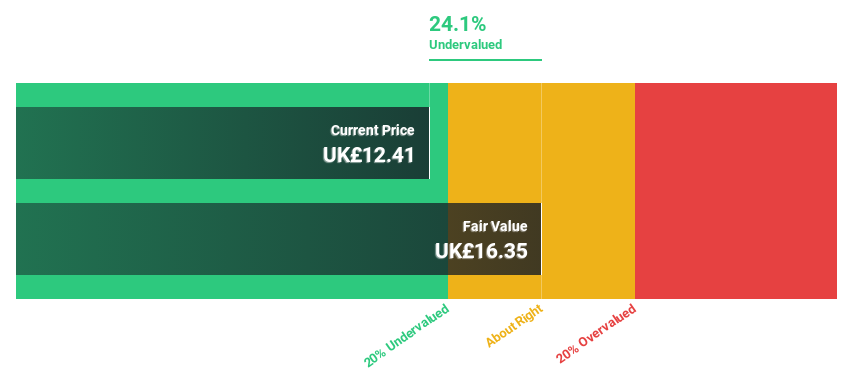

Estimated Discount To Fair Value: 31.6%

Trainline is trading at £3.61, significantly below its estimated fair value of £5.28, representing a discount of over 20%. The company has demonstrated strong earnings growth, with net income rising to £34.02 million for the half year ended August 31, 2024. Analysts expect earnings to grow at an annual rate of 16.7%, surpassing UK market forecasts. Recent share buybacks totaling £83 million further highlight robust cash flow management and shareholder value enhancement efforts.

- According our earnings growth report, there's an indication that Trainline might be ready to expand.

- Unlock comprehensive insights into our analysis of Trainline stock in this financial health report.

Taking Advantage

- Dive into all 49 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WH Smith might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SMWH

WH Smith

Operates as a travel retailer in the United Kingdom, North America, Australia, Ireland, Spain, and internationally.

Reasonable growth potential and fair value.