WPP plc's (LON:WPP) investors are due to receive a payment of £0.15 per share on 3rd of November. This means the annual payment is 4.9% of the current stock price, which is above the average for the industry.

View our latest analysis for WPP

WPP's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last payment made up 79% of earnings, but cash flows were much higher. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

The next year is set to see EPS grow by 104.3%. If the dividend continues along recent trends, we estimate the payout ratio will be 38%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Dividend Volatility

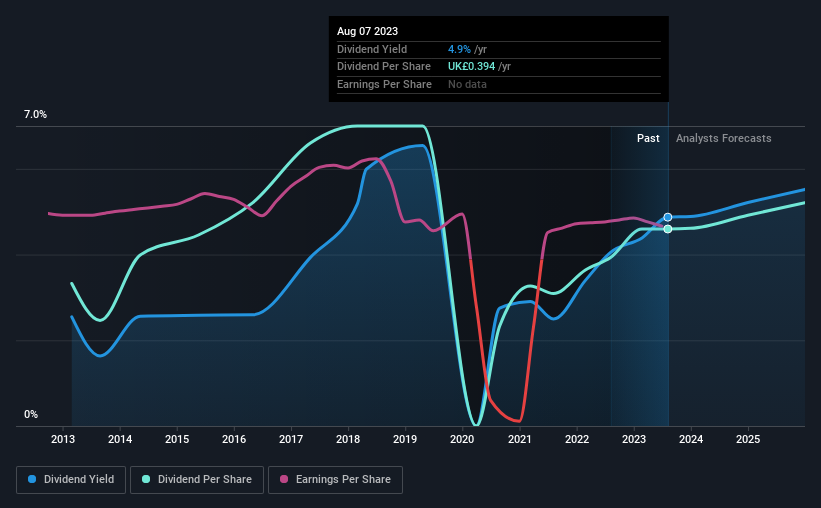

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was £0.285 in 2013, and the most recent fiscal year payment was £0.394. This means that it has been growing its distributions at 3.3% per annum over that time. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though WPP's EPS has declined at around 20% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for WPP that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WPP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:WPP

WPP

A creative transformation company, provides communications, experience, commerce, and technology services in North America, the United Kingdom, Western Continental Europe, the Asia Pacific, Latin America, Africa, the Middle East, and Central and Eastern Europe.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)