- United Kingdom

- /

- Media

- /

- LSE:RCH

Shareholders Will Probably Not Have Any Issues With Reach plc's (LON:RCH) CEO Compensation

Key Insights

- Reach to hold its Annual General Meeting on 2nd of May

- CEO Jim Mullen's total compensation includes salary of UK£504.0k

- Total compensation is 34% below industry average

- Reach's EPS grew by 78% over the past three years while total shareholder loss over the past three years was 62%

Performance at Reach plc (LON:RCH) has been rather uninspiring recently and shareholders may be wondering how CEO Jim Mullen plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 2nd of May. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

View our latest analysis for Reach

How Does Total Compensation For Jim Mullen Compare With Other Companies In The Industry?

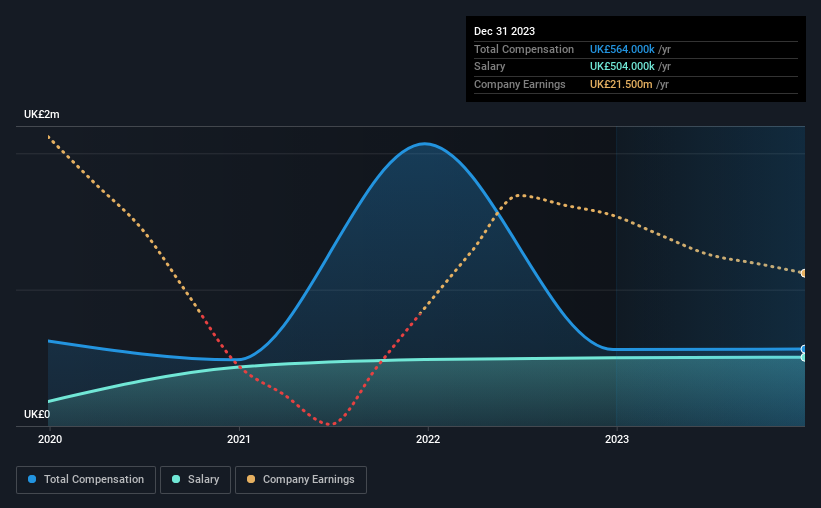

Our data indicates that Reach plc has a market capitalization of UK£218m, and total annual CEO compensation was reported as UK£564k for the year to December 2023. This means that the compensation hasn't changed much from last year. Notably, the salary which is UK£504.0k, represents most of the total compensation being paid.

For comparison, other companies in the British Media industry with market capitalizations ranging between UK£80m and UK£320m had a median total CEO compensation of UK£858k. Accordingly, Reach pays its CEO under the industry median. Furthermore, Jim Mullen directly owns UK£513k worth of shares in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | UK£504k | UK£501k | 89% |

| Other | UK£60k | UK£60k | 11% |

| Total Compensation | UK£564k | UK£561k | 100% |

Speaking on an industry level, nearly 55% of total compensation represents salary, while the remainder of 45% is other remuneration. According to our research, Reach has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Reach plc's Growth

Reach plc's earnings per share (EPS) grew 78% per year over the last three years. It saw its revenue drop 5.4% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Reach plc Been A Good Investment?

With a total shareholder return of -62% over three years, Reach plc shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The loss to shareholders over the past three years is certainly concerning. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 3 warning signs for Reach (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RCH

Reach

Operates as commercial news publisher in the United Kingdom, rest of Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)