- United Kingdom

- /

- Consumer Finance

- /

- LSE:FCH

3 UK Penny Stocks With Market Caps Under £3B

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over China's economic recovery. In such uncertain times, investors often seek out opportunities in smaller or newer companies that may offer growth potential at a lower cost. Penny stocks, despite their somewhat dated name, can still present valuable opportunities for those willing to explore this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.15 | £810.04M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.895 | £387.38M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.175 | £67.03M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.90 | £68.16M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.64 | £191.24M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.225 | £104.55M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.27 | £195.87M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.405 | £178.93M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.38 | $220.9M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.27 | £418.44M | ★★★★★★ |

Click here to see the full list of 461 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Helios Underwriting (AIM:HUW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Helios Underwriting plc, along with its subsidiaries, offers limited liability investment opportunities in the Lloyd's insurance market in the UK and has a market capitalization of £139.83 million.

Operations: Helios Underwriting's revenue is primarily derived from Syndicate Participation (£258.32 million) and Investment Management (£4.62 million).

Market Cap: £139.83M

Helios Underwriting plc, with a market capitalization of £139.83 million, has shown substantial earnings growth, reporting a 236.7% increase over the past year, surpassing the insurance industry's growth rate. Despite an increased debt-to-equity ratio from 4.9% to 42.3% over five years, the company's debt is well covered by operating cash flow and interest payments are adequately managed with EBIT coverage at 14.4 times interest expenses. The recent appointment of Katharine Wade as an Independent Non-Executive Director adds significant industry expertise to its board. Helios trades at a favorable price-to-earnings ratio of 7.9x compared to the UK market average of 16.2x.

- Get an in-depth perspective on Helios Underwriting's performance by reading our balance sheet health report here.

- Learn about Helios Underwriting's future growth trajectory here.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Funding Circle Holdings plc operates online lending platforms in the UK, the US, and internationally, with a market cap of £428.90 million.

Operations: The company's revenue is primarily derived from its UK operations, with £10.8 million generated from FlexiPay and £138.6 million from Term Loans.

Market Cap: £428.9M

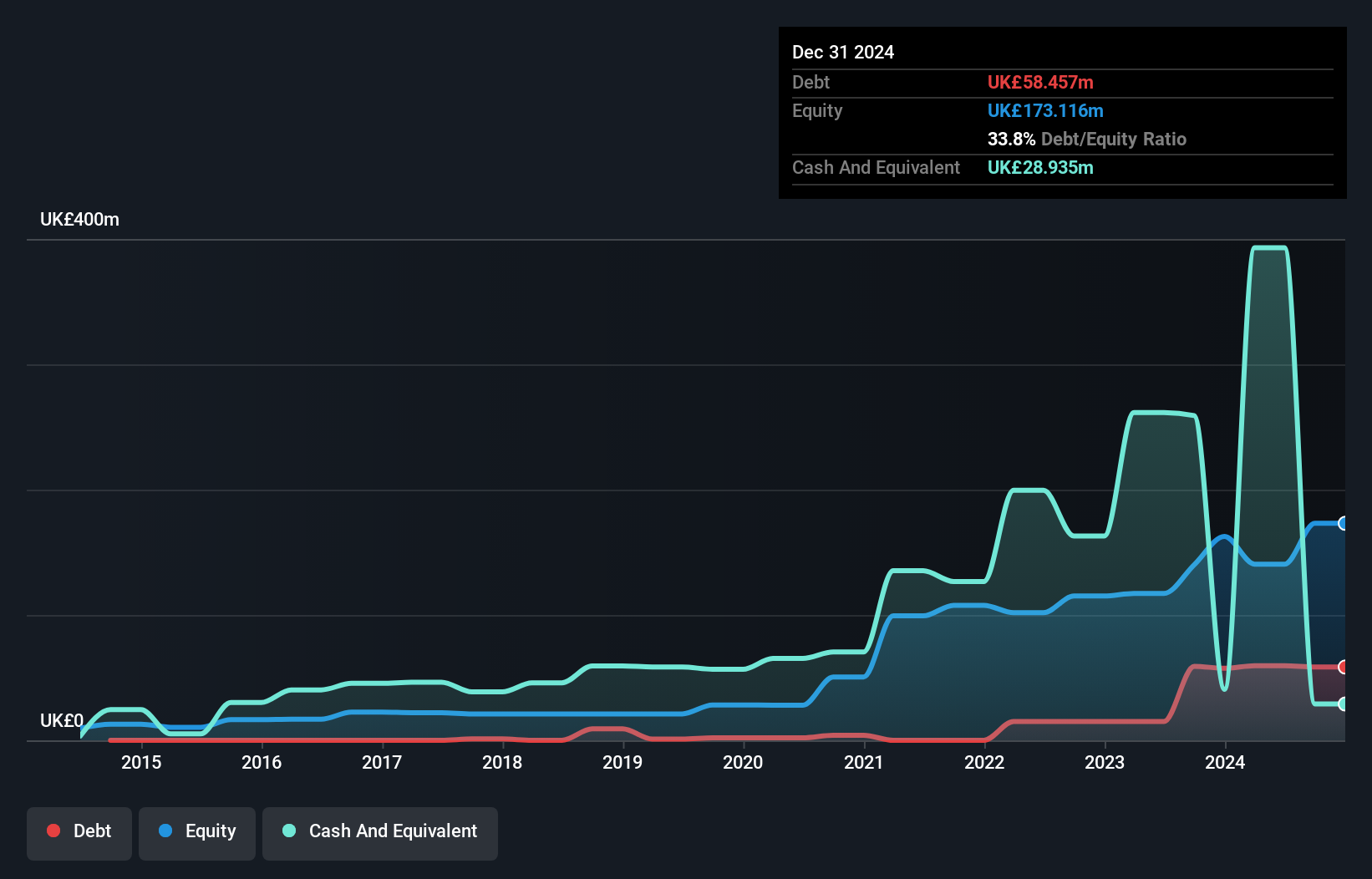

Funding Circle Holdings plc, with a market cap of £428.90 million, has been reducing its losses at 32.8% per year over the past five years despite being unprofitable. The company has a strong balance sheet with short-term assets of £296 million exceeding both short and long-term liabilities, and more cash than total debt. Recent strategic moves include completing a share buyback program worth £24.45 million to enhance balance sheet efficiency by returning capital to shareholders. While earnings are forecasted to grow significantly at 87.7% annually, recent volatility in share price remains high compared to UK stocks.

- Click to explore a detailed breakdown of our findings in Funding Circle Holdings' financial health report.

- Examine Funding Circle Holdings' earnings growth report to understand how analysts expect it to perform.

QinetiQ Group (LSE:QQ.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: QinetiQ Group plc is a science and engineering company serving the defense, security, and infrastructure markets across the UK, US, Australia, and internationally with a market cap of £2.40 billion.

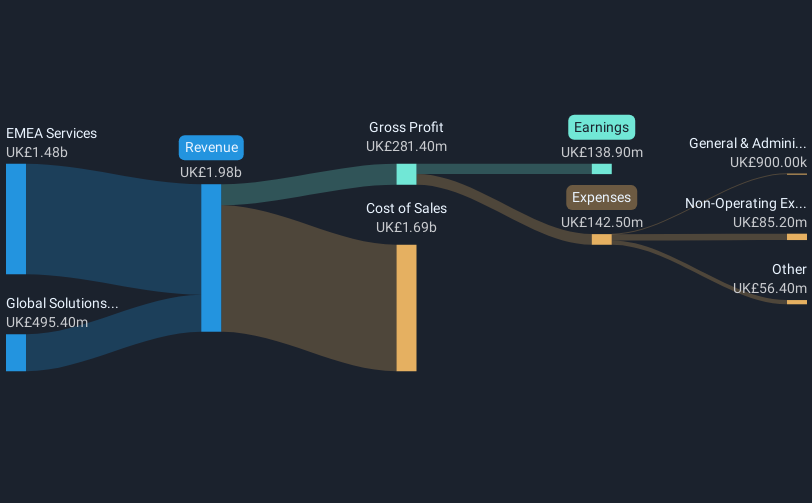

Operations: The company's revenue is primarily derived from EMEA Services, contributing £1.48 billion, and Global Solutions, which accounts for £495.4 million.

Market Cap: £2.4B

QinetiQ Group plc, with a market cap of £2.40 billion, has demonstrated stable financial performance and strategic growth in the defense sector. Its recent earnings report shows sales of £946.8 million for the half-year ending September 2024, reflecting steady revenue growth from its EMEA Services and Global Solutions divisions. The company's net profit margins have improved to 7%, supported by well-covered interest payments and satisfactory debt levels. A new three-year contract with the UK's Ministry of Defence worth up to £150 million further strengthens its position in military communications. Despite these positives, QinetiQ's earnings growth slightly lags behind industry averages, yet it remains undervalued compared to peers and forecasts suggest continued earnings expansion at 13.9% annually.

- Jump into the full analysis health report here for a deeper understanding of QinetiQ Group.

- Review our growth performance report to gain insights into QinetiQ Group's future.

Summing It All Up

- Unlock our comprehensive list of 461 UK Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Funding Circle Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:FCH

Funding Circle Holdings

Provides online lending platforms in the United Kingdom, the United States, and internationally.

Reasonable growth potential with adequate balance sheet.