- United Kingdom

- /

- Capital Markets

- /

- LSE:CLDN

Helios Underwriting And 2 Other UK Penny Stocks Worth Watching

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and global economic uncertainties. In such conditions, identifying stocks with strong financial health becomes crucial for investors seeking potential growth opportunities. Penny stocks, despite their somewhat outdated moniker, continue to offer intriguing prospects in the UK market; when backed by robust financials, these smaller or newer companies can provide hidden value and potential for significant returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.80 | £537.39M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.02 | £163.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.72 | £10.87M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.903 | £333.91M | ✅ 5 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.73 | £10.05M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.43 | £74.04M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.856 | £701.05M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Helios Underwriting (AIM:HUW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Helios Underwriting plc, along with its subsidiaries, offers limited liability investment opportunities in the Lloyd's insurance market in the UK and has a market capitalization of £160.24 million.

Operations: The company generates revenue from its operations in the United Kingdom, amounting to £36.00 million.

Market Cap: £160.24M

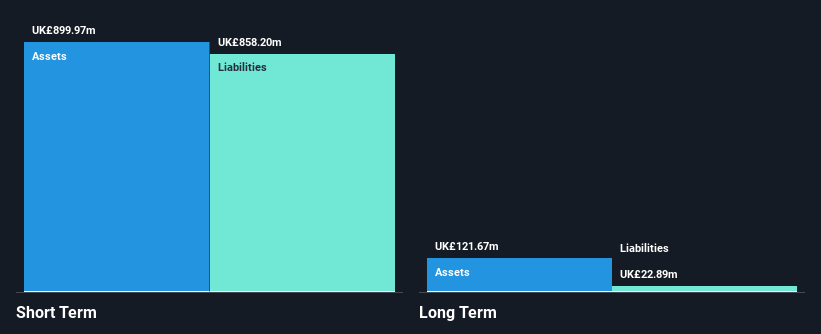

Helios Underwriting presents a mixed picture for penny stock investors. While it trades at a favorable price-to-earnings ratio of 8.6x compared to the UK market, its recent financial performance shows challenges, with negative earnings growth and declining profit margins. The company's short-term assets exceed liabilities, but negative operating cash flow raises concerns about debt coverage. Recent executive changes bring potential for strategic shifts; the appointment of Louis Tucker as CEO could leverage his extensive experience in the Lloyd's Market to drive future growth and stability. However, significant insider selling may warrant caution among prospective investors.

- Get an in-depth perspective on Helios Underwriting's performance by reading our balance sheet health report here.

- Evaluate Helios Underwriting's prospects by accessing our earnings growth report.

Jersey Oil and Gas (AIM:JOG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jersey Oil and Gas Plc is involved in the exploration, appraisal, development, and production of oil and gas properties in the UK's North Sea, with a market cap of £51.29 million.

Operations: Jersey Oil and Gas Plc has not reported any revenue segments.

Market Cap: £51.29M

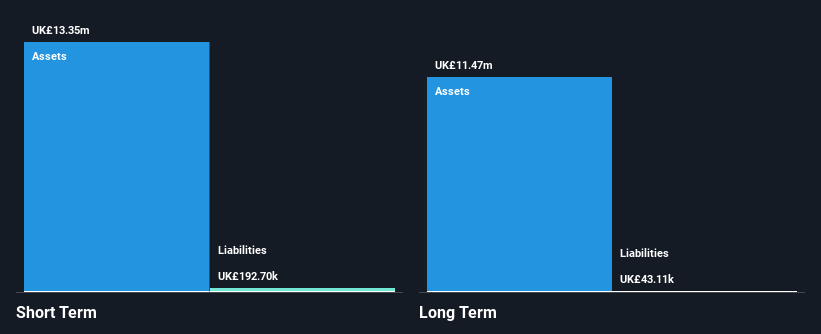

Jersey Oil and Gas Plc, a pre-revenue company with a market cap of £51.29 million, is navigating the challenges typical of penny stocks. Despite an experienced management team and board, the company remains unprofitable with increasing losses over the past five years. Its short-term assets significantly exceed liabilities (£11.6M vs £147.1K), providing some financial stability alongside being debt-free. However, high share price volatility and lack of profitability forecasts for the next three years pose risks for investors seeking stability or near-term returns in this sector-focused venture in the UK's North Sea oil exploration landscape.

- Jump into the full analysis health report here for a deeper understanding of Jersey Oil and Gas.

- Gain insights into Jersey Oil and Gas' outlook and expected performance with our report on the company's earnings estimates.

Caledonia Investments (LSE:CLDN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caledonia Investments plc is a self-managed investment trust company with a market capitalization of approximately £1.97 billion.

Operations: The company's revenue is primarily generated from its investment portfolio, comprising £44.10 million from public companies, £30.50 million from private capital, and £19.50 million from funds, alongside other investments contributing £2.50 million.

Market Cap: £1.97B

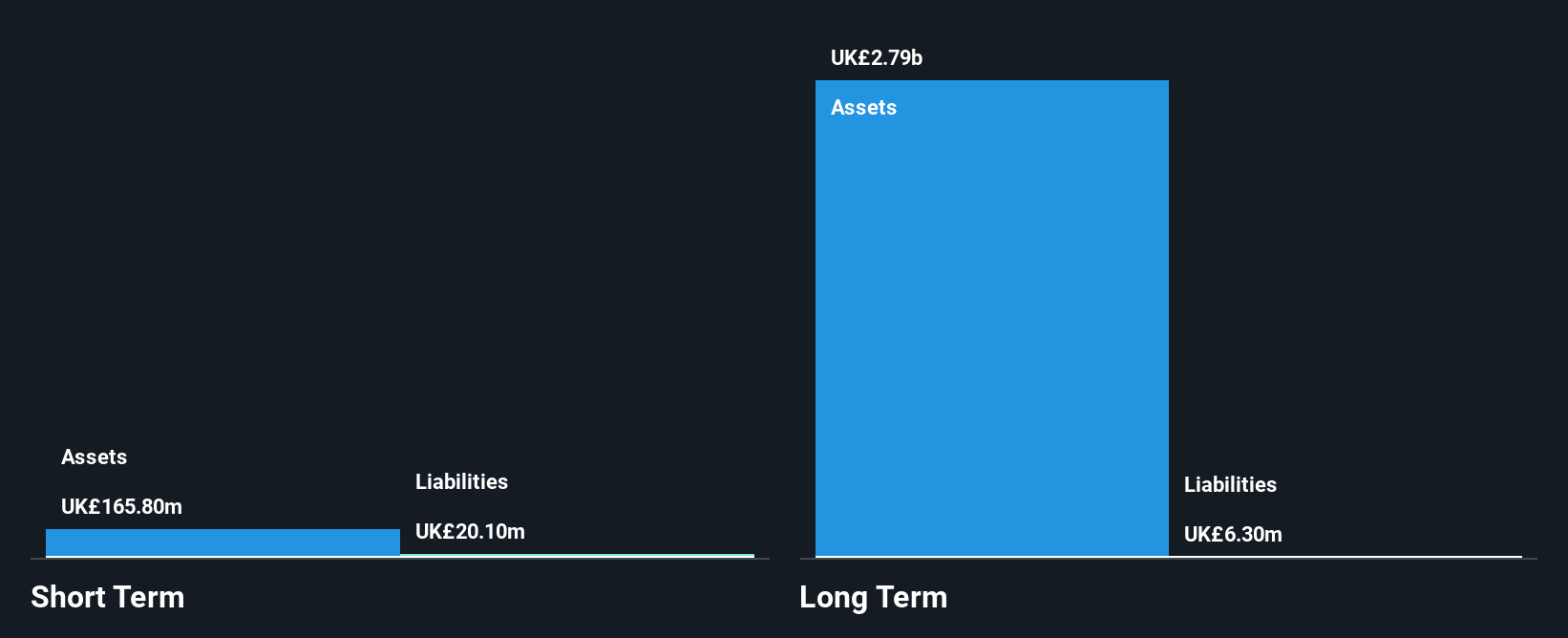

Caledonia Investments plc, with a market capitalization of £1.97 billion, stands out in the penny stock landscape due to its robust financial position and strategic initiatives. The company is debt-free, with short-term assets (£165.80 million) comfortably covering both short-term (£20.10 million) and long-term liabilities (£6.30 million). However, recent challenges include negative earnings growth over the past year and a decline in net profit margins from 86.3% to 68.4%. Recent board changes and an ongoing share repurchase program indicate active management strategies aimed at enhancing shareholder value amidst fluctuating returns on equity (2.3%).

- Navigate through the intricacies of Caledonia Investments with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Caledonia Investments' track record.

Seize The Opportunity

- Click through to start exploring the rest of the 294 UK Penny Stocks now.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLDN

Caledonia Investments

Caledonia Investments plc is a self-managed investment trust company.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives