- United Kingdom

- /

- Capital Markets

- /

- LSE:STJ

3 UK Stocks That May Be Trading At Discounts Of Up To 49.9%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China and declining commodity prices, highlighting the interconnectedness of global economies. In such a market environment, identifying stocks that may be trading at discounts can present opportunities for investors seeking value amidst broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £1.71 | 44.8% |

| Hercules Site Services (AIM:HERC) | £0.47 | £0.91 | 48.2% |

| Fevertree Drinks (AIM:FEVR) | £6.575 | £13.12 | 49.9% |

| Gaming Realms (AIM:GMR) | £0.37 | £0.72 | 48.4% |

| GlobalData (AIM:DATA) | £1.805 | £3.57 | 49.4% |

| Zotefoams (LSE:ZTF) | £2.95 | £5.67 | 48% |

| Informa (LSE:INF) | £8.372 | £16.31 | 48.7% |

| Duke Capital (AIM:DUKE) | £0.3025 | £0.58 | 48% |

| Victrex (LSE:VCT) | £10.64 | £19.55 | 45.6% |

| St. James's Place (LSE:STJ) | £9.315 | £18.60 | 49.9% |

We'll examine a selection from our screener results.

discoverIE Group (LSE:DSCV)

Overview: discoverIE Group plc designs, manufactures, and supplies components for electronic applications globally, with a market cap of £663.75 million.

Operations: The company generates revenue through two main segments: Magnetics & Controls, contributing £256.50 million, and Sensing & Connectivity, which accounts for £169.60 million.

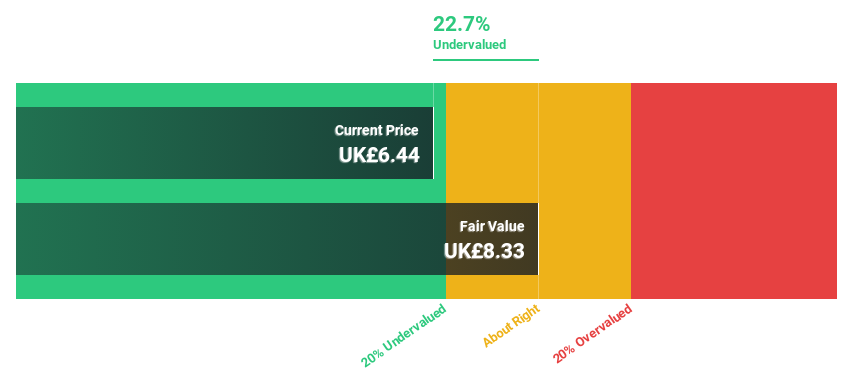

Estimated Discount To Fair Value: 18.7%

discoverIE Group's recent earnings report shows a slight sales decline but an increase in net income, reflecting resilient cash flows. The company is trading at £6.82, below its estimated fair value of £8.38, suggesting potential undervaluation based on cash flow analysis. Earnings are projected to grow significantly at 20.3% annually over the next three years, outpacing the UK market average of 14.5%, although return on equity remains modest at 11.7%.

- The growth report we've compiled suggests that discoverIE Group's future prospects could be on the up.

- Get an in-depth perspective on discoverIE Group's balance sheet by reading our health report here.

St. James's Place (LSE:STJ)

Overview: St. James's Place plc is a publicly owned investment manager with a market cap of £4.97 billion.

Operations: The company's revenue is primarily derived from its Wealth Management Business, totaling £26.80 billion.

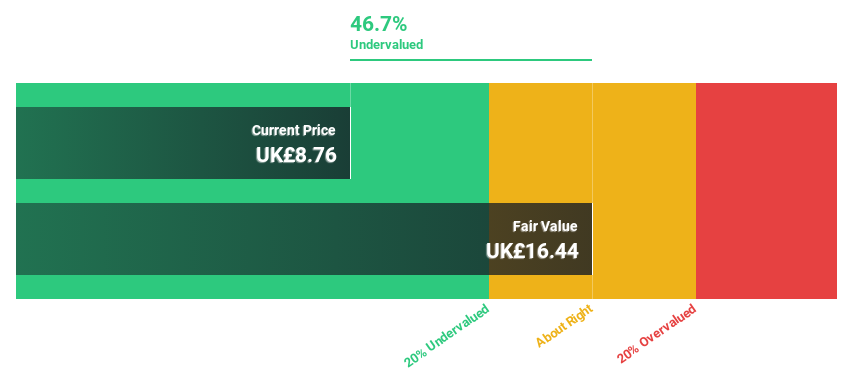

Estimated Discount To Fair Value: 49.9%

St. James's Place, trading at £9.32, is significantly undervalued based on cash flow analysis with an estimated fair value of £18.6. Despite a projected annual revenue decline of 83.4% over the next three years, earnings are expected to grow by 23.71% annually and become profitable within this period, surpassing average market growth rates. Recent inclusion in the FTSE 100 Index enhances its visibility amid executive board changes aimed at strengthening governance.

- According our earnings growth report, there's an indication that St. James's Place might be ready to expand.

- Click here to discover the nuances of St. James's Place with our detailed financial health report.

Supermarket Income REIT (LSE:SUPR)

Overview: Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust focused on investing in grocery properties across the UK, with a market cap of £838.72 million.

Operations: The company generates revenue primarily from its real estate investment segment, totaling £107.23 million.

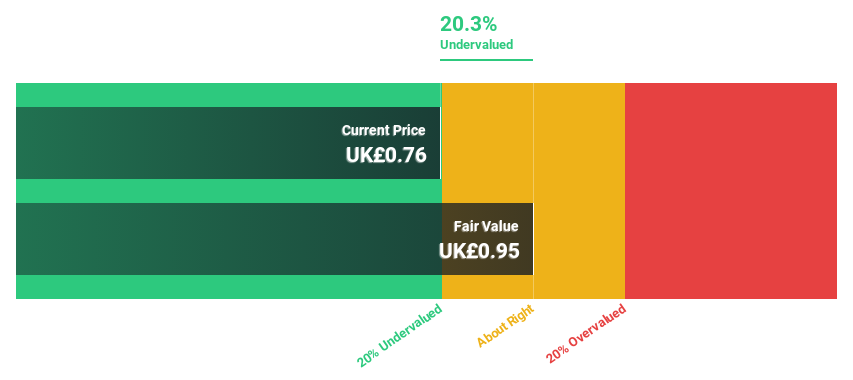

Estimated Discount To Fair Value: 27.1%

Supermarket Income REIT, trading at £0.66, is significantly undervalued with an estimated fair value of £0.90. Despite debt concerns not well covered by operating cash flow, it is forecast to become profitable within three years with earnings growth of 48.04% annually, surpassing market averages. Recent board changes include appointing Roger Blundell as an independent director and Audit Chair, enhancing governance amid consistent dividend distributions to shareholders.

- Our growth report here indicates Supermarket Income REIT may be poised for an improving outlook.

- Take a closer look at Supermarket Income REIT's balance sheet health here in our report.

Make It Happen

- Click this link to deep-dive into the 50 companies within our Undervalued UK Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:STJ

Undervalued with reasonable growth potential.