- United Kingdom

- /

- Professional Services

- /

- LSE:STEM

Top UK Dividend Stocks For January 2025

Reviewed by Simply Wall St

The UK market has faced recent challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery and its impact on sectors tied to commodities. In such uncertain times, dividend stocks can offer a measure of stability and income potential for investors seeking resilience amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.18% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.46% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.16% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.06% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.04% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.63% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.76% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.03% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.26% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.81% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

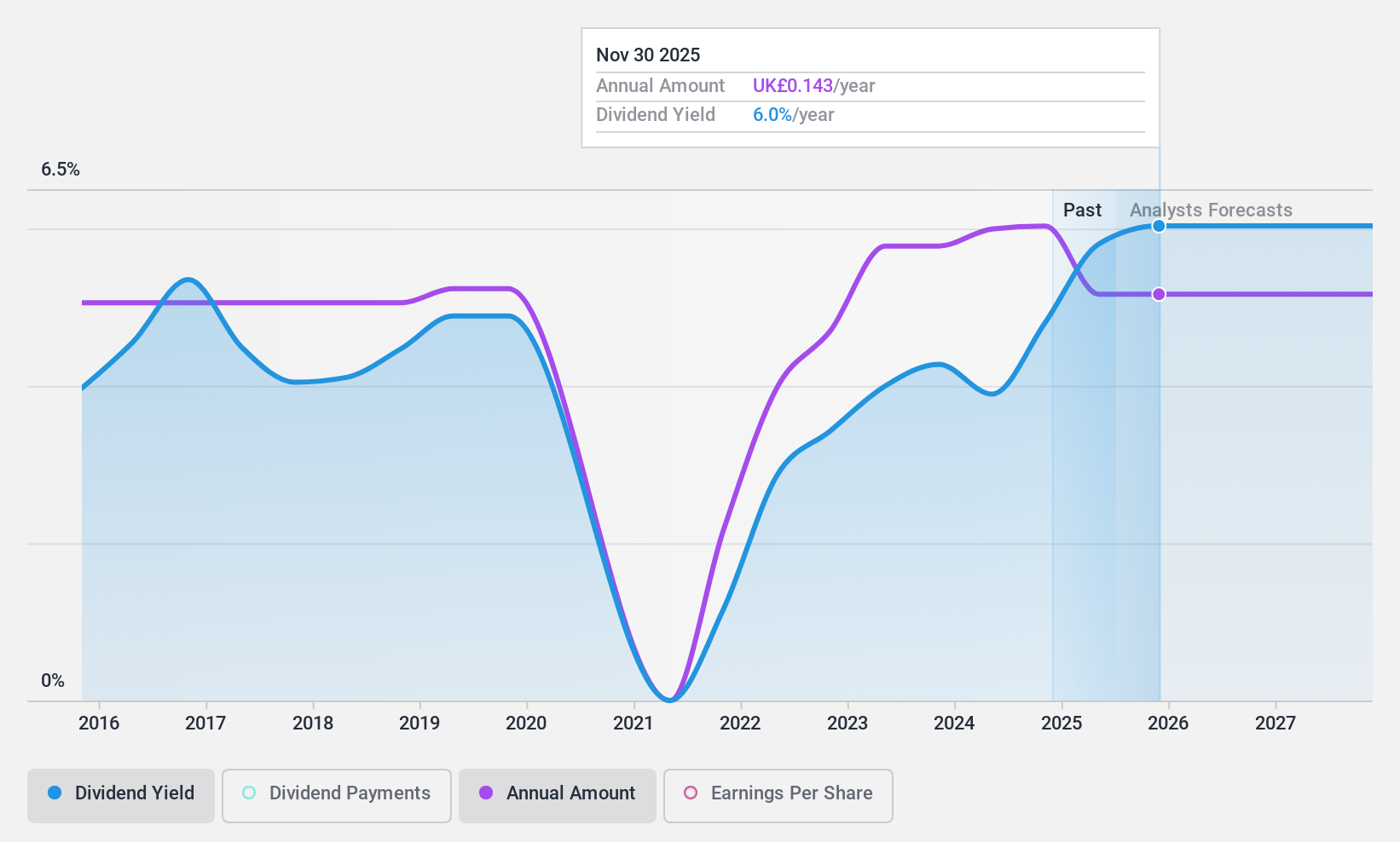

Livermore Investments Group (AIM:LIV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Livermore Investments Group Limited is a publicly owned investment manager with a market cap of £91.77 million.

Operations: Livermore Investments Group Limited generates revenue primarily from its equity and debt instruments investment activities, amounting to $23.75 million.

Dividend Yield: 6.2%

Livermore Investments Group's dividend yield of 6.19% ranks in the top 25% of UK dividend payers, supported by a low payout ratio of 25.3% and a cash payout ratio of 33%, indicating sustainability from earnings and cash flows. However, dividends have been volatile over the past decade with periods of significant drops. Recent board changes include Mr. Ron Baron's transition to a Non-Executive Director role, potentially impacting strategic direction.

- Click to explore a detailed breakdown of our findings in Livermore Investments Group's dividend report.

- Our comprehensive valuation report raises the possibility that Livermore Investments Group is priced higher than what may be justified by its financials.

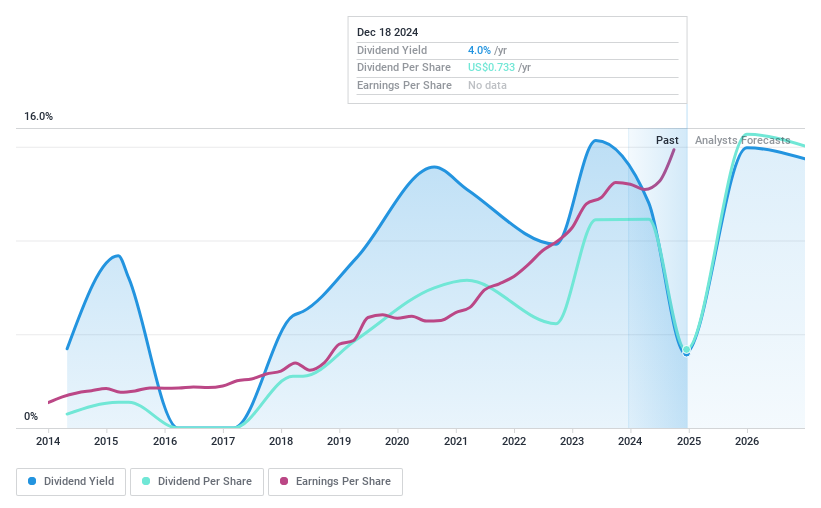

Halyk Bank of Kazakhstan (LSE:HSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Halyk Bank of Kazakhstan Joint Stock Company operates as a provider of corporate and retail banking services in Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan with a market cap of $5.41 billion.

Operations: Halyk Bank of Kazakhstan generates revenue through its segments, with Corporate Banking contributing KZT 483.28 billion, Investment Banking at KZT 272.50 billion, Retail Banking at KZT 153.85 billion, and Small and Medium Enterprises (SME) Banking providing KZT 152.10 billion.

Dividend Yield: 3.7%

Halyk Bank of Kazakhstan's dividend yield of 3.68% is below the top 25% of UK dividend payers, and its dividends have been volatile over the past decade. Despite this, a low payout ratio of 35% suggests dividends are well-covered by earnings, with future coverage projected at 48.4%. Recent earnings growth and a fixed-income offering highlight financial stability, though high non-performing loans (6.9%) and low bad loan allowance (76%) remain concerns.

- Take a closer look at Halyk Bank of Kazakhstan's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Halyk Bank of Kazakhstan shares in the market.

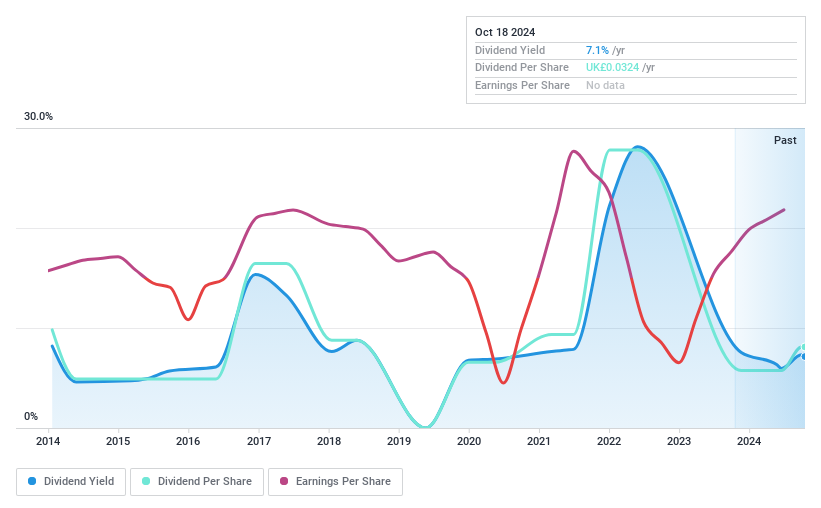

SThree (LSE:STEM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SThree plc is a specialist recruitment company operating in the sciences, technology, engineering, and mathematics sectors across various countries including the UK and the US, with a market cap of £389.69 million.

Operations: SThree plc's revenue is segmented as follows: USA at £318.74 million, DACH at £490.18 million, Rest of Europe at £384.35 million, Middle East & Asia at £42.03 million, and Netherlands (including Spain) at £366.06 million.

Dividend Yield: 5.9%

SThree's dividend payments are well-covered by earnings and cash flows, with payout ratios of 39.2% and 42.9%, respectively. However, its dividends have been volatile over the past decade despite recent growth. The dividend yield of 5.92% is slightly below the top UK payers, yet it trades at a good relative value compared to peers. A recent £20 million share buyback program may impact capital structure positively but does not directly address dividend stability concerns.

- Click here to discover the nuances of SThree with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, SThree's share price might be too pessimistic.

Make It Happen

- Explore the 61 names from our Top UK Dividend Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:STEM

SThree

Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan.

Outstanding track record with flawless balance sheet and pays a dividend.