- United Kingdom

- /

- Metals and Mining

- /

- AIM:EEE

Empire Metals Leads The Pack Of 3 UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, certain investment opportunities remain attractive. Penny stocks, often representing smaller or newer companies, continue to captivate investors with their potential for growth and affordability. In this article, we explore three UK penny stocks that stand out for their financial strength and resilience amidst current market conditions.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.944 | £150.76M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £776.24M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.425 | £178.93M | ★★★★★☆ |

| Foresight Group Holdings (LSE:FSG) | £3.72 | £426.51M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £4.46 | £88.11M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.595 | £358.04M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.0575 | £92.27M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.95 | £188.38M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £155.53M | ★★★★★☆ |

| QinetiQ Group (LSE:QQ.) | £3.824 | £2.16B | ★★★★★☆ |

Click here to see the full list of 444 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Empire Metals (AIM:EEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Empire Metals Limited is involved in the exploration and development of properties across the United Kingdom, Australia, and Austria with a market cap of £46.32 million.

Operations: Empire Metals Limited does not have reported revenue segments.

Market Cap: £46.32M

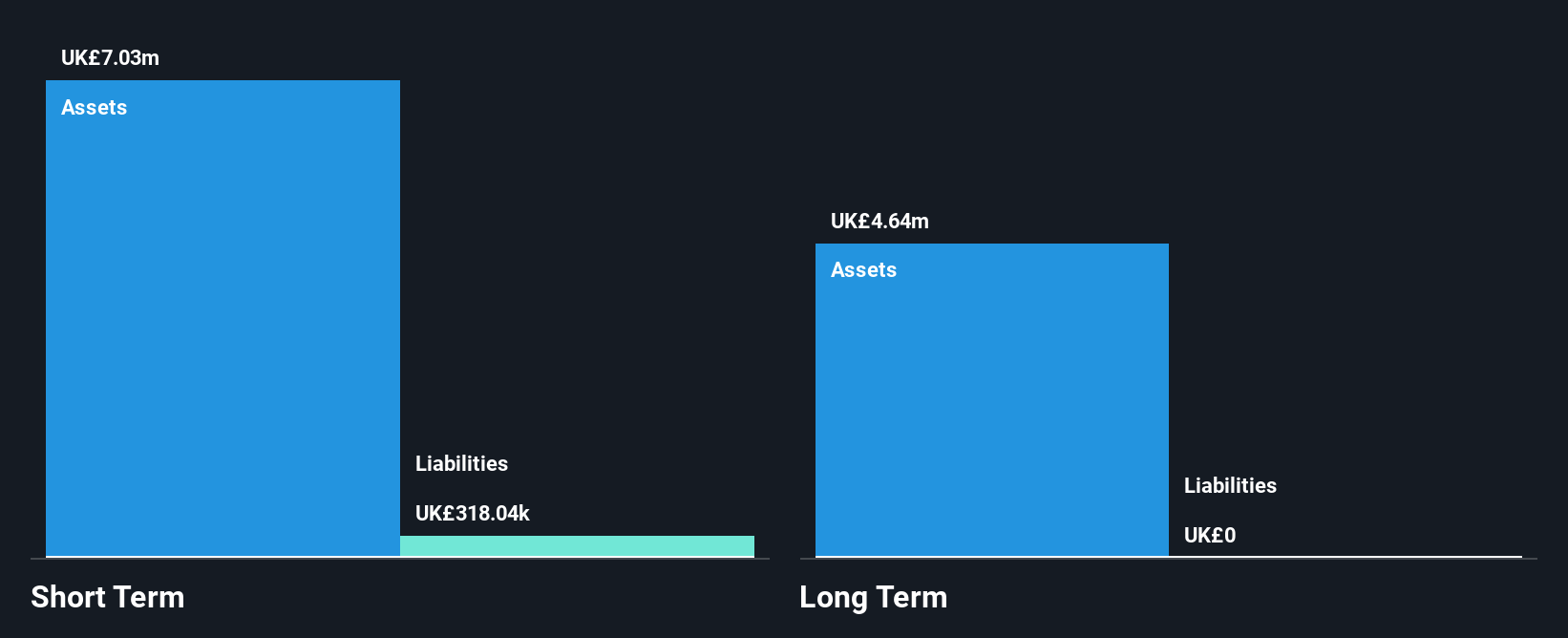

Empire Metals Limited, with a market cap of £46.32 million, is pre-revenue and focused on exploration projects in Australia and other regions. Recent developments at their Pitfield Project in Western Australia show promising metallurgical test results for high-purity anatase mineralisation, which could lead to lower-cost processing options. The company has no debt and its short-term assets significantly exceed liabilities, providing some financial stability despite being unprofitable. Empire's management team is experienced, recently strengthened by the appointment of Phillip Brumit as Non-executive Director, enhancing its strategic capabilities in mining operations.

- Navigate through the intricacies of Empire Metals with our comprehensive balance sheet health report here.

- Explore historical data to track Empire Metals' performance over time in our past results report.

Tribal Group (AIM:TRB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tribal Group plc, with a market cap of £90.97 million, provides software and services to education institutions worldwide through its subsidiaries.

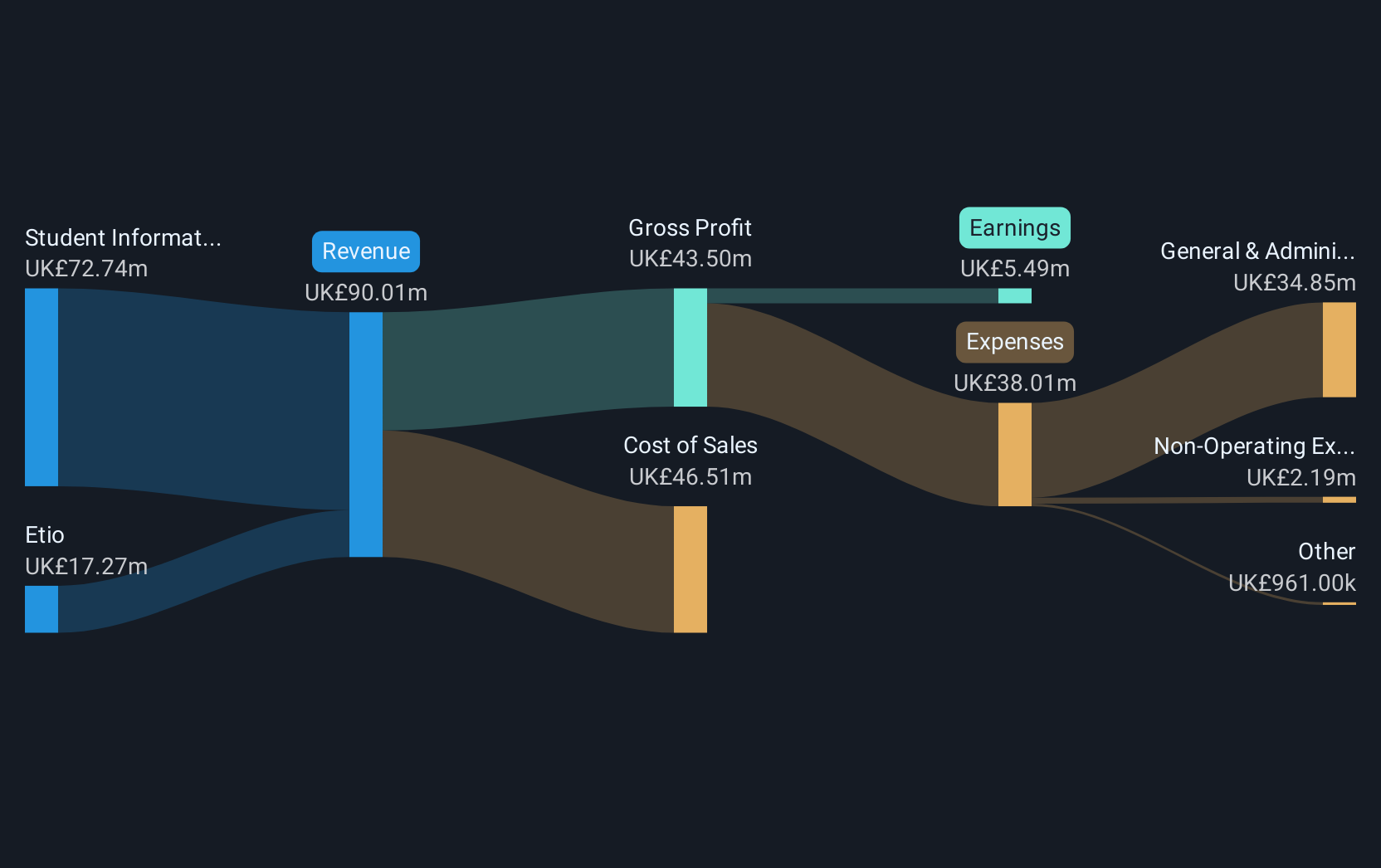

Operations: The company's revenue is primarily derived from its Student Information Systems (SIS) segment, which generated £70.08 million, and its Education Services segment, contributing £17.24 million.

Market Cap: £90.97M

Tribal Group plc, with a market cap of £90.97 million, derives most of its revenue from its Student Information Systems segment (£70.08 million) and Education Services (£17.24 million). The company has not experienced significant shareholder dilution recently and maintains a satisfactory net debt to equity ratio of 20.1%. Despite negative earnings growth (-27.1%) over the past year, earnings are forecast to grow by 35.84% annually moving forward. However, current profit margins (2.2%) have declined compared to last year (3.1%), partly due to a substantial one-off loss of £4M impacting recent financial results up to June 2024.

- Click to explore a detailed breakdown of our findings in Tribal Group's financial health report.

- Gain insights into Tribal Group's future direction by reviewing our growth report.

GSTechnologies (LSE:GST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GSTechnologies Ltd., along with its subsidiaries, offers data infrastructure, storage, and technology services globally and has a market cap of £40.15 million.

Operations: The company generates revenue of $3.53 million from its Information Data Technology and Infrastructure segment.

Market Cap: £40.15M

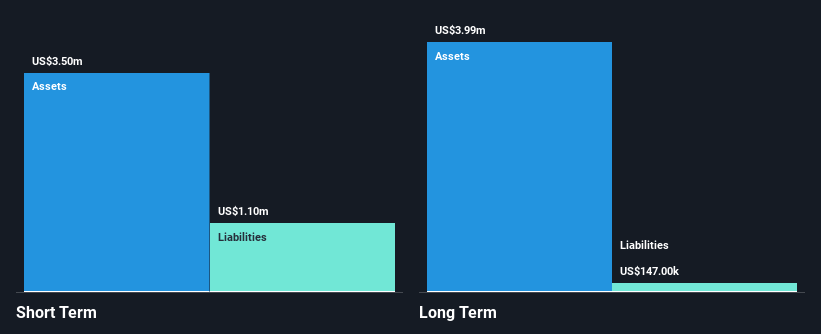

GSTechnologies Ltd., with a market cap of £40.15 million, has been actively raising capital, recently completing equity offerings totaling £2.75 million to support its GS Money strategy and potential acquisitions. Despite generating US$3.53 million in revenue from its Information Data Technology and Infrastructure segment, the company remains unprofitable with increasing losses over the past five years at 15.7% annually. However, GST's financial position is bolstered by more cash than debt and sufficient short-term assets to cover liabilities, although share price volatility has increased recently from 14% to 20%. The management team is experienced with an average tenure of 3.3 years.

- Get an in-depth perspective on GSTechnologies' performance by reading our balance sheet health report here.

- Learn about GSTechnologies' historical performance here.

Key Takeaways

- Dive into all 444 of the UK Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Empire Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EEE

Empire Metals

Engages in the exploration and development of properties in the United Kingdom, Australia, and Austria.

Flawless balance sheet low.

Market Insights

Community Narratives