- United Kingdom

- /

- Media

- /

- LSE:INF

High Growth Tech Stocks In The United Kingdom January 2025

Reviewed by Simply Wall St

As the UK market grapples with the ripple effects of faltering trade data from China, reflected in the recent declines of both the FTSE 100 and FTSE 250 indices, investors are closely monitoring how these global economic challenges impact sectors reliant on international demand. In this environment, identifying high-growth tech stocks that demonstrate resilience through innovative solutions and robust business models becomes crucial for navigating potential market volatility.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| Filtronic | 20.89% | 35.52% | ★★★★★★ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| YouGov | 8.47% | 55.02% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| Cordel Group | 28.67% | 117.46% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

GB Group (AIM:GBG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the UK, US, Australia, and other international markets, with a market capitalization of £842.07 million.

Operations: GB Group plc generates revenue primarily through its Identity, Fraud, and Location segments, with the Identity segment contributing £159.78 million. The company's operations span the UK, US, Australia, and other international markets.

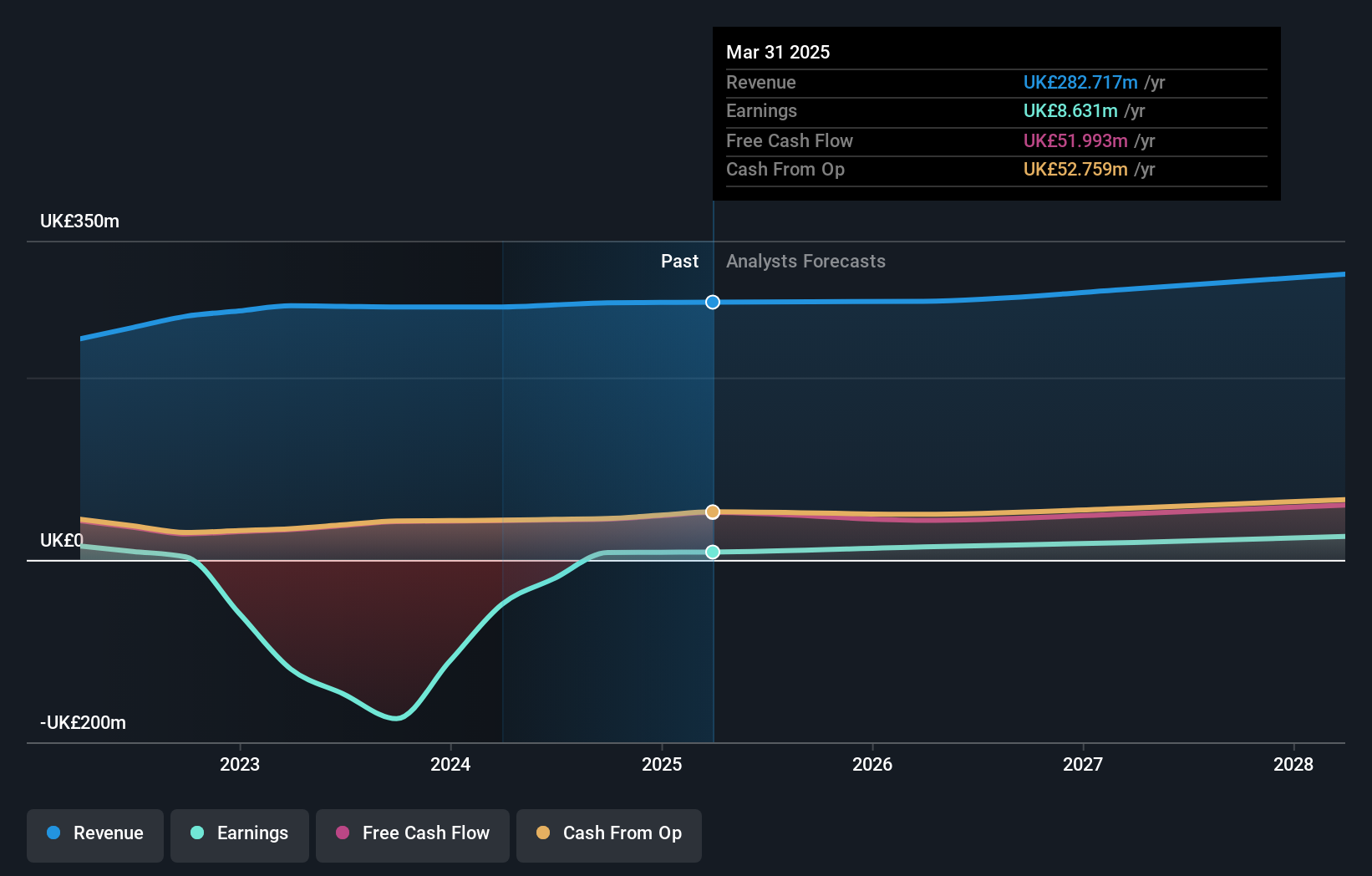

GB Group's recent financial performance marks a significant turnaround, with sales rising to £136.9 million and a shift from a net loss of £55.15 million to a net income of £1.58 million in the latest half-year report. This recovery is underscored by an impressive forecasted annual earnings growth rate of 38.9%, substantially outpacing the UK market average of 14.5%. Despite slower revenue growth at 6.8% annually—below the high-growth threshold but still double the UK market rate—the company benefits from positive free cash flow and high-quality earnings, albeit influenced by a substantial one-off gain of £52.5M last year. GB Group's ability to exceed industry growth rates while transitioning into profitability highlights its potential within the tech sector, even as it faces challenges like a low forecasted return on equity at 3.7% in three years' time.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

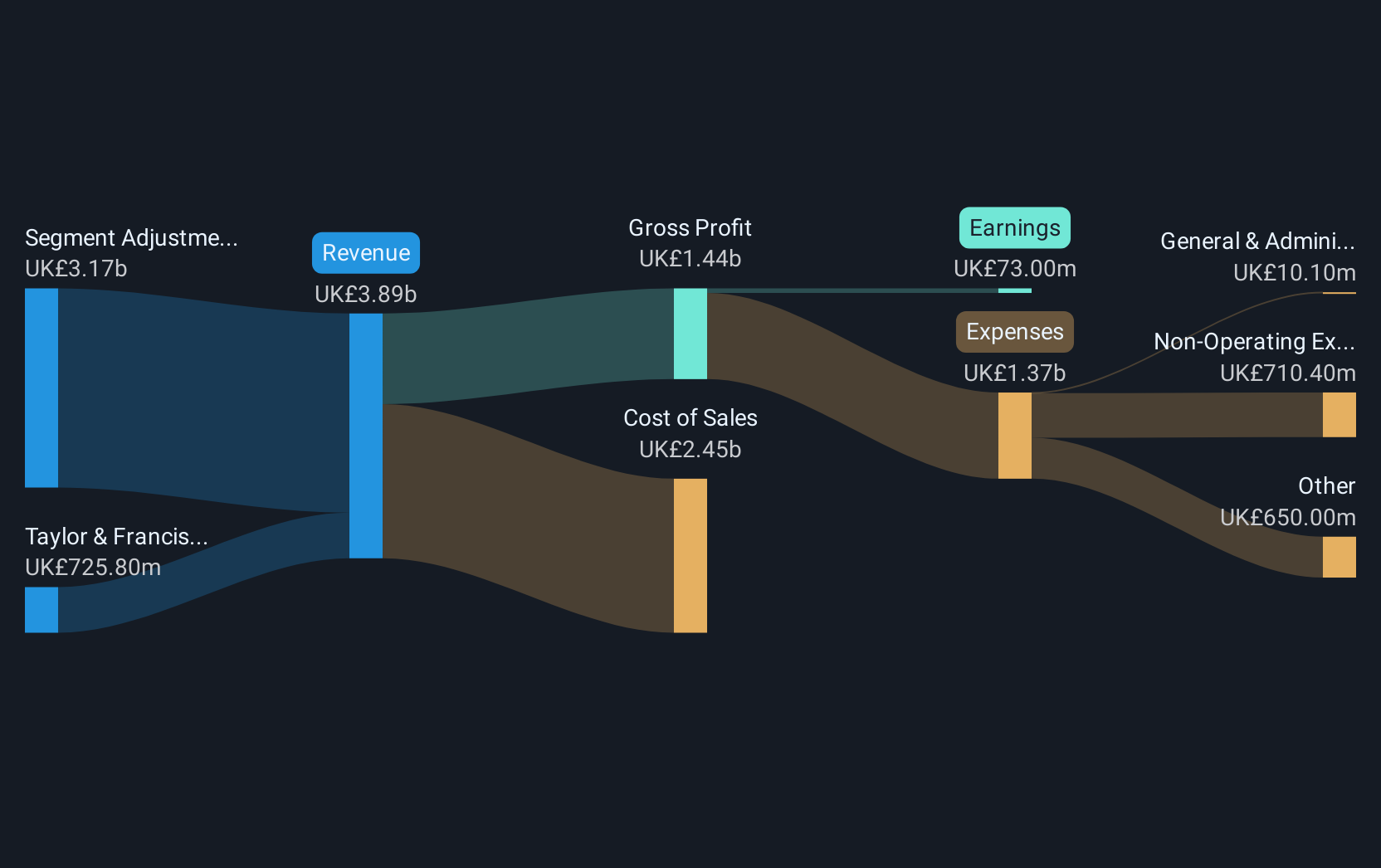

Overview: Informa plc is an international company that specializes in events, digital services, and academic research across various regions including the United Kingdom, Continental Europe, the United States, and China with a market capitalization of approximately £11.02 billion.

Operations: With a diverse portfolio, Informa generates revenue primarily from its segments: Informa Markets (£1.67 billion), Informa Connect (£630.20 million), Taylor & Francis (£636.70 million), and Informa Tech (£426.70 million). The company focuses on delivering events, digital services, and academic research across several key regions globally.

Informa's strategic positioning in the tech conference sector, as evidenced by its recent high-profile events like Tissue World Istanbul and RiskMinds International, underscores its role in shaping industry dialogues and trends. Despite a challenging past marked by a significant one-off loss of £213.5 million, Informa is on a recovery path with expected revenue growth at 9.2% annually, outpacing the UK market average of 3.5%. Moreover, its earnings are projected to surge by 21.9% annually over the next three years, significantly higher than the broader market's 14.5%, highlighting resilience and potential for robust financial health amidst evolving market dynamics.

- Delve into the full analysis health report here for a deeper understanding of Informa.

Understand Informa's track record by examining our Past report.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oxford Biomedica plc is a contract development and manufacturing organization specializing in delivering therapies to patients globally, with a market capitalization of £439.65 million.

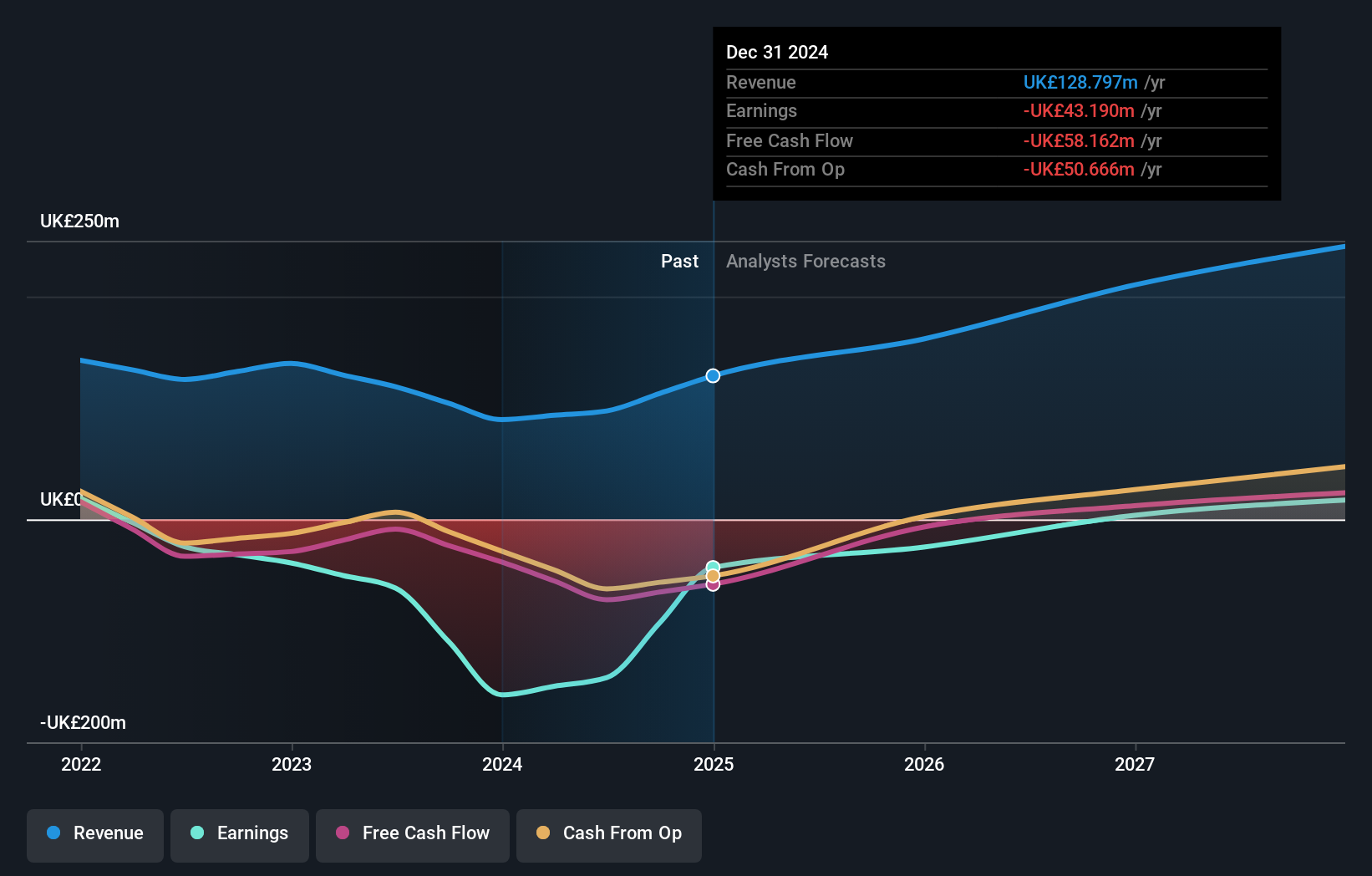

Operations: The company generates revenue primarily from its Platform segment, amounting to £97.24 million. The focus is on contract development and manufacturing services for therapeutic delivery worldwide.

Oxford Biomedica's recent strategic moves, including the appointment of Colin Bond as Non-Executive Director, underscore its commitment to strengthening governance amidst expansion in the biotech sector. With a projected annual revenue growth of 21.2% and earnings anticipated to surge by 92.5%, OXB is poised for significant financial improvement, outpacing the UK market average significantly. These developments, coupled with high-profile conference presentations, position Oxford Biomedica favorably within the rapidly evolving biopharmaceutical landscape as it transitions towards profitability over the next three years.

- Click to explore a detailed breakdown of our findings in Oxford Biomedica's health report.

Gain insights into Oxford Biomedica's past trends and performance with our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 46 UK High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:INF

Informa

Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives