- United Kingdom

- /

- Oil and Gas

- /

- LSE:CAD

Here's Why We Think Cadogan Energy Solutions (LON:CAD) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Cadogan Energy Solutions (LON:CAD), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Cadogan Energy Solutions

Cadogan Energy Solutions' Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Cadogan Energy Solutions' EPS went from US$0.000053 to US$0.0068 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

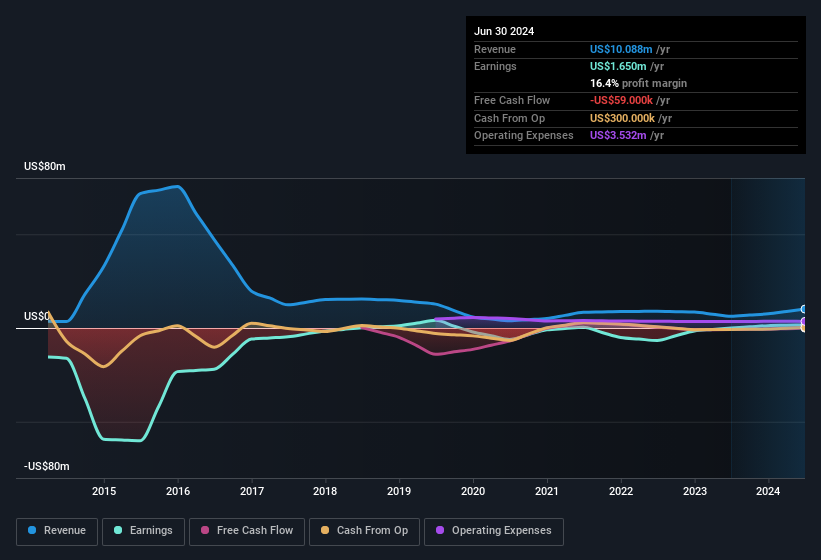

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Cadogan Energy Solutions shareholders is that EBIT margins have grown from -22% to 4.0% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Cadogan Energy Solutions is no giant, with a market capitalisation of UK£11m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Cadogan Energy Solutions Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that Cadogan Energy Solutions insiders spent a staggering US$736k on acquiring shares in just one year, without single share being sold in the meantime. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was Interim Chairman of the Board Michel Francois Meeus who made the biggest single purchase, worth UK£622k, paying UK£0.05 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Cadogan Energy Solutions will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 51%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Of course, Cadogan Energy Solutions is a very small company, with a market cap of only UK£11m. That means insiders only have US$5.7m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add Cadogan Energy Solutions To Your Watchlist?

Cadogan Energy Solutions' earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Cadogan Energy Solutions belongs near the top of your watchlist. It is worth noting though that we have found 3 warning signs for Cadogan Energy Solutions (1 is potentially serious!) that you need to take into consideration.

The good news is that Cadogan Energy Solutions is not the only stock with insider buying. Here's a list of small cap, undervalued companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CAD

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives