Catalysts

- Mounjaro/Zepbound: Lilly’s tirzepatide franchise is the engine of growth. Mounjaro (for type 2 diabetes) and Zepbound (obesity) each grew rapidly in 2024. Analysts project Mounjaro sales of $18.4 B in 2025 and $22.8B in 2026, and Zepbound jumping from $4.9B (2024) to $12.5 B in 2025 (and $18.1B in 2026). In other words, Lilly’s tirzepatide sales are expected to surpass Novo’s by 2026.

- Growing protectionism: The USA market is getting more protective so market is shifting towards drug makers based in the USA such as Lilly rather than from companies based overseas

- Patents & Exclusivity: The main growth driver, tirzepatide, is well protected for years to come. According to drug-patent data, the earliest generic entry for Mounjaro is estimated ~2036, giving Lilly long exclusivity on tirzepatide.

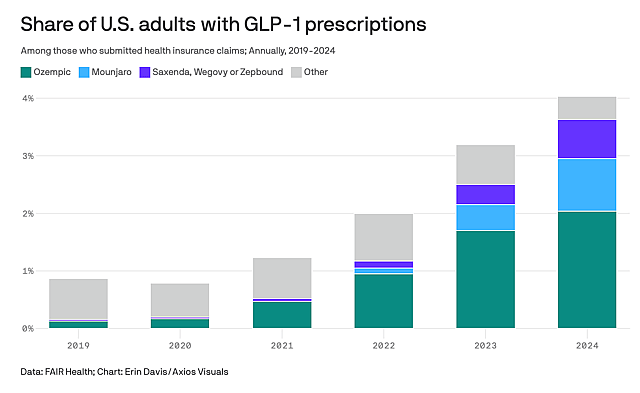

- Market penetration for all GLP-1 drugs is only at 4% of target audience of 100 - 120 Million people in the USA alone. Still has a lot of room to penetrate for more than 1 GLP-1 drug.

- Insurance coverage: In the U.S., insurers are increasingly covering GLP-1s for diabetes. Coverage for obesity drugs is more patchy but improving: some large employers and Medicare Advantage plans now reimburse Zepbound/Wegovy. Wider coverage = stronger pricing leverage.

Assumptions

- Current production capacity is the main limiting factor, not patient willingness. Both Lilly and Novo are investing billions in new plants (e.g., Lilly in Indiana, Ireland, Germany). Analysts expect supply bottlenecks to persist through 2025, but gradually ease by 2026. This will help drive units shipped.

Risks

- GLP-1 drugs are priced at $900-110 per month in the USA. This might be too much for most of the target market in the USA and overseas. However, at time of writing, demand has still outstripped supply.

- New and off market brands entering the market. Competitors (Amgen, Pfizer, AstraZeneca) are still in trials. Until at least 2027–28, Lilly and Novo likely keep premium pricing.

- Facilities are not built in time / delayed.

- Side effects of these drugs may cause panic amongst customers / lawsuits

- P/E ratio is currently quite high at the moment but is reflected based on projected growth

Valuation

- Revenue growth of 20% - 25% p.a for the next 3 - 5 years due to lack of competition in the market place. Expecting production capacity to be sorted in the next few years which will increase units shipped, and lower operating costs as time goes on. The 10+ years time frame is still unknown due new entrants. Confidence in time time frame is low. Based on this forecast and a discount of 9%, using the valuator tool puts the share price at around $1200 USD.

How well do narratives help inform your perspective?

Disclaimer

eat_dis_watermelon is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. eat_dis_watermelon holds no position in NYSE:LLY. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.