- United Kingdom

- /

- Media

- /

- AIM:EYE

UK Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines following weak trade data from China, which highlighted ongoing struggles in global economic recovery. Despite these broader market pressures, investors often look to penny stocks for potential opportunities. Although the term "penny stock" may seem outdated, these investments can still offer growth prospects by focusing on smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £511.64M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.88 | £232.67M | ✅ 5 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.405 | £43.82M | ✅ 4 ⚠️ 3 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.43 | £427.07M | ✅ 4 ⚠️ 1 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.914 | £337.98M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.66 | £273.37M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.225 | £115.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.18 | £187.83M | ✅ 4 ⚠️ 3 View Analysis > |

| Next 15 Group (AIM:NFG) | £2.685 | £270.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.34 | £71.91M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Eagle Eye Solutions Group (AIM:EYE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eagle Eye Solutions Group PLC offers marketing technology software as a service across various regions including the United Kingdom, France, the United States, and others, with a market cap of £66.68 million.

Operations: Eagle Eye Solutions Group PLC has not reported specific revenue segments.

Market Cap: £66.68M

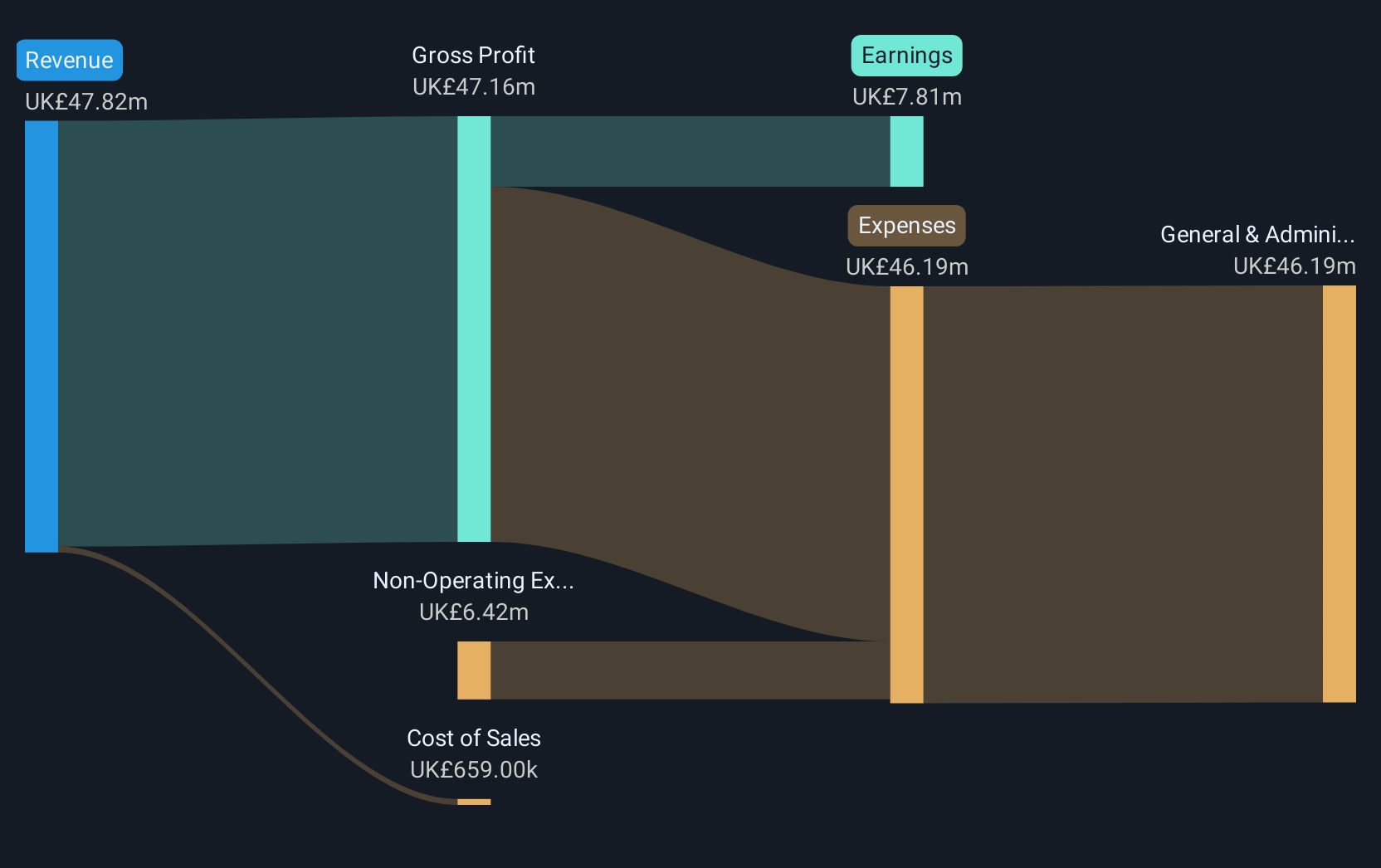

Eagle Eye Solutions Group PLC, with a market cap of £66.68 million, has shown significant financial improvement by becoming profitable and growing earnings at a very large rate over the past five years. Its price-to-earnings ratio of 8.5x suggests it may be undervalued compared to the broader UK market. The company's debt is well covered by operating cash flow, and its short-term assets exceed both short-term and long-term liabilities, indicating strong liquidity. A recent £1 million share buyback program aims to enhance shareholder value while maintaining financial flexibility for growth despite forecasts of declining earnings in the coming years.

- Click here to discover the nuances of Eagle Eye Solutions Group with our detailed analytical financial health report.

- Learn about Eagle Eye Solutions Group's future growth trajectory here.

Landore Resources (AIM:LND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Landore Resources Limited, operating through its subsidiary Landore Resources Canada Inc., focuses on acquiring, exploring, and developing precious, base, and battery metals projects in eastern Canada with a market cap of £13.07 million.

Operations: Landore Resources Limited does not report any revenue segments.

Market Cap: £13.07M

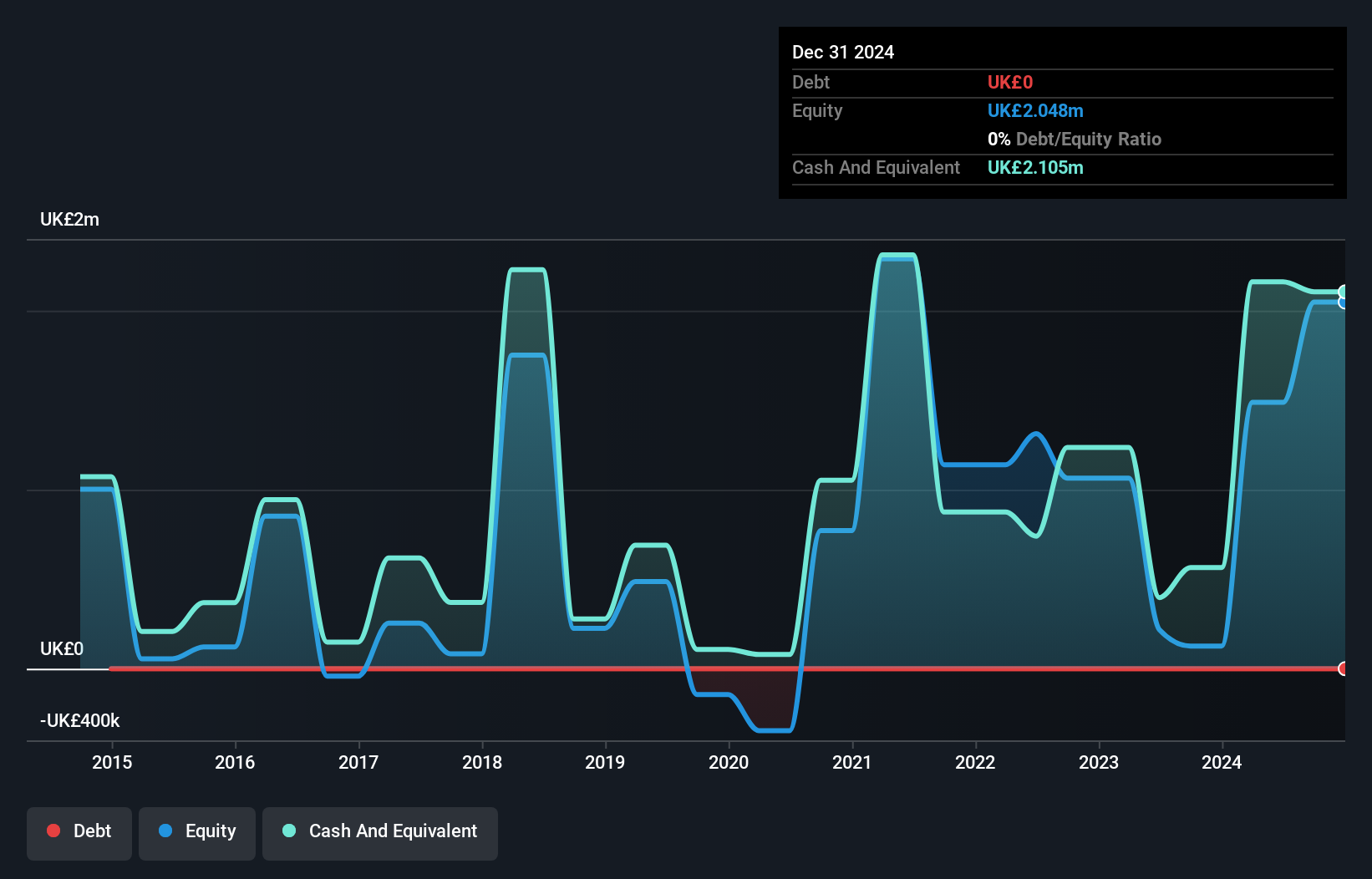

Landore Resources Limited, with a market cap of £13.07 million, remains pre-revenue and unprofitable, though it has reduced losses over the past five years. The company is debt-free and its short-term assets of £2.2 million exceed short-term liabilities of £303.7k, providing some financial stability despite having less than a year of cash runway. Recent drilling results at the BAM Gold Project in Ontario have confirmed additional mineralization potential, which could enhance future resource estimates expected in Q3 2025. However, the stock's high volatility and negative return on equity highlight ongoing risks for investors interested in penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Landore Resources.

- Assess Landore Resources' previous results with our detailed historical performance reports.

EJF Investments (LSE:EJFI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EJF Investments Limited is a principal investment firm with a market cap of £76.43 million.

Operations: The firm generates revenue primarily through its investment in EJFIH, which amounts to £13.40 million.

Market Cap: £76.43M

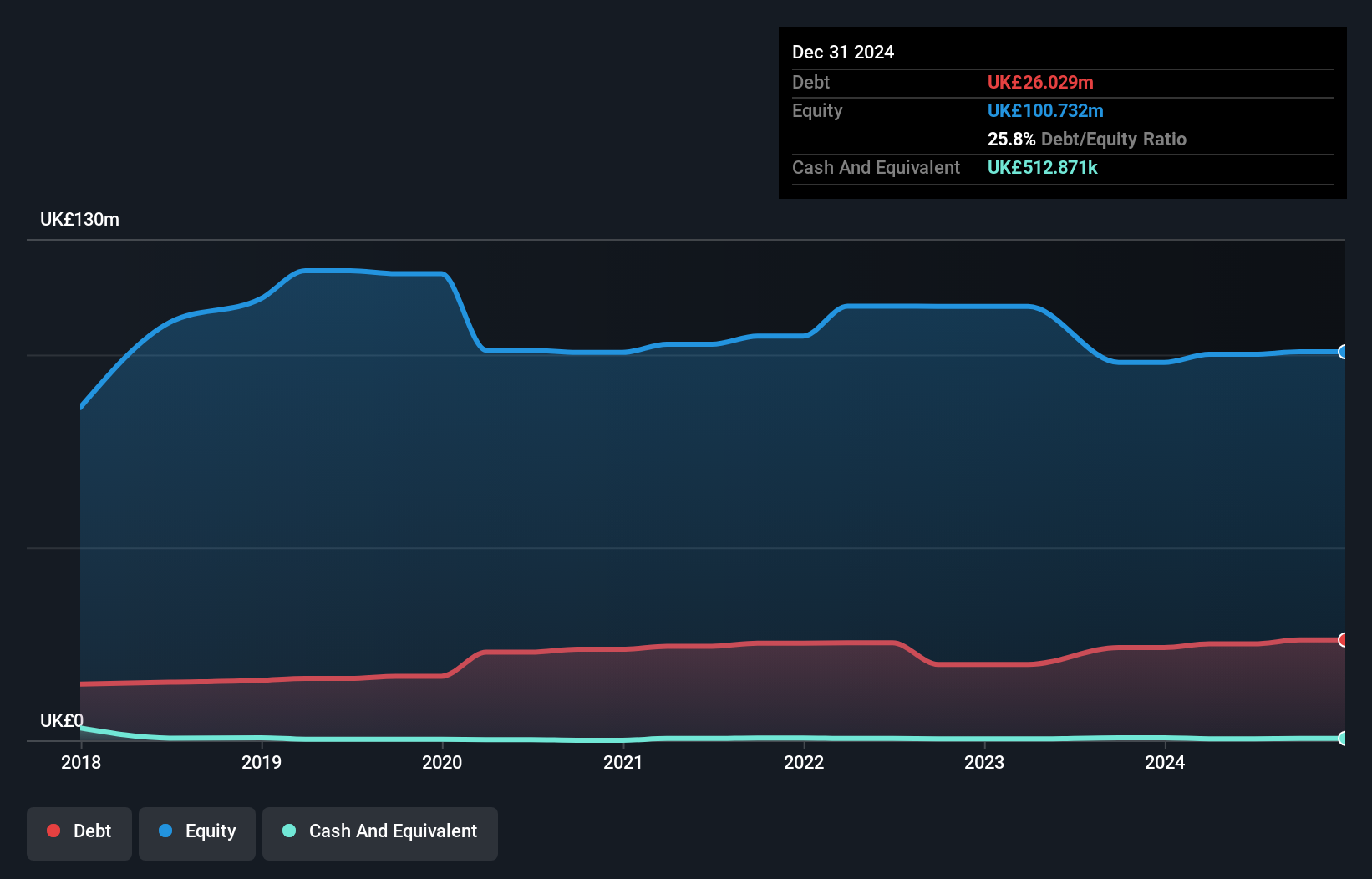

EJF Investments Limited, with a market cap of £76.43 million, has transitioned to profitability this year. The company's earnings have grown annually by 6.5% over five years, although its Return on Equity remains low at 9.2%. Its debt is well covered by operating cash flow (24.6%), yet short-term assets (£990.8K) fall short of covering liabilities (£26.6M). Recent announcements include a potential share repurchase program and affirmed quarterly dividends targeting an annual yield of approximately 6.48%. Despite stable weekly volatility, the company's dividend coverage by free cash flows is not robust, posing risks for investors in penny stocks.

- Take a closer look at EJF Investments' potential here in our financial health report.

- Gain insights into EJF Investments' historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Discover the full array of 299 UK Penny Stocks right here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Eye Solutions Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EYE

Eagle Eye Solutions Group

Provides marketing technology software as a service solution in the United Kingdom, France, the United States, Canada, Australia, rest of Europe, and the Asia Pacific.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives