- United Kingdom

- /

- Capital Markets

- /

- LSE:ASHM

3 UK Penny Stocks With Market Caps Over £60M

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies closely tied to its economy. In light of these broader market conditions, investors might consider exploring penny stocks—often smaller or newer companies—that can offer unique opportunities for growth and value. Despite being a somewhat outdated term, penny stocks remain relevant for those seeking potential upside with strong financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.645 | £520.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.17 | £175.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.78 | £11.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.095 | £15.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.54 | $313.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.47 | £71M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.31M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.882 | £710.88M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 290 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Gear4music (Holdings) (AIM:G4M)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gear4music (Holdings) plc is a retailer of musical instruments, musician equipment, and audio-visual equipment operating in the United Kingdom, Europe, and internationally with a market cap of £64.19 million.

Operations: The company generates £146.72 million in revenue from selling musical instruments and equipment.

Market Cap: £64.19M

Gear4music (Holdings) plc, with a market cap of £64.19 million, reported significant revenue growth for the six months ending September 2025 at £80.7 million compared to £61.7 million a year earlier. Despite this, the company's Return on Equity remains low at 2.1%, and its interest coverage is not well covered by EBIT at 2.2x, raising concerns about financial stability in light of recent auditor doubts regarding its ability to continue as a going concern. However, Gear4music has improved its debt position with a net debt to equity ratio of 16.3% and strong operating cash flow coverage of debt at 68.8%.

- Unlock comprehensive insights into our analysis of Gear4music (Holdings) stock in this financial health report.

- Understand Gear4music (Holdings)'s earnings outlook by examining our growth report.

Ashmore Group (LSE:ASHM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ashmore Group plc is a publicly owned investment manager with a market cap of approximately £1.22 billion.

Operations: The company generates its revenue primarily from the provision of investment management services, amounting to £142.4 million.

Market Cap: £1.22B

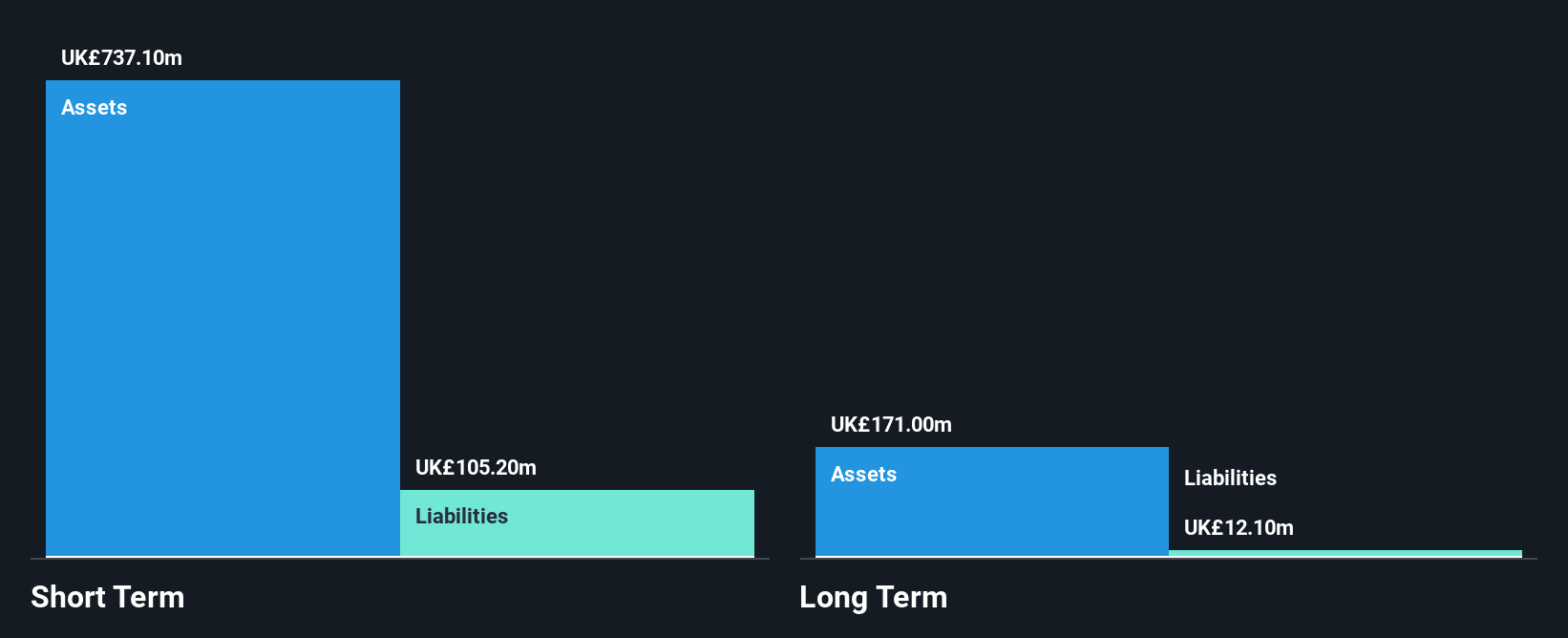

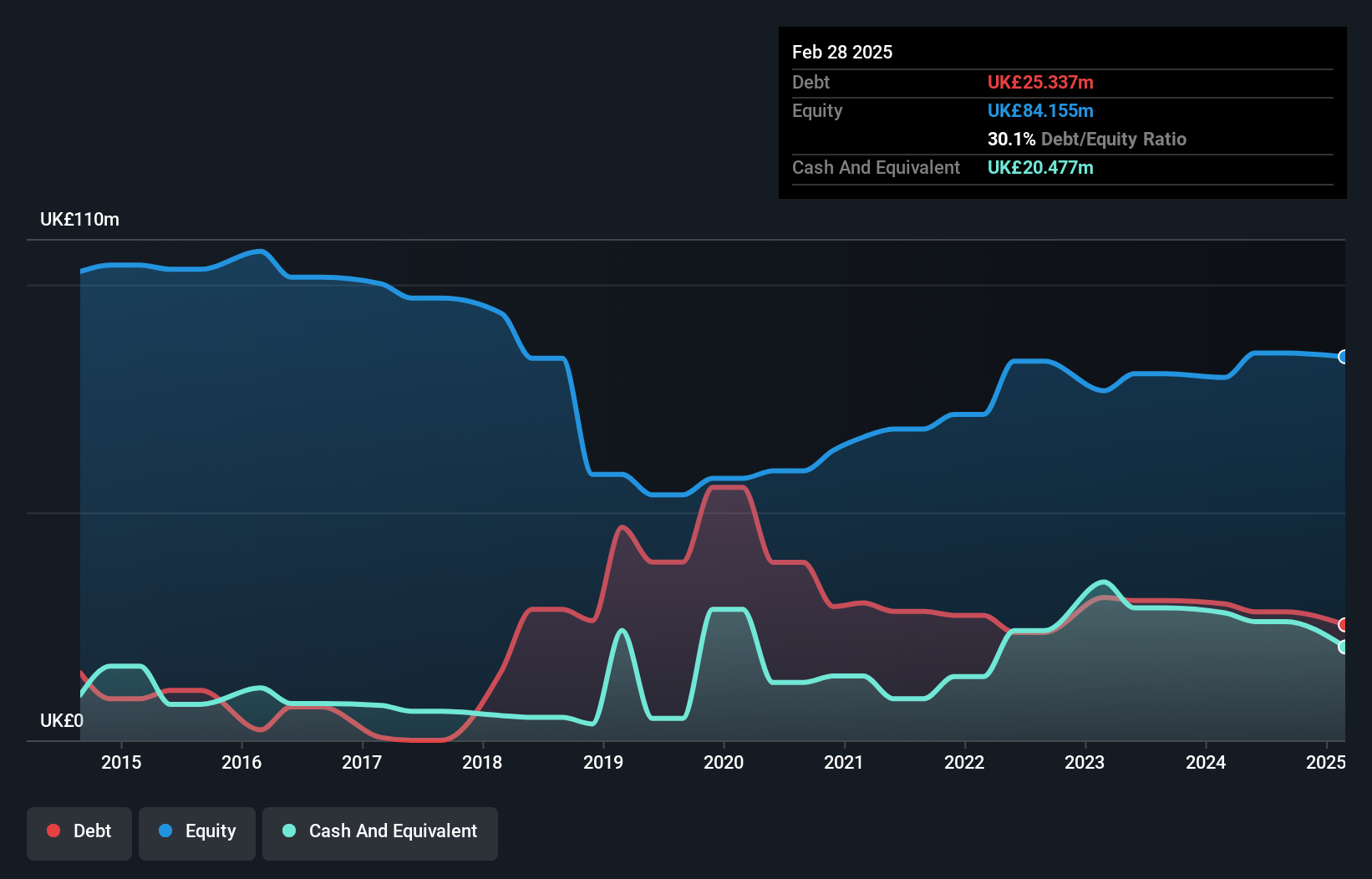

Ashmore Group plc, with a market cap of £1.22 billion, faces challenges as its revenue declined to £144.1 million from £189.3 million year-on-year, and earnings growth was negative at -13.3%. Despite no debt and high net profit margins improving to 57%, the company's Return on Equity is low at 10.8%, indicating potential inefficiencies in generating returns on investments. The seasoned management team has not diluted shareholders recently, but future earnings are forecasted to decline by an average of 8.5% annually over the next three years, raising concerns about long-term profitability sustainability amidst dividend coverage issues.

- Click here and access our complete financial health analysis report to understand the dynamics of Ashmore Group.

- Evaluate Ashmore Group's prospects by accessing our earnings growth report.

Braemar (LSE:BMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Braemar Plc offers shipbroking services across various countries including the United Kingdom, Singapore, Australia, Switzerland, the United States, and Germany with a market cap of £75.87 million.

Operations: Braemar's revenue is primarily derived from its Chartering segment at £89.35 million, followed by Investment Advisory at £30.17 million and Risk Advisory at £22.34 million.

Market Cap: £75.87M

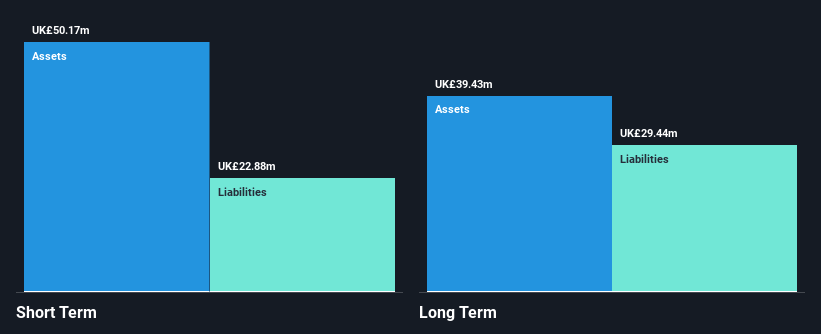

Braemar Plc, with a market cap of £75.87 million, has demonstrated strong earnings growth of 33.1% over the past year, outpacing the infrastructure industry average. However, its Return on Equity remains low at 7.3%, suggesting potential inefficiencies in generating returns for investors. The company benefits from experienced board members and stable weekly volatility at 5%. While Braemar's debt is well covered by operating cash flow and interest payments are adequately managed with EBIT coverage of 7.3x, its dividend track record remains unstable due to large one-off items affecting financial results over the last year.

- Get an in-depth perspective on Braemar's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Braemar's future.

Next Steps

- Reveal the 290 hidden gems among our UK Penny Stocks screener with a single click here.

- Contemplating Other Strategies? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ASHM

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)