- United Kingdom

- /

- Packaging

- /

- AIM:RBN

October 2025's Top UK Penny Stocks Revealed

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting ongoing global economic uncertainties. In such conditions, investors often look beyond blue-chip stocks to explore opportunities in smaller or newer companies that might offer growth potential at lower price points. Penny stocks, despite being an older term, remain relevant as they represent these underappreciated opportunities; when backed by strong fundamentals and sound balance sheets, they can provide intriguing prospects for those willing to explore this segment of the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.595 | £514.44M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.12 | £171.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.775 | £11.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.535 | $311.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.485 | £71.73M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £1.898 | £716.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 292 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Manolete Partners (AIM:MANO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Manolete Partners Plc is a UK-based company specializing in insolvency litigation financing, with a market cap of £39.43 million.

Operations: The company generates revenue from unclassified services totaling £30.48 million.

Market Cap: £39.43M

Manolete Partners, with a market cap of £39.43 million and revenue of £30.48 million, is navigating challenges typical for penny stocks such as volatile share prices and low return on equity (2.2%). Despite declining earnings over the past five years, its interest payments are well covered by EBIT (21.8x), and it maintains more cash than total debt. Recent executive changes include Mena Halton stepping up as CEO and Will Sawyer joining as CFO, indicating a strategic leadership shift amidst ongoing business stabilization post-COVID disruptions. The company forecasts earnings growth of 29.51% annually despite current negative growth trends.

- Click here to discover the nuances of Manolete Partners with our detailed analytical financial health report.

- Examine Manolete Partners' earnings growth report to understand how analysts expect it to perform.

Robinson (AIM:RBN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Robinson plc manufactures and sells plastic and paperboard packaging products across the United Kingdom, Poland, Denmark, Germany, Hungary, Belgium, and internationally with a market cap of £23.54 million.

Operations: The company's revenue of £56.87 million is generated from its plastic and paperboard packaging segment.

Market Cap: £23.54M

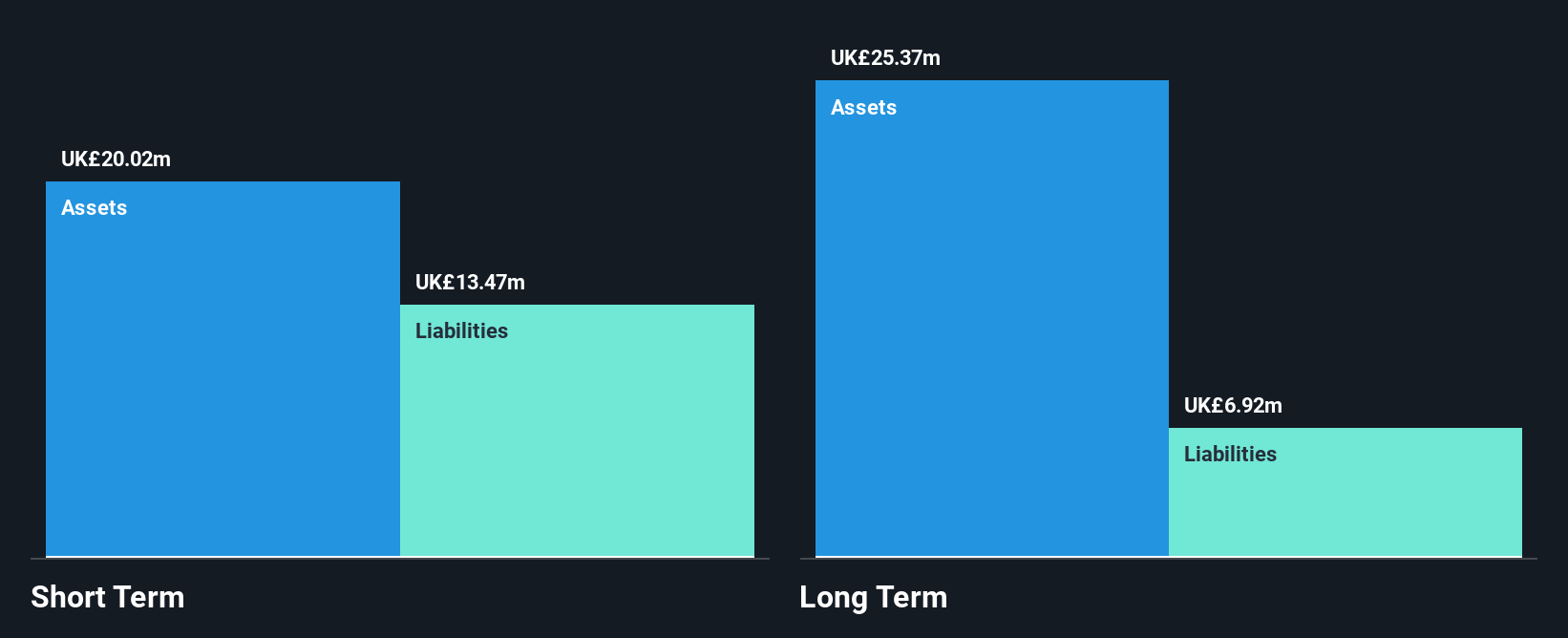

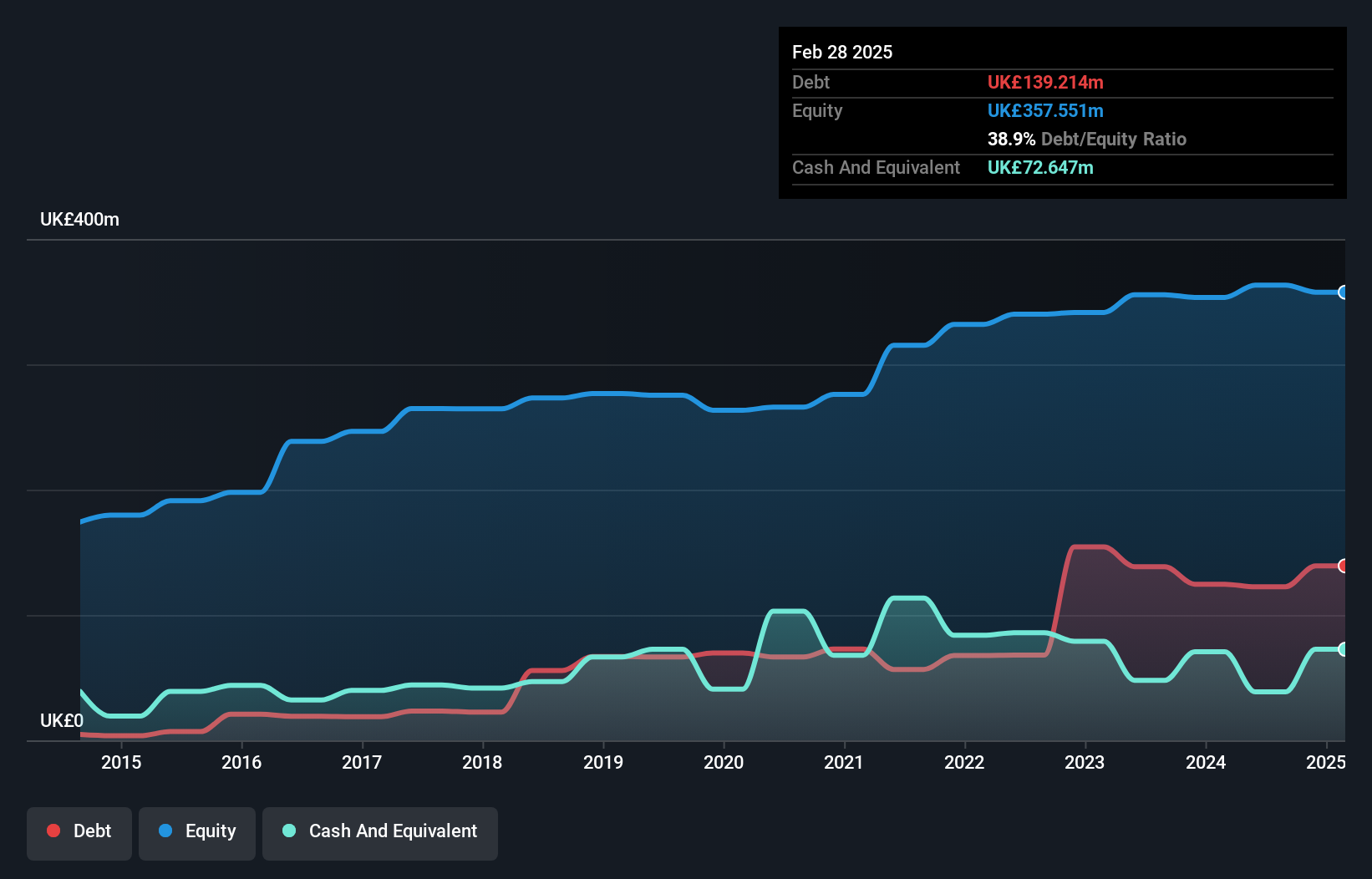

Robinson plc, with a market cap of £23.54 million and revenue of £56.87 million, faces typical penny stock challenges such as profitability issues despite reporting improved earnings for the first half of 2025. The company's net income rose to £1.31 million from £0.454 million a year ago, yet it remains unprofitable overall with negative return on equity (-9.86%). Debt management appears satisfactory, as short-term assets (£20M) cover both short-term (£13.5M) and long-term liabilities (£6.9M), while operating cash flow adequately covers debt obligations (54.7%). The board's experience supports strategic decisions like maintaining a stable dividend policy amidst financial volatility.

- Unlock comprehensive insights into our analysis of Robinson stock in this financial health report.

- Gain insights into Robinson's future direction by reviewing our growth report.

Vertu Motors (AIM:VTU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vertu Motors plc is an automotive retailer in the United Kingdom with a market cap of £183.25 million.

Operations: The company's revenue is primarily derived from its retail segment focused on gasoline and auto dealerships, generating £4.80 billion.

Market Cap: £183.25M

Vertu Motors, with a market cap of £183.25 million and revenue of £4.80 billion, presents both opportunities and challenges typical for penny stocks. Recent buybacks totaling 3.35% of shares indicate shareholder value focus, while an interim dividend reflects a commitment to returns despite an unstable dividend history. The company's debt is well-covered by operating cash flow (60.1%), though the debt-to-equity ratio has increased over five years to 37.6%. Earnings growth forecasts are strong at 65.63% annually; however, recent negative earnings growth (-14.7%) and low return on equity (4.5%) highlight profitability concerns amidst stable management tenure and board experience.

- Dive into the specifics of Vertu Motors here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Vertu Motors' future.

Next Steps

- Get an in-depth perspective on all 292 UK Penny Stocks by using our screener here.

- Ready For A Different Approach? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RBN

Robinson

Manufactures and sells plastic and paperboard packaging products in the United Kingdom, Poland, Denmark, Germany, Hungary, Belgium, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives