- United Kingdom

- /

- Media

- /

- LSE:SFOR

Science Group And 2 Other UK Penny Stocks With Promising Prospects

Reviewed by Simply Wall St

The UK stock market has faced challenges recently, with the FTSE 100 index experiencing declines amid weak trade data from China, highlighting broader global economic concerns. In such a fluctuating market landscape, identifying stocks with solid fundamentals becomes crucial. Penny stocks, often smaller or newer companies, may offer unique growth opportunities when backed by strong financials and balance sheet resilience.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Ultimate Products (LSE:ULTP) | £0.714 | £60.53M | ✅ 4 ⚠️ 3 View Analysis > |

| Next 15 Group (AIM:NFG) | £3.005 | £298.87M | ✅ 4 ⚠️ 5 View Analysis > |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.20 | £339.31M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.63 | £412.89M | ✅ 4 ⚠️ 1 View Analysis > |

| City of London Investment Group (LSE:CLIG) | £3.30 | £162.63M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.43 | £427.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.015 | £161.76M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.784 | £2.1B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.32 | £34.62M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 448 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Science Group (AIM:SAG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Science Group plc is a science, engineering, and technology company offering consultancy services and systems businesses across the UK, Europe, North America, Asia, and internationally with a market cap of £189.79 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: £189.79M

Science Group plc, with a market cap of £189.79 million, has demonstrated robust financial health and growth potential. The company reported a net income increase to £12.02 million for 2024, up from £5.52 million the previous year, while maintaining stable weekly volatility at 2%. Its interest payments are well-covered by EBIT at 15.3 times coverage and its debt is fully covered by operating cash flow (156.9%). With short-term assets exceeding liabilities and no significant shareholder dilution recently, Science Group remains financially sound despite earnings forecasted to decline slightly over the next three years by an average of 1.6% annually.

- Click to explore a detailed breakdown of our findings in Science Group's financial health report.

- Examine Science Group's earnings growth report to understand how analysts expect it to perform.

Virgin Wines UK (AIM:VINO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Virgin Wines UK PLC is a direct-to-consumer online wine retailer in the United Kingdom with a market cap of £27.63 million.

Operations: The company's revenue is primarily derived from the sale of alcohol, amounting to £59.01 million.

Market Cap: £27.63M

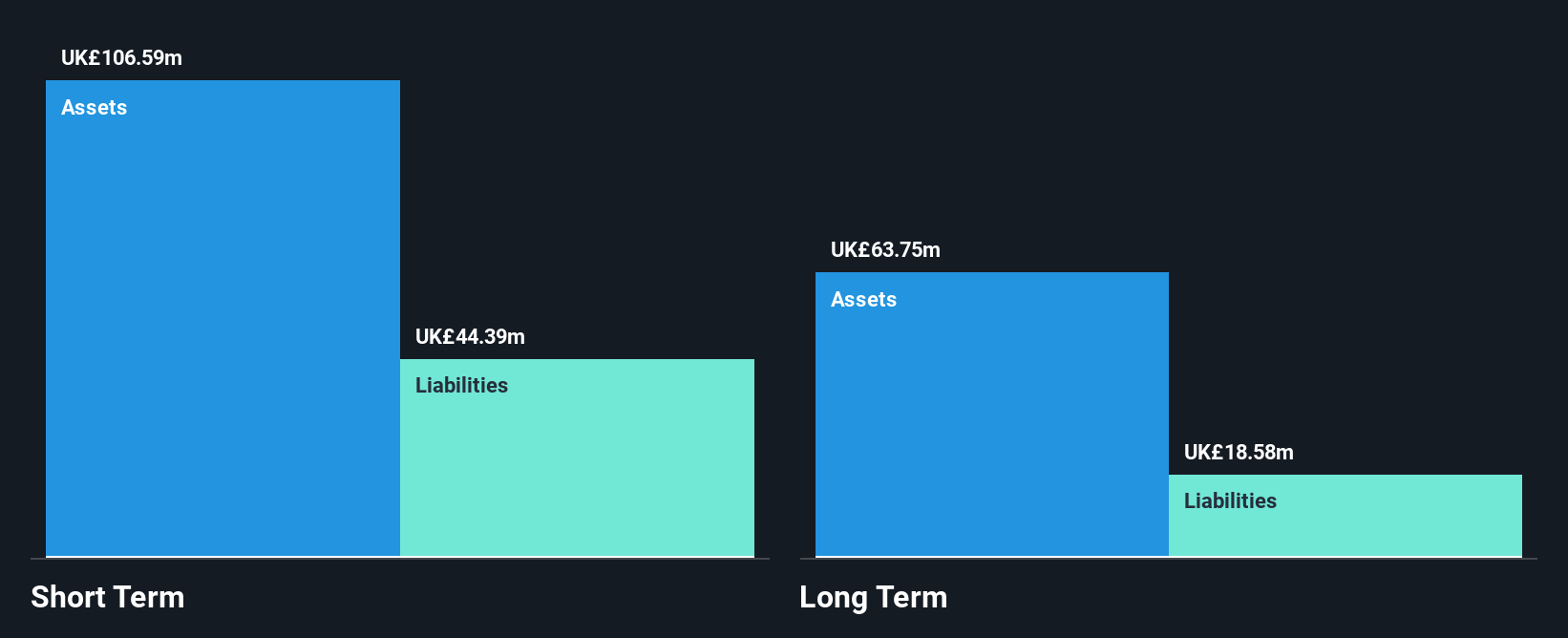

Virgin Wines UK PLC, with a market cap of £27.63 million, has recently become profitable, though its earnings have declined by 23.8% annually over the past five years. The company operates without debt, alleviating concerns about interest payments and cash flow coverage. Short-term assets of £26.9 million comfortably exceed both short-term and long-term liabilities, reflecting financial stability despite low return on equity at 5.9%. Recent management changes include Amanda Cherry succeeding Graeme Weir as CFO in April 2025 after his significant contributions to the company's growth trajectory since its IPO in 2021 and private equity-backed buyout in 2013.

- Jump into the full analysis health report here for a deeper understanding of Virgin Wines UK.

- Explore Virgin Wines UK's analyst forecasts in our growth report.

S4 Capital (LSE:SFOR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: S4 Capital plc, with a market cap of £211.94 million, offers digital advertising and marketing services across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

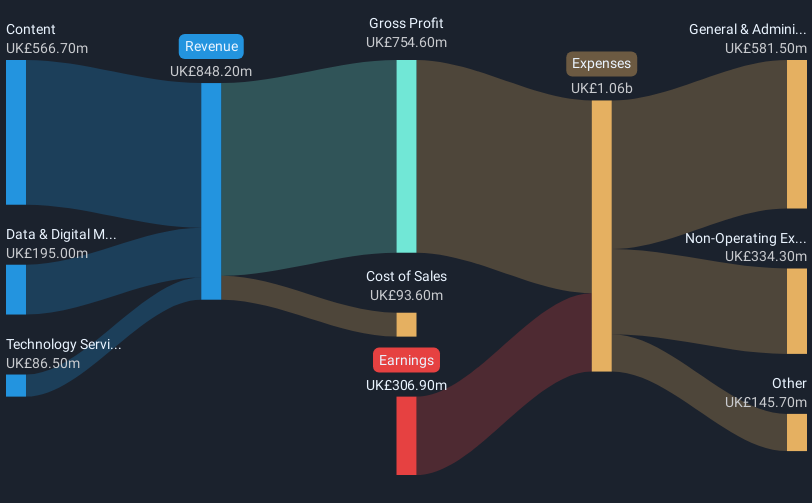

Operations: S4 Capital does not report specific revenue segments.

Market Cap: £211.94M

S4 Capital plc, with a market cap of £211.94 million, is currently unprofitable but maintains a positive cash flow and sufficient cash runway for over three years. Despite trading at 60.8% below its estimated fair value, the company faces challenges with increased net loss to £306.9 million in 2024 from £14.3 million the previous year. However, it benefits from strong asset coverage over liabilities and a satisfactory net debt to equity ratio of 24.1%. Recent leadership appointments aim to leverage AI-powered services for growth amid industry shifts toward digital transformation and marketing integration strategies.

- Click here and access our complete financial health analysis report to understand the dynamics of S4 Capital.

- Review our growth performance report to gain insights into S4 Capital's future.

Make It Happen

- Unlock more gems! Our UK Penny Stocks screener has unearthed 445 more companies for you to explore.Click here to unveil our expertly curated list of 448 UK Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SFOR

S4 Capital

Provides digital advertising and marketing services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives