- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

UK Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns about global economic recovery. Despite these broader market pressures, investors may find opportunities in smaller or newer companies known as penny stocks. These stocks, often overlooked yet still relevant today, can offer unique value and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Croma Security Solutions Group (AIM:CSSG) | £0.855 | £11.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.638 | £53.87M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.80 | £289.04M | ✅ 5 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £3.75 | £302.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £419.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £3.92 | £377.88M | ✅ 3 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.648 | £1.02B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £0.916 | £146.09M | ✅ 4 ⚠️ 2 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £3.926 | £2.16B | ✅ 5 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.35 | £37.87M | ✅ 5 ⚠️ 2 View Analysis > |

Click here to see the full list of 392 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

Fintel (AIM:FNTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £257.36 million.

Operations: Fintel generates revenue through three main segments: Research & Fintech (£25.4 million), Distribution Channels (£23.8 million), and Intermediary Services (£29.1 million).

Market Cap: £257.36M

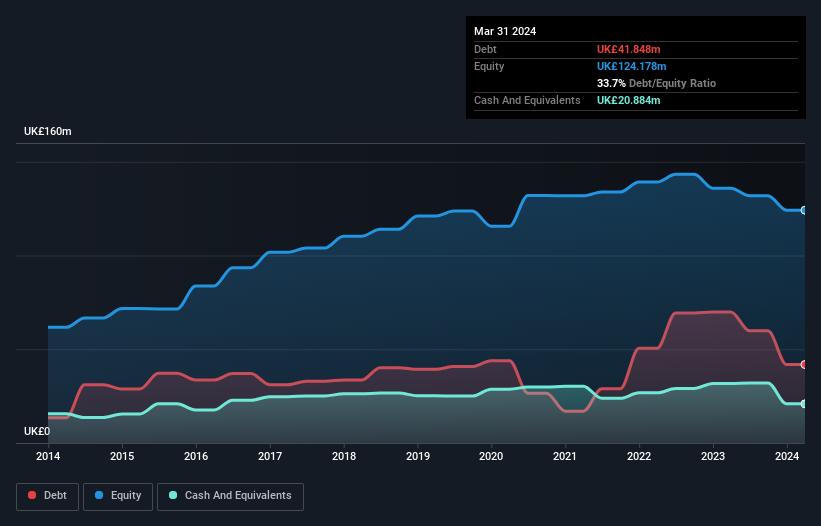

Fintel Plc, with a market cap of £257.36 million, operates across three revenue-generating segments: Research & Fintech (£25.4M), Distribution Channels (£23.8M), and Intermediary Services (£29.1M). Despite a satisfactory net debt to equity ratio of 23.2% and strong interest coverage (7.8x EBIT), Fintel faces challenges such as declining profit margins (7.5% from 10.9%) and negative earnings growth (-16.9%). Recent executive changes include Matt Timmins assuming sole CEO responsibilities after Neil Stevens' departure, while the board undergoes adjustments with Imogen Joss stepping down as Senior Independent Director in May 2025 for personal reasons.

- Click to explore a detailed breakdown of our findings in Fintel's financial health report.

- Evaluate Fintel's prospects by accessing our earnings growth report.

Serica Energy (AIM:SQZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Serica Energy plc is an upstream oil and gas company focused on identifying, acquiring, and exploiting oil and gas reserves in the United Kingdom, with a market cap of £500.72 million.

Operations: The company generates revenue primarily from its oil and gas exploration, development, and production activities, amounting to $727.18 million.

Market Cap: £500.72M

Serica Energy, with a market cap of £500.72 million, faces both opportunities and challenges as it navigates the volatile oil and gas sector. Despite its shares trading significantly below estimated fair value, recent earnings have declined with net income dropping to US$92.43 million from US$127.76 million year-on-year. The company's debt is well covered by operating cash flow (128.5%), yet short-term assets fall short of covering long-term liabilities ($397.7M vs $462M). Recent production disruptions due to Storm Éowyn highlight operational risks, while ongoing merger discussions with Enquest Plc could reshape its future strategic direction if finalized.

- Dive into the specifics of Serica Energy here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Serica Energy's future.

Trifast (LSE:TRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Trifast plc, with a market cap of £90.62 million, manufactures and distributes industrial fasteners and category C components across the United Kingdom, Ireland, Europe, North America, and Asia.

Operations: The company's revenue is primarily generated from its industrial fasteners and category C components segment, amounting to £229.94 million.

Market Cap: £90.62M

Trifast, with a market cap of £90.62 million, presents a mixed picture in the penny stock landscape. The company is currently unprofitable and faces challenges such as its interest payments not being well covered by EBIT (1.9x coverage) and an unsustainable dividend yield of 2.68%. Despite these issues, Trifast's short-term assets (£154.8M) comfortably exceed both its long-term (£59.6M) and short-term liabilities (£47.1M), suggesting solid liquidity management. The debt level is satisfactory with a net debt to equity ratio of 12.6%, while operating cash flow adequately covers the debt at 53.8%.

- Unlock comprehensive insights into our analysis of Trifast stock in this financial health report.

- Explore Trifast's analyst forecasts in our growth report.

Taking Advantage

- Jump into our full catalog of 392 UK Penny Stocks here.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives