- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

Fintel And 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, there are opportunities for investors willing to explore beyond well-known names. Penny stocks, though an older term, remain relevant as they often represent smaller or newer companies that can offer surprising value when built on solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.735 | £530.11M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.755 | £11.4M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.495 | $287.76M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £256.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.425 | £123.16M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £184.68M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.70 | £9.64M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.41 | £73.43M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.836 | £693.5M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 287 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Fintel (AIM:FNTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £249.02 million.

Operations: The company's revenue is derived entirely from its operations in the United Kingdom, amounting to £85 million.

Market Cap: £249.02M

Fintel Plc has shown a modest earnings growth of 5.1% over the past year, surpassing its five-year average decline and the industry’s negative growth rate. The company reported half-year sales of £42.4 million with net income rising to £2.4 million, reflecting stable financial performance despite a significant one-off loss impacting results. Its debt management has improved, reducing the debt-to-equity ratio significantly over five years, while interest payments are well covered by EBIT. However, short-term liabilities exceed assets slightly and net profit margins have declined compared to last year. An interim dividend increase signals confidence in underlying business strength.

- Click here to discover the nuances of Fintel with our detailed analytical financial health report.

- Examine Fintel's earnings growth report to understand how analysts expect it to perform.

Northern Bear (AIM:NTBR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Northern Bear PLC, with a market cap of £15.89 million, offers building and support services to local authorities, housing associations, NHS trusts, universities, construction companies, and national house builders in Northern England and internationally.

Operations: The company generates revenue through its Roofing Activities (£33.81 million), Materials Handling Activities (£3.75 million), and Specialist Building Services Activities (£41.84 million).

Market Cap: £15.89M

Northern Bear PLC, with a market cap of £15.89 million, has demonstrated robust financial performance, reporting £78.11 million in sales for the year ended March 31, 2025, and net income of £2.31 million. The company’s earnings growth of 41.9% outpaced the industry decline and was supported by strong cash flow covering its debt well over five times. Despite an inexperienced board and unstable dividend history, Northern Bear's seasoned management team has ensured no significant shareholder dilution while maintaining a solid balance sheet with more cash than total debt and short-term assets exceeding liabilities comfortably.

- Unlock comprehensive insights into our analysis of Northern Bear stock in this financial health report.

- Examine Northern Bear's past performance report to understand how it has performed in prior years.

Water Intelligence (AIM:WATR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Water Intelligence plc offers leak detection and remediation services for potable and non-potable water across the United States, the United Kingdom, Ireland, Australia, Canada, and other international markets with a market cap of £51.67 million.

Operations: Revenue segments for the company are not reported.

Market Cap: £51.67M

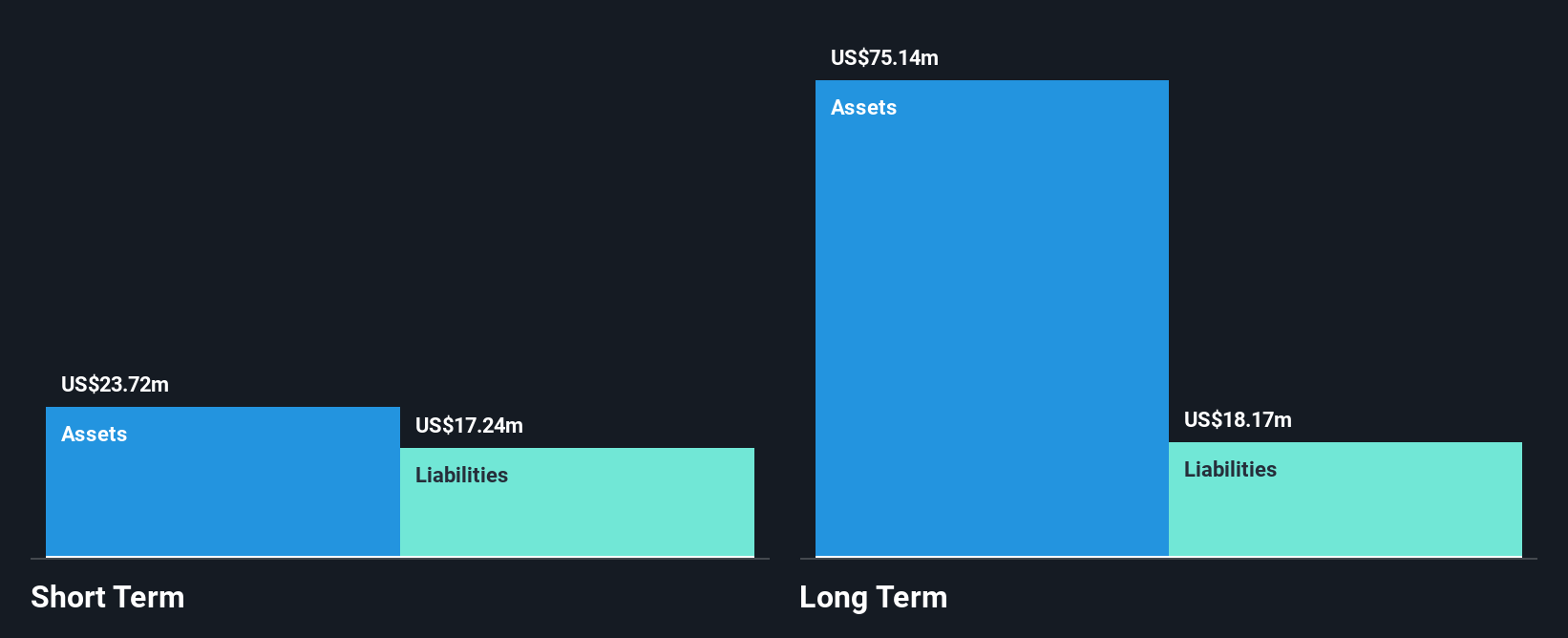

Water Intelligence plc, with a market cap of £51.67 million, has shown stable weekly volatility and solid financial health, evidenced by operating cash flow covering 40.5% of its debt and EBIT covering interest payments four times over. Despite a recent decline in net profit margin from 6.1% to 5.1%, the company reported half-year sales growth to US$45.03 million compared to the previous year’s US$41.53 million, though net income slightly decreased to US$3.04 million from US$3.3 million. The management team is experienced with an average tenure of 6.2 years, supporting strategic stability amidst challenges like increased debt levels and negative earnings growth last year.

- Dive into the specifics of Water Intelligence here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Water Intelligence's future.

Key Takeaways

- Embark on your investment journey to our 287 UK Penny Stocks selection here.

- Ready For A Different Approach? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Good value with reasonable growth potential.

Market Insights

Community Narratives