- United Kingdom

- /

- Diversified Financial

- /

- LSE:OSB

Next 15 Group And 2 More Top UK Dividend Stocks

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faltered, closing lower amid weak trade data from China, which has struggled to recover from the pandemic. In such uncertain market conditions, dividend stocks can offer a reliable income stream and potential stability. Here we explore Next 15 Group and two other top UK dividend stocks that stand out in this environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.79% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.23% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.35% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.30% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.81% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.73% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.56% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.80% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.86% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.51% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Next 15 Group (AIM:NFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Next 15 Group plc, with a market cap of £451.53 million, provides communications services across the United Kingdom, Europe, Africa, the United States, and the Asia Pacific through its subsidiaries.

Operations: Next 15 Group plc generates revenue from providing communications services across various regions, including the United Kingdom, Europe, Africa, the United States, and the Asia Pacific.

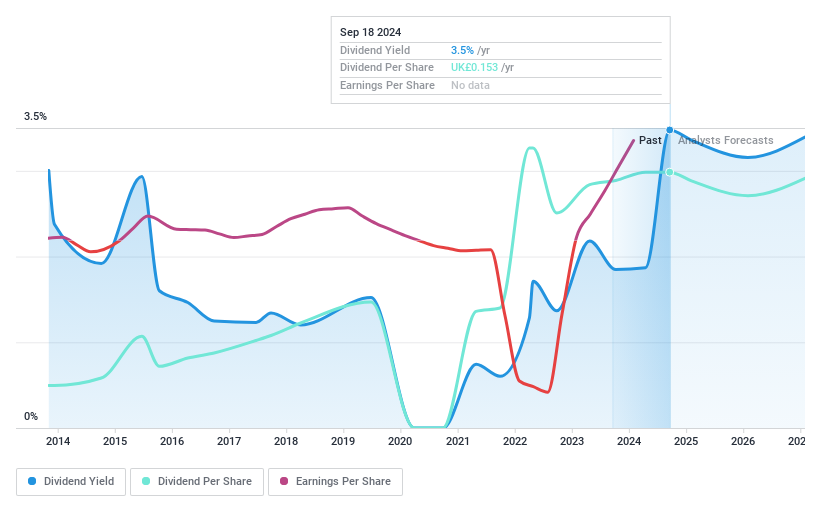

Dividend Yield: 3.4%

Next 15 Group's dividend yield of 3.38% is lower than the top 25% of UK dividend payers. Despite a high debt level and volatile share price, its dividends are well-covered by earnings (payout ratio: 25.2%) and cash flows (cash payout ratio: 23.3%). However, the company's dividend history has been unstable over the past decade. Recent earnings show net income increased to £22.14 million for H1 2025 from £14.26 million a year ago, with EPS rising accordingly.

- Click here to discover the nuances of Next 15 Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Next 15 Group is trading behind its estimated value.

Morgan Advanced Materials (LSE:MGAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Advanced Materials plc operates as a materials science and application engineering company primarily in the United Kingdom, with a market cap of £786.81 million.

Operations: Morgan Advanced Materials plc generates revenue from its Carbon & Technical Ceramics Division, with the Technical Ceramics segment contributing £320.90 million.

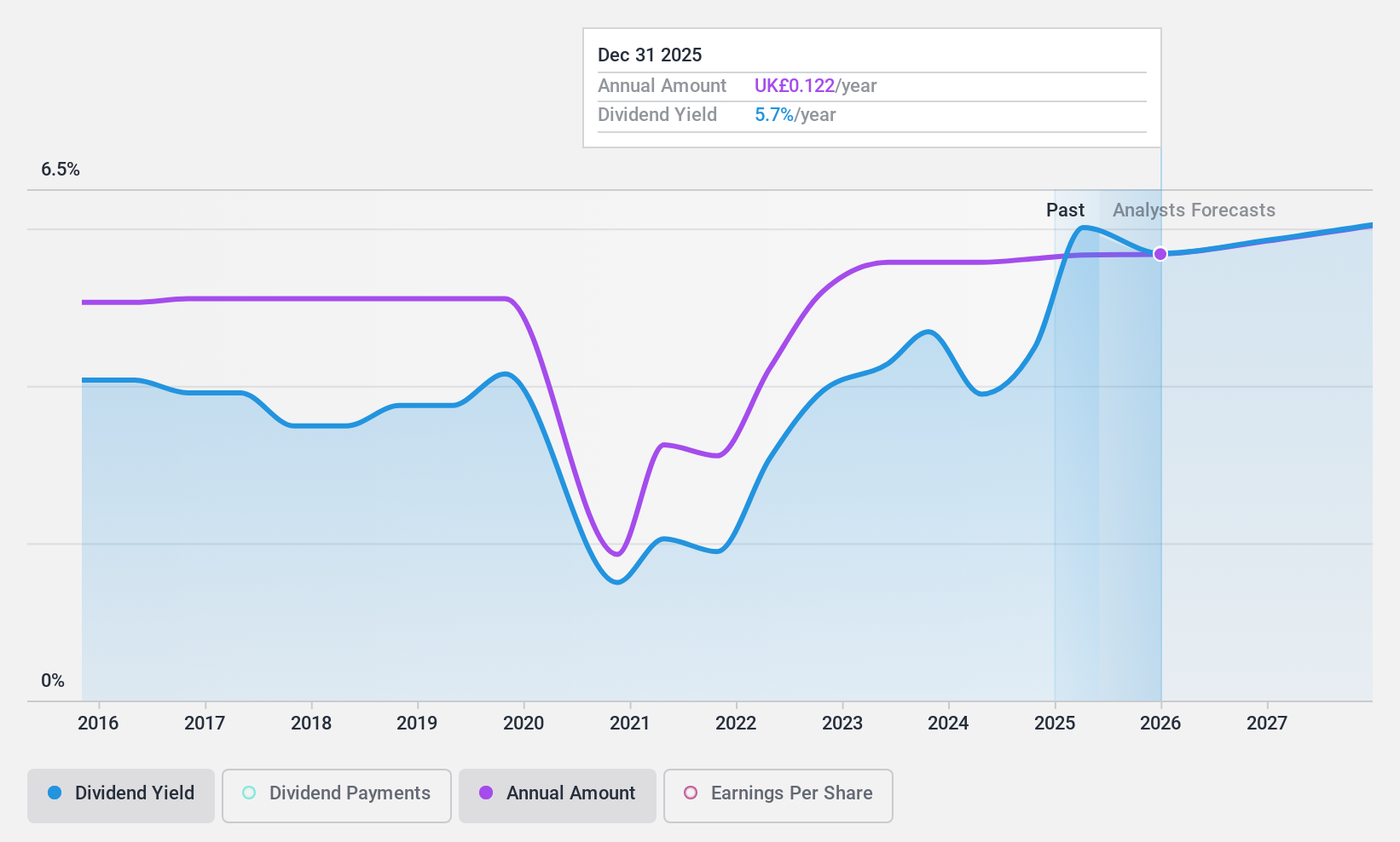

Dividend Yield: 4.4%

Morgan Advanced Materials has a mixed dividend history, with past payments being volatile and unreliable. However, recent performance shows improvement: earnings for H1 2024 rose to £37.4 million from £14.8 million in H1 2023, with EPS increasing significantly. The company announced an interim dividend of 5.4 pence per share, slightly up from last year. Despite a high debt level, dividends are well-covered by earnings (payout ratio: 49.8%) and cash flows (cash payout ratio: 73.1%).

- Navigate through the intricacies of Morgan Advanced Materials with our comprehensive dividend report here.

- Our valuation report here indicates Morgan Advanced Materials may be undervalued.

OSB Group (LSE:OSB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OSB Group Plc, with a market cap of £1.48 billion, operates as a specialist mortgage lending and retail savings company in the United Kingdom and the Channel Islands through its subsidiaries.

Operations: OSB Group's revenue segments include £431.10 million from Onesavings Bank Plc (OSB) and £377.20 million from Charter Court Financial Services Group Plc (CCFS).

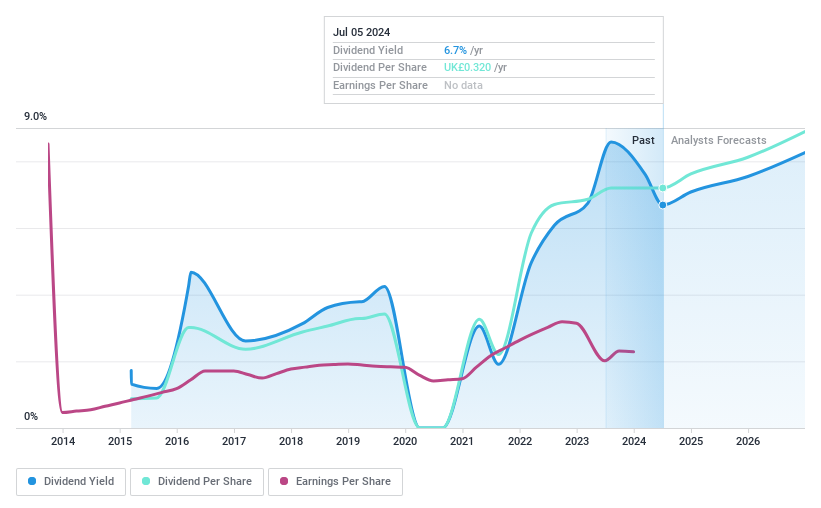

Dividend Yield: 8.4%

OSB Group's dividend payments have been cut at least once in the past decade due to UK authorities requesting banks and lenders suspend their dividends following the outbreak of COVID-19, although they have increased overall. The company recently declared an interim dividend of 10.7 pence per share for 2024, up from 10.2 pence in 2023. Despite a high bad loans ratio (3.6%), dividends are well-covered by earnings with a current payout ratio of 32.8% and forecasted to remain sustainable at 34.2%. Recent earnings surged significantly, with H1 net income rising to £178.3 million from £59.3 million last year, reflecting strong financial performance that supports its dividend strategy.

- Unlock comprehensive insights into our analysis of OSB Group stock in this dividend report.

- According our valuation report, there's an indication that OSB Group's share price might be on the cheaper side.

Key Takeaways

- Embark on your investment journey to our 58 Top UK Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St , where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade OSB Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OSB

OSB Group

Through its subsidiaries, operates as a specialist mortgage lending company in the United Kingdom and India.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives