- Germany

- /

- Auto Components

- /

- XTRA:CON

Is It Smart To Buy Continental Aktiengesellschaft (ETR:CON) Before It Goes Ex-Dividend?

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Continental Aktiengesellschaft (ETR:CON) is about to trade ex-dividend in the next four days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase Continental's shares on or after the 28th of April will not receive the dividend, which will be paid on the 30th of April.

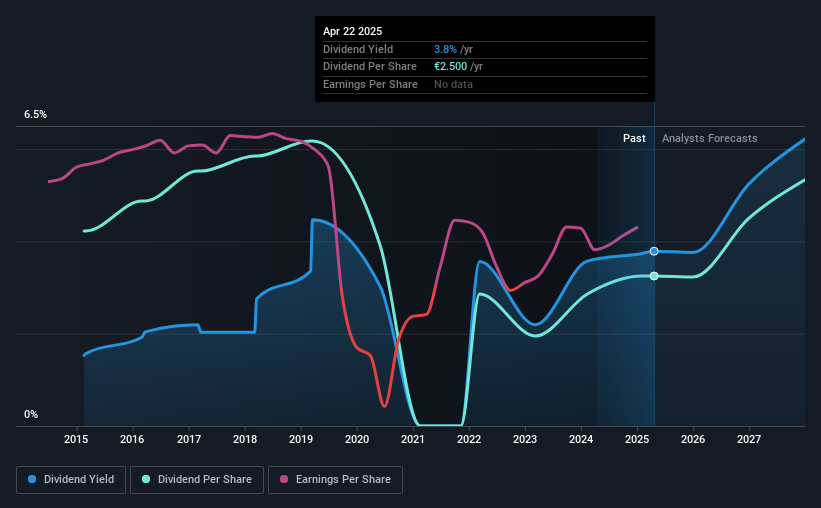

The company's upcoming dividend is €2.50 a share, following on from the last 12 months, when the company distributed a total of €2.50 per share to shareholders. Calculating the last year's worth of payments shows that Continental has a trailing yield of 3.8% on the current share price of €66.02. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Our free stock report includes 1 warning sign investors should be aware of before investing in Continental. Read for free now.Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Continental paid out a comfortable 43% of its profit last year. A useful secondary check can be to evaluate whether Continental generated enough free cash flow to afford its dividend. Fortunately, it paid out only 45% of its free cash flow in the past year.

It's positive to see that Continental's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

See our latest analysis for Continental

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. It's encouraging to see Continental has grown its earnings rapidly, up 56% a year for the past five years. Earnings per share have been growing very quickly, and the company is paying out a relatively low percentage of its profit and cash flow. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Continental's dividend payments per share have declined at 2.6% per year on average over the past 10 years, which is uninspiring. It's unusual to see earnings per share increasing at the same time as dividends per share have been in decline. We'd hope it's because the company is reinvesting heavily in its business, but it could also suggest business is lumpy.

The Bottom Line

Should investors buy Continental for the upcoming dividend? Continental has grown its earnings per share while simultaneously reinvesting in the business. Unfortunately it's cut the dividend at least once in the past 10 years, but the conservative payout ratio makes the current dividend look sustainable. It's a promising combination that should mark this company worthy of closer attention.

On that note, you'll want to research what risks Continental is facing. To help with this, we've discovered 1 warning sign for Continental that you should be aware of before investing in their shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CON

Continental

Manufactures tire and develops and produces solutions for automotive manufacturers, industrial, and end customers worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)