3 Growth Companies With High Insider Ownership And Earnings Growth Up To 83%

Reviewed by Simply Wall St

As global markets continue to reach new highs, with major indices like the Dow Jones Industrial Average and S&P 500 Index setting record intraday levels, investor sentiment is buoyed by domestic policy developments and geopolitical events. Amid this backdrop of market optimism, identifying growth companies with high insider ownership can offer potential opportunities for investors seeking alignment of interests between company insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG develops, markets, and sells integrated banking software systems to banking and other financial institutions worldwide with a market cap of CHF4.20 billion.

Operations: Revenue segments for the company include software licensing, which generated $366.80 million; software-as-a-service (SaaS), contributing $133.50 million; maintenance, accounting for $458.60 million; and services, bringing in $148.20 million.

Insider Ownership: 21.8%

Earnings Growth Forecast: 11.4% p.a.

Temenos, with its recent focus on AI innovation through collaboration with NVIDIA, is poised to enhance banking services by providing real-time insights and improved customer experiences. Its Q3 2024 earnings showed revenue growth to US$246.92 million and net income of US$30.85 million, indicating a positive financial trajectory despite high debt levels. Forecasts suggest moderate revenue growth at 6.9% annually, outpacing the Swiss market but not significantly high overall.

- Take a closer look at Temenos' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Temenos' current price could be quite moderate.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market cap of CN¥83.16 billion.

Operations: The company's revenue primarily comes from its Optical Communication Equipment segment, which generated CN¥6.14 billion.

Insider Ownership: 24.9%

Earnings Growth Forecast: 36.7% p.a.

Eoptolink Technology has demonstrated substantial growth, with earnings increasing by 233.8% over the past year and revenue reaching CNY 5.13 billion for the first nine months of 2024. The company's earnings per share rose significantly, indicating high-quality earnings. Forecasts suggest Eoptolink's revenue will grow at an impressive rate of 41.7% annually, outpacing both market averages and industry peers, despite recent share price volatility and no significant insider trading activity reported in the last three months.

- Click here to discover the nuances of Eoptolink Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Eoptolink Technology is trading beyond its estimated value.

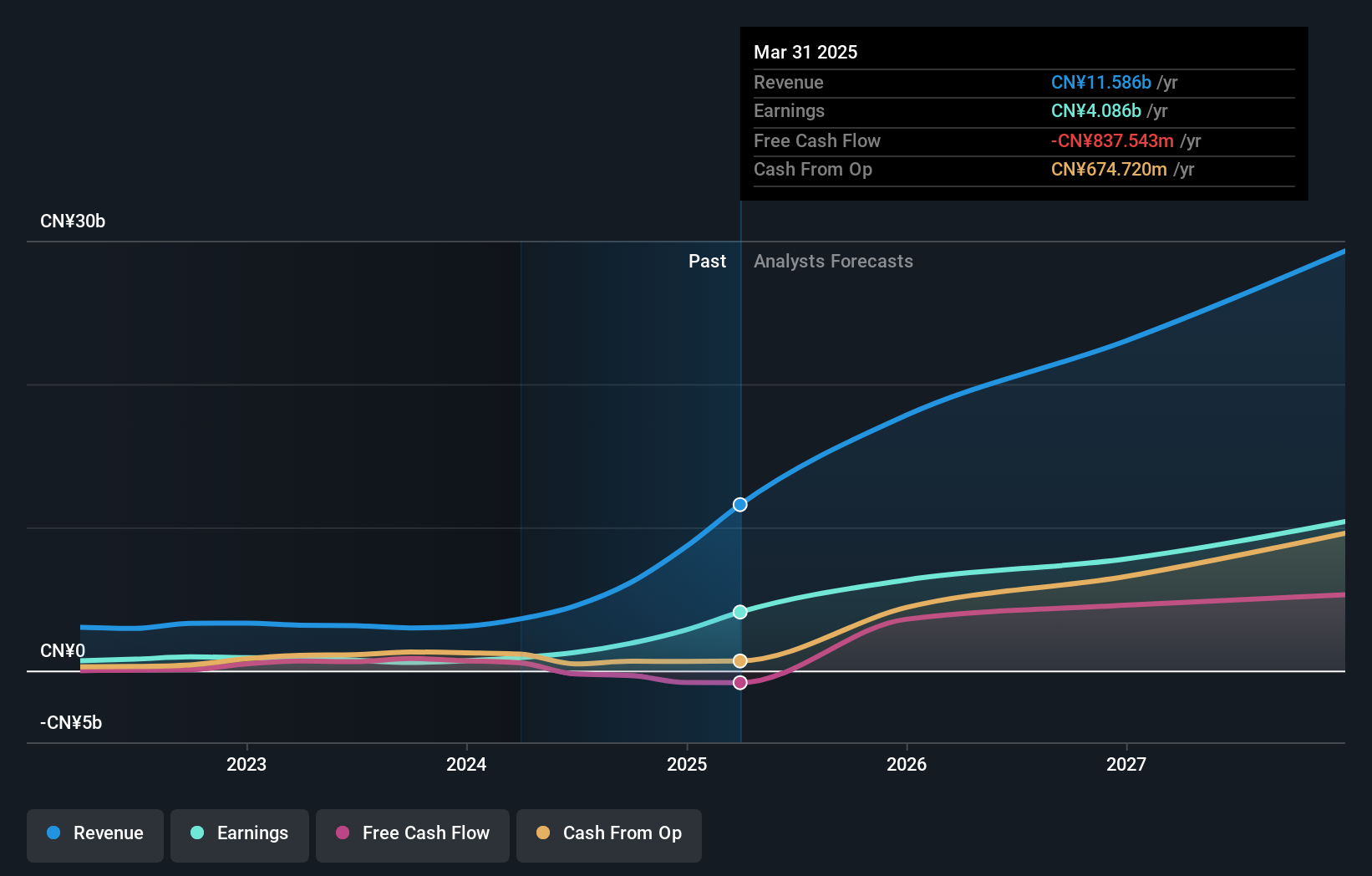

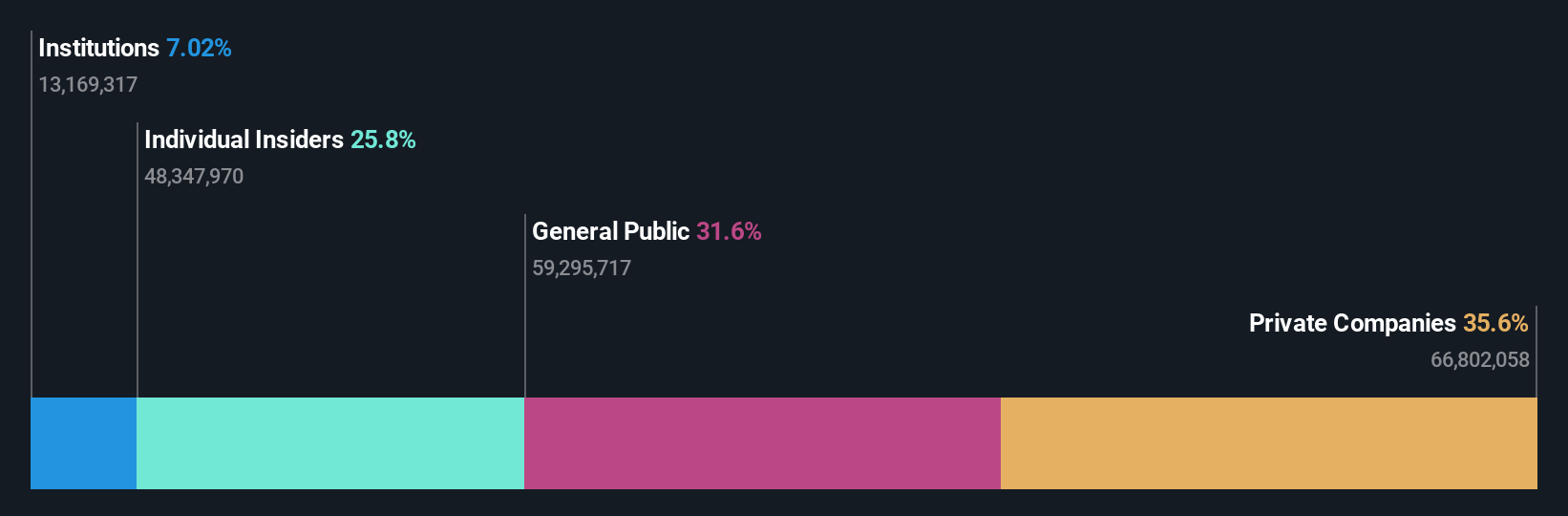

Fujian Wanchen Biotechnology Group (SZSE:300972)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fujian Wanchen Biotechnology Co., Ltd focuses on the research, development, cultivation, production, and sale of edible fungi in China with a market cap of CN¥13.95 billion.

Operations: Revenue Segments (in millions of CN¥): Fujian Wanchen Biotechnology Group generates its revenue through the research, development, cultivation, production, and sale of edible fungi in China.

Insider Ownership: 14.7%

Earnings Growth Forecast: 83.3% p.a.

Fujian Wanchen Biotechnology Group has shown impressive growth, with revenue reaching CNY 20.61 billion for the first nine months of 2024, up from CNY 4.90 billion a year ago. The company became profitable this year, reporting a net income of CNY 84.07 million compared to a previous loss. Forecasts indicate strong annual earnings growth of over 83%, significantly outpacing market averages. Despite past shareholder dilution and share price volatility, insider ownership remains substantial without recent significant trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Fujian Wanchen Biotechnology Group.

- Our expertly prepared valuation report Fujian Wanchen Biotechnology Group implies its share price may be lower than expected.

Key Takeaways

- Dive into all 1511 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300972

Fujian Wanchen Biotechnology Group

Fujian Wanchen Biotechnology Co., Ltd engages in the research and development, cultivation, production, and sale of edible fungi in China.

Exceptional growth potential and undervalued.