As we step into January 2025, global markets are navigating a landscape of mixed signals. While the S&P 500 and Nasdaq Composite have shown robust gains over the past two years, recent economic indicators such as the Chicago PMI's decline and revised GDP forecasts hint at potential challenges ahead. In this context, identifying promising stocks requires a keen eye for companies that demonstrate resilience and adaptability amid fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shenzhen Rapoo Technology (SZSE:002577)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Rapoo Technology Co., Ltd. engages in the research, development, design, manufacture, and sale of wired and wireless peripheral products globally, with a market cap of CN¥5.27 billion.

Operations: Rapoo Technology generates revenue primarily from the sale of wired and wireless peripheral products. The company's cost structure includes expenses related to research, development, design, and manufacturing. Its financial performance is characterized by a specific profit margin trend that reflects its operational efficiency.

Shenzhen Rapoo Technology, a tech player with a market cap under the radar, showcases promising financial health. Over the past year, its earnings surged by 69%, outpacing the tech industry's -0.7% growth rate. The company is debt-free and reported net income of CNY 34.18 million for nine months ending September 2024, up from CNY 29.97 million the previous year. A significant one-off gain of CN¥11.7 million influenced recent results, yet it remains profitable with positive free cash flow at CN¥98.89 million as of September 2024 end; repurchasing over a million shares reflects confidence in its prospects.

Suzhou Sunmun Technology (SZSE:300522)

Simply Wall St Value Rating: ★★★★★☆

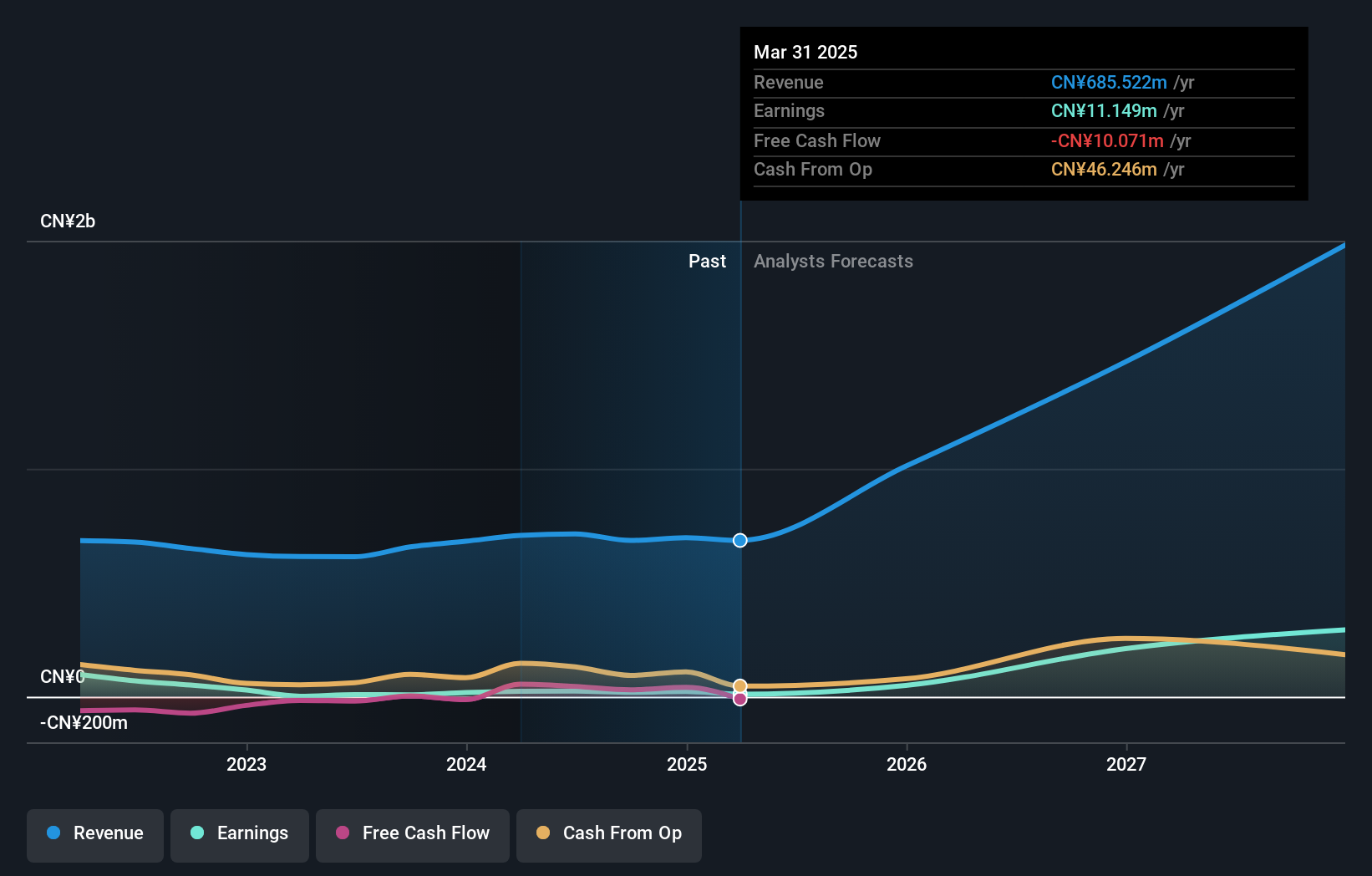

Overview: Suzhou Sunmun Technology Co., Ltd. specializes in the research, production, and sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals in China with a market cap of CN¥3.90 billion.

Operations: Suzhou Sunmun Technology generates revenue primarily from the sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals. The company's cost structure includes expenses related to research and production. Its net profit margin has shown variability over recent periods.

Suzhou Sunmun Technology, a promising player in its field, showcases solid financial health with a net debt to equity ratio of 7.2%, indicating prudent management of leverage. Over the past year, earnings surged by 124.4%, outpacing the broader Chemicals industry which saw -4.7% growth. The company's interest payments are comfortably covered by EBIT at 8.8 times, reflecting robust operational efficiency. Recent announcements highlight steady sales growth to CNY 525.8 million for nine months ending September 2024 and net income of CNY 35.96 million, alongside plans for a private placement raising up to CNY 310 million at CNY 9.41 per share.

Shanghai Hajime Advanced Material Technology (SZSE:301000)

Simply Wall St Value Rating: ★★★★★★

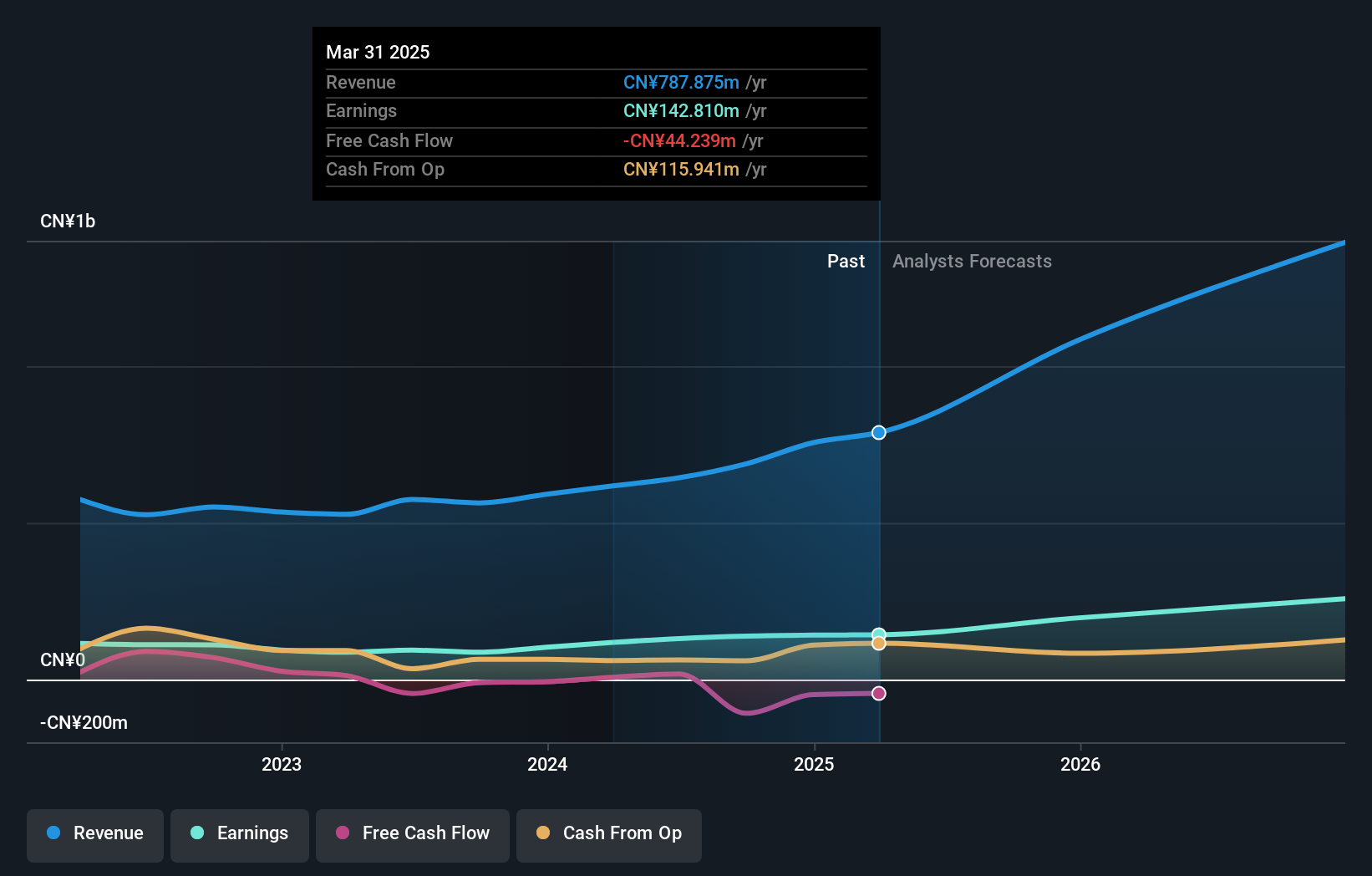

Overview: Shanghai Hajime Advanced Material Technology Co., Ltd. focuses on producing advanced materials and solutions for various industrial applications, with a market capitalization of approximately CN¥5.73 billion.

Operations: Shanghai Hajime Advanced Material Technology generates revenue primarily from the Machinery & Industrial Equipment segment, amounting to approximately CN¥688.37 million.

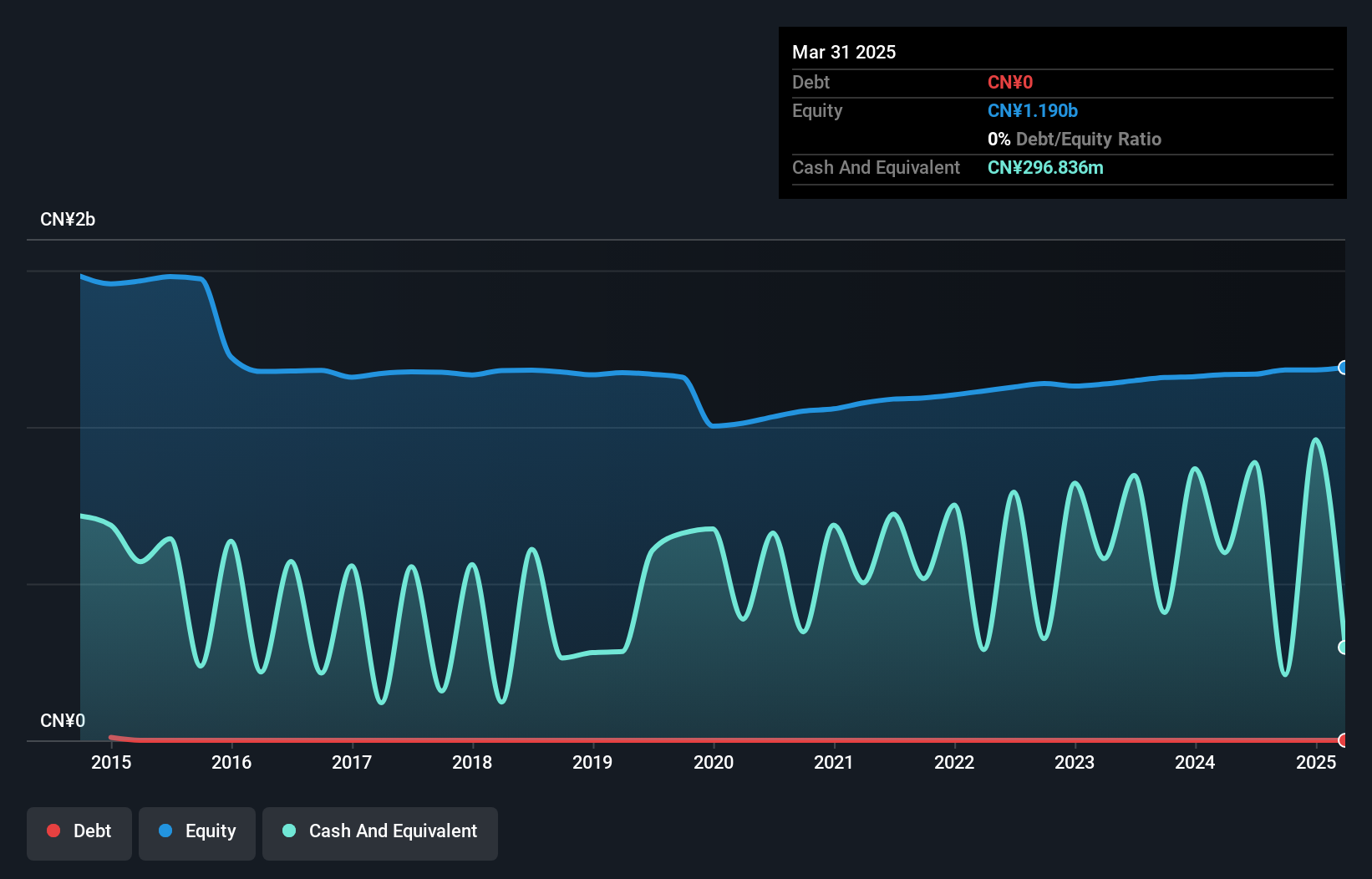

Shanghai Hajime Advanced Material Technology showcases a compelling narrative with its debt-free status, having eradicated a 9.5% debt-to-equity ratio from five years ago. Earnings surged by 58.8% last year, outpacing the broader Chemicals industry decline of 4.7%. For the nine months ending September 2024, sales climbed to CNY 527.5 million from CNY 430.34 million in the previous year, while net income increased to CNY 105 million from CNY 69.77 million. Despite this growth trajectory and high levels of non-cash earnings, free cash flow remains negative, indicating potential areas for improvement in cash management strategies moving forward.

- Navigate through the intricacies of Shanghai Hajime Advanced Material Technology with our comprehensive health report here.

Learn about Shanghai Hajime Advanced Material Technology's historical performance.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4659 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300522

Suzhou Sunmun Technology

Engages in the research, production, and sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals in China.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives