3 Growth Companies With High Insider Ownership Growing Earnings Up To 55%

Reviewed by Simply Wall St

As global markets navigate a mixed performance with U.S. stocks closing out a strong year despite recent slumps, investors are keenly observing the economic indicators such as the Chicago PMI and GDP forecasts that suggest cautious optimism. In this environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate confidence in their potential for earnings growth, even amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Let's dive into some prime choices out of the screener.

Shanghai Suochen Information TechnologyLtd (SHSE:688507)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Suochen Information Technology Ltd, with a market cap of CN¥4.66 billion, operates in the technology sector providing information technology solutions and services.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Shanghai Suochen Information Technology Ltd.

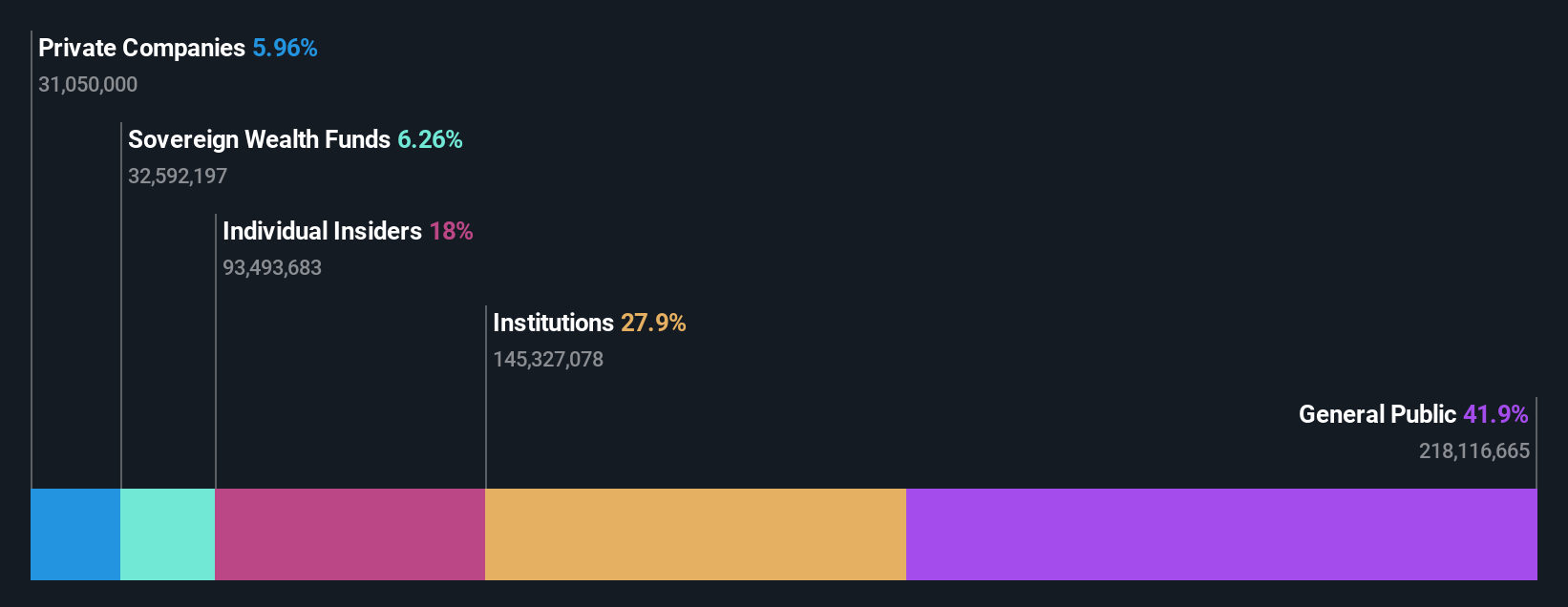

Insider Ownership: 26.9%

Earnings Growth Forecast: 55.8% p.a.

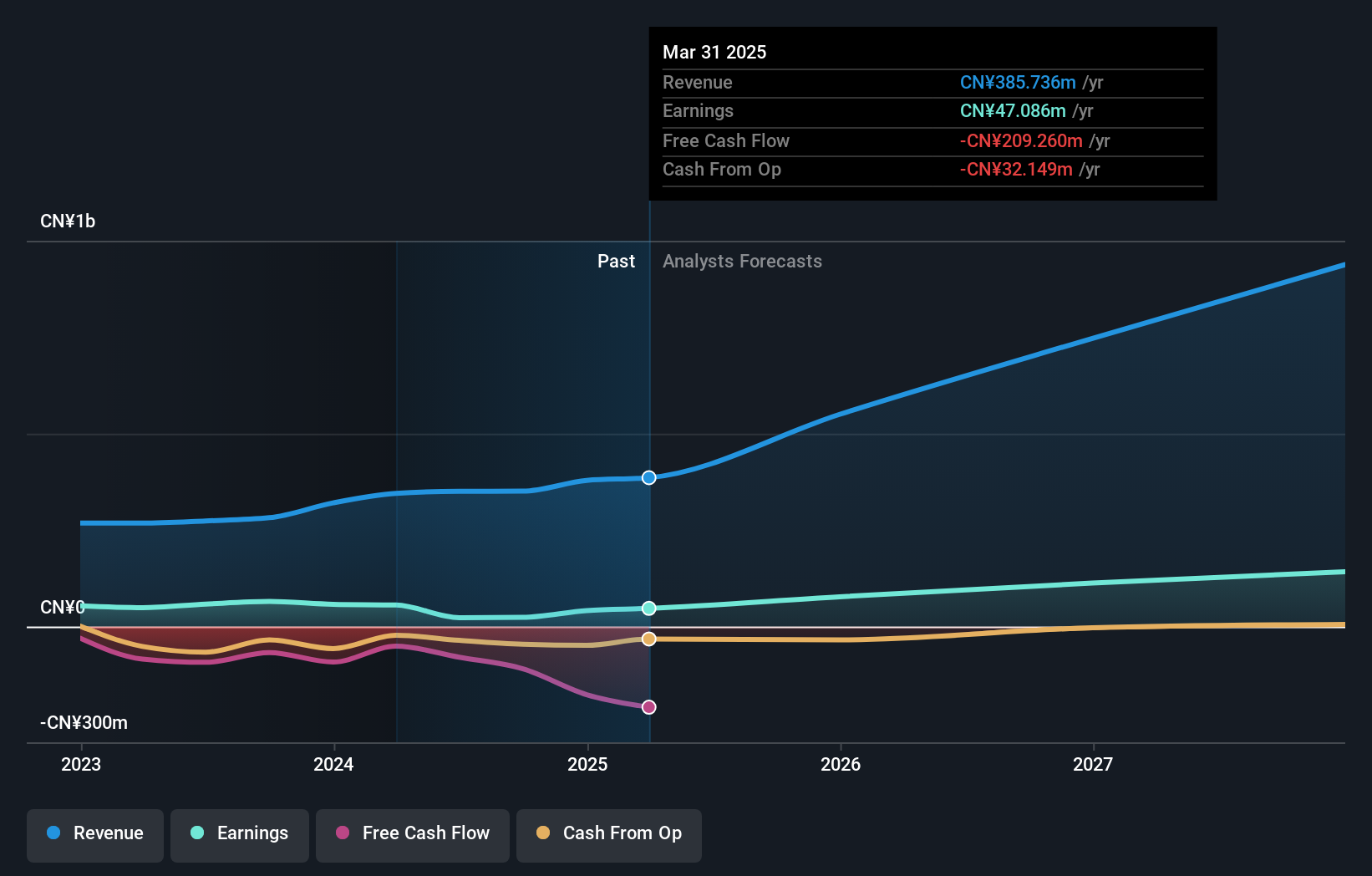

Shanghai Suochen Information Technology Ltd. exhibits significant growth potential, with revenue expected to grow 35.3% annually, outpacing the broader Chinese market's 13.5%. Despite a net loss of CNY 70.65 million for the first nine months of 2024, earnings are forecasted to increase substantially by 55.8% per year over the next three years. However, return on equity remains low at a projected 4.3%, and recent share price volatility may concern some investors.

- Click to explore a detailed breakdown of our findings in Shanghai Suochen Information TechnologyLtd's earnings growth report.

- Our valuation report unveils the possibility Shanghai Suochen Information TechnologyLtd's shares may be trading at a premium.

Hubei Feilihua Quartz Glass (SZSE:300395)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hubei Feilihua Quartz Glass Co., Ltd. is a global manufacturer and seller of quartz material and quartz fiber products, with a market cap of CN¥19.44 billion.

Operations: The company generates revenue primarily from the Non-Metallic Mineral Products Industry, amounting to CN¥1.84 billion.

Insider Ownership: 18%

Earnings Growth Forecast: 44.6% p.a.

Hubei Feilihua Quartz Glass demonstrates robust growth prospects, with revenue expected to increase by 28.5% annually, surpassing the Chinese market's 13.5%. Despite a drop in net income to CNY 234.65 million for the first nine months of 2024, earnings are projected to grow significantly at 44.6% per year over three years, outpacing the market's 25.2%. However, return on equity is forecasted to be modest at 14.9%.

- Dive into the specifics of Hubei Feilihua Quartz Glass here with our thorough growth forecast report.

- Our valuation report here indicates Hubei Feilihua Quartz Glass may be overvalued.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: King Slide Works Co., Ltd. operates in Taiwan, focusing on the research and development, design, and sale of rail kits for servers and network communication equipment, with a market cap of NT$143.42 billion.

Operations: The company's revenue segments include NT$2.16 billion from Chuanhu Company and NT$7.12 billion from Chuan Yi Company.

Insider Ownership: 14.3%

Earnings Growth Forecast: 18.4% p.a.

King Slide Works shows promising growth potential, with revenue projected to grow by 21.2% annually, outpacing the Taiwanese market's 12.4%. Despite a highly volatile share price recently, it trades at 11.7% below its estimated fair value. Recent earnings reports reveal significant improvement, with third-quarter sales reaching TWD 2.58 billion and net income at TWD 1.15 billion, reflecting strong year-over-year growth in financial performance and robust insider confidence without substantial recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of King Slide Works.

- Upon reviewing our latest valuation report, King Slide Works' share price might be too optimistic.

Key Takeaways

- Delve into our full catalog of 1487 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688507

Shanghai Suochen Information TechnologyLtd

Shanghai Suochen Information Technology Ltd.

High growth potential with mediocre balance sheet.