- Canada

- /

- Consumer Finance

- /

- TSX:GSY

TSX Growth Companies With High Insider Ownership In October 2025

Reviewed by Simply Wall St

In the current Canadian market landscape, economic indicators such as a stronger-than-expected labor report have tempered expectations for an imminent rate cut by the Bank of Canada, even as inflation is anticipated to moderate. Amidst this backdrop, investors often look towards growth companies with high insider ownership as these stocks can offer potential resilience and alignment of interests between company management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 23.1% | 93.4% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.4% |

| Orla Mining (TSX:OLA) | 10.7% | 74.9% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Heliostar Metals (TSXV:HSTR) | 16.4% | 41% |

| First National Financial (TSX:FN) | 26.7% | 22.1% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| Almonty Industries (TSX:AII) | 12.5% | 64.9% |

Let's uncover some gems from our specialized screener.

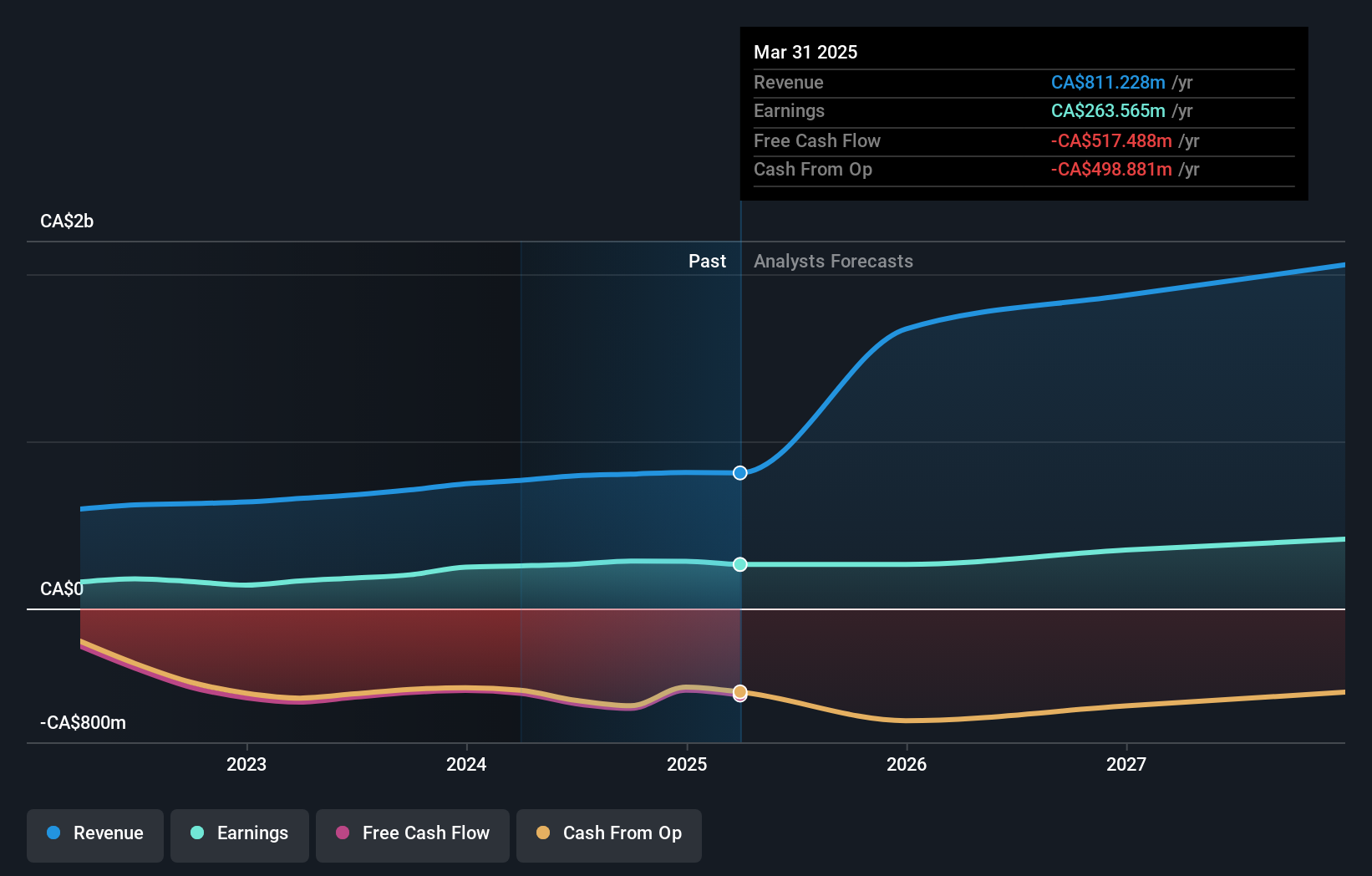

Aritzia (TSX:ATZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market cap of CA$9.91 billion.

Operations: The company's revenue is primarily generated from its apparel segment, amounting to CA$3.10 billion.

Insider Ownership: 17.2%

Return On Equity Forecast: 26% (2028 estimate)

Aritzia demonstrates robust growth potential, with earnings forecasted to grow at 19.4% annually, outpacing the Canadian market's 12%. Recent guidance indicates strong revenue momentum, expecting $875 million to $900 million for Q3 2026. Insider ownership remains high despite limited recent insider buying. The company’s strategic buyback of shares worth CAD 16.2 million underscores confidence in its valuation, trading significantly below estimated fair value. Revenue is projected to grow faster than the broader market at 12.7% annually.

- Click here to discover the nuances of Aritzia with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Aritzia's share price might be too pessimistic.

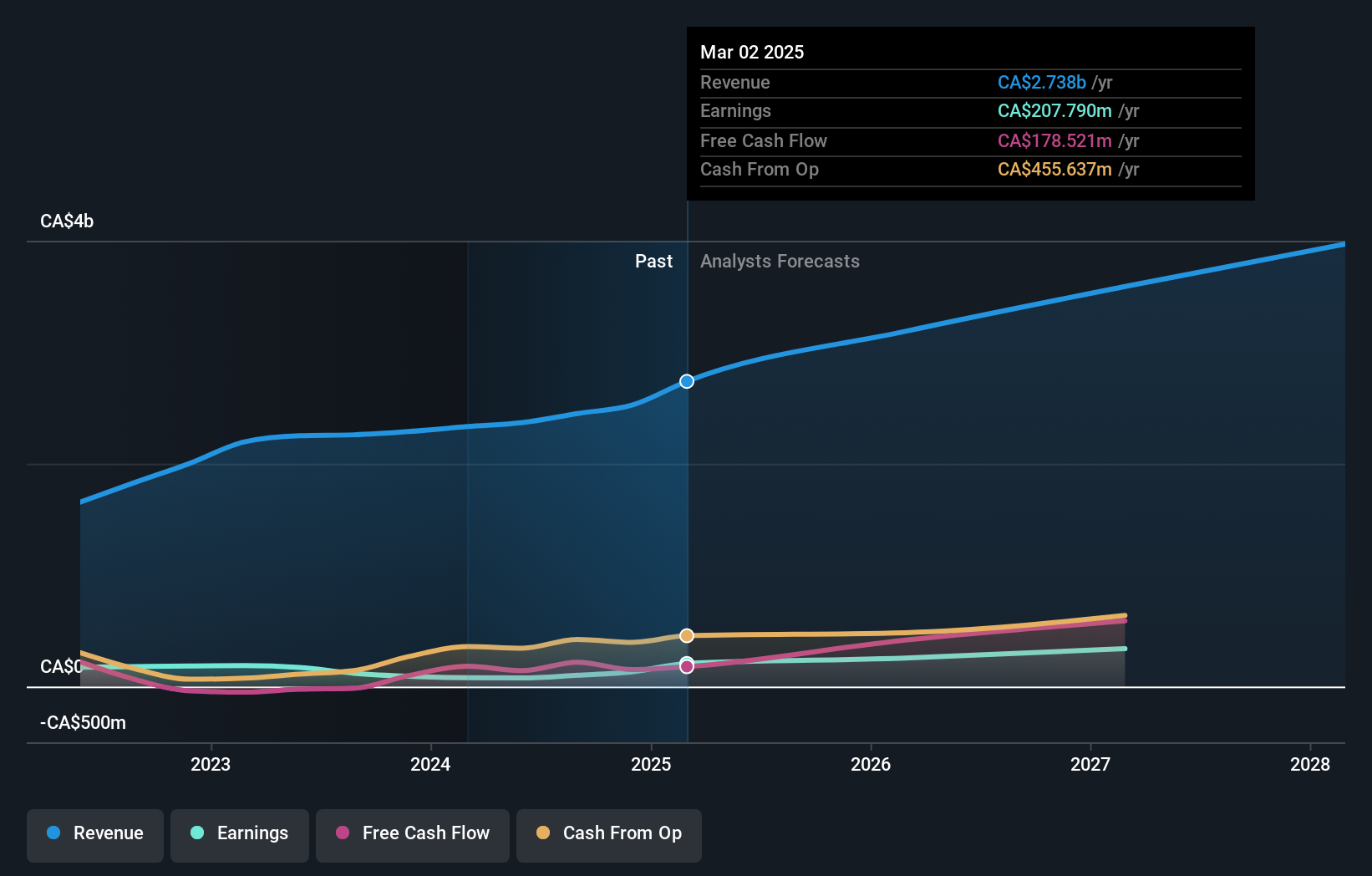

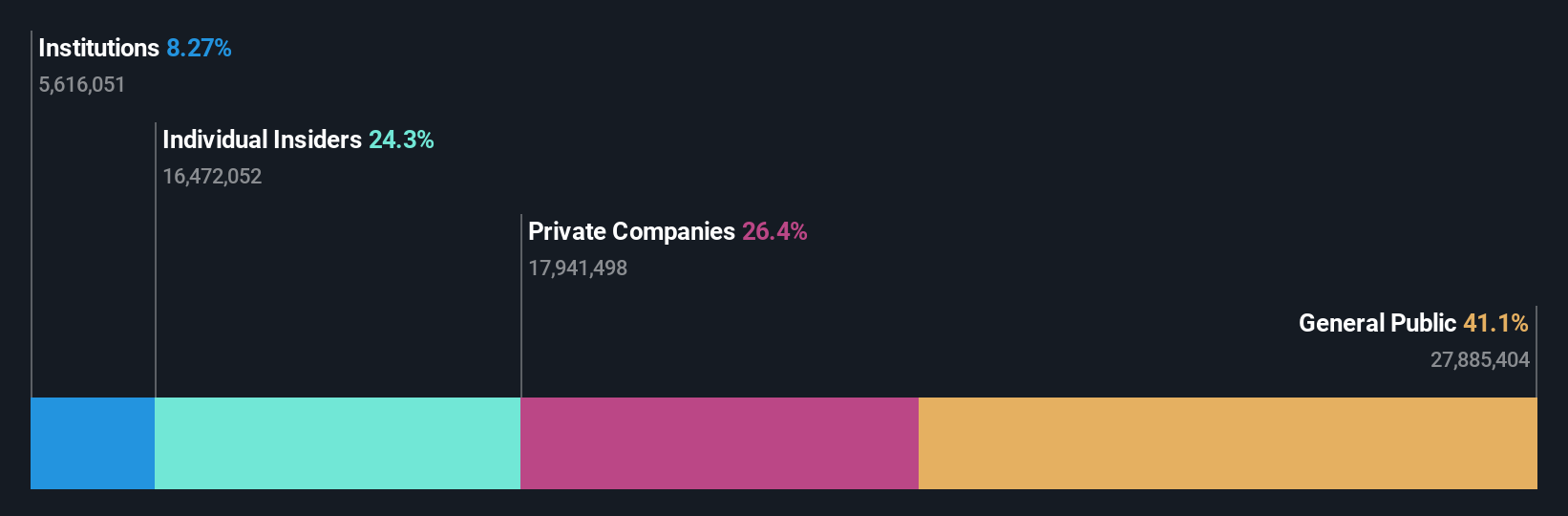

goeasy (TSX:GSY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. offers non-prime leasing and lending services in Canada through its easyhome, easyfinancial, and LendCare brands, with a market cap of CA$2.55 billion.

Operations: The company's revenue segments include CA$150.03 million from easyhome and CA$1.45 billion from easyfinancial, focusing on non-prime leasing and lending services in Canada.

Insider Ownership: 21.9%

Return On Equity Forecast: 25% (2028 estimate)

goeasy's revenue is projected to grow at 29.9% annually, significantly outpacing the Canadian market's 4.9%. Despite limited recent insider buying, insider ownership remains strong. The stock trades at a substantial discount to its estimated fair value, and analysts expect a price increase of 47.9%. However, the dividend yield of 3.68% lacks full coverage by free cash flows. Recent executive changes include Felix Wu as Interim CFO, enhancing leadership with his extensive financial expertise.

- Navigate through the intricacies of goeasy with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that goeasy's current price could be quite moderate.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. is a music, media, and technology company with operations in Canada, the United States, and internationally, and it has a market cap of CA$713.17 million.

Operations: The company generates revenue through its Radio segment, which accounts for CA$134.34 million, and its Broadcasting and Commercial Music segment, contributing CA$259.12 million.

Insider Ownership: 22.4%

Return On Equity Forecast: 24% (2028 estimate)

Stingray Group's strategic partnership with Just For Laughs to expand Free Ad-Supported Streaming TV channels highlights its growth potential. Despite high debt levels, Stingray is trading significantly below its estimated fair value. Although insider buying has been limited recently, the company maintains substantial insider ownership. Revenue and earnings are expected to grow faster than the Canadian market at 6.1% and 19.3% annually, respectively, while analysts anticipate a 25.4% stock price rise.

- Take a closer look at Stingray Group's potential here in our earnings growth report.

- According our valuation report, there's an indication that Stingray Group's share price might be on the cheaper side.

Seize The Opportunity

- Unlock more gems! Our Fast Growing TSX Companies With High Insider Ownership screener has unearthed 38 more companies for you to explore.Click here to unveil our expertly curated list of 41 Fast Growing TSX Companies With High Insider Ownership.

- Curious About Other Options? The end of cancer? These 28 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GSY

goeasy

Provides non-prime leasing and lending services under the easyhome, easyfinancial, and LendCare brands to consumers in Canada.

Very undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives